Understanding VusionGroup's AMF CP Document 2025E1029754

Table of Contents

Key Financial Highlights of VusionGroup's AMF CP Document 2025E1029754

This section delves into the core financial data presented within VusionGroup's AMF CP Document 2025E1029754.

Revenue and Growth Projections

The document projects substantial revenue growth for VusionGroup. Key highlights include:

- A projected year-on-year growth rate of X% (replace X with the actual percentage from the document).

- Significant expansion in market share, targeting a Y% increase (replace Y with the actual percentage).

- Primary revenue drivers identified as Z (replace Z with specific revenue streams, e.g., new product launches, expansion into new markets).

The projections are based on assumptions including sustained market demand, successful product launches, and effective marketing strategies. Comparing these projections to previous years’ performance will reveal VusionGroup's growth trajectory and the effectiveness of its strategic initiatives. For example, if previous years showed a growth rate of 5%, a projected 10% increase demonstrates accelerated growth.

Profitability and Margin Analysis

Analyzing profitability metrics reveals the efficiency of VusionGroup's operations. Key metrics from the AMF CP Document 2025E1029754 likely include:

- Gross Profit Margin: This indicates the profitability of VusionGroup's core products and services, showing the efficiency of their production and operations.

- Operating Profit Margin: This reveals the efficiency of VusionGroup's operations after considering operating expenses. A high operating profit margin suggests excellent cost control.

- Net Profit Margin: This metric demonstrates VusionGroup's overall profitability after considering all expenses, including taxes and interest. This is a key indicator of financial health.

Analyzing these margins in comparison to industry benchmarks allows for an evaluation of VusionGroup's performance relative to its competitors. Trends in these margins can highlight the success (or failure) of cost-cutting measures or pricing strategies.

Capital Expenditures and Investments

VusionGroup's AMF CP Document 2025E1029754 likely details significant capital expenditures and investments aimed at future growth. These investments might include:

- Expansion of production facilities to increase capacity.

- Investments in research and development to create innovative products.

- Acquisitions to expand market reach or gain access to new technologies.

The document should articulate the expected return on investment (ROI) for each major investment and demonstrate how these investments align with VusionGroup's strategic goals. It's crucial to analyze the potential risks associated with these investments, such as economic downturns or unexpected market changes.

Understanding VusionGroup's Strategic Initiatives in AMF CP Document 2025E1029754

This section explores the strategic direction outlined in the AMF CP Document 2025E1029754.

Growth Strategies

VusionGroup's growth strategies, as detailed in the document, likely include:

- Market Expansion: Targeting new geographic regions or customer segments.

- Product Diversification: Introducing new products or services to broaden their offerings.

- Strategic Partnerships: Collaborating with other companies to leverage synergies and expand market reach.

- Acquisitions: Acquiring companies to gain access to new technologies, markets, or talent.

Each strategy's feasibility and potential risks should be carefully assessed. Factors such as competitive intensity, regulatory hurdles, and economic conditions should be considered. The potential impact on VusionGroup's market position – strengthening its competitive advantage or facing increased competition – needs thorough examination.

Risk Factors and Mitigation Strategies

The AMF CP Document 2025E1029754 will undoubtedly address key risks facing VusionGroup. These might include:

- Competition: Intense competition from established players or new entrants.

- Economic Downturn: The vulnerability of the company's business model to economic recessions.

- Regulatory Changes: The potential impact of new regulations or changes in existing regulations.

- Technological Disruption: The risk of obsolescence due to rapid technological advancements.

VusionGroup's proposed mitigation strategies for each risk must be carefully analyzed for their effectiveness and plausibility. The effectiveness of these strategies in minimizing the impact of these risks is vital to evaluating the overall soundness of VusionGroup's plan.

Analyzing the Implications of VusionGroup's AMF CP Document 2025E1029754

This section explores the broader implications of the document.

Impact on Investors

The projections and strategies presented in the AMF CP Document 2025E1029754 will significantly influence investor decisions. Positive projections and robust strategies will likely boost investor confidence and potentially increase the company's stock valuation. Conversely, negative projections or weak strategies could negatively affect investor sentiment and lead to a decrease in stock price. Analyzing investor reaction to similar documents from previous years provides valuable context.

Industry Outlook and Competition

The document should provide insights into the overall industry outlook and VusionGroup's competitive landscape. This includes:

- Market trends such as growth rates, technological advancements, and changing consumer preferences.

- Analysis of VusionGroup's competitive advantages and disadvantages compared to its key competitors. This involves evaluating factors such as market share, brand recognition, technological capabilities, and pricing strategies.

This analysis is crucial for understanding the realistic potential for VusionGroup to achieve its projected growth and maintain its market position.

Long-Term Sustainability and Vision

Finally, the AMF CP Document 2025E1029754 should outline VusionGroup's long-term vision and sustainability initiatives. This includes:

- Long-term strategic goals and the plans to achieve them.

- ESG (Environmental, Social, and Governance) factors and the company's commitment to sustainable practices.

Understanding these aspects provides insight into the company's values and its long-term viability, impacting investor perception and long-term growth potential.

Conclusion: Mastering VusionGroup's AMF CP Document 2025E1029754

Analyzing VusionGroup's AMF CP Document 2025E1029754 provides valuable insights into the company's financial health, strategic direction, and future outlook. Understanding the key financial highlights, strategic initiatives, and their implications is crucial for stakeholders to make informed decisions. The document reveals VusionGroup's growth projections, profitability analysis, investment plans, growth strategies, risk assessment, and long-term vision. This analysis is vital for investors, enabling a better understanding of potential returns and risks associated with investing in VusionGroup.

We strongly encourage you to access the original AMF CP Document 2025E1029754 for complete details and conduct further research on VusionGroup and its activities. This will provide a more comprehensive understanding of their financial performance and future outlook. Look for additional resources, such as analyst reports and company press releases, to gain further insights into VusionGroup's performance and strategy.

Featured Posts

-

Disposition Des Sieges Pour Les Funerailles Du Pape Une Tache Complexe

Apr 30, 2025

Disposition Des Sieges Pour Les Funerailles Du Pape Une Tache Complexe

Apr 30, 2025 -

Family Files Wrongful Death Suit Against San Diego County Sheriffs Office

Apr 30, 2025

Family Files Wrongful Death Suit Against San Diego County Sheriffs Office

Apr 30, 2025 -

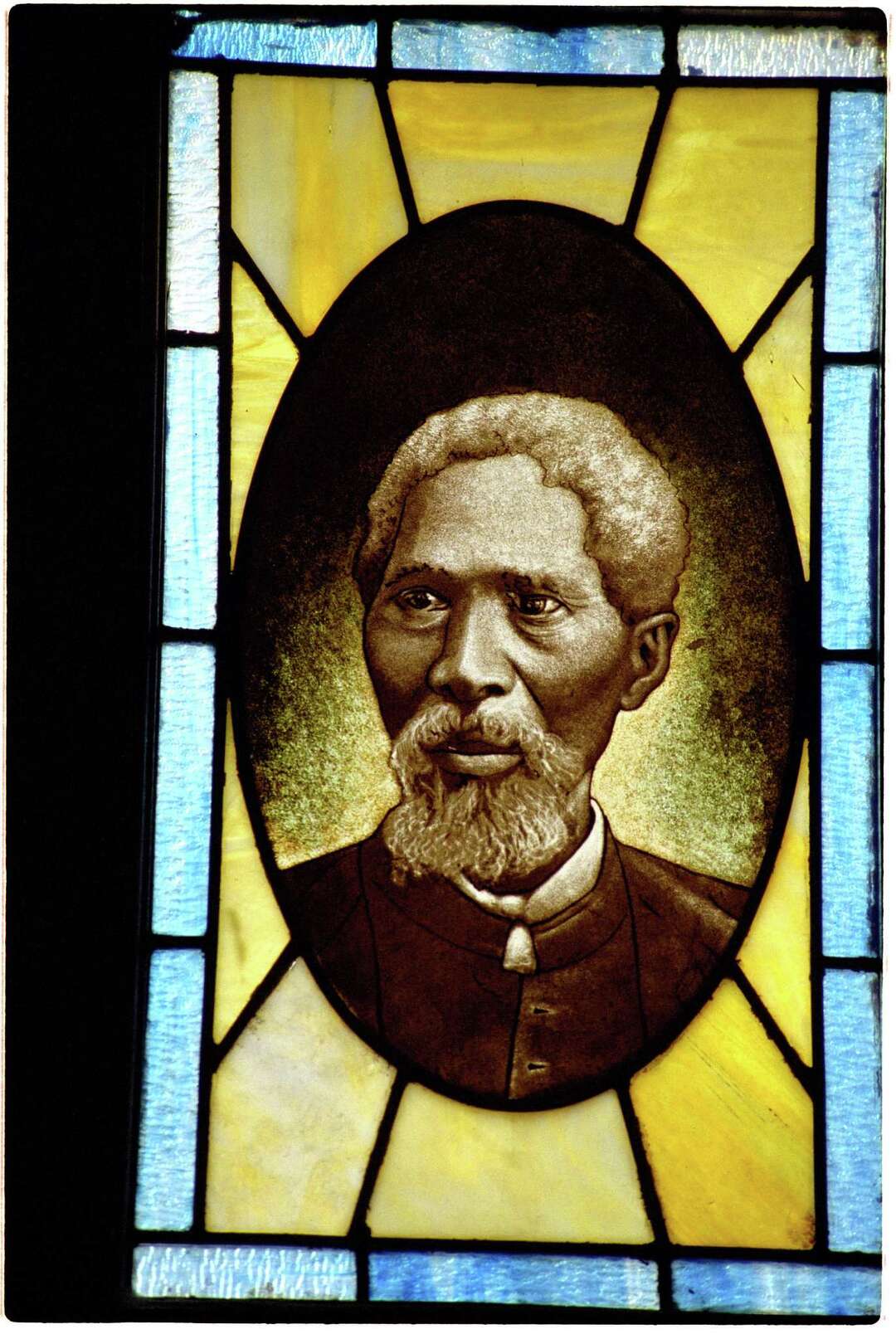

Dr Jessica Johnsons Analysis Of Yates Contribution To Black History

Apr 30, 2025

Dr Jessica Johnsons Analysis Of Yates Contribution To Black History

Apr 30, 2025 -

Amanda Owen Photos Of Her 9 Childrens Rural Life

Apr 30, 2025

Amanda Owen Photos Of Her 9 Childrens Rural Life

Apr 30, 2025 -

En Flykt Fran Doeden Helena Och Ivas Historia Fran Skolmassakern

Apr 30, 2025

En Flykt Fran Doeden Helena Och Ivas Historia Fran Skolmassakern

Apr 30, 2025

Latest Posts

-

Mstqbl Alelaqat Alamrykyt Alkndyt Ray Tramb Waldwr Alamryky Alhasm

Apr 30, 2025

Mstqbl Alelaqat Alamrykyt Alkndyt Ray Tramb Waldwr Alamryky Alhasm

Apr 30, 2025 -

Us Canada Relations In The Spotlight Trumps Influence On The Canadian Vote

Apr 30, 2025

Us Canada Relations In The Spotlight Trumps Influence On The Canadian Vote

Apr 30, 2025 -

Trump And Canada Understanding The 51st State Controversy

Apr 30, 2025

Trump And Canada Understanding The 51st State Controversy

Apr 30, 2025 -

The Canadian Election And Us Relations Trumps Perspective

Apr 30, 2025

The Canadian Election And Us Relations Trumps Perspective

Apr 30, 2025 -

Decoding Trumps 51st State Remarks On Canada Fact Or Fiction

Apr 30, 2025

Decoding Trumps 51st State Remarks On Canada Fact Or Fiction

Apr 30, 2025