US-China Trade Uncertainty Drives Copper Market Volatility

Table of Contents

The Intertwined Fate of US-China Trade and Copper Demand

China's position as the world's largest consumer of copper is undeniable. Its massive infrastructure projects, burgeoning construction sector, and thriving manufacturing industries all rely heavily on this red metal. Consequently, any disruption to its economy, particularly one stemming from trade disputes with the US, directly impacts global copper demand. Trade wars, characterized by tariffs and trade restrictions, significantly affect Chinese demand for copper in several ways.

-

Impact of tariffs on copper-intensive industries in China: Tariffs on imported goods increase the cost of production for Chinese manufacturers, reducing their competitiveness and potentially lowering their demand for copper. Industries like electronics, construction, and automotive manufacturing are particularly vulnerable.

-

Reduced infrastructure spending due to trade uncertainty: Trade uncertainty can lead to a slowdown in economic growth, prompting the Chinese government to scale back ambitious infrastructure projects. This directly translates to lower copper consumption as these projects require vast quantities of the metal.

-

Shift in global supply chains affecting copper demand: The ongoing trade tensions have prompted some companies to reconsider their reliance on Chinese manufacturing, leading to a shift in global supply chains. This relocation of production away from China can decrease copper demand in the short term, although it may eventually lead to increased demand in other regions. Keywords: China copper consumption, copper demand, trade tariffs, infrastructure spending, global supply chains.

How Trade Wars Affect Copper Supply Chains and Production

Copper's journey from mine to market is a global affair, involving extraction in various countries, processing, and transportation across continents. Trade restrictions and sanctions, often a feature of US-China trade disputes, significantly disrupt this intricate network. The consequences are felt throughout the entire copper supply chain.

-

Impact of sanctions on copper mining and processing operations: Sanctions imposed on specific countries can hinder copper mining and processing activities, leading to supply shortages and price spikes. Geopolitical instability in major copper-producing regions further exacerbates this problem.

-

Disruptions to logistics and transportation: Trade wars often involve increased customs checks, delays at ports, and more complex shipping routes. These disruptions increase transportation costs and lead to uncertainties in delivery times, impacting the overall efficiency and cost of the copper supply chain.

-

Increased uncertainty for copper producers leading to investment hesitancy: The volatility caused by trade uncertainty discourages investment in new copper mining and processing projects. This reluctance to commit capital can create long-term supply constraints, pushing copper prices higher. Keywords: copper supply chain, copper production, trade restrictions, global copper market, copper mining.

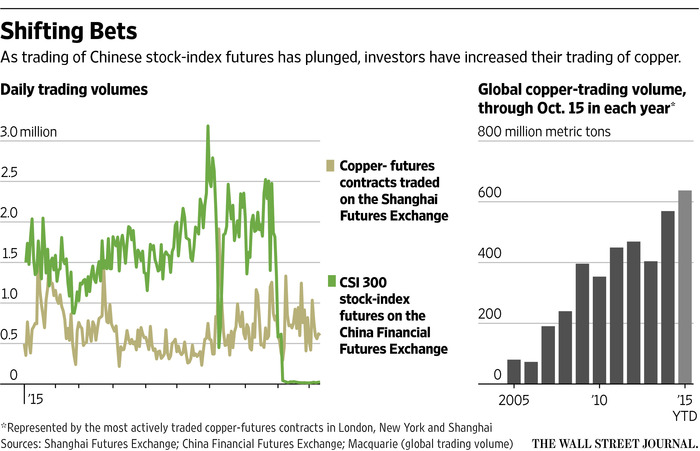

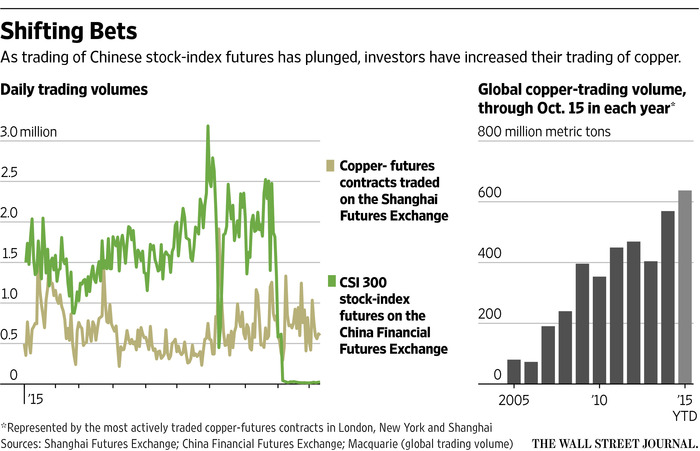

The Role of Investor Sentiment and Speculation

US-China trade tensions significantly impact investor confidence in the global economy. This uncertainty directly influences investment decisions related to copper and other commodities. The copper futures market, a key indicator of future prices, reflects this sentiment.

-

Increased volatility in copper futures prices: The uncertainty surrounding trade relations creates volatility in copper futures prices, making it difficult for investors to predict future price movements and increasing risk.

-

Flight to safety impacting investment in commodities like copper: During times of economic uncertainty, investors often move their assets into perceived “safe havens”. While typically gold is considered a safe haven, copper can sometimes benefit from this flight to safety depending on the overall market sentiment.

-

Speculative trading exacerbating price fluctuations: The volatile nature of copper prices during periods of trade uncertainty attracts speculative traders who may amplify price swings through their trading activities. Keywords: copper futures, investor sentiment, commodity investment, speculation, copper price volatility.

Geopolitical Risks and their Influence on Copper Prices

The broader geopolitical landscape, often intertwined with US-China relations, also significantly influences copper prices. Political instability in major copper-producing regions, for instance, can directly impact supply and, consequently, prices.

-

Impact of political instability on copper supply: Political unrest or conflict in copper-rich nations can disrupt mining operations and transportation, creating supply shortages and driving up prices.

-

Currency fluctuations related to trade disputes: Trade disputes can lead to currency fluctuations, impacting the cost of copper imports and exports for different countries.

-

Increased risk premiums impacting copper prices: Increased geopolitical risk generally leads to higher risk premiums embedded in commodity prices, including copper. This reflects the uncertainty associated with future supply and demand. Keywords: geopolitical risk, copper price forecast, currency exchange rates, political instability.

Understanding and Managing Copper Market Volatility in the Face of US-China Trade Uncertainty

In conclusion, US-China trade tensions are a major driver of copper market volatility, influencing both supply and demand dynamics. The intricate interplay between tariffs, sanctions, investor sentiment, and geopolitical risks creates a complex and challenging environment for copper market participants. It's crucial to monitor US-China trade relations closely to anticipate potential shifts in the copper market. To effectively manage your exposure to copper market volatility, consider diversifying your portfolio and exploring hedging strategies to mitigate risks associated with US-China trade uncertainty and copper price fluctuations. Learn more about hedging strategies for managing copper market volatility.

Featured Posts

-

Patrick Schwarzenegger On White Lotus Denies Nepotism Claims Details Hard Work

May 06, 2025

Patrick Schwarzenegger On White Lotus Denies Nepotism Claims Details Hard Work

May 06, 2025 -

Broadway Legends George Clooney And Patti Lu Pone In Conversation

May 06, 2025

Broadway Legends George Clooney And Patti Lu Pone In Conversation

May 06, 2025 -

Mindy Kaling And B J Novak Photos Through The Years

May 06, 2025

Mindy Kaling And B J Novak Photos Through The Years

May 06, 2025 -

Guelsen Bubikoglu Nun Son Hali Yesilcam Efsanesi

May 06, 2025

Guelsen Bubikoglu Nun Son Hali Yesilcam Efsanesi

May 06, 2025 -

Practical Guide To Affordable Shopping

May 06, 2025

Practical Guide To Affordable Shopping

May 06, 2025