Urgent HMRC Communication: Action Required For UK Taxpayers

Table of Contents

Identifying Legitimate HMRC Communications

One of the first steps when dealing with an urgent HMRC communication is verifying its authenticity. Scammers frequently impersonate HMRC to steal personal and financial information. Knowing how to identify genuine HMRC communications is crucial for protecting yourself from fraudulent activity. Legitimate HMRC contact uses specific visual cues and communication channels.

-

Visual Cues: Look for official HMRC letterhead, clearly displayed logos, and professional design. Government communications rarely contain grammatical errors or urgent, threatening language designed to pressure you into immediate action. Be wary of communications that are overly aggressive or demanding immediate payment without providing clear details.

-

Suspicious Communications: Phishing emails are a common tactic used by scammers. These emails often contain links to fake websites designed to steal your data. Other fraudulent communications may arrive via text message or even phone calls claiming to be from HMRC.

-

Key Verification Steps:

- Check the sender's email address carefully: Does it end in @gov.uk? Government agencies use specific, identifiable email addresses.

- Look for official HMRC branding and logos: Legitimate communications will prominently feature the HMRC logo and use consistent branding.

- Never click on links in suspicious emails: Always navigate to the official HMRC website directly to verify any communication.

- Verify communication via HMRC's official website: Use the official HMRC website to check for any updates or messages regarding your tax account.

Understanding Different Types of Urgent HMRC Communications

Urgent HMRC communications can range from reminders to more serious demands. Understanding the implications of each type is vital for responding appropriately.

-

Tax Return Reminders: These communications alert you to an impending tax return deadline. Ignoring these reminders can lead to significant penalties for late submission. The penalties can be substantial and increase the longer you delay filing.

-

Payment Demands: These communications demand payment for outstanding tax liabilities. Failure to meet these demands will result in interest charges accumulating on the unpaid amount. Further action may include debt collection proceedings.

-

Investigation Notices: These indicate that HMRC is investigating your tax affairs. Cooperation during an HMRC tax investigation is essential to avoid further penalties. Ignoring such a notice can severely worsen your situation.

How to Respond to Urgent HMRC Communications

Responding promptly and correctly to HMRC communications is key to avoiding penalties and potential legal issues.

-

Gather Necessary Documents: Before responding, gather all relevant documents like payslips, bank statements, and any other supporting evidence. This ensures you can accurately and efficiently address HMRC's concerns.

-

Log in to Your Online HMRC Account: Access your online HMRC account to verify the details in the communication. This allows you to check outstanding balances, view payment history and manage your tax affairs effectively.

-

Respond Promptly via the Recommended Method: Respond to the communication using the method specified (e.g., online reply, post). Keep a record of your response.

-

Keep Copies of All Correspondence: Retain copies of all communications and responses for your records. This is important for proof of communication and helps in case of any future disputes.

Seeking Help with Urgent HMRC Communications

If you're struggling to understand or respond to an urgent HMRC communication, help is available.

-

Contact HMRC Directly: Use HMRC's official channels (phone, online services) to seek clarification or assistance. Avoid responding to unofficial contact numbers or email addresses.

-

Seek Advice from a Qualified Tax Advisor: A tax advisor can offer professional guidance on navigating complex tax issues and responding appropriately to HMRC communications.

-

Explore Options for Payment Plans or Hardship Arrangements: If you're experiencing financial difficulties, contact HMRC to explore options for payment plans or hardship arrangements. They may offer support to individuals struggling to meet their tax obligations.

Conclusion: Taking Action on Urgent HMRC Communication

Ignoring an urgent HMRC communication is not advisable. Prompt action is essential to avoid penalties and potential legal repercussions. Remember to identify the legitimacy of the communication, understand its nature, and respond appropriately using the official channels provided by HMRC. Don't ignore that urgent HMRC communication! Take action today by visiting the [link to HMRC website] to avoid unnecessary penalties and ensure your tax affairs are in order. Addressing urgent HMRC correspondence promptly is crucial for maintaining a healthy relationship with the tax authority and avoiding further complications.

Featured Posts

-

Familia Schumacher Se Mareste Prima Imagine Cu Noul Membru

May 20, 2025

Familia Schumacher Se Mareste Prima Imagine Cu Noul Membru

May 20, 2025 -

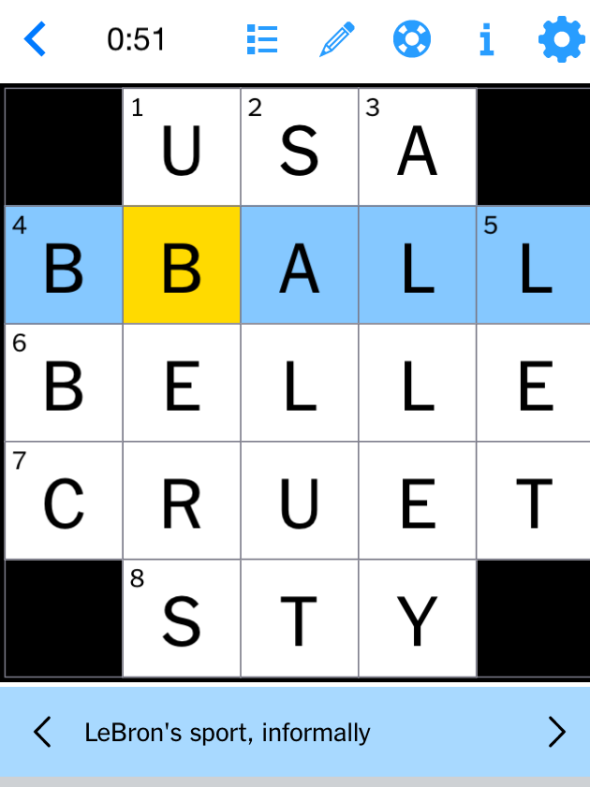

Nyt Mini Crossword Solutions Tips And How To Play May 13 2025

May 20, 2025

Nyt Mini Crossword Solutions Tips And How To Play May 13 2025

May 20, 2025 -

Sueper Lig Maci Dusan Tadic In Oenemli Basarisi

May 20, 2025

Sueper Lig Maci Dusan Tadic In Oenemli Basarisi

May 20, 2025 -

Efimereyontes Giatroi Patra 10 Kai 11 Maioy Eyresi And Plirofories

May 20, 2025

Efimereyontes Giatroi Patra 10 Kai 11 Maioy Eyresi And Plirofories

May 20, 2025 -

Wwe News John Cena Randy Orton Feud Rumors And Bayley Injury Update

May 20, 2025

Wwe News John Cena Randy Orton Feud Rumors And Bayley Injury Update

May 20, 2025

Latest Posts

-

The Housemaid And Echo Valley Whats Next For Sydney Sweeney

May 21, 2025

The Housemaid And Echo Valley Whats Next For Sydney Sweeney

May 21, 2025 -

Sejarah Dan Statistik Juara Premier League Siapa Yang Akan Menang Selanjutnya

May 21, 2025

Sejarah Dan Statistik Juara Premier League Siapa Yang Akan Menang Selanjutnya

May 21, 2025 -

Liverpool Menjuarai Liga Inggris Analisis Faktor Kunci Dan Peran Pelatih

May 21, 2025

Liverpool Menjuarai Liga Inggris Analisis Faktor Kunci Dan Peran Pelatih

May 21, 2025 -

Sydney Sweeney Post Echo Valley And The Housemaid Projects

May 21, 2025

Sydney Sweeney Post Echo Valley And The Housemaid Projects

May 21, 2025 -

Analisa Peluang Liverpool Menjadi Juara Liga Inggris 2024 2025

May 21, 2025

Analisa Peluang Liverpool Menjadi Juara Liga Inggris 2024 2025

May 21, 2025