US-China Trade Talks And Economic Data Drive Chinese Stock Market Rally

Table of Contents

Positive US-China Trade Developments Fuel Market Optimism

Recent progress in US-China trade negotiations has significantly boosted investor confidence and contributed to the Chinese stock market rally. The de-escalation of trade tensions, marked by specific agreements and a reduction in trade war rhetoric, has reduced uncertainty and encouraged increased investment.

- Specific examples of positive developments: The signing of the Phase One trade deal, which included commitments from China to purchase a substantial amount of US agricultural products and other goods, significantly eased trade concerns. Further, agreements on intellectual property rights and currency manipulation have also helped to stabilize trade relations.

- Impact on investor confidence: These developments reduce the risk of further tariff increases and trade disruptions, leading to a more favorable investment climate. Investors are now more willing to allocate capital to Chinese assets, anticipating greater stability and growth.

- Remaining trade concerns: While significant progress has been made, some trade concerns remain. The full implementation of the Phase One deal and the potential for future trade disputes still pose risks to the market's continued optimism.

Stronger-Than-Expected Economic Data Bolsters Investor Sentiment

The release of positive economic data from China has further fueled the recent stock market rally. Key economic indicators have surpassed expectations, pointing towards a strengthening economy and bolstering investor sentiment.

- Specific economic data points: Recent data reveals robust GDP growth, exceeding analyst forecasts. Industrial production figures also indicate a healthy expansion of the manufacturing sector. Furthermore, data on consumer spending and retail sales suggest increased domestic consumption.

- Significance of data points: Strong GDP growth signals a healthy economy capable of sustaining further growth. Increased industrial production demonstrates the resilience of the manufacturing sector. Rising consumer spending points to strong domestic demand, indicating a positive outlook for consumer-related businesses and Chinese stocks within that sector.

- Potential risks and challenges: While the economic outlook is positive, potential challenges remain. The ongoing global economic slowdown and potential trade disputes could still impact China's economic growth. Inflationary pressures also need to be carefully monitored.

Sector-Specific Performances within the Chinese Stock Market Rally

The Chinese stock market rally has not been uniform across all sectors. Certain sectors have benefited disproportionately, reflecting the specific dynamics of the economic recovery and government policies.

- High-performing sectors: Technology stocks have experienced substantial gains, driven by government support for technological innovation and advancements in areas like artificial intelligence and 5G. Consumer stocks have also performed well, benefiting from increased consumer spending. Specific sectors like real estate have shown fluctuating performance.

- Underlying factors: Government policies aimed at stimulating economic growth, such as tax cuts and infrastructure spending, have played a significant role in the performance of certain sectors. Increased domestic consumption, fueled by rising incomes and consumer confidence, is another key driver for many sectors.

- Underperforming sectors: Some sectors, such as energy, have seen more muted performance, reflecting specific challenges within those industries. Careful analysis of individual sectors is crucial for informed investment decisions.

Analyzing the Risks and Potential Future Trends for Chinese Stocks

While the current market rally is promising, it's crucial to acknowledge potential risks and uncertainties that could impact future performance. A balanced perspective on the long-term outlook is essential for investors.

- Geopolitical risks: Ongoing tensions with other countries and geopolitical uncertainties present potential risks. Changes in global trade policies or international relations could negatively affect market sentiment.

- Economic vulnerabilities: While the economy is showing strength, there are vulnerabilities. A potential slowdown in growth, increased debt levels, or shifts in global demand could impact the market.

- Market volatility: The stock market is inherently volatile, and the Chinese market is no exception. Corrections and periods of uncertainty are possible, even in the context of an overall positive trend.

Conclusion

The recent Chinese stock market rally is largely attributable to positive developments in US-China trade talks and strong economic data. These factors have combined to boost investor confidence and drive significant gains across various sectors. However, it's crucial to acknowledge potential risks and uncertainties.

Stay informed about the latest developments in US-China trade talks and economic data to make informed decisions regarding your investments in the Chinese stock market. Further research into specific sectors, considering their unique dynamics and potential risks, is essential for navigating this dynamic market effectively. Understanding the interplay between these crucial factors is key to successful investment in Chinese stocks.

Featured Posts

-

The China Market Hurdles And Opportunities For Premium Car Brands Like Bmw And Porsche

May 07, 2025

The China Market Hurdles And Opportunities For Premium Car Brands Like Bmw And Porsche

May 07, 2025 -

Mariners Vs Reds Live Stream Where To Watch The Mlb Game

May 07, 2025

Mariners Vs Reds Live Stream Where To Watch The Mlb Game

May 07, 2025 -

Cavaliers Vs Knicks Prediction Will The Knicks Triumph At Msg

May 07, 2025

Cavaliers Vs Knicks Prediction Will The Knicks Triumph At Msg

May 07, 2025 -

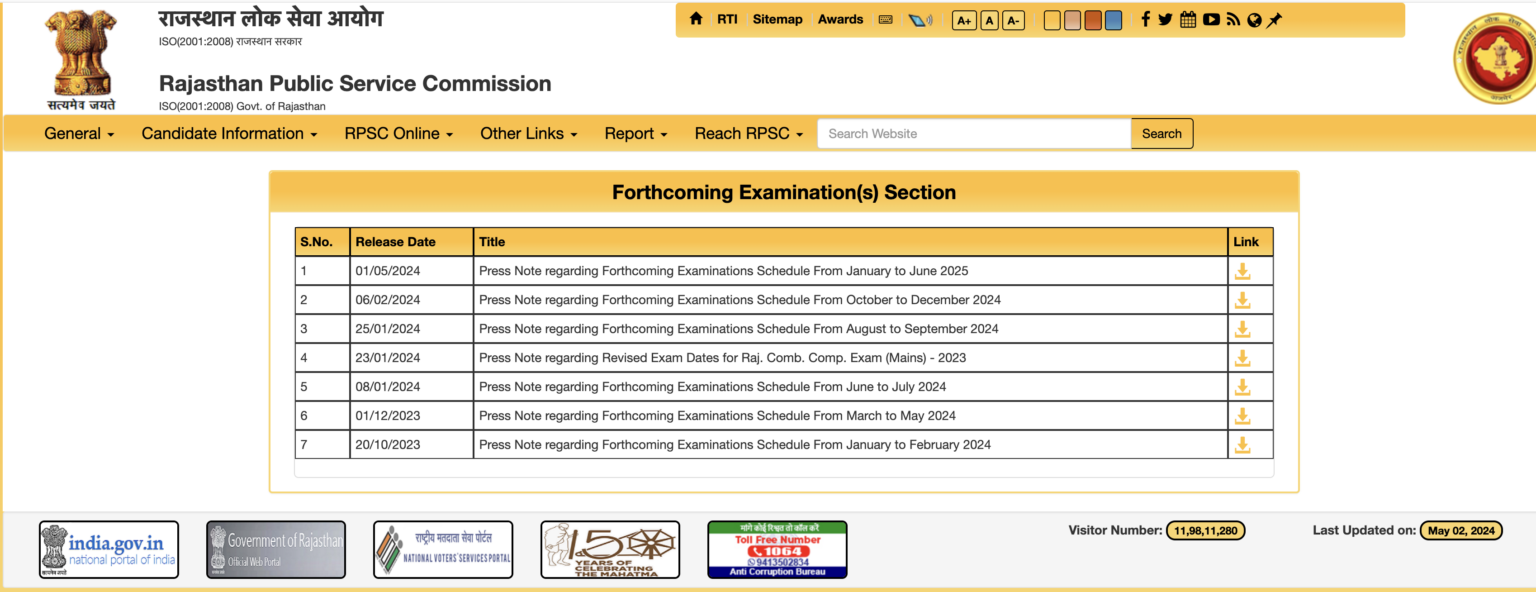

Rsmssb Exam Calendar 2025 26 Complete Schedule And Important Dates

May 07, 2025

Rsmssb Exam Calendar 2025 26 Complete Schedule And Important Dates

May 07, 2025 -

Laura And Jason Kenny Welcome Third Child After Fertility Struggles

May 07, 2025

Laura And Jason Kenny Welcome Third Child After Fertility Struggles

May 07, 2025

Latest Posts

-

Jalen Brunson And Donovan Mitchell Rising To The Occasion In The Playoffs

May 07, 2025

Jalen Brunson And Donovan Mitchell Rising To The Occasion In The Playoffs

May 07, 2025 -

Playoff Stars Emerge Mitchell And Brunson Shine Bright

May 07, 2025

Playoff Stars Emerge Mitchell And Brunson Shine Bright

May 07, 2025 -

Cavaliers Vs Grizzlies Injury Report March 14th Game Status

May 07, 2025

Cavaliers Vs Grizzlies Injury Report March 14th Game Status

May 07, 2025 -

Nba Playoffs Smart Bets For The Cavaliers Vs Pacers Series

May 07, 2025

Nba Playoffs Smart Bets For The Cavaliers Vs Pacers Series

May 07, 2025 -

Nba Playoffs Mitchell And Brunson Prove Their Worth

May 07, 2025

Nba Playoffs Mitchell And Brunson Prove Their Worth

May 07, 2025