US Airlines Face Airbus Tariff Costs

Table of Contents

The US airline industry is grappling with a significant financial burden stemming from Airbus tariffs imposed by the US government. These tariffs, a consequence of a long-running World Trade Organization (WTO) dispute over illegal government subsidies to Airbus, are estimated to cost US airlines billions of dollars annually. This article analyzes the multifaceted impact of these Airbus tariff costs on the US airline industry, exploring their implications for aircraft acquisition, airfare prices, competitive standing, and potential mitigation strategies. Understanding the Airbus tariff impact on US aviation economics is crucial for both industry stakeholders and consumers.

<h2>Increased Aircraft Acquisition Costs</h2>

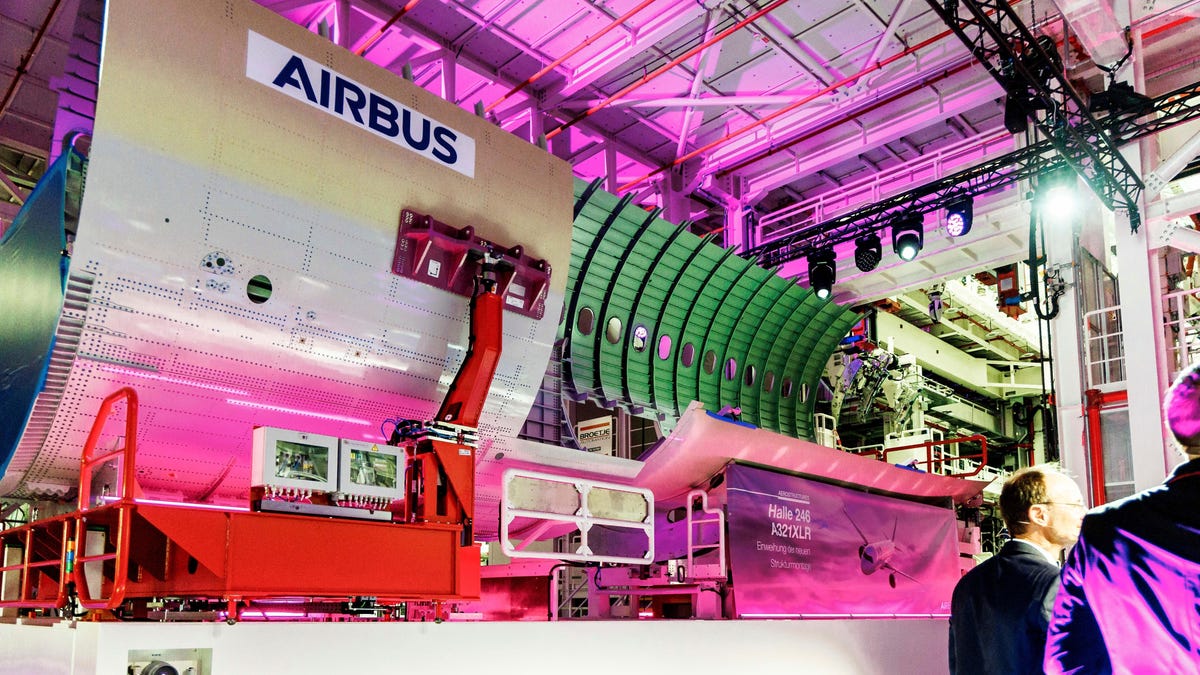

The most direct impact of Airbus tariffs is the increased cost of acquiring new aircraft. US airlines purchasing Airbus planes, including popular models like the A320neo family and the A330neo, face significantly higher prices due to the tariffs. These tariffs represent a substantial percentage increase on the base price, translating to millions of dollars in extra expenditure per aircraft. The exact impact varies depending on the model and the specific tariff rate at any given time, but the effect on aircraft pricing is undeniable.

- Higher upfront costs for new aircraft purchases: The added tariff expense necessitates larger capital investments, potentially straining airline budgets.

- Reduced profitability on new aircraft investments: The increased initial cost impacts the overall return on investment for new planes, reducing profitability margins.

- Potential for delays in fleet modernization plans: Facing higher costs, airlines may postpone or scale back fleet modernization and expansion plans, impacting their long-term competitiveness. This could also lead to delays in the implementation of more fuel-efficient aircraft, adding to operational costs. Analyzing Airbus A320neo pricing with and without tariffs clearly demonstrates this financial burden.

<h2>Ripple Effects on Airfare Prices and Consumer Costs</h2>

The increased cost of aircraft acquisition is unlikely to remain contained within airline balance sheets. Many experts predict that airlines will attempt to pass at least a portion of these added Airbus tariff costs onto consumers through higher airfares. This airfare inflation could have significant economic repercussions, impacting travel demand and the broader tourism sector. The extent to which airfare increases are possible, however, will depend on factors such as existing competition between airlines and the overall price elasticity of demand for air travel. Fuel price volatility also plays a significant role.

- Increased airfare costs for passengers: Consumers should prepare for potential increases in air travel costs.

- Reduced air travel demand due to higher prices: Higher airfares could lead to decreased demand, impacting both leisure and business travel.

- Economic implications for the travel and tourism sector: The ripple effects could extend throughout the economy, affecting related businesses such as hotels, restaurants, and tourist attractions. The consumer impact of tariffs on the airline industry is a significant concern.

<h2>Competitive Disadvantage Against International Airlines</h2>

US airlines now face a competitive disadvantage compared to their international counterparts. Foreign airlines purchasing Airbus aircraft do not bear the same tariff burden, giving them a significant cost advantage. This uneven playing field could lead to a loss of market share to foreign carriers, particularly on international routes. The competitive landscape is shifting, and US airlines may need to lobby for policy changes to level the playing field and protect US airline competitiveness.

- Loss of competitive edge in international routes: US airlines risk losing market share to foreign competitors with lower operating costs.

- Reduced profitability compared to international airlines: The additional tariff burden impacts profitability and could lead to reduced investment in the US airline industry.

- Potential job losses in the US airline industry: Reduced competitiveness may translate to job losses and reduced economic activity within the US aviation sector. The global airline competition is becoming fiercer due to these tariff-related disparities.

<h2>Potential Mitigation Strategies for US Airlines</h2>

Faced with these challenges, US airlines are exploring several mitigation strategies. These range from negotiating better deals directly with Airbus to exploring increased reliance on Boeing aircraft, a domestic manufacturer. Seeking government subsidies or relief is also a possibility. Effective airline financial management during this period of uncertainty is paramount. Supply chain diversification also needs consideration, potentially including exploring aircraft leasing options to minimize immediate capital outlay.

- Negotiating better deals with Airbus: Airlines may attempt to negotiate price reductions or other concessions to lessen the tariff's impact.

- Increased reliance on Boeing aircraft: Shifting orders towards Boeing aircraft would eliminate the tariff burden, but this depends on Boeing's production capacity and market availability.

- Seeking government subsidies or relief: Airlines could lobby for government assistance or relief measures to offset the tariffs' financial impact. This would require effective risk mitigation strategies.

<h2>Conclusion: Navigating the Challenges of Airbus Tariffs for US Airlines</h2>

The Airbus tariffs pose significant financial and competitive challenges for US airlines. The increased cost of aircraft acquisition has a ripple effect, potentially leading to higher airfares, reduced consumer demand, and a competitive disadvantage against international carriers. The long-term implications for the US airline industry and its competitiveness remain uncertain. Understanding the complexities of these tariff-related challenges is crucial for industry players, policymakers, and travelers alike. Stay updated on the latest news regarding US airlines and Airbus tariff costs to understand the evolving landscape of US aviation.

Featured Posts

-

International Harry Potter Day Your Online Shopping Guide For Series Collectibles

May 02, 2025

International Harry Potter Day Your Online Shopping Guide For Series Collectibles

May 02, 2025 -

Social Media Frenzy Kashmir Cat Owners On High Alert

May 02, 2025

Social Media Frenzy Kashmir Cat Owners On High Alert

May 02, 2025 -

Enexis En Kampen In Juridisch Conflict Kort Geding Om Stroomnetaansluiting

May 02, 2025

Enexis En Kampen In Juridisch Conflict Kort Geding Om Stroomnetaansluiting

May 02, 2025 -

Will The Harry Potter Remake Succeed 6 Essential Ingredients

May 02, 2025

Will The Harry Potter Remake Succeed 6 Essential Ingredients

May 02, 2025 -

Tulsa Storm Warning Highest Risk After 2 Am

May 02, 2025

Tulsa Storm Warning Highest Risk After 2 Am

May 02, 2025

Epl Souness Critical Of Havertzs Arsenal Performance

Epl Souness Critical Of Havertzs Arsenal Performance

Souness On Rice Arsenal Star Needs To Sharpen Final Third Play

Souness On Rice Arsenal Star Needs To Sharpen Final Third Play

Graeme Souness Declan Rice Needs Final Third Improvement For World Class Status

Graeme Souness Declan Rice Needs Final Third Improvement For World Class Status