Volatility Ahead? Secure S&P 500 Downside Protection Now

Table of Contents

Understanding S&P 500 Volatility and its Impact

S&P 500 volatility refers to the degree of price fluctuation in the index, a measure of the performance of 500 large-cap US companies. High volatility means significant price swings in short periods, creating both opportunities and risks for investors. Understanding this volatility is key to effective investment management.

Historical examples abound: the dot-com bubble burst in the early 2000s and the 2008 financial crisis caused dramatic drops in the S&P 500, wiping out substantial investor wealth. These events highlight the importance of proactive risk management.

- Factors contributing to S&P 500 volatility: Inflation, rising interest rates, geopolitical instability (wars, trade disputes), unexpected economic data releases, and shifts in investor sentiment all contribute to market uncertainty and price fluctuations.

- Potential consequences of unpreparedness: Without proper downside protection, a market downturn can lead to significant portfolio losses, potentially delaying or even derailing long-term financial goals like retirement planning.

- Importance of a diversified investment portfolio: A well-diversified portfolio, spread across different asset classes, is a cornerstone of mitigating risk and reducing exposure to S&P 500 volatility.

Strategies for S&P 500 Downside Protection

Several strategies can help you secure S&P 500 downside protection. Let's explore some key approaches:

Hedging Strategies

Hedging involves using financial instruments to offset potential losses in your S&P 500 investments.

- Put options: These give you the right, but not the obligation, to sell your S&P 500 holdings at a predetermined price (strike price) before a specific date (expiration date). They act as insurance against price drops.

- Inverse ETFs: These exchange-traded funds (ETFs) aim to profit inversely from the performance of the S&P 500. They can be used to hedge against potential losses.

- Collars: This strategy involves simultaneously buying put options and selling call options on your S&P 500 holdings, limiting both upside potential and downside risk.

Pros and Cons: Each hedging strategy has its advantages and disadvantages, including cost considerations (premiums for options), risk mitigation potential, and suitability for different investor profiles. For example, put options offer more targeted protection but have a cost, while inverse ETFs may not perfectly mirror index movements.

- Cost considerations: Put options and collars involve premium payments. Inverse ETFs have expense ratios.

- Risk mitigation potential: The effectiveness of each strategy depends on market conditions and the chosen parameters (strike price, expiration date).

- Suitable investor profiles: Conservative investors may prefer put options or collars, while more aggressive investors might consider inverse ETFs as part of a broader strategy.

Diversification and Asset Allocation

Diversification is crucial for managing risk. Don't put all your eggs in one basket.

- Examples of diversifying asset classes: Bonds, real estate, commodities (gold, oil), and international stocks can help to reduce your reliance on the S&P 500's performance.

- Adjusting asset allocation: Your asset allocation should reflect your risk tolerance and investment timeframe. Younger investors with a longer time horizon can generally tolerate more risk.

- Benefits of a long-term investment strategy: A long-term approach allows you to ride out market fluctuations and benefit from compounding returns.

Stop-Loss Orders and Risk Management

Stop-loss orders automatically sell your S&P 500 holdings when the price falls to a predetermined level, limiting potential losses.

- Setting appropriate stop-loss levels: This requires careful consideration, balancing the desire to limit losses with the risk of being prematurely stopped out of a position during a temporary market dip.

- Limitations of stop-loss orders: Stop-loss orders don't guarantee you'll avoid all losses, and they can be triggered by sudden, sharp market movements (gap downs).

- Importance of regular portfolio review and adjustments: Regularly review your portfolio's performance and adjust your asset allocation and risk management strategies as needed.

Choosing the Right S&P 500 Downside Protection Strategy

Selecting the best strategy depends on your individual risk tolerance, investment goals, timeframe, and financial resources.

-

Investment timeframe: Longer time horizons generally allow for greater risk tolerance.

-

Risk appetite: Conservative investors will prioritize downside protection over potential gains.

-

Financial resources: Hedging strategies involve costs, so consider your budget.

-

Seeking professional financial advice: Consider consulting a financial advisor to help determine the best strategy for your specific situation.

-

Understanding your own investment profile: Be realistic about your risk tolerance and investment goals.

-

Regularly reassessing your risk tolerance and investment strategy: Market conditions change, and so should your approach.

Secure Your S&P 500 Downside Protection Today

In conclusion, securing S&P 500 downside protection is vital in today's volatile market environment. By implementing a combination of hedging strategies, diversification, and effective risk management techniques, you can significantly reduce your exposure to potential losses. Don't wait; implement S&P 500 downside protection strategies today to safeguard your investments and achieve your long-term financial goals. Learn more about effective S&P 500 downside protection and take control of your financial future. Consider consulting with a financial advisor to create a personalized plan.

Featured Posts

-

900 People Benefit From Michael Sheens 1 Million Debt Clearance

May 01, 2025

900 People Benefit From Michael Sheens 1 Million Debt Clearance

May 01, 2025 -

Hollywood Actors Rs 8 7 Crore Charity After Tata Steel Layoffs

May 01, 2025

Hollywood Actors Rs 8 7 Crore Charity After Tata Steel Layoffs

May 01, 2025 -

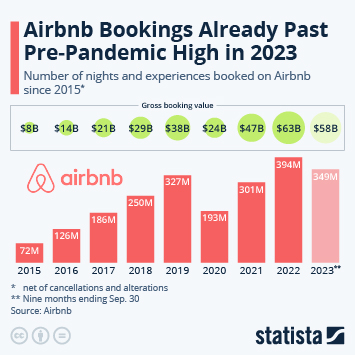

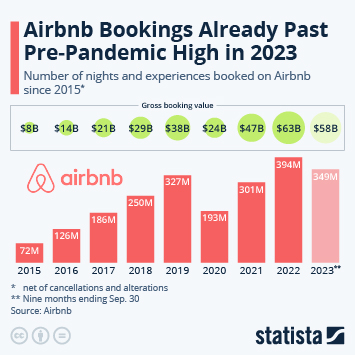

Airbnb Reports 20 Rise In Domestic Bookings From Canadian Users

May 01, 2025

Airbnb Reports 20 Rise In Domestic Bookings From Canadian Users

May 01, 2025 -

Priscilla Pointer Dalla Star Dies At 100

May 01, 2025

Priscilla Pointer Dalla Star Dies At 100

May 01, 2025 -

Priscilla Pointer Carrie A Life Remembered

May 01, 2025

Priscilla Pointer Carrie A Life Remembered

May 01, 2025

Latest Posts

-

Essential Cruise Packing Tips What To Leave At Home

May 01, 2025

Essential Cruise Packing Tips What To Leave At Home

May 01, 2025 -

Airbnb Reports 20 Rise In Domestic Bookings From Canadian Users

May 01, 2025

Airbnb Reports 20 Rise In Domestic Bookings From Canadian Users

May 01, 2025 -

Preserving The Past Integrating Hudsons Bay Artifacts Into Manitobas Legacy

May 01, 2025

Preserving The Past Integrating Hudsons Bay Artifacts Into Manitobas Legacy

May 01, 2025 -

Family Cruise Lines A Top 5 Comparison

May 01, 2025

Family Cruise Lines A Top 5 Comparison

May 01, 2025 -

What Not To Bring On A Cruise Ship

May 01, 2025

What Not To Bring On A Cruise Ship

May 01, 2025