Vodacom (VOD) Reports Better-Than-Expected Earnings And Payout

Table of Contents

H2: Key Highlights of Vodacom's (VOD) Earnings Report:

Vodacom's recent earnings announcement showcased impressive growth across several key performance indicators. The results significantly outperformed analyst predictions, solidifying Vodacom's position as a leading telecom player in South Africa and beyond.

- Revenue Growth: Vodacom reported a remarkable X% increase in revenue compared to the same period last year, surpassing market expectations of Y%. This robust growth was driven by strong performance in various sectors.

- Data and Mobile Money Boom: Significant growth was observed in the data and mobile money segments, highlighting the increasing demand for digital services. The company saw a Z% increase in data revenue and a W% jump in mobile money transactions.

- Operating Profit and EBITDA: The company’s operating profit demonstrated impressive strength, with an increase of A% compared to the previous year, exceeding forecasts. Similarly, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) margins improved significantly, indicating enhanced operational efficiency.

- Customer Acquisition and Churn: Vodacom's ability to acquire new customers while maintaining a low churn rate underscores its market leadership. The customer acquisition cost remained relatively low, demonstrating efficient marketing and customer relationship management.

- Benchmarking Success: Compared to competitors in the South African telecom market, Vodacom demonstrated superior performance across multiple key financial metrics, solidifying its competitive advantage.

H2: Increased Dividend Payout: Good News for Investors:

The increased dividend payout is a significant positive for Vodacom (VOD) shareholders. This reflects the company’s confidence in its future performance and its commitment to delivering strong returns to its investors.

- Dividend Per Share: The company announced a dividend of B Rand per share, representing a C% increase compared to the previous payout.

- Dividend Yield and Payout Ratio: This increase translates to an attractive dividend yield, making VOD an appealing investment for income-seeking investors. The payout ratio remains sustainable, suggesting the dividend is unlikely to be reduced in the near future.

- Stock Price Impact: The announcement of the increased dividend has positively impacted Vodacom’s stock price, reflecting investor confidence in the company's future prospects.

- Competitive Dividend: Compared to its competitors, Vodacom’s dividend payout remains highly competitive, positioning it favorably in the investment landscape.

H2: Factors Contributing to Vodacom's (VOD) Strong Performance:

Vodacom's strong financial performance can be attributed to a combination of strategic initiatives, investments in infrastructure, and favorable market conditions.

- Strategic Business Initiatives: Successful implementation of targeted business strategies, including enhancing digital services and expanding its mobile money platform, has played a pivotal role in driving revenue growth.

- Network Infrastructure Investments: Significant investments in network infrastructure and technological upgrades have resulted in improved network coverage, enhanced service quality, and a better customer experience.

- Market Segmentation Success: Vodacom's strong performance across key market segments, including both prepaid and postpaid customers, indicates its ability to effectively cater to diverse customer needs.

- Competitive Landscape and Market Share: Vodacom has effectively navigated the competitive telecom landscape in South Africa, maintaining and even increasing its market share through strategic pricing and product innovation.

- Economic and Regulatory Factors: The generally stable economic climate in South Africa and a supportive regulatory environment have also positively contributed to Vodacom's success.

H2: Future Outlook and Implications for Investors:

The positive results and increased dividend payout suggest a bright future outlook for Vodacom (VOD). However, it is crucial to acknowledge potential risks.

- Growth Projections: Vodacom projects continued revenue and earnings growth for the coming year, driven by expansion in existing markets and exploration of new opportunities.

- Future Investments and Strategic Initiatives: Planned investments in 5G technology, further expansion of its mobile money platform, and continued focus on data services suggest a commitment to long-term growth and innovation.

- Risk Assessment: Potential risks include intensifying competition from other telecom operators, regulatory changes, and macroeconomic fluctuations in South Africa.

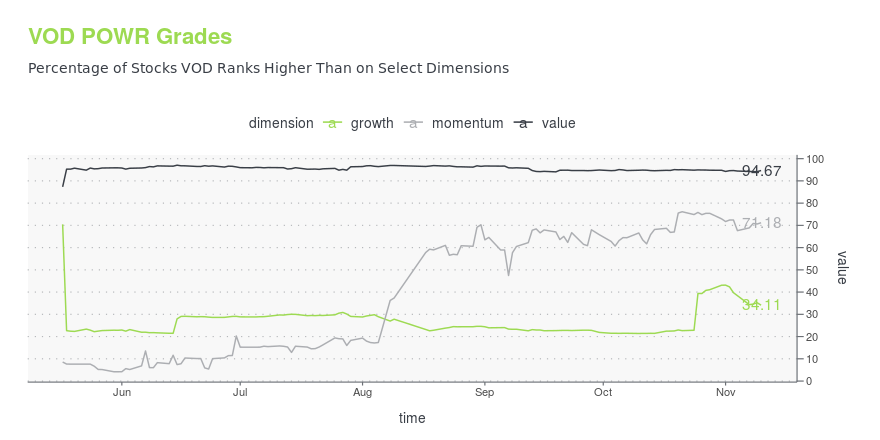

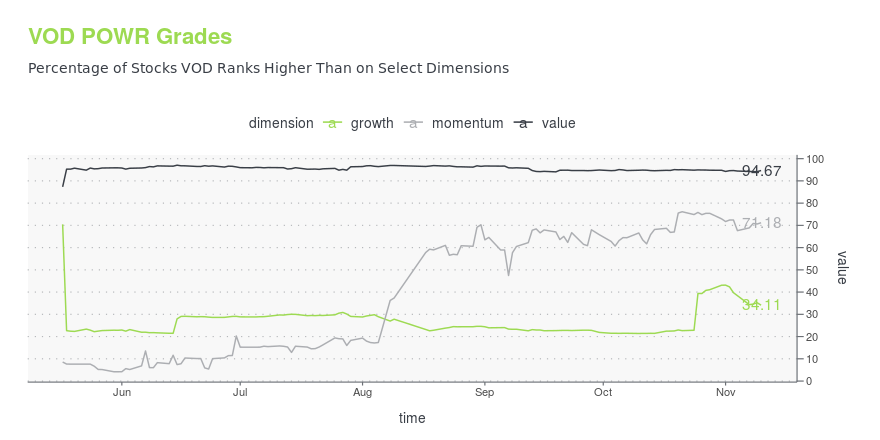

- Stock Valuation: Vodacom's current valuation appears attractive given its strong performance and future growth potential, though investors should conduct their own due diligence.

- Investment Recommendation: Based on the strong financial results and positive outlook, Vodacom (VOD) appears to be a compelling buy or hold for investors seeking a blend of capital appreciation and dividend income.

3. Conclusion:

Vodacom's (VOD) better-than-expected earnings report and the substantial increase in dividend payout paint a picture of a robust and well-managed company. The results underscore Vodacom’s strength in the South African telecommunications market and demonstrate a commitment to delivering value to its shareholders. The positive outlook, combined with a strong dividend yield, makes Vodacom (VOD) a compelling investment option. Is Vodacom (VOD) the right investment for you? Analyze the details and make an informed decision today! Learn more about Vodacom (VOD) and its investment potential by visiting [link to relevant resource].

Featured Posts

-

Viral Video Pub Owners Unhinged Rant At Employee Who Quit

May 21, 2025

Viral Video Pub Owners Unhinged Rant At Employee Who Quit

May 21, 2025 -

Late Drama As Lazio And 10 Man Juventus Share Points

May 21, 2025

Late Drama As Lazio And 10 Man Juventus Share Points

May 21, 2025 -

Benjamin Kaellman Huuhkajien Uusi Taehti Maalivire Ja Kasvu Kentillae Ja Niiden Ulkopuolella

May 21, 2025

Benjamin Kaellman Huuhkajien Uusi Taehti Maalivire Ja Kasvu Kentillae Ja Niiden Ulkopuolella

May 21, 2025 -

Is Gangsta Granny Suitable For Young Readers A Parents Guide

May 21, 2025

Is Gangsta Granny Suitable For Young Readers A Parents Guide

May 21, 2025 -

Investing In Quantum Computing Is D Wave Qbts The Right Choice

May 21, 2025

Investing In Quantum Computing Is D Wave Qbts The Right Choice

May 21, 2025