Understanding Today's Stock Market: Dow Futures And The Implications Of China's Economic Strategy

Table of Contents

Dow Futures: A Window into Market Sentiment

Dow Jones Industrial Average Futures (Dow Futures) are contracts obligating the buyer to purchase the Dow Jones Industrial Average (DJIA) at a specific price on a future date. These futures contracts are traded on exchanges and serve as a powerful barometer of investor sentiment towards the US stock market.

- Mechanism of Futures Contracts: Investors buy or sell contracts based on their expectations of the DJIA's future performance. A rising price suggests bullish sentiment (expectation of price increases), while a falling price signals bearishness (expectation of price decreases).

- Interpreting Dow Futures Prices: Analyzing Dow Futures prices involves considering factors like volume, open interest (number of outstanding contracts), and price movements relative to the cash market (actual DJIA). Technical analysis tools, such as moving averages and chart patterns, are often used.

- Relationship with the DJIA: Dow Futures prices generally track the DJIA closely. However, discrepancies can arise due to speculation and hedging activities. Futures prices can sometimes anticipate DJIA movements, offering a preview of potential market trends.

- Hedging and Speculation: Companies use Dow Futures to hedge against potential losses from adverse price movements in their stock portfolios. Speculators utilize Dow Futures to bet on the future direction of the market, aiming to profit from price fluctuations.

China's Economic Strategy: A Global Impact

China's economic strategy is multifaceted and has profound global implications. Its influence extends far beyond its borders, significantly impacting global market dynamics and investor confidence.

- The Belt and Road Initiative (BRI): This ambitious infrastructure project aims to connect Asia, Africa, and Europe through land and maritime networks. The BRI's impact is felt in increased trade, infrastructure development, and geopolitical influence across participating nations.

- Impact of Trade Policies: China's trade policies, including tariffs and trade agreements, influence global supply chains and affect the competitiveness of businesses worldwide. Trade disputes, particularly with the US, significantly impact market volatility.

- The Yuan Exchange Rate: The value of the Chinese Yuan (CNY) impacts global currency markets and international trade. Fluctuations in the Yuan's exchange rate influence the cost of Chinese goods and the profitability of businesses involved in international trade.

- Investing in China: Risks and Opportunities: China presents both significant risks and opportunities for investors. While offering high growth potential, investors need to consider political and regulatory risks, as well as currency fluctuations.

The Interplay Between Dow Futures and China's Economy

The US and Chinese economies are deeply intertwined. Changes in China's economic policies directly and indirectly influence Dow Futures and the broader US stock market.

- Trade Disputes and Tariffs: US-China trade disputes and tariffs create uncertainty in global markets, impacting investor sentiment and Dow Futures prices. These events can lead to increased market volatility and affect the profitability of US companies reliant on Chinese supply chains.

- Influence on Global Supply Chains: China's economic growth and its role in global manufacturing significantly influence supply chains. Disruptions in Chinese production can cause shortages, price increases, and disruptions to US companies.

- Risk Management Strategies: Investors can mitigate risks stemming from the interconnectedness of these markets through diversification (investing in different asset classes and geographies), hedging (using financial instruments to offset potential losses), and careful risk assessment.

- Investment Opportunities: While volatility exists, the relationship between Dow Futures and China's economy also presents potential investment opportunities. Careful analysis of market trends and economic indicators can help identify undervalued assets and potentially profitable investment strategies.

Analyzing Market Volatility

Market volatility arising from Dow Futures movements and shifts in China's economic strategy requires careful risk assessment. Understanding these dynamics is critical for effective portfolio management.

- Market Risk: Understanding the potential for losses due to market fluctuations is crucial. This includes assessing the sensitivity of investments to changes in Dow Futures and China's economic performance.

- Risk Assessment and Mitigation: This involves analyzing historical data, understanding current economic conditions, and considering various scenarios to gauge potential risks. Implementing risk mitigation strategies, such as diversification and hedging, is essential.

- Diversification and Portfolio Management: Diversifying investments across different asset classes and geographies helps reduce overall portfolio risk. Careful portfolio management involves regularly rebalancing assets to maintain the desired risk profile.

- Hedge Funds and Sophisticated Strategies: Sophisticated investors might utilize hedge funds and other strategies to manage risks related to Dow Futures and China's economic influence. These strategies often involve complex financial instruments and require considerable expertise.

Conclusion

Dow Futures provide valuable insights into market sentiment, while China's economic strategy significantly shapes global economic trends. Understanding the interplay between these two factors is crucial for effective navigation of today's dynamic stock market. Staying informed about Dow Futures and China's economic policies, coupled with a robust risk management strategy, is essential for making sound investment decisions. Continue your research into Dow Futures and their connection to China's economic strategy – consult financial advisors for personalized guidance to help you build a resilient investment portfolio in this complex global landscape.

Featured Posts

-

Groeiend Draagvlak Steun Voor Koninklijke Familie Bereikt 59

Apr 26, 2025

Groeiend Draagvlak Steun Voor Koninklijke Familie Bereikt 59

Apr 26, 2025 -

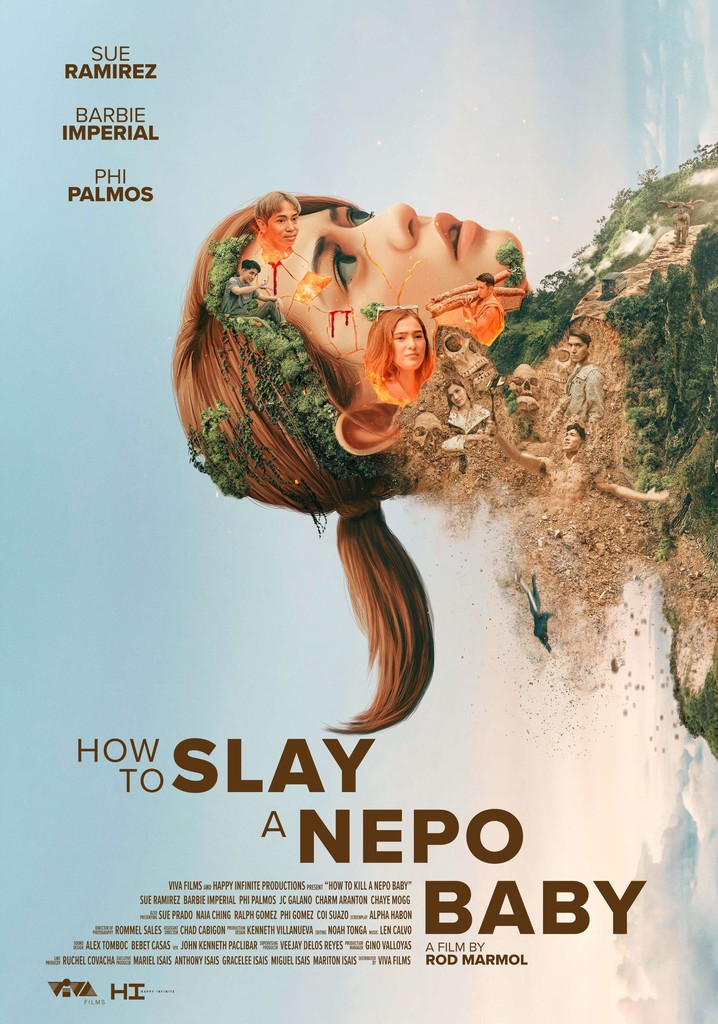

Nepotism In Hollywood A Thunderbolt Stars Candid Confession

Apr 26, 2025

Nepotism In Hollywood A Thunderbolt Stars Candid Confession

Apr 26, 2025 -

The Nepo Baby Controversy Amanda Seyfrieds Heated Response

Apr 26, 2025

The Nepo Baby Controversy Amanda Seyfrieds Heated Response

Apr 26, 2025 -

Your Guide To April Events Indie Bookstore Day Kings Day And Tumbleweeds Film Fest

Apr 26, 2025

Your Guide To April Events Indie Bookstore Day Kings Day And Tumbleweeds Film Fest

Apr 26, 2025 -

Seven Year Prison Sentence Sought For George Santos In Fraud Case

Apr 26, 2025

Seven Year Prison Sentence Sought For George Santos In Fraud Case

Apr 26, 2025

Latest Posts

-

Chillin In Alaska Ariana Biermanns Romantic Trip

Apr 27, 2025

Chillin In Alaska Ariana Biermanns Romantic Trip

Apr 27, 2025 -

Alaska Adventure Ariana Biermanns Romantic Escape

Apr 27, 2025

Alaska Adventure Ariana Biermanns Romantic Escape

Apr 27, 2025 -

Buying Ariana Grandes Lovenote Fragrance Set Online A Complete Guide To Pricing And Retailers

Apr 27, 2025

Buying Ariana Grandes Lovenote Fragrance Set Online A Complete Guide To Pricing And Retailers

Apr 27, 2025 -

Find The Best Price For Ariana Grande Lovenote Fragrance Set Online

Apr 27, 2025

Find The Best Price For Ariana Grande Lovenote Fragrance Set Online

Apr 27, 2025 -

Where To Buy Ariana Grande Lovenote Fragrance Set Online A Price Comparison Guide

Apr 27, 2025

Where To Buy Ariana Grande Lovenote Fragrance Set Online A Price Comparison Guide

Apr 27, 2025