US Stock Market Rally Fueled By Tech Giants, Tesla

Table of Contents

The Tech Giants' Dominance

The recent tech stock rally has been a major driver of the overall market surge. FAANG stocks (Facebook, Apple, Amazon, Netflix, and Google) and other major tech companies have significantly boosted market capitalization, reflecting strong investor confidence in the sector. This dominance is driven by several key factors:

- Strong Earnings Reports: Consistently impressive earnings reports from these tech behemoths have fueled positive investor sentiment. These reports showcase robust revenue growth, exceeding analysts' expectations and demonstrating the resilience of these companies even amidst economic uncertainty.

- Technological Innovation: Continuous innovation in areas like artificial intelligence, cloud computing, and e-commerce keeps these companies at the forefront of technological advancement, attracting investment and driving market share growth. This consistent innovation reinforces their positions as market leaders, contributing to their sustained growth.

- Impact on Market Indices: The exceptional performance of these tech giants has had a substantial ripple effect on major market indices like the S&P 500 and Nasdaq, significantly pushing these indices upwards and fueling the broader US stock market rally. Their influence is undeniable and serves as a key indicator of overall market health.

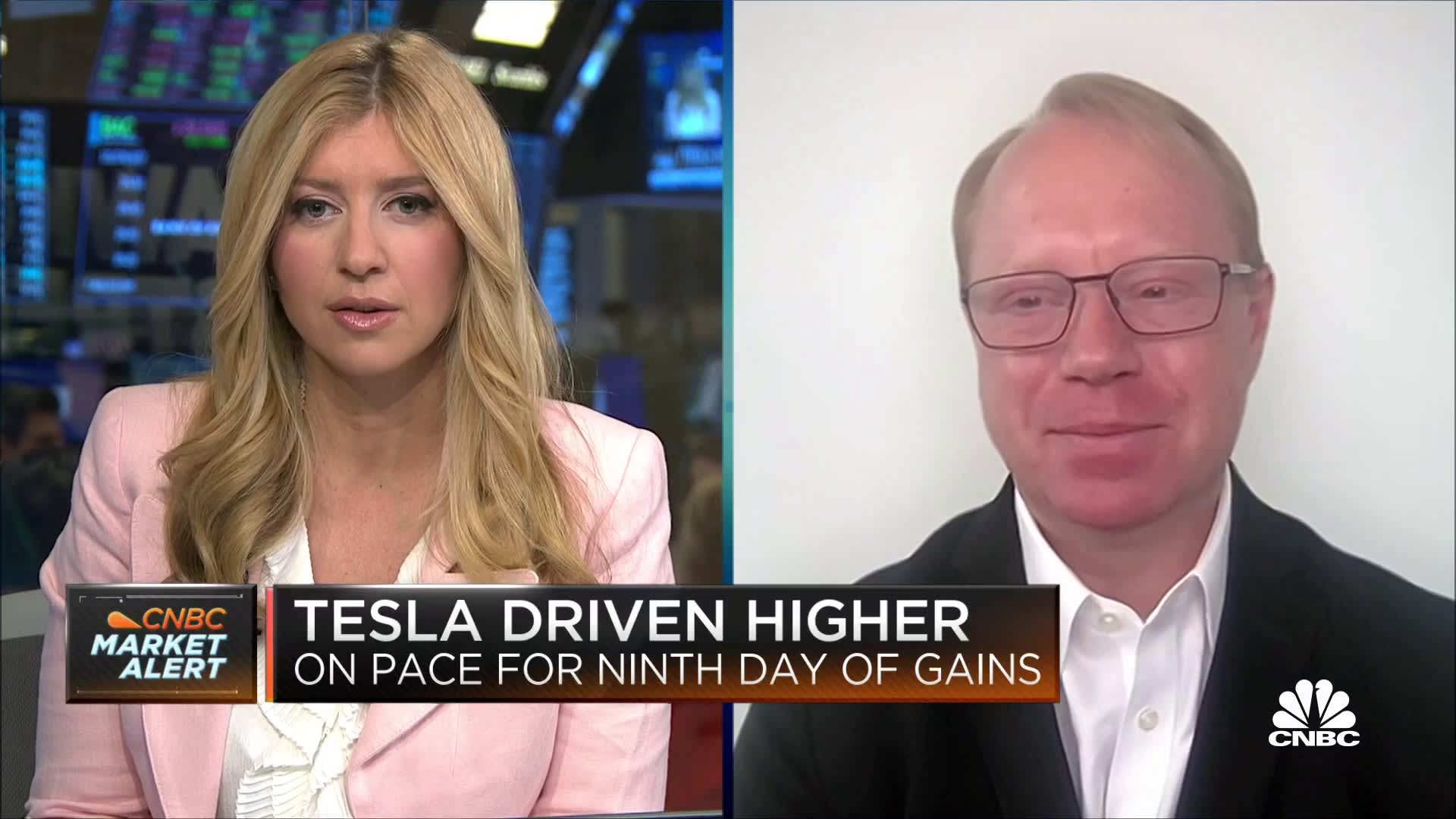

Tesla's Electrifying Performance

Tesla's remarkable performance has been another significant catalyst for the current US stock market rally. Its influence extends beyond its own stock price, impacting the entire electric vehicle (EV) sector and boosting investor sentiment towards renewable energy stocks.

- Strong Sales and Production: Tesla's consistently strong sales figures, coupled with increased production capacity, have solidified its position as a market leader in the EV industry. This demonstrable growth fuels investor confidence.

- Expansion into New Markets: Tesla's aggressive expansion into new global markets further contributes to its growth trajectory and enhances its appeal to investors seeking exposure to high-growth sectors.

- Influence on the EV Sector: Tesla's success has a significant spillover effect, boosting investor confidence in the broader EV sector and attracting capital to companies developing related technologies and infrastructure. This creates a positive feedback loop, driving the entire sector forward.

Macroeconomic Factors Contributing to the Rally

While the performance of tech giants and Tesla has been a primary driver, macroeconomic factors also contribute to the overall US stock market rally. These factors create a supportive environment for investment and economic growth.

- Interest Rate Decisions: The Federal Reserve's monetary policy decisions, including interest rate adjustments, play a crucial role in shaping investor sentiment and market behavior. Moderate interest rate hikes, if managed well, can support economic growth without stifling it.

- Inflation and Consumer Spending: The level of inflation and its impact on consumer spending are key indicators of economic health. Controlled inflation and strong consumer spending create a positive environment for businesses and the stock market.

- Investor Confidence and Risk Appetite: Overall investor confidence and risk appetite are vital factors influencing the stock market. Positive economic indicators and the anticipation of future growth contribute to increased risk appetite and fuel investment.

Risks and Potential Corrections

While the current US stock market rally presents numerous opportunities, it's crucial to acknowledge potential risks and the possibility of a market correction.

- Market Volatility: The stock market is inherently volatile, and rapid price swings are a common occurrence. Understanding and managing this volatility is crucial for investors.

- Geopolitical Instability: Geopolitical events and uncertainties can significantly impact market sentiment and trigger corrections. Staying informed about global events is essential for investors.

- Unexpected Economic Events: Unexpected economic downturns or recessions can trigger significant market corrections. Having a diversified investment portfolio and a long-term investment strategy can help mitigate these risks.

Conclusion

The current US stock market rally is largely driven by the exceptional performance of tech giants and Tesla, alongside favorable macroeconomic conditions. While these factors contribute to a positive outlook, it's crucial to remember that market volatility and unforeseen events can lead to corrections. Stay updated on the latest developments in the US stock market rally. Learn more about investing in tech giants and Tesla, and understand the risks and rewards before making any investment decisions. Continuously monitoring the US stock market rally and its key players remains paramount for informed investment strategies.

Featured Posts

-

Mwedna Me Fn Abwzby 19 Nwfmbr

Apr 29, 2025

Mwedna Me Fn Abwzby 19 Nwfmbr

Apr 29, 2025 -

The Devastating Effect Of River Road Construction On Louisville Restaurants

Apr 29, 2025

The Devastating Effect Of River Road Construction On Louisville Restaurants

Apr 29, 2025 -

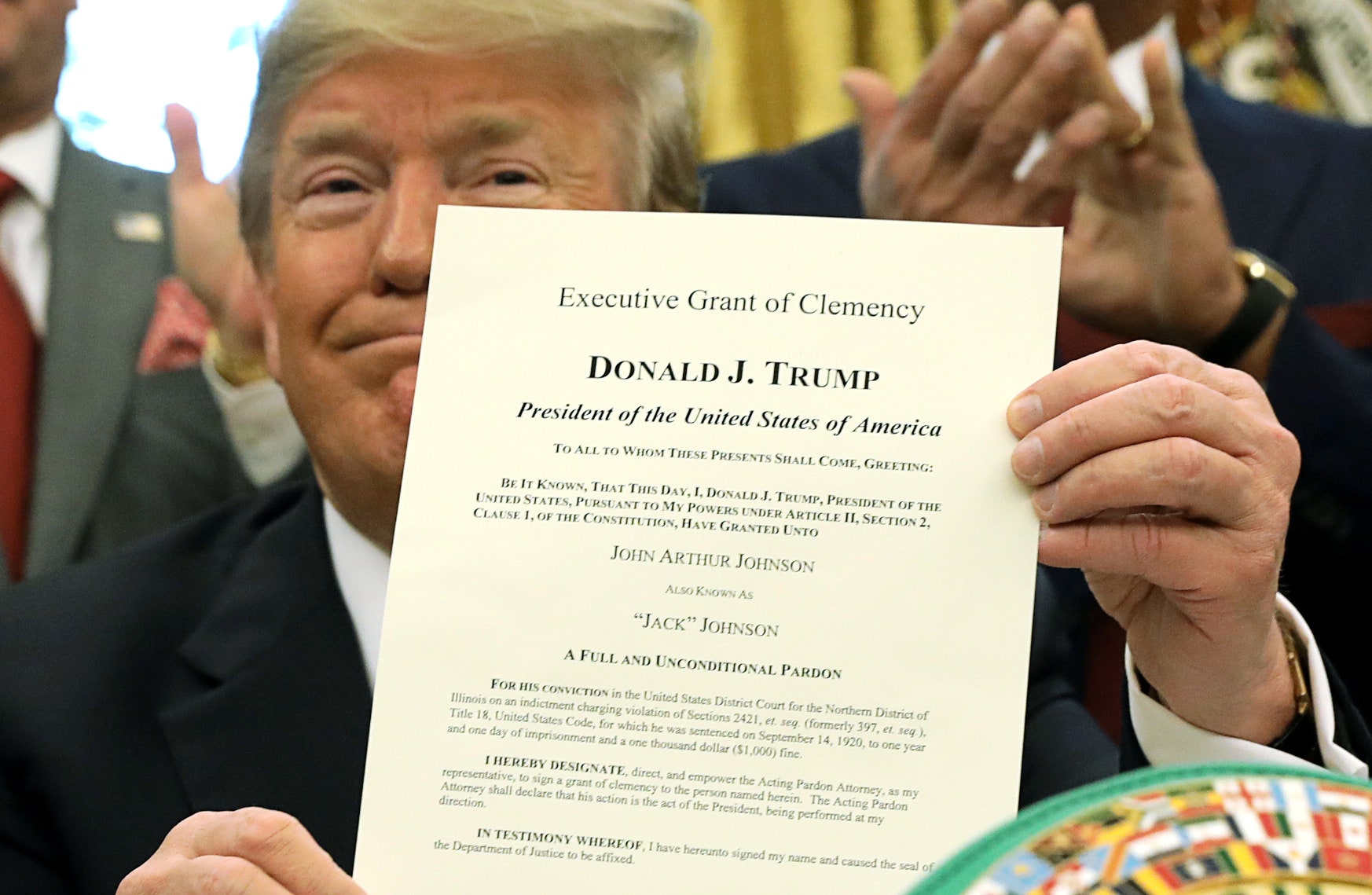

Full Pardon For Rose Trumps Decision And Its Fallout

Apr 29, 2025

Full Pardon For Rose Trumps Decision And Its Fallout

Apr 29, 2025 -

Kl Ma Tryd Merfth En Antlaq Fn Abwzby Fy 19 Nwfmbr

Apr 29, 2025

Kl Ma Tryd Merfth En Antlaq Fn Abwzby Fy 19 Nwfmbr

Apr 29, 2025 -

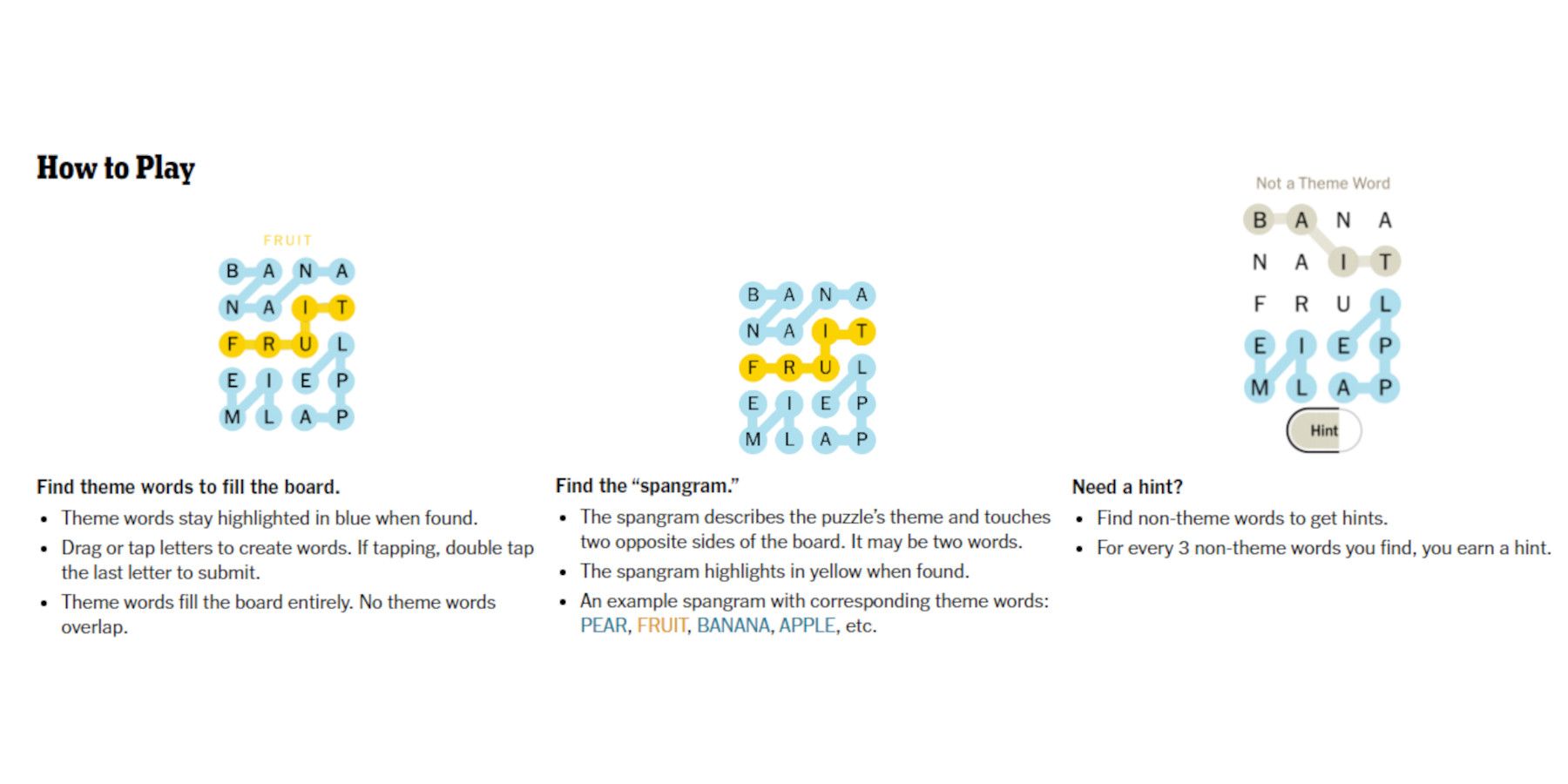

Nyt Strands Puzzle February 27 2025 Answers And Clues

Apr 29, 2025

Nyt Strands Puzzle February 27 2025 Answers And Clues

Apr 29, 2025

Latest Posts

-

Finding Nostalgia On You Tube Older Viewers Share Their Experiences

Apr 29, 2025

Finding Nostalgia On You Tube Older Viewers Share Their Experiences

Apr 29, 2025 -

Returning To Beloved Shows How You Tube Caters To Older Viewers

Apr 29, 2025

Returning To Beloved Shows How You Tube Caters To Older Viewers

Apr 29, 2025 -

London Real Estate Fraud British Court Upholds Vaticans Claim

Apr 29, 2025

London Real Estate Fraud British Court Upholds Vaticans Claim

Apr 29, 2025 -

Vatican Defrauded London Real Estate Deal Ruled Fraudulent By British Court

Apr 29, 2025

Vatican Defrauded London Real Estate Deal Ruled Fraudulent By British Court

Apr 29, 2025 -

Analyzing You Tubes Appeal To An Aging Viewership

Apr 29, 2025

Analyzing You Tubes Appeal To An Aging Viewership

Apr 29, 2025