US Credit Rating Cut: Dow Futures And Dollar React

Table of Contents

Fitch Ratings Downgrade: The Rationale

Fitch Ratings' decision to downgrade the US credit rating from AAA to AA+ is a significant event with far-reaching implications. Their reasoning centers on the deterioration of US governance standards and the repeated debt-ceiling standoffs that have characterized recent years. These political battles, Fitch argues, highlight a weakening of the US's fiscal policymaking process and increase the risk of default.

Key factors cited by Fitch include:

- Repeated Debt-Ceiling Standoffs: The near-misses on debt defaults in recent years demonstrate a troubling trend of political gridlock undermining the country's fiscal responsibility.

- Erosion of Governance Standards: Fitch points to a decline in the effectiveness of the US government's ability to manage its finances and navigate the challenges of rising debt.

- Rising National Debt: The persistent growth of the US national debt poses a significant long-term challenge to fiscal sustainability.

These factors, taken together, led Fitch to conclude that the US's fiscal strength is eroding, warranting a downgrade of its sovereign credit rating. The keywords associated with this downgrade include: Fitch Ratings downgrade, US creditworthiness, debt ceiling crisis, governance concerns, and fiscal policy.

Immediate Market Reactions: Dow Futures and the Dollar

The announcement of the Fitch Ratings downgrade immediately triggered significant market reactions, particularly affecting Dow futures and the US dollar.

Dow Futures Plunge

Following the news, Dow futures experienced a significant drop, reflecting a negative investor sentiment.

- The percentage drop in Dow futures was substantial, indicating a considerable level of market uncertainty and apprehension. (Insert specific percentage drop here when available).

- Investor sentiment shifted dramatically, with many anticipating further market volatility in the short term.

- This sharp decline underscores the significant weight investors place on the US credit rating and the broader implications for the global economy.

Keywords associated with this section include: Dow Jones Industrial Average, Dow futures, market volatility, investor sentiment, and stock market reaction.

Dollar's Initial Response

The initial reaction of the US dollar to the Fitch downgrade was complex and not entirely predictable. (Describe whether the dollar strengthened or weakened. Explain the reasoning, referencing potential "safe-haven" status or other factors impacting currency exchange rates).

- The impact on the US dollar is influenced by various factors, including risk aversion among investors and the perceived safety of US assets.

- The implications for international trade and currency markets are significant, particularly for countries heavily reliant on US trade or investment.

Keywords relevant to this section include: US dollar, currency exchange rate, forex market, international trade, and safe-haven asset.

Potential Long-Term Economic Impacts of the US Credit Rating Cut

The downgrade by Fitch has far-reaching implications for the US economy and the global financial system. The long-term consequences could be significant and multifaceted.

Increased Borrowing Costs

The downgrade will likely lead to increased borrowing costs for the US government.

- Higher interest rates on US Treasury bonds will increase the cost of servicing the national debt.

- This will put pressure on government spending and potentially restrict future economic growth.

- The increased cost of borrowing could also affect businesses and consumers, leading to higher interest rates on loans and mortgages.

Keywords for this section include: US government debt, interest rates, bond yields, fiscal deficit, and economic growth.

Impact on Inflation

The credit rating cut could have significant, though uncertain, effects on inflation.

- Increased borrowing costs could, in theory, lead to lower demand and potentially deflationary pressures.

- However, the ripple effects of higher interest rates on various sectors of the economy could also lead to inflationary pressures.

- The actual impact on inflation will depend on various macroeconomic factors and the Federal Reserve's response.

Keywords: inflation, interest rates, monetary policy, consumer price index (CPI), and economic outlook.

Global Market Implications

The downgrade's impact extends far beyond US borders, with potential consequences for global markets and international finance.

- There is a risk of contagion effects, where the downgrade could negatively impact the credit ratings of other countries.

- Global financial markets could experience increased volatility and uncertainty.

- The stability of the global economic system might be affected, potentially leading to disruptions in international trade and investment.

Keywords: global financial markets, international finance, contagion effect, sovereign debt, and global economic stability.

Conclusion

The Fitch Ratings downgrade of the US credit rating represents a significant event with potentially profound implications. The immediate market reaction, evidenced by sharp drops in Dow futures and the dollar's fluctuating response, highlights the gravity of the situation. The long-term economic impacts, including increased borrowing costs, potential inflationary pressures, and global market instability, necessitate close monitoring. The impact on Dow futures and the dollar will continue to unfold as investors grapple with the implications of this unprecedented event.

Call to Action: Stay informed about the evolving situation regarding the US credit rating cut and its impact on Dow futures and the dollar. Follow reputable financial news sources for continuous updates and informed investment decisions. Monitor market developments closely to manage your financial portfolio effectively in the face of this significant economic event. Learn more about mitigating risk in your investment portfolio in the face of a US credit rating cut.

Featured Posts

-

Agatha Christies Poirot Unraveling The Mysteries

May 20, 2025

Agatha Christies Poirot Unraveling The Mysteries

May 20, 2025 -

Jacob Friis Seger I Malta Trots Kaempig Match

May 20, 2025

Jacob Friis Seger I Malta Trots Kaempig Match

May 20, 2025 -

The Cunha Chase Manchester Uniteds Late Entry Into The Arsenal Race

May 20, 2025

The Cunha Chase Manchester Uniteds Late Entry Into The Arsenal Race

May 20, 2025 -

Ap

May 20, 2025

Ap

May 20, 2025 -

Solve The Nyt Mini Crossword April 25th Answers

May 20, 2025

Solve The Nyt Mini Crossword April 25th Answers

May 20, 2025

Latest Posts

-

Abn Amro Toenemend Autobezit Drijft Occasionverkoop Omhoog

May 21, 2025

Abn Amro Toenemend Autobezit Drijft Occasionverkoop Omhoog

May 21, 2025 -

Hypotheken Intermediair Karin Polman Neemt Directie Abn Amro Florius En Moneyou Over

May 21, 2025

Hypotheken Intermediair Karin Polman Neemt Directie Abn Amro Florius En Moneyou Over

May 21, 2025 -

Abn Amro Analyse Van De Halvering Voedselexport Naar De Vs Door Heffingen

May 21, 2025

Abn Amro Analyse Van De Halvering Voedselexport Naar De Vs Door Heffingen

May 21, 2025 -

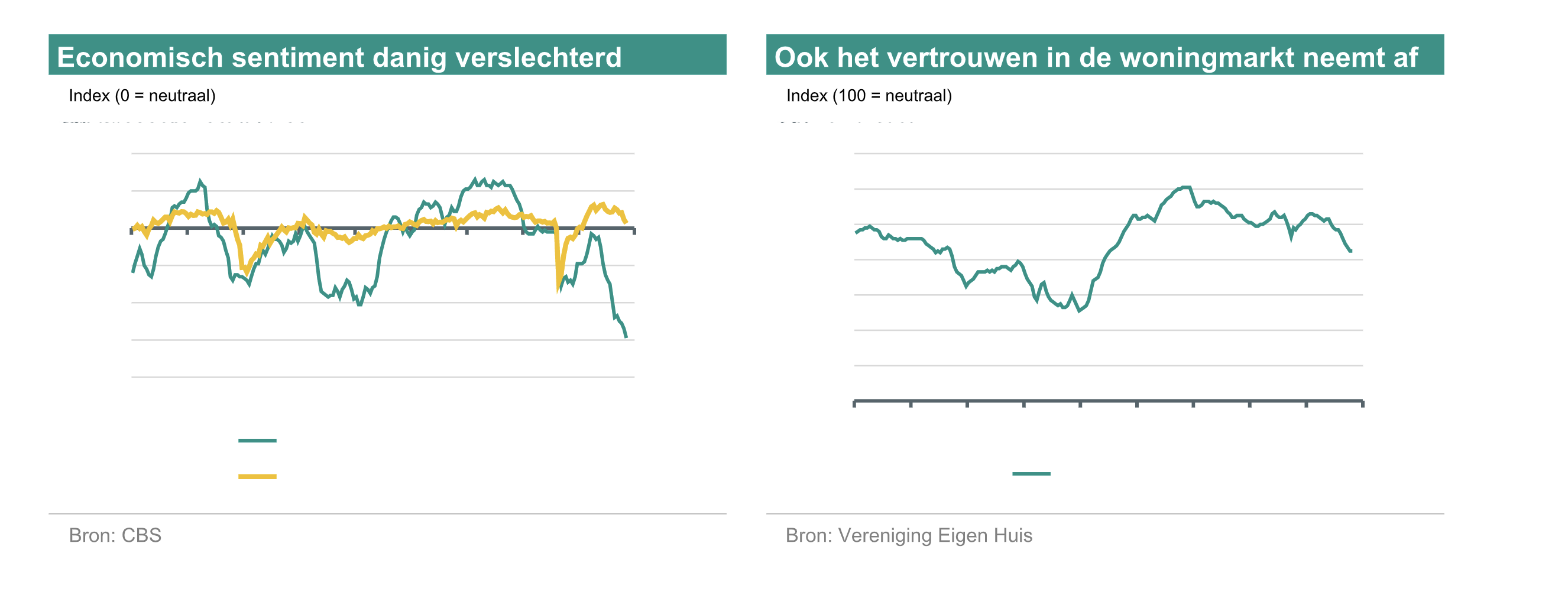

Rentedaling Verwacht Abn Amro Positief Over Huizenmarkt

May 21, 2025

Rentedaling Verwacht Abn Amro Positief Over Huizenmarkt

May 21, 2025 -

Abn Amro Florius En Moneyou Karin Polman Nieuwe Directeur Hypotheken

May 21, 2025

Abn Amro Florius En Moneyou Karin Polman Nieuwe Directeur Hypotheken

May 21, 2025