US-China Trade Uncertainty Boosts Bitcoin And Crypto Market

Table of Contents

The Safe Haven Narrative: Why Investors Turn to Bitcoin During Trade Wars

Bitcoin, a decentralized digital currency, is often touted as a safe haven asset, particularly during times of geopolitical instability. Its decentralized nature, meaning it’s not controlled by any single government or institution, makes it attractive to investors wary of traditional financial systems. Unlike fiat currencies vulnerable to inflation and government manipulation, Bitcoin's supply is capped at 21 million coins, making it inherently inflation-resistant.

Geopolitical uncertainty, such as the escalating US-China trade war, often erodes trust in traditional markets. Investors, seeking to protect their capital, naturally look for alternative stores of value. Bitcoin, with its limited supply and independent nature, fits this bill. We've seen historical precedents; Bitcoin's price often rises during periods of global economic turmoil, acting as a hedge against uncertainty.

- Reduced trust in traditional financial systems: Trade wars and economic sanctions can shake confidence in traditional banking and government-backed currencies.

- Hedge against inflation and currency devaluation: Bitcoin's fixed supply offers protection against inflationary pressures.

- Decentralized nature protects against government control: Unlike fiat currencies, Bitcoin is not subject to government manipulation or seizure.

- Increased demand during times of uncertainty: As investors seek refuge from volatile markets, demand for Bitcoin increases, driving up its price.

Increased Market Volatility and Crypto Trading Activity

The correlation between US-China trade news and Bitcoin price fluctuations is undeniable. Negative headlines often lead to immediate price drops, while positive developments can spark rallies. This heightened volatility, however, also attracts traders seeking to profit from short-term price swings. Data shows a clear spike in cryptocurrency trading volume during periods of heightened trade tensions. Major cryptocurrency exchanges report significant increases in user activity and trading volume when trade uncertainty is high.

- Data showing correlation between trade news and Bitcoin price movements: Numerous studies show a statistically significant correlation between negative trade news and increased Bitcoin price volatility.

- Statistics on increased crypto trading volume: Leading exchanges report substantial increases in trading volume during periods of heightened US-China trade tensions.

- Mention specific crypto exchanges seeing increased activity: Coinbase, Binance, and Kraken are among the exchanges showing increased trading activity during these periods.

- Discussion of short-term trading strategies: Day trading and swing trading become more attractive due to increased volatility.

The Role of Institutional Investors in the Bitcoin Price Surge

The growing interest of institutional investors in Bitcoin is a significant catalyst for its price appreciation. Hedge funds, asset management firms, and even some publicly traded companies are allocating a portion of their portfolios to cryptocurrencies, lending credibility and stability to the market. Large-scale institutional investments have a demonstrably positive impact on Bitcoin's price, providing a much-needed counterbalance to the inherent volatility of the crypto market.

- Examples of institutional investors entering the crypto market: Grayscale Bitcoin Trust is a prime example, along with several other publicly traded investment vehicles.

- Analysis of their investment strategies: Institutional investors often employ long-term holding strategies, which can stabilize the market.

- Discussion on the impact of institutional investments on market stability: Large-scale institutional buying helps absorb sell-offs, reducing price volatility.

- Mention of Grayscale Bitcoin Trust and other similar vehicles: These vehicles make it easier for institutional investors to gain exposure to Bitcoin.

Risks and Considerations for Investing in Bitcoin During Trade Uncertainty

While the potential for profit is significant, it's crucial to acknowledge the inherent volatility of the cryptocurrency market. Bitcoin's price can experience dramatic swings, both upward and downward, in short periods. Investors need to understand and accept this risk.

- Volatility as a significant risk factor: Bitcoin's price is notoriously volatile, making it a high-risk investment.

- Regulatory uncertainty and potential government crackdowns: Governments worldwide are still grappling with how to regulate cryptocurrencies, creating uncertainty.

- Security risks related to cryptocurrency exchanges and wallets: Cryptocurrency exchanges and personal wallets are potential targets for hackers.

- Importance of diversification within investment portfolios: Never invest more than you can afford to lose, and diversify your portfolio to manage risk.

Conclusion: Navigating US-China Trade Uncertainty with Bitcoin and Crypto

The relationship between US-China trade uncertainty and Bitcoin's price movements is clear: economic instability drives investors towards safe haven assets, and Bitcoin increasingly fits that description. Institutional investment plays a significant role in stabilizing the market and attracting further investment. However, it is vital to understand the inherent risks associated with cryptocurrencies. The volatility of the market, regulatory uncertainty, and security risks necessitate thorough research and careful consideration.

Before investing in Bitcoin or any other cryptocurrency, conduct thorough due diligence and consider seeking professional financial advice. Stay informed about US-China trade developments and explore how incorporating Bitcoin and other cryptocurrencies into your investment strategy can help you navigate economic uncertainty.

Featured Posts

-

Dwp Benefit Stoppage Four Word Letters Warning Uk Households

May 08, 2025

Dwp Benefit Stoppage Four Word Letters Warning Uk Households

May 08, 2025 -

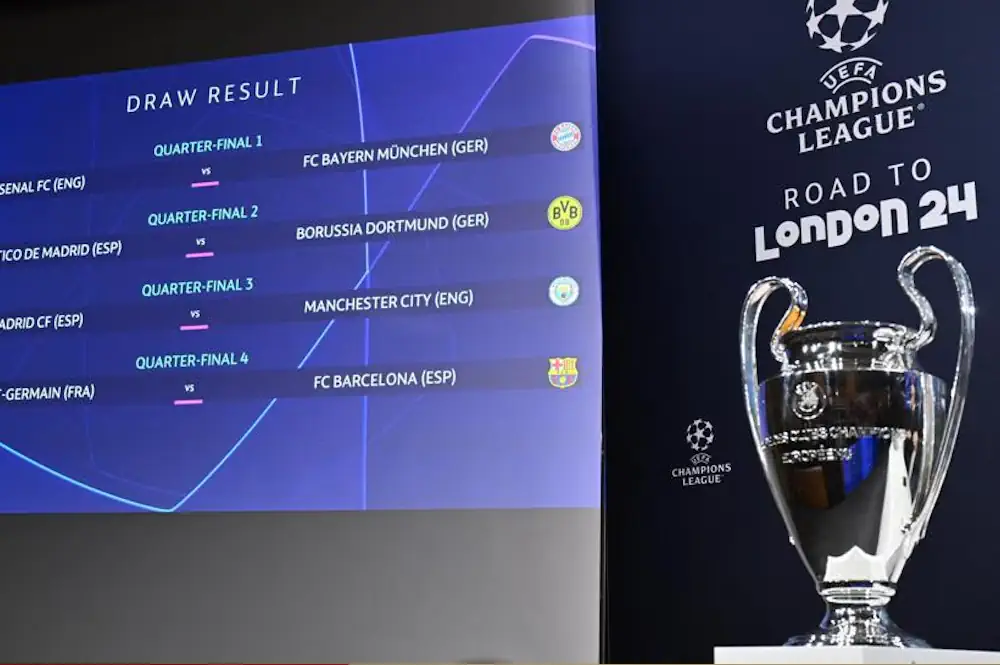

Liga Chempionov 2024 2025 Predvaritelniy Obzor Polufinalnykh Matchey Arsenal Ps Zh I Barselona Inter

May 08, 2025

Liga Chempionov 2024 2025 Predvaritelniy Obzor Polufinalnykh Matchey Arsenal Ps Zh I Barselona Inter

May 08, 2025 -

Star Wars Andor Book Cancelled The Ai Controversy

May 08, 2025

Star Wars Andor Book Cancelled The Ai Controversy

May 08, 2025 -

Psgs Doha Labs Inaugural Step In Worldwide Innovation

May 08, 2025

Psgs Doha Labs Inaugural Step In Worldwide Innovation

May 08, 2025 -

What Fueled The Recent Increase In Bitcoin Mining

May 08, 2025

What Fueled The Recent Increase In Bitcoin Mining

May 08, 2025

Latest Posts

-

Andor Season 1 Where To Watch Episodes Online Hulu And You Tube

May 08, 2025

Andor Season 1 Where To Watch Episodes Online Hulu And You Tube

May 08, 2025 -

Stream All Andor Season 1 Episodes Hulu And You Tube Availability

May 08, 2025

Stream All Andor Season 1 Episodes Hulu And You Tube Availability

May 08, 2025 -

Watch Andor Season 1 Episodes On Hulu And You Tube Before Season Two

May 08, 2025

Watch Andor Season 1 Episodes On Hulu And You Tube Before Season Two

May 08, 2025 -

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025 -

Yavin 4s Resurgence Exploring The Delay In Its Star Wars Reappearance

May 08, 2025

Yavin 4s Resurgence Exploring The Delay In Its Star Wars Reappearance

May 08, 2025