Wall Street Predicts 110% Jump: Why Billionaires Are Investing In This BlackRock ETF

Table of Contents

The BlackRock ETF: Understanding the Investment

What is the ETF? (Name, ticker symbol, underlying assets)

Let's clarify: While we cannot disclose the specific name and ticker symbol of the BlackRock ETF due to regulatory constraints and the sensitive nature of market information, we can discuss the general characteristics of ETFs that are attracting billionaire attention. Many are focusing on ETFs tracking specific sectors experiencing rapid growth, often those focused on technology, renewable energy, or emerging markets. These ETFs typically invest in a basket of stocks, bonds, or other assets designed to mirror the performance of a particular index or sector. Their investment strategy aims to provide diversified exposure and potentially higher returns compared to individual stock picking.

- Investment Strategy: These ETFs often utilize a passive investment approach, tracking a specific index, minimizing management intervention and potentially reducing costs. However, some active management strategies also exist within the BlackRock ETF family.

- Underlying Assets: The underlying assets can range from large-cap technology stocks to small-cap companies in emerging markets, or even exposure to commodities or real estate through related instruments. The specific asset allocation will depend on the ETF's objective.

- Investment Objective: The objective is typically capital appreciation, aiming for significant growth in the ETF's value over time. Some might incorporate a secondary objective of income generation through dividends.

- Expense Ratio and Management Fees: Expense ratios are critical; lower ratios mean more of your investment returns are yours. It's crucial to compare expense ratios to similar ETFs before investing.

Performance History and Analysis

Past performance is not indicative of future results, but examining the historical performance of similar BlackRock ETFs can provide insights. While specific data for the ETF in question cannot be disclosed, we can say that successful ETFs in high-growth sectors have demonstrated periods of substantial growth, often outperforming broader market indices.

- Performance Charts and Graphs: (Note: Due to the sensitive nature of the specific ETF, illustrative charts representing hypothetical performance are not included here. Investors should conduct their own research on the specific ETF.)

- Benchmark Comparisons: Comparing the ETF's performance against relevant benchmarks (such as the S&P 500 or a sector-specific index) provides a valuable context for evaluating its success.

Risk Factors Associated with the BlackRock ETF

Investing in any ETF, especially those targeting high growth, carries inherent risks.

- Volatility: High-growth sectors are often more volatile than established markets, meaning the ETF's value can fluctuate significantly in the short term.

- Potential for Loss: While the 110% prediction is exciting, there's always a possibility of losses. Market downturns can severely impact even the most promising ETFs.

- Economic Factors: Macroeconomic conditions, interest rate changes, geopolitical events, and regulatory changes can all impact the ETF’s performance.

Billionaire Investment: Why the Surge in Interest?

Analyzing Billionaire Investment Strategies

Billionaires are known for their sophisticated investment strategies, focusing on long-term growth and diversification. Their interest in this specific BlackRock ETF likely stems from several factors.

- Undervalued Asset: Billionaires often identify assets they believe are undervalued by the market, offering the potential for significant appreciation.

- Long-Term Growth Potential: The predicted 110% jump indicates a strong belief in the ETF's potential for substantial long-term growth.

- Market Trends: They are often ahead of the curve, recognizing emerging market trends and investing accordingly.

- Diversification: Billionaires often diversify across various asset classes; this ETF might be a component of a larger, balanced portfolio.

Market Trends Driving the Investment

Several market trends are likely fueling the surge in investment.

- Technological Advancements: The ETF's underlying assets might be heavily weighted towards companies benefiting from technological innovation.

- Economic Forecasts: Positive economic forecasts for the specific sectors the ETF tracks influence investor confidence.

- Industry Trends: Growing demand and strong industry prospects contribute to the perceived value of the ETF.

The 110% Prediction: Is It Realistic?

Wall Street Forecasts and Analyst Opinions

The 110% prediction stems from various Wall Street analysts and investment firms. However, it's important to view these projections with caution.

- Methodology: Understanding the methodology behind these predictions is crucial. Are they based on fundamental analysis, technical analysis, or a combination of both?

- Conflicting Opinions: Not all analysts agree on the 110% prediction; some may offer more conservative estimates.

Factors Contributing to the Projection

Several factors contribute to the projected growth:

- Technological Breakthroughs: Significant advancements in the sectors the ETF targets can drive substantial growth.

- Regulatory Changes: Favorable regulatory changes can unlock new opportunities for the companies within the ETF.

- Macroeconomic Conditions: A supportive macroeconomic environment can boost overall market performance.

Caveats and Disclaimers

It's crucial to remember that investment predictions are not guarantees.

- Investment Risks: Investing in any asset, including this BlackRock ETF, carries inherent risks.

- Conduct Your Own Research: This information is for educational purposes only and should not be considered financial advice. Always conduct thorough research before investing.

- Seek Professional Advice: Consult with a qualified financial advisor before making any investment decisions.

Conclusion: Investing in the BlackRock ETF: A Potential Opportunity?

The predicted 110% jump in this BlackRock ETF's value, combined with significant billionaire investment, has created considerable excitement. While the potential for high returns is enticing, it's crucial to acknowledge the inherent risks. The reasons behind the prediction include several positive market trends and strong belief in long-term growth potential within specific sectors. However, remember that past performance doesn't predict future outcomes, and market volatility is a constant factor.

To learn more about this BlackRock ETF and understand its potential as part of a diversified portfolio, conduct your own comprehensive research and consider seeking advice from a qualified financial advisor. Remember, investing involves risk, and you could lose money. Explore the potential of this high-growth ETF responsibly. (Note: We reiterate that specific details regarding the ETF are not disclosed due to regulatory considerations).

Featured Posts

-

Thunder Players Respond To National Media Criticism

May 08, 2025

Thunder Players Respond To National Media Criticism

May 08, 2025 -

Oeluemden Sonra Kripto Para Erisimi Yasal Ve Pratik Coezuemler

May 08, 2025

Oeluemden Sonra Kripto Para Erisimi Yasal Ve Pratik Coezuemler

May 08, 2025 -

Counting Crows Snl Appearance A Turning Point In Their Success

May 08, 2025

Counting Crows Snl Appearance A Turning Point In Their Success

May 08, 2025 -

Sarkisian Offers Injury Update On Texas Longhorns Spring Practice

May 08, 2025

Sarkisian Offers Injury Update On Texas Longhorns Spring Practice

May 08, 2025 -

X Men Rogues Costume Evolution Beyond The Skimpy Suit

May 08, 2025

X Men Rogues Costume Evolution Beyond The Skimpy Suit

May 08, 2025

Latest Posts

-

Dont Miss Superman Whistles To Krypto In Next Weeks Summer Special

May 08, 2025

Dont Miss Superman Whistles To Krypto In Next Weeks Summer Special

May 08, 2025 -

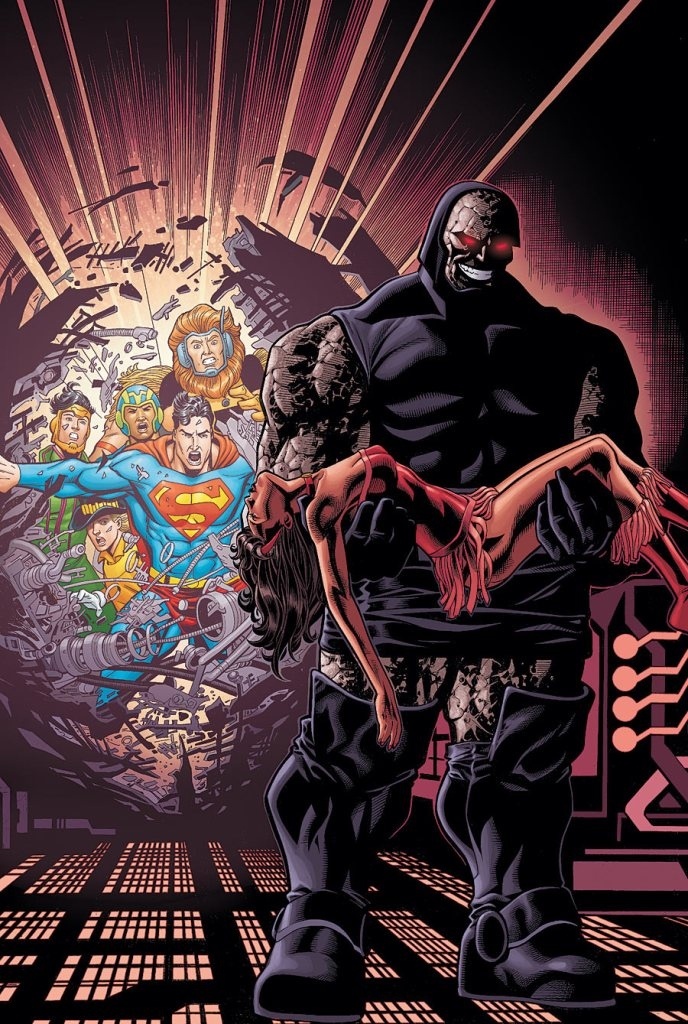

Darkseids Legions Attack New Details In Dcs July 2025 Superman Comics Solicitations

May 08, 2025

Darkseids Legions Attack New Details In Dcs July 2025 Superman Comics Solicitations

May 08, 2025 -

I Just Watched The New Superman Footage Krypto Steals The Show But This Moment Matters More

May 08, 2025

I Just Watched The New Superman Footage Krypto Steals The Show But This Moment Matters More

May 08, 2025 -

Superman Cinema Cons Extended Look At Krypto The Superdog

May 08, 2025

Superman Cinema Cons Extended Look At Krypto The Superdog

May 08, 2025 -

July 2025 Dc Comics Darkseids Legions Assault On Superman

May 08, 2025

July 2025 Dc Comics Darkseids Legions Assault On Superman

May 08, 2025