US-China Trade Soars Ahead Of Trade Truce

Table of Contents

Increased Bilateral Trade Volumes

The recent increase in US-China trade volumes is undeniable. Data suggests a significant leap compared to previous years, driven primarily by growth in several key sectors.

Specific Sectors Driving Growth

Several sectors are spearheading this remarkable growth in bilateral trade. The technology sector, for instance, has witnessed a substantial increase in the exchange of components and finished goods. Agricultural exports from the US to China have also seen a notable rise, particularly in soybeans and other key agricultural products. Manufacturing, while experiencing some complexities, also contributes to the overall increase.

- Technology: Increased trade in semiconductors, electronic components, and software.

- Agriculture: Significant surge in soybean, corn, and cotton exports.

- Manufacturing: Growth in the exchange of machinery, textiles, and other manufactured goods.

Data from [Source: reputable economic data source, e.g., US Census Bureau] indicates a [Percentage]% increase in US-China trade volume in [Time Period], compared to the same period last year. This translates to an increase of approximately $[Dollar Amount] in trade value.

Reasons for the Surge

Several factors contribute to this surge in US-China trade. One prominent theory is preemptive stockpiling by businesses anticipating potential future tariffs or trade restrictions. Another contributing factor is likely increased demand from China for specific US goods. Finally, adjustments in global supply chains, potentially driven by geopolitical factors, might also play a role.

- Preemptive Stockpiling: Businesses may be accumulating goods to avoid higher tariffs.

- Increased Demand: China's economic recovery and consumer demand contribute to higher imports.

- Supply Chain Adjustments: Global supply chain shifts could redirect trade flows towards the US.

Economic indicators like [mention relevant indicators, e.g., Chinese consumer confidence index, US manufacturing PMI] further support these observations.

Impact on the US Economy

The surge in US-China trade has multifaceted impacts on the US economy. While boosting certain sectors, it also poses challenges for others.

Job Creation and Economic Growth

Increased trade with China can stimulate economic growth through job creation in sectors directly involved in exporting goods to China. However, it could simultaneously lead to job displacement in sectors competing with Chinese imports.

- Positive Impacts: Increased employment in agriculture, manufacturing (certain segments), and logistics. Potential boost to GDP growth.

- Negative Impacts: Potential job losses in sectors facing intense competition from Chinese imports. Potential widening of the trade deficit.

Data from the Bureau of Labor Statistics shows [insert data on job creation/losses in relevant sectors]. GDP growth figures for [specific period] show [insert relevant data].

Implications for Various Industries

The impact on US industries varies considerably. Agriculture, particularly soybean farmers, has benefited greatly. However, certain manufacturing sectors might face increased pressure from Chinese competition. The technology sector experiences both opportunities and challenges due to the complex interplay of cooperation and competition.

- Benefiting Industries: Agriculture (soybeans, corn), certain manufacturing sectors (specialized goods).

- Challenged Industries: Sectors facing direct competition from lower-priced Chinese imports.

Geopolitical Implications of the Trade Truce

The increased trade volume carries significant geopolitical implications, impacting the overall US-China relationship.

Easing of Tensions

The surge in trade could indicate a potential de-escalation of tensions between the two countries. Increased economic interdependence might encourage more cooperation and communication on other fronts.

- Reduced Tensions: Improved communication channels and potential for future collaborations.

- Increased Cooperation: Joint efforts on global issues might become more likely.

Remaining Challenges and Uncertainties

Despite the positive trends, significant challenges remain. Underlying trade disputes, intellectual property rights concerns, and persistent geopolitical competition could still jeopardize a long-term trade agreement.

- Unresolved Trade Disputes: Lingering disagreements on tariffs and market access.

- Intellectual Property Concerns: Continued concerns about the protection of US intellectual property in China.

- Geopolitical Competition: Underlying competition in areas like technology and influence will continue to impact relations.

Conclusion: The Future of US-China Trade

The recent surge in US-China trade presents a complex picture. While offering economic opportunities and the potential for easing geopolitical tensions, it also poses challenges for certain industries and highlights the ongoing complexities in the bilateral relationship. The future of US-China trade remains uncertain, contingent on the success of any trade truce and the resolution of underlying geopolitical issues. Understanding the dynamics of this relationship is more critical than ever. Stay informed on the evolving landscape of US-China trade and its impact on global markets. Follow our blog for regular updates on the latest developments in US-China trade relations.

Featured Posts

-

The Benefits Of C Beebies Bedtime Stories For Children

May 23, 2025

The Benefits Of C Beebies Bedtime Stories For Children

May 23, 2025 -

Antony On His Close Call Joining Man Utds Arch Rivals

May 23, 2025

Antony On His Close Call Joining Man Utds Arch Rivals

May 23, 2025 -

Neal Mc Donough Visits Boises Acero Boards And Bottles

May 23, 2025

Neal Mc Donough Visits Boises Acero Boards And Bottles

May 23, 2025 -

Shadman Islams Heroics Power Bangladesh Past Zimbabwe

May 23, 2025

Shadman Islams Heroics Power Bangladesh Past Zimbabwe

May 23, 2025 -

Bsmt Qmrt Ela Snaet Alaflam Alqtryt

May 23, 2025

Bsmt Qmrt Ela Snaet Alaflam Alqtryt

May 23, 2025

Latest Posts

-

A Married Couples Fight Over Joe Jonas His Reaction

May 23, 2025

A Married Couples Fight Over Joe Jonas His Reaction

May 23, 2025 -

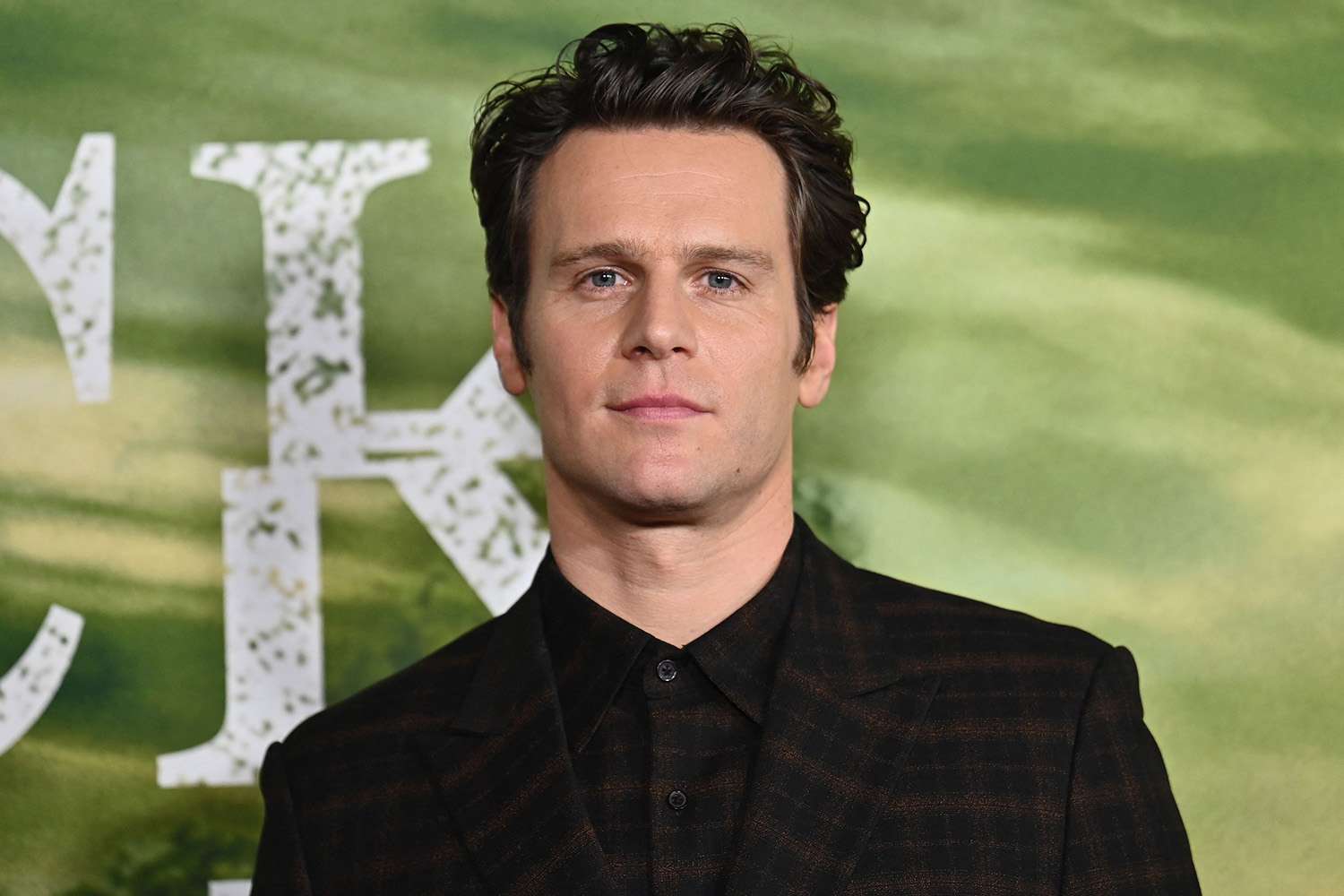

Jonathan Groffs Potential Tony Awards History With Just In Time

May 23, 2025

Jonathan Groffs Potential Tony Awards History With Just In Time

May 23, 2025 -

Jonathan Groffs Just In Time Opening Lea Michele Daniel Radcliffe And More Attend

May 23, 2025

Jonathan Groffs Just In Time Opening Lea Michele Daniel Radcliffe And More Attend

May 23, 2025 -

The Jonas Brothers A Married Couples Unexpected Dispute And Joes Reaction

May 23, 2025

The Jonas Brothers A Married Couples Unexpected Dispute And Joes Reaction

May 23, 2025 -

Analyzing Jonathan Groffs Chances At A Tony For Just In Time

May 23, 2025

Analyzing Jonathan Groffs Chances At A Tony For Just In Time

May 23, 2025