Warren Buffett Denies Involvement In Trump Tariff Controversy

Table of Contents

Buffett's Explicit Denial and Public Statements

Speculation regarding Warren Buffett's involvement in the Trump tariff policies has circulated, prompting a clear and public denial from the Oracle of Omaha himself. Understanding the nuances of his statements is crucial to separating fact from fiction.

- Specific Quotes: While a singular, overarching statement directly addressing the tariffs may not exist, Buffett's consistent messaging on long-term investment strategies, his aversion to short-term market manipulation, and his overall public demeanor strongly contradict any suggestion of active participation in shaping the tariffs. Numerous interviews and shareholder meetings have featured discussions about his investment philosophy, emphasizing long-term value creation rather than short-term gains derived from policy changes. [Link to relevant interview transcript or news article]. [Link to another reputable source].

- Platform of Denial: Buffett’s denial is less a singular statement and more a consistent narrative woven throughout his public appearances and communications over the years. His long-standing aversion to political involvement and focus on sound business practices implicitly refute any implication of direct participation in the Trump tariffs.

- Timing and Context: The denials are not isolated events but rather stem from a consistent communication style where he focuses on the fundamentals of investing and business management, largely avoiding direct political commentary. This consistent messaging implicitly refutes speculation surrounding his alleged role in the tariff controversy.

Analyzing the Impact of Tariffs on Berkshire Hathaway's Portfolio

While Warren Buffett has explicitly denied involvement, it's crucial to analyze how the Trump tariffs could have theoretically impacted Berkshire Hathaway's vast portfolio.

- Potential Sectoral Impacts: Berkshire Hathaway’s holdings span numerous sectors. Some, like manufacturing, could have faced increased input costs due to tariffs on imported materials. Conversely, other sectors might have benefited from a shift in domestic demand. The actual impact is far more nuanced than a simple positive or negative effect.

- Buffett's Long-Term Strategy: Buffett's famed "buy-and-hold" strategy, focused on long-term value creation, inherently mitigates the impact of short-term economic shocks like tariffs. His investments are chosen for their underlying strength and resilience, making them less susceptible to immediate market volatility.

- Portfolio Diversification: Berkshire Hathaway's incredibly diversified portfolio acts as a significant buffer against the risks associated with any single economic policy. The impact of tariffs on one sector is likely offset by the performance of other holdings within the portfolio. [Insert data or analysis comparing Berkshire Hathaway's performance during the tariff period against market benchmarks].

The Broader Economic Context and Market Reactions

The Trump tariffs had significant and far-reaching consequences for the global economy. Understanding this broader context is vital to accurately assessing the impact – or lack thereof – of Buffett’s stance.

- Economic Impact of Tariffs: The Trump tariffs led to increased costs for consumers, trade disputes with other nations, and uncertainty in global markets. The full economic consequences are still being assessed by economists. [Link to economic analysis of Trump tariffs].

- Market Volatility and Investor Sentiment: The implementation and subsequent effects of the tariffs significantly impacted market volatility and investor sentiment. Periods of uncertainty often lead to increased market fluctuations.

- Buffett's Influence and Market Reactions: Warren Buffett is widely considered a market indicator; his actions and statements can influence investor sentiment. While his denial of involvement likely had a stabilizing effect on some investors, the broader economic impact of the tariffs overshadowed any singular influence of his position.

Separating Fact from Speculation

Misinformation and speculation are rampant in the financial news cycle. It is crucial to critically evaluate information sources concerning Warren Buffett and the Trump tariffs.

- Addressing Misleading Information: Various news outlets and commentators may have presented incomplete or biased accounts regarding Buffett's supposed involvement. Fact-checking is crucial to navigating the complex information landscape. [Link to a fact-checking website]. [Link to a reputable financial news source offering balanced analysis].

- Importance of Credible Sources: Readers should prioritize information from reputable financial news sources, official statements, and verified transcripts when researching complex financial issues. Avoiding unverified claims and partisan narratives is crucial for informed decision-making.

- Responsible Reporting: Accurate and unbiased reporting is essential in financial news, as misinformation can have significant implications for investor decisions.

Conclusion

Warren Buffett's denial of any involvement in the Trump tariff controversy remains firm. Analysis shows that while the tariffs presented potential challenges and opportunities within Berkshire Hathaway's diverse portfolio, Buffett's long-term investment strategy and portfolio diversification served as effective mitigation factors. The broader economic consequences of the tariffs, however, were far-reaching and complex. Understand the facts behind the headlines regarding Warren Buffett and the Trump tariffs. Learn how to navigate misinformation concerning major economic events. Stay informed about the evolving situation involving Warren Buffett and trade policy. By critically evaluating information sources and focusing on reputable journalism, investors can make more informed decisions.

Featured Posts

-

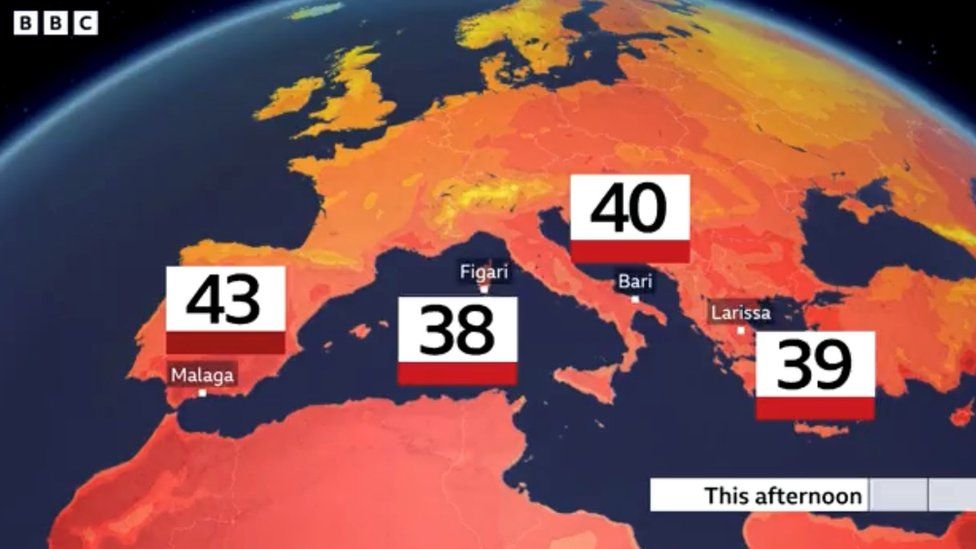

Urgent Weather Update Heatwave Sweeps Across Four West Bengal Districts

May 05, 2025

Urgent Weather Update Heatwave Sweeps Across Four West Bengal Districts

May 05, 2025 -

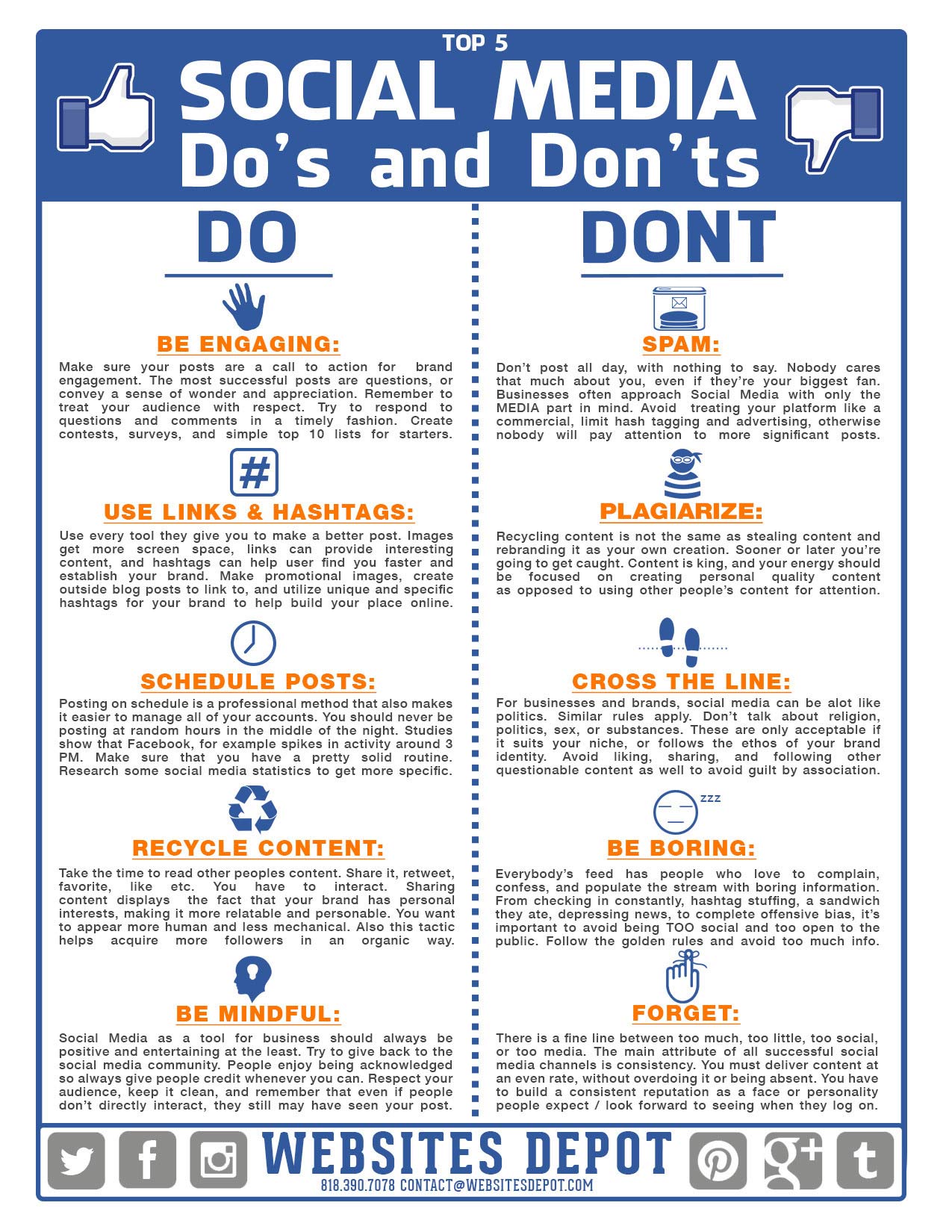

Crack The Code 5 Dos And Don Ts To Land A Private Credit Role

May 05, 2025

Crack The Code 5 Dos And Don Ts To Land A Private Credit Role

May 05, 2025 -

Emma Stoun Ta Yiyi Efektniy Obraz Na Premiyi Shou Biznes Minispidnitsya

May 05, 2025

Emma Stoun Ta Yiyi Efektniy Obraz Na Premiyi Shou Biznes Minispidnitsya

May 05, 2025 -

Emma Stones Quirky Snl Dress A Popcorn Butt Lift Moment

May 05, 2025

Emma Stones Quirky Snl Dress A Popcorn Butt Lift Moment

May 05, 2025 -

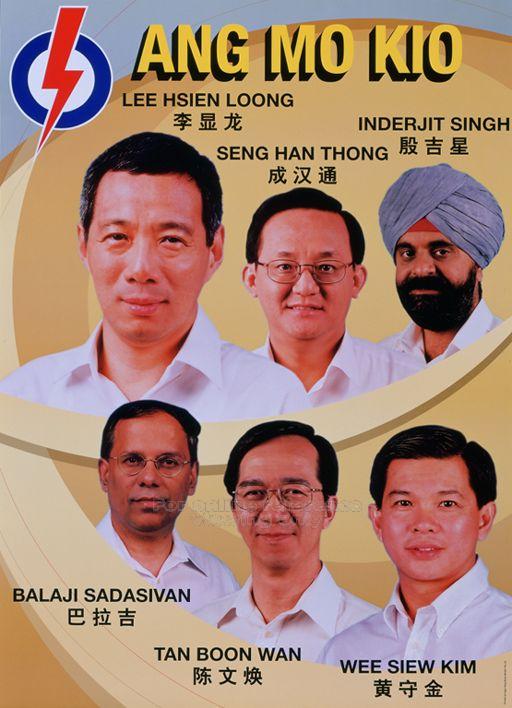

Singapore Elections A Crucial Test For The Paps Grip On Power

May 05, 2025

Singapore Elections A Crucial Test For The Paps Grip On Power

May 05, 2025

Latest Posts

-

Marina Rodriguez Vs Gillian Robertson Ufc Iowa Fight Analysis Prediction And Odds Comparison

May 05, 2025

Marina Rodriguez Vs Gillian Robertson Ufc Iowa Fight Analysis Prediction And Odds Comparison

May 05, 2025 -

Ufc Iowa Marina Rodriguez Vs Gillian Robertson Fight Preview Prediction And Best Bets

May 05, 2025

Ufc Iowa Marina Rodriguez Vs Gillian Robertson Fight Preview Prediction And Best Bets

May 05, 2025 -

Marina Rodriguez Vs Gillian Robertson Who Wins At Ufc Iowa Prediction And Betting Odds

May 05, 2025

Marina Rodriguez Vs Gillian Robertson Who Wins At Ufc Iowa Prediction And Betting Odds

May 05, 2025 -

Marina Rodriguez Vs Gillian Robertson Ufc Iowa Fight Prediction Odds And Pick

May 05, 2025

Marina Rodriguez Vs Gillian Robertson Ufc Iowa Fight Prediction Odds And Pick

May 05, 2025 -

Gillian Robertson Confident In Ufc Des Moines Win Against Marina Rodriguez

May 05, 2025

Gillian Robertson Confident In Ufc Des Moines Win Against Marina Rodriguez

May 05, 2025