Universal Credit Refund: DWP Details On April And May Payments

Table of Contents

Understanding Potential Universal Credit Overpayments

Overpayments of Universal Credit can happen for various reasons, impacting your budget significantly. Knowing how to identify and address them is vital.

Common Reasons for Overpayments:

Several factors can lead to Universal Credit overpayments. It's crucial to report any changes in your circumstances promptly to avoid these issues.

-

Changes in circumstances not reported: Failing to report a change in employment status (e.g., starting a new job, increase in earnings), a change in your living situation (moving in with a partner, change of address), or a change in household composition (someone moving in or out) can lead to overpayments. The DWP needs up-to-date information to calculate your entitlement accurately. For example, a sudden increase in income without notification will likely result in an overpayment.

-

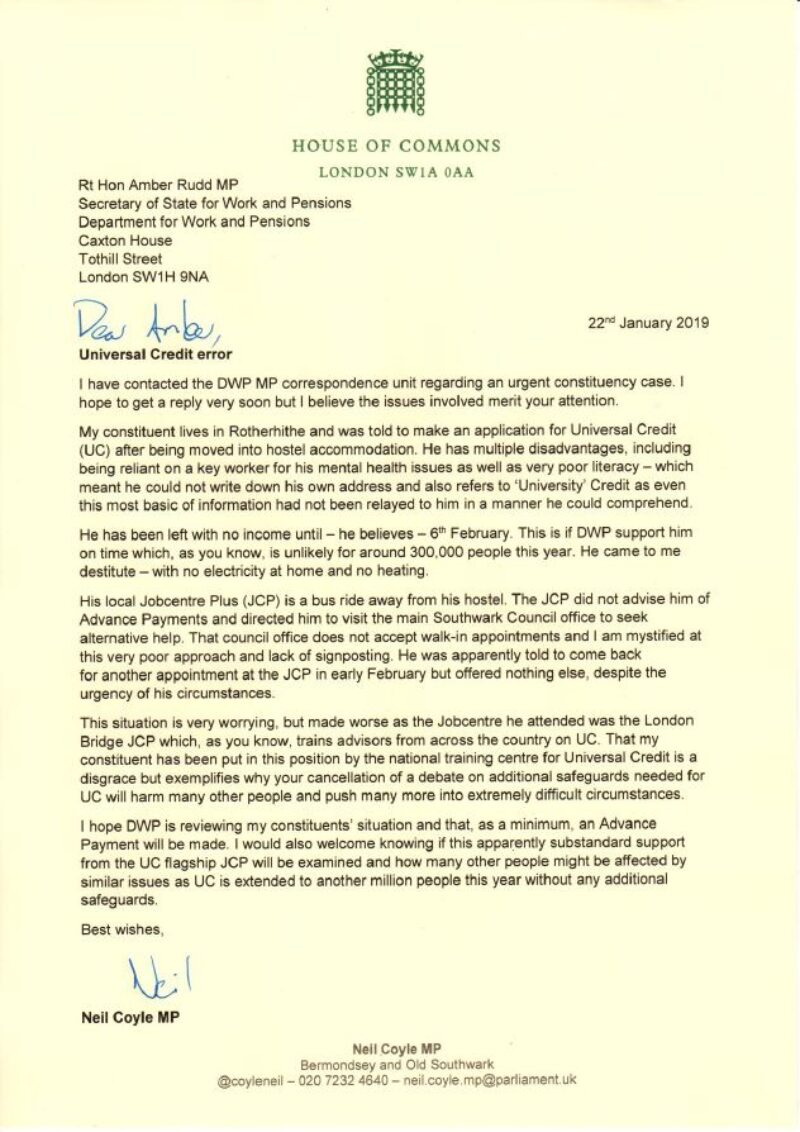

Errors in DWP calculations: While rare, mistakes in the DWP's calculations can occur. This might involve incorrect application of rules or missing information.

-

Incorrectly reported income or savings: Providing inaccurate information about your income, savings, or other financial details will affect your Universal Credit entitlement and may lead to an overpayment that needs rectifying with a Universal Credit refund claim. Ensure all details provided are completely accurate and up-to-date.

Identifying an Overpayment:

Regularly checking your Universal Credit account is essential to detect any potential overpayments.

-

Checking your Universal Credit online account statement: Log in to your online Universal Credit account. Your statement will detail your payment history, showing the amount received for each payment period. Compare this to your expected payments based on your circumstances. You can usually find detailed payment information by clicking on individual payment entries.

-

Reviewing your payment history for discrepancies: Look for any unusually large payments or payments that don't match your expectations. Keep detailed records of your income and expenses to help in comparing your payments. If anything appears wrong, this is a sign you need to seek a Universal Credit refund.

-

Contacting the DWP directly: If you suspect an overpayment after reviewing your statements, contact the DWP immediately. They can help investigate and determine if a refund is necessary. You might require a Universal Credit refund form.

How to Claim a Universal Credit Refund

If you've identified an overpayment, here's how to claim a Universal Credit refund.

The DWP's Claim Process:

The process for claiming a refund involves contacting the DWP and providing supporting evidence.

-

Contacting the DWP: You can contact the DWP via phone, online through your account, or by writing a letter. Choose the method you feel most comfortable with. Keep a record of all your communication with them. This could be helpful in following up on your claim.

-

Providing necessary documentation: Gather supporting documents to substantiate your claim. This might include bank statements showing unexpected payments, payslips demonstrating a change in income, or any other relevant financial records. The more information you provide, the smoother the process should be.

-

Necessary documentation:

- Bank statements showing the overpayment

- Payslips reflecting changes in income

- Proof of address changes

- Any other relevant financial documentation

Timescales for Processing Refunds:

The DWP aims to process refund claims efficiently, but processing times can vary.

-

Estimated processing times: While the DWP aims for swift processing, it's advisable to allow several weeks for your claim to be reviewed and processed.

-

Potential delays: Delays can occur due to a high volume of claims or the need for further investigation.

-

Following up on your claim: If you haven't heard back within a reasonable timeframe (around 4-6 weeks), proactively follow up with the DWP to check on the status of your claim. You may need to contact them again to get an update on your Universal Credit refund.

Managing Future Universal Credit Payments

Preventing future overpayments requires proactive management of your Universal Credit claim.

Reporting Changes in Circumstances:

It's crucial to report any changes to your circumstances promptly.

-

Importance of reporting changes: Immediately report any changes in your income, address, or household composition. This will ensure your Universal Credit payments remain accurate and prevent future overpayments.

-

Consequences of failing to report: Failing to report changes promptly can lead to penalties and repayment demands. This could severely impact your finances.

-

DWP online reporting tools: Utilize the DWP's online reporting tools to update your information quickly and efficiently. This will help avoid problems later.

Maintaining Accurate Records:

Keeping thorough records is key to avoiding future overpayments and simplifying the refund process.

-

Importance of accurate records: Maintain meticulous records of your income and expenses. This will help you monitor your financial situation and identify any discrepancies in your Universal Credit payments.

-

Methods for maintaining records: Use spreadsheets, budgeting apps, or a simple notebook to track your income and expenses. This will provide a clear overview of your finances.

-

Preventing future issues: Accurate financial records provide evidence for your Universal Credit claim and help avoid future overpayments.

Conclusion:

Receiving a Universal Credit refund can be crucial for managing your finances. By understanding potential reasons for overpayments, navigating the DWP's claim process, and proactively managing your circumstances, you can ensure accurate payments and avoid future issues. Remember to report changes promptly and maintain detailed records.

Need help with your Universal Credit refund? Learn more about claiming back overpayments and navigating the DWP process today! Contact the DWP or seek independent advice if needed to secure your Universal Credit refund.

Featured Posts

-

Unforgettable Krypto Stories A Readers Guide

May 08, 2025

Unforgettable Krypto Stories A Readers Guide

May 08, 2025 -

Papezevo Zdravstveno Stanje Stabilno A Prognoza Negotova

May 08, 2025

Papezevo Zdravstveno Stanje Stabilno A Prognoza Negotova

May 08, 2025 -

Tuerkiye De Kripto Para Piyasasi Spk Nin Yeni Duezenlemeleri Ve Etkileri

May 08, 2025

Tuerkiye De Kripto Para Piyasasi Spk Nin Yeni Duezenlemeleri Ve Etkileri

May 08, 2025 -

18 April 2025 Daily Lotto Winning Numbers Announced

May 08, 2025

18 April 2025 Daily Lotto Winning Numbers Announced

May 08, 2025 -

Four Inter Milan Players Out Of Contract In 2026 Whos Next

May 08, 2025

Four Inter Milan Players Out Of Contract In 2026 Whos Next

May 08, 2025

Latest Posts

-

Pochemu Sinoptiki Ne Mogut Tochno Predskazat Snegopady V Mae

May 09, 2025

Pochemu Sinoptiki Ne Mogut Tochno Predskazat Snegopady V Mae

May 09, 2025 -

Anchorage Fin Whale Recovery Delayed Soft Mudflats And Rising Temperatures

May 09, 2025

Anchorage Fin Whale Recovery Delayed Soft Mudflats And Rising Temperatures

May 09, 2025 -

Aeroport Permi Otmena I Zaderzhka Reysov V Svyazi So Snegopadom

May 09, 2025

Aeroport Permi Otmena I Zaderzhka Reysov V Svyazi So Snegopadom

May 09, 2025 -

10 Ahli Dewan Undangan Negeri Pas Selangor Bantu Mangsa Tragedi Putra Heights

May 09, 2025

10 Ahli Dewan Undangan Negeri Pas Selangor Bantu Mangsa Tragedi Putra Heights

May 09, 2025 -

Sinoptiki O Snegopadakh V Mae Faktory Nepredskazuemosti

May 09, 2025

Sinoptiki O Snegopadakh V Mae Faktory Nepredskazuemosti

May 09, 2025