US Capital Exodus Fuels Record Investment In Japanese Assets

Table of Contents

Why the US Capital Exodus?

Rising inflation, fluctuating interest rates, and increasing geopolitical instability are major factors contributing to the US capital exodus. Investors are seeking safer havens for their money, and the perception of risk within the US economy is pushing them to seek alternatives.

-

Rising Inflation and Interest Rates: Rampant inflation in the US is eroding the purchasing power of the dollar, making other assets more appealing. Simultaneously, rising interest rates, while intended to curb inflation, also increase borrowing costs and reduce the attractiveness of certain US investments.

-

Geopolitical Instability: The ongoing war in Ukraine, coupled with other geopolitical tensions around the globe, creates a climate of uncertainty that is impacting investor confidence worldwide. This uncertainty makes a stable economy like Japan's more attractive.

-

Domestic Political Concerns: Concerns surrounding the US debt ceiling and the potential for government shutdowns further add to investor anxieties. This political uncertainty contributes to the perception of risk in the US market.

-

Weakening US Dollar: The weakening US dollar relative to other currencies, notably the Yen, makes Japanese assets more attractive to foreign investors. This currency fluctuation directly impacts the relative value of investments.

-

Market Diversification: Many investors are seeking to diversify their portfolios, moving away from a US market some perceive as potentially overvalued and heading for correction. This diversification strategy involves spreading risk across different geographical locations and asset classes.

The Appeal of Japanese Assets

Japan is currently experiencing an influx of foreign investment, becoming a prime destination for capital seeking stability and potential returns. Several factors contribute to this growing appeal.

-

The Stability of the Japanese Yen: While subject to market fluctuations, the Japanese Yen is considered a relatively stable currency compared to the more volatile US dollar. This perceived stability makes it an attractive store of value.

-

Strong Economic Fundamentals and Political Stability: Japan's relatively stable political climate and robust economic fundamentals offer a safe haven for investors concerned about global uncertainty. This predictability is a key draw for international investors.

-

Attractive Investment Yields: Japanese government bonds and other fixed-income securities are offering attractive yields to investors seeking relatively low-risk options. This provides a balance between security and returns.

-

Growth Opportunities in Specific Sectors: Several sectors of the Japanese economy, particularly technology and infrastructure, present significant growth opportunities for investors. This offers a chance for capital appreciation in addition to stability.

-

Japanese Real Estate Market: Increased foreign interest in Japanese real estate, driven by both residential and commercial opportunities, is another significant driver of investment. The market shows promise for long-term capital growth.

Specific Asset Classes Seeing Increased Investment

The increased foreign investment in Japan isn't limited to a single sector; it spans across multiple asset classes.

-

Japanese Equities: Foreign direct investment (FDI) into Japanese companies, particularly in the technology sector, has seen substantial increases. This reflects a positive outlook on the future growth potential of Japanese businesses.

-

Japanese Bonds: The demand for Japanese government bonds is high, driven largely by their perceived safety and relative stability compared to other government debt instruments. This shows the confidence international investors have in the Japanese economy.

-

Japanese Real Estate: A resurgence in foreign investment in both commercial and residential real estate in Japan underscores the attractiveness of this asset class. This reflects a long-term view on the potential growth of Japan's property market.

Impact on the US and Japanese Economies

The capital exodus from the US and the influx into Japan are having notable impacts on both economies.

-

Impact on the US Economy: The capital flight from the US could contribute to slower economic growth in the short term, particularly if the outflow continues at its current pace. This outflow can limit the availability of capital for domestic investment and growth.

-

Impact on the Japanese Economy: The increased investment in Japanese assets is boosting the Japanese economy, contributing to economic growth and strengthening the Yen. This inflow of foreign capital helps to fuel economic expansion and stability.

-

Increased Competition: The influx of foreign investment could increase competition in Japanese markets, potentially creating new challenges and opportunities for domestic businesses. This increased competition can stimulate innovation and efficiency.

-

Long-Term Implications: The long-term implications for global economic stability and the balance of power are significant and require ongoing monitoring. This shift in capital flow can significantly affect the global economic landscape.

Conclusion

The significant outflow of US capital and the record investment in Japanese assets highlight a global search for stability and higher returns in a volatile market. Factors such as rising inflation in the US, geopolitical uncertainty, and the appeal of Japan's relatively stable economy are the key drivers of this trend. Understanding the dynamics of this US capital exodus and the surge in investment in Japanese assets is crucial for investors seeking to navigate the current global economic climate. Explore the opportunities and risks associated with Japanese assets and diversify your portfolio strategically. Consider consulting a financial advisor specializing in international investments to make informed decisions regarding Japanese assets and effectively manage your investment in this changing global market.

Featured Posts

-

Negotiating Peace On The Dnieper Key Actors And Their Roles

Apr 25, 2025

Negotiating Peace On The Dnieper Key Actors And Their Roles

Apr 25, 2025 -

Trump The Unmentioned Elephant In Canadas Election

Apr 25, 2025

Trump The Unmentioned Elephant In Canadas Election

Apr 25, 2025 -

End Of Ryujinx Emulator Development Stops After Nintendo Intervention

Apr 25, 2025

End Of Ryujinx Emulator Development Stops After Nintendo Intervention

Apr 25, 2025 -

Stock Market Valuation Concerns Bof A Offers Perspective For Investors

Apr 25, 2025

Stock Market Valuation Concerns Bof A Offers Perspective For Investors

Apr 25, 2025 -

Jan 6th Conspiracy Theories Ray Epps Sues Fox News For Defamation

Apr 25, 2025

Jan 6th Conspiracy Theories Ray Epps Sues Fox News For Defamation

Apr 25, 2025

Latest Posts

-

Pro Bono Deal Fourth Firm Averts Sanctions Over Trump Representation

Apr 30, 2025

Pro Bono Deal Fourth Firm Averts Sanctions Over Trump Representation

Apr 30, 2025 -

Analysis Of Trumps Removal Of Doug Emhoff From Holocaust Memorial Council

Apr 30, 2025

Analysis Of Trumps Removal Of Doug Emhoff From Holocaust Memorial Council

Apr 30, 2025 -

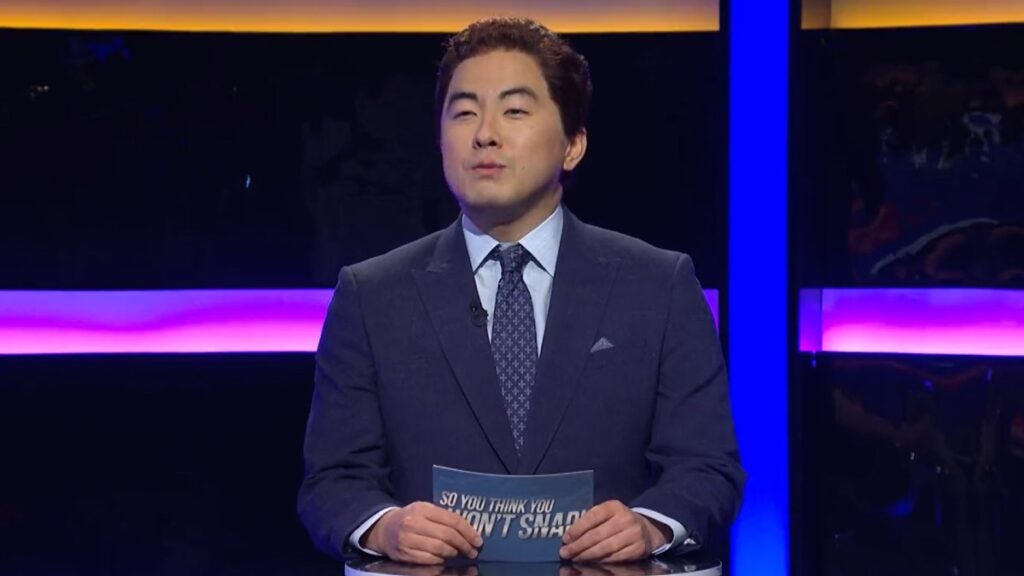

Did Bowen Yang Try To Quit Playing Jd Vance On Snl

Apr 30, 2025

Did Bowen Yang Try To Quit Playing Jd Vance On Snl

Apr 30, 2025 -

Bowen Yangs Plea To Lorne Michaels A Different Snl Jd Vance

Apr 30, 2025

Bowen Yangs Plea To Lorne Michaels A Different Snl Jd Vance

Apr 30, 2025 -

Trumps Dismissal Of Doug Emhoff From Holocaust Memorial Council Jta Report

Apr 30, 2025

Trumps Dismissal Of Doug Emhoff From Holocaust Memorial Council Jta Report

Apr 30, 2025