Updated April Outlook: What's New And What To Expect

Table of Contents

Economic Indicators and Their Impact on the April Outlook

Understanding key economic indicators is crucial for interpreting the April Outlook. These indicators provide a snapshot of the current economic health and help predict future trends. Let's examine some key factors:

-

GDP Growth: April's GDP growth projections are vital. A strong GDP growth rate generally indicates a healthy economy, potentially leading to increased consumer spending and business investment. Conversely, a slowdown could signal reduced economic activity. For example, if preliminary data suggests a slowdown in the Eurozone's GDP growth, it could impact the April outlook for European markets and influence global investor sentiment.

-

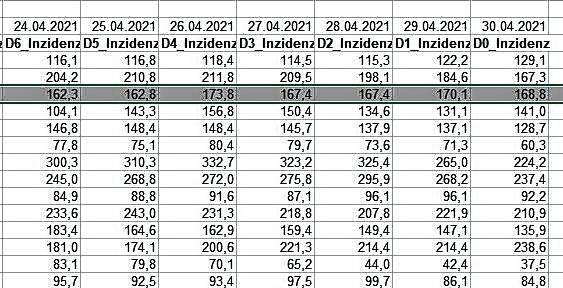

Inflation Rates: Inflation rates directly influence consumer behavior and pricing strategies. Rising inflation erodes purchasing power, potentially dampening consumer demand. Conversely, controlled inflation can encourage spending and investment. Analyzing the inflation rates in major economies like the US and China will be crucial for assessing the overall April outlook. The April inflation numbers will be key to assessing the success of recent central bank policies.

-

Unemployment Figures: The unemployment rate provides insights into job market dynamics and consumer confidence. A declining unemployment rate often indicates a strong economy and boosted consumer confidence, which will influence spending patterns and overall economic activity for April. Conversely, rising unemployment often signals economic uncertainty, impacting consumer spending and business investment throughout April.

Market Trends Shaping the April Outlook

Several market trends will significantly shape the April Outlook. Analyzing these trends is essential for businesses and investors to make informed decisions:

-

Stock Market Performance: The performance of major stock indices, such as the S&P 500, Dow Jones Industrial Average, and NASDAQ, will be a key indicator of the overall market sentiment for April. Analyzing past performance and current market conditions will help in forecasting potential movements for the month. Factors such as interest rate changes and geopolitical events significantly influence the stock market's performance within the April outlook.

-

Geopolitical Events: Geopolitical events, such as international conflicts or trade disputes, can create significant market volatility. These events can impact investor sentiment, leading to market fluctuations throughout April. For instance, ongoing tensions in Eastern Europe can significantly affect energy prices and global supply chains, creating uncertainty in the April market trends.

-

Consumer Preferences: Shifting consumer preferences—influenced by factors like sustainability, technology adoption, and economic conditions—will impact supply and demand dynamics. Understanding these shifts is essential for businesses to adapt their strategies and meet evolving consumer needs in April. Analyzing consumer spending data from March will help predict trends for April's market.

Emerging Opportunities in the April Outlook

Despite the challenges, the April Outlook presents several exciting opportunities:

-

Investment Opportunities: Market downturns or sector-specific corrections can create attractive investment opportunities. Careful analysis of the April outlook can reveal undervalued assets or sectors poised for growth. Companies with resilient business models might present particularly good investment opportunities during times of economic uncertainty, as reflected in the April outlook.

-

Growth Opportunities for Businesses: Businesses can leverage emerging trends, such as increased demand for sustainable products or technological advancements, to drive growth in April. Focusing on innovative marketing strategies and supply chain optimization can further support business growth throughout April.

-

Technological Advancements: April might see the launch of new technologies or innovations. Businesses that are quick to adopt and integrate these technologies will gain a competitive advantage. This is especially true in the rapidly growing tech sector, where the April outlook points towards continued innovation and potential for disruptive technologies.

Risks and Challenges in the April Outlook

While opportunities abound, it's vital to acknowledge potential risks and challenges:

-

Economic Slowdown/Recession: The possibility of an economic slowdown or even a recession significantly impacts the April outlook. This could lead to reduced consumer spending, decreased business investment, and increased unemployment. Monitoring key economic indicators is crucial for assessing the likelihood of such an event.

-

Supply Chain Disruptions: Ongoing supply chain disruptions can constrain production, increase costs, and limit business growth. Businesses must proactively mitigate these risks through diversification, inventory management, and strategic partnerships. The April outlook requires a careful assessment of these potential disruptions and their potential to negatively impact various business sectors.

-

Geopolitical Instability: Geopolitical instability, including international conflicts and trade wars, can create significant uncertainty and risk within the April outlook. These events can disrupt global trade, impact market volatility, and increase commodity prices. Businesses must develop effective risk management strategies to navigate such uncertainties.

Conclusion

This updated April Outlook reveals a dynamic and complex economic landscape. While opportunities exist for growth and innovation, businesses and individuals must be prepared to navigate the associated risks and challenges. By understanding the key economic indicators, market trends, and potential opportunities detailed above, you can make informed decisions and effectively position yourself for success in the coming weeks. Stay informed and continue to monitor the April Outlook for further updates and insights. Regularly check back for our updated monthly outlook reports to stay ahead of the curve and benefit from our in-depth analyses. Remember to strategize effectively using this April outlook information to make the most of the month ahead.

Featured Posts

-

Trumps Iran Deal Will It Box Israel In

May 31, 2025

Trumps Iran Deal Will It Box Israel In

May 31, 2025 -

Bomberos Forestales Combaten Incendio En Constanza Densa Humarada Afecta A Residentes

May 31, 2025

Bomberos Forestales Combaten Incendio En Constanza Densa Humarada Afecta A Residentes

May 31, 2025 -

Pflege Im Bodenseekreis Highlights Der Ersten Pflegekonferenz

May 31, 2025

Pflege Im Bodenseekreis Highlights Der Ersten Pflegekonferenz

May 31, 2025 -

I Wont Travel Without These 10 Android Apps

May 31, 2025

I Wont Travel Without These 10 Android Apps

May 31, 2025 -

Tulsa Remote Worker Program A Cost Benefit Analysis

May 31, 2025

Tulsa Remote Worker Program A Cost Benefit Analysis

May 31, 2025