Update: Caesar's Las Vegas Strip Properties Show Minor Decline

Table of Contents

Analysis of the Revenue Decline

The recent financial reports show a 2% year-over-year decrease in revenue for Caesar's Las Vegas Strip properties in the second quarter of 2024. This decline wasn't uniform across all properties; Caesar's Palace experienced a more significant drop (3%) compared to the slightly lower decline (1%) seen at the Flamingo and Harrah's. This contrasts with the performance of some competitors on the Strip, who reported either flat or slightly positive growth during the same period. A closer look reveals a complex picture:

- Occupancy Rates: While occupancy rates remained relatively high at around 90%, they were down 2% compared to the same period last year. This suggests a potential decrease in the overall number of visitors to Las Vegas.

- Average Daily Rate (ADR): The average daily rate also experienced a minor dip, decreasing by 1%. This indicates that while the number of rooms booked may have been slightly lower, the average price paid per room also decreased, suggesting potentially softer demand or increased competition driving down prices.

- Revenue Breakdown: The decline wasn't solely in gaming revenue. Non-gaming revenue, including food and beverage, entertainment, and retail sales, also experienced a slight decrease, suggesting a broader downturn in visitor spending.

- External Factors: The current economic climate, characterized by inflation and rising interest rates, likely contributed to the decrease in visitor spending and overall tourism to Las Vegas.

Factors Contributing to the Decrease

Several factors contributed to the revenue decrease experienced by Caesar's Las Vegas Strip properties:

- Inflation's Impact: The current inflationary environment has undoubtedly affected visitor spending. Guests are more conscious of their budgets, potentially opting for cheaper entertainment options or shorter trips.

- Increased Competition: The Las Vegas Strip is highly competitive. New resorts and entertainment options constantly emerge, increasing competition for market share and driving down prices.

- Marketing Effectiveness: While Caesar's invests heavily in marketing, the effectiveness of its campaigns might need reevaluation. Analyzing visitor demographics and preferences could help tailor more effective strategies.

- Operational Challenges: Potential operational inefficiencies, including staffing shortages or increased supply chain costs, may have contributed to higher operating expenses, impacting overall profitability.

- Tourism Trends: A slight decrease in overall tourism to Las Vegas, potentially due to economic concerns or shifting travel preferences, would also have affected Caesar's revenue.

The Impact on the Gaming Industry

This minor decline at Caesar's reflects a broader trend within the gaming industry. The sector is grappling with economic headwinds and increased competition. The dip in Caesar's stock price following the revenue report indicates investor concern. However, it's crucial to remember that this is a minor decline, and Caesar's still holds a significant market share on the Las Vegas Strip. Competitors are also experiencing similar pressures, suggesting a more general industry-wide adjustment rather than a crisis specific to Caesar's.

Caesar's Response and Future Outlook

Caesar's Entertainment has acknowledged the revenue decline and is implementing strategies to address the challenges:

- Cost-Cutting Measures: The company is actively reviewing its operational expenses and implementing cost-cutting measures without compromising guest experience.

- Refreshed Marketing Strategies: Caesar's is focusing on targeted marketing campaigns to attract specific demographics and enhance customer loyalty.

- Future Projections: While acknowledging the short-term challenges, Caesar's remains optimistic about long-term growth, projecting a gradual revenue recovery in the coming quarters.

- New Developments: Planned renovations and potential new developments at some of its Las Vegas properties signal a commitment to enhancing its offerings and attracting new visitors.

Conclusion

This minor decline in Caesar's Las Vegas Strip properties' revenue highlights the dynamic nature of the hospitality and gaming industry. The reasons are multifaceted, encompassing economic conditions, increased competition, and operational factors. Understanding these factors allows for a more informed assessment of the current market landscape and Caesar's future strategies. The company's proactive approach and long-term vision suggest a capacity to navigate these challenges and maintain its position as a leading player on the Las Vegas Strip.

Call to Action: Stay informed about the evolving situation with Caesar's Las Vegas properties and the wider gaming industry. Keep checking back for updates on Caesar's performance and analysis of the Las Vegas Strip's fluctuating revenue trends. Understanding the fluctuations in Caesar's Palace revenue and the broader Las Vegas casino market is key to informed investment decisions and travel planning.

Featured Posts

-

Mikey Madisons Snl Cold Open A Signal Group Chat Parody

May 18, 2025

Mikey Madisons Snl Cold Open A Signal Group Chat Parody

May 18, 2025 -

Trzaskowski Liderem Rankingu Zaufania Ib Ri S Dla Onetu

May 18, 2025

Trzaskowski Liderem Rankingu Zaufania Ib Ri S Dla Onetu

May 18, 2025 -

Goggins Mocks White Lotus Fan Theories Ahead Of Snl Appearance

May 18, 2025

Goggins Mocks White Lotus Fan Theories Ahead Of Snl Appearance

May 18, 2025 -

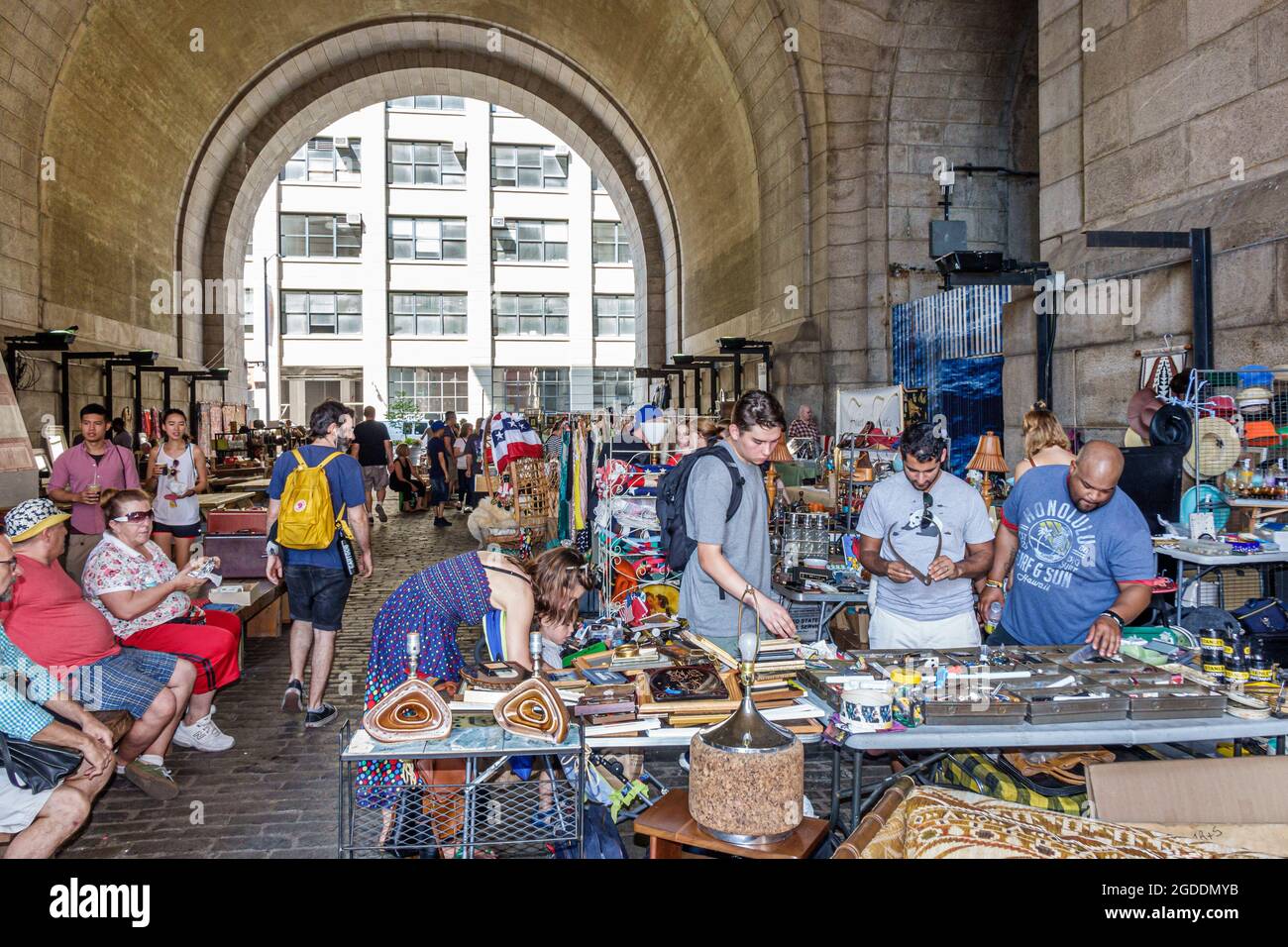

Brooklyn Flea Secures Dumbo Archway Plaza Spot Until 2027

May 18, 2025

Brooklyn Flea Secures Dumbo Archway Plaza Spot Until 2027

May 18, 2025 -

Finalni Mec Barselone Rune Nadjacao Povredenog Alkarasa

May 18, 2025

Finalni Mec Barselone Rune Nadjacao Povredenog Alkarasa

May 18, 2025

Latest Posts

-

Presiden Prancis Emmanuel Macron Palestina Israel Dan Masa Depan Perdamaian

May 18, 2025

Presiden Prancis Emmanuel Macron Palestina Israel Dan Masa Depan Perdamaian

May 18, 2025 -

Apakah Pengakuan Palestina Oleh Macron Akan Mengubah Peta Politik Timur Tengah

May 18, 2025

Apakah Pengakuan Palestina Oleh Macron Akan Mengubah Peta Politik Timur Tengah

May 18, 2025 -

Macron Siap Akui Palestina Analisis Dampak Geopolitik

May 18, 2025

Macron Siap Akui Palestina Analisis Dampak Geopolitik

May 18, 2025 -

Reaksi Israel Atas Kemungkinan Pengakuan Palestina Oleh Presiden Macron

May 18, 2025

Reaksi Israel Atas Kemungkinan Pengakuan Palestina Oleh Presiden Macron

May 18, 2025 -

027 Tahanan Palestina Ditukar Dengan Satu Tentara Israel Studi Kasus Negosiasi Internasional

May 18, 2025

027 Tahanan Palestina Ditukar Dengan Satu Tentara Israel Studi Kasus Negosiasi Internasional

May 18, 2025