US Credit Downgrade: Impact On Dow Futures And Dollar — Live Analysis

Table of Contents

Immediate Impact on Dow Futures

The announcement of the US credit downgrade triggered a swift and dramatic reaction in Dow futures trading. The Dow Jones Industrial Average futures experienced a sharp decline, plummeting by [Insert Percentage]% within the first [Insert timeframe, e.g., hour] of the news breaking.

- 14:00 EST: Dow futures dropped [Insert Percentage]%.

- 14:30 EST: Further decline of [Insert Percentage]%, reaching a low of [Insert Value].

- 15:00 EST: Slight recovery, but still down [Insert Percentage]% from the pre-downgrade level.

This immediate market reaction reflects a heightened sense of investor sentiment and risk aversion. The downgrade signaled a loss of confidence in the US economy's fiscal strength, prompting many investors to liquidate their holdings and seek safer investment havens. Increased market volatility was immediately evident in the rapid and significant price swings in Dow futures contracts. The uncertainty surrounding the long-term implications of the downgrade further exacerbated the sell-off. Keywords: Dow Jones Industrial Average, Dow futures trading, futures contracts, market volatility, immediate market reaction.

Dollar's Response to US Credit Downgrade

Following the credit downgrade, the US dollar's performance exhibited a mixed reaction. While initially showing signs of weakness against some major currencies, it later demonstrated resilience, reflecting its role as a safe-haven asset.

- EUR/USD: Increased from [Insert Value] to [Insert Value].

- GBP/USD: Moved from [Insert Value] to [Insert Value].

- USD/JPY: Showed minimal change, remaining relatively stable around [Insert Value].

The dollar's behavior can be attributed to several factors. While the downgrade raised concerns about the US economy's future, the dollar's perceived safe-haven status attracted investors seeking stability amidst uncertainty. Furthermore, interest rate expectations played a role, with some anticipating potential interest rate hikes by the Federal Reserve to counter the effects of the downgrade, bolstering the dollar. Keywords: US dollar index, currency exchange rates, forex trading, safe-haven asset, interest rate differentials.

Longer-Term Implications for Dow Futures and the Dollar

Predicting the long-term consequences of this US credit downgrade remains challenging, but several potential scenarios can be explored.

- Scenario 1: Sustained Decline: Continued economic uncertainty could lead to a sustained decline in Dow futures and potential further weakening of the dollar.

- Scenario 2: Gradual Recovery: If the government implements effective measures to address the underlying issues, a gradual recovery in both Dow futures and the dollar is possible.

- Scenario 3: Increased Volatility: High levels of uncertainty could result in prolonged market volatility for both Dow futures and the US dollar, creating both opportunities and risks for investors.

The long-term market outlook will largely depend on the government's response, global economic conditions, and investor confidence. Effective policy changes and signs of economic stability could mitigate the negative impact, while further economic setbacks could exacerbate the situation. Keywords: long-term market outlook, economic forecasts, investment strategies, risk assessment, future market predictions.

Expert Opinions and Market Sentiment

Market analysts and economists are divided in their assessments. Some express concerns about a prolonged period of economic uncertainty, while others remain cautiously optimistic about the US economy's resilience.

“[Insert Quote from Market Analyst 1 about the impact on Dow Futures],” stated [Analyst 1's Name and Title].

“[Insert Quote from Economist 2 regarding the dollar’s future],” commented [Economist 2's Name and Title].

The prevailing market sentiment is currently one of cautious pessimism. While the immediate reaction was negative, the long-term impact remains uncertain, with investors closely monitoring economic indicators and government actions. Keywords: market analysis, expert opinion, investor sentiment, market psychology, economic commentary.

Technical Analysis of Dow Futures and the Dollar (Optional)

[Insert technical analysis section with charts, graphs, and discussion of key technical indicators such as support levels, resistance levels, and moving averages. Remember to include relevant keywords such as technical indicators, chart patterns, support and resistance, trading strategies, and technical analysis.]

Conclusion: Navigating the Aftermath of the US Credit Downgrade

The US credit downgrade has undeniably created significant uncertainty in the financial markets. Our live analysis reveals immediate negative impacts on both Dow futures and the US dollar, although the degree and duration of these impacts remain uncertain. The long-term outlook depends heavily on future economic developments, governmental responses, and overall investor sentiment. Navigating this turbulent period requires careful monitoring of market trends, expert analysis, and informed investment strategies. Stay updated on the situation by following our website/platform for continued live analysis of the US credit downgrade's impact on Dow futures and the dollar. Subscribe to our newsletters or alerts to receive timely updates and insights. Understanding the evolving impact of this US credit downgrade on Dow futures and the US dollar is crucial for making informed investment decisions.

Featured Posts

-

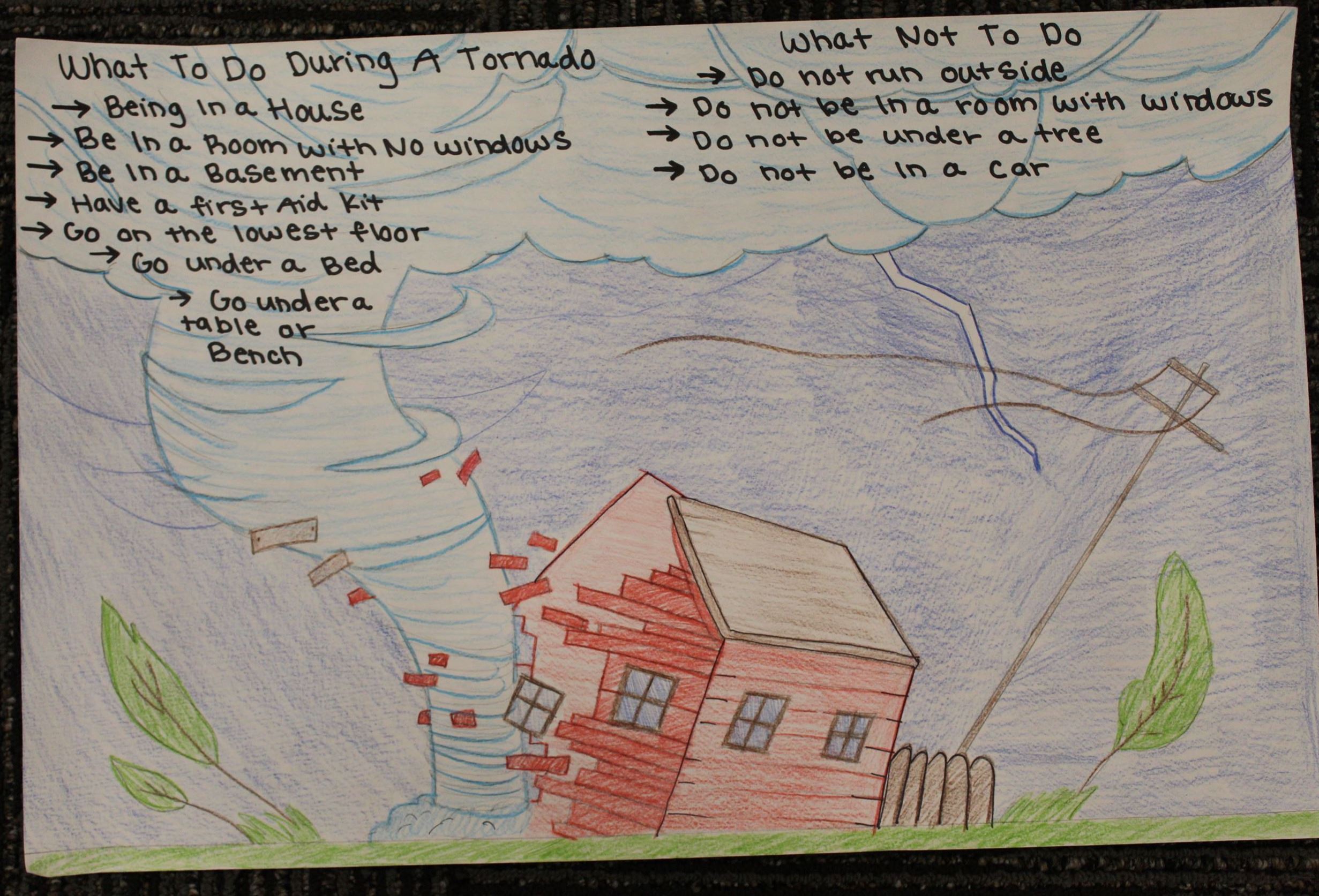

Severe Weather Awareness Recognizing And Responding To Damaging Winds

May 21, 2025

Severe Weather Awareness Recognizing And Responding To Damaging Winds

May 21, 2025 -

Bayley Injury Update And Speculation On A John Cena Vs Randy Orton Match

May 21, 2025

Bayley Injury Update And Speculation On A John Cena Vs Randy Orton Match

May 21, 2025 -

Peppa Pigs Cinema Event 10 Episodes Featuring Baby This May

May 21, 2025

Peppa Pigs Cinema Event 10 Episodes Featuring Baby This May

May 21, 2025 -

March 26th 2025 Nyt Mini Crossword Answers

May 21, 2025

March 26th 2025 Nyt Mini Crossword Answers

May 21, 2025 -

A Critical Look At Water Colour A New Play Script

May 21, 2025

A Critical Look At Water Colour A New Play Script

May 21, 2025