Warren Buffett's Greatest Investing Wins And Losses: Key Lessons Learned

Table of Contents

Warren Buffett, the Oracle of Omaha, is a legendary investor whose career spans decades of remarkable success and occasional setbacks. Studying his greatest investing wins and painful losses offers invaluable lessons for both seasoned and novice investors. This article delves into some of his most significant investments, analyzing the strategies behind them and extracting key takeaways to help you improve your own investment approach.

Warren Buffett's Biggest Investing Wins

Coca-Cola Investment

Buffett's investment in Coca-Cola is a textbook example of long-term value investing. Beginning in 1988, Berkshire Hathaway gradually accumulated shares, recognizing the immense brand power and enduring consumer loyalty associated with the iconic beverage.

- Reasons for Success:

- Unwavering Brand Strength: Coca-Cola boasts unparalleled global brand recognition and consumer preference.

- Consistent Growth & Dividends: The company's consistent revenue growth and dividend payouts have generated substantial returns for Berkshire Hathaway over decades.

- Long-Term Hold Strategy: Buffett's commitment to a long-term hold strategy allowed him to benefit from the company's sustained growth and compounding returns.

This investment highlights the potential rewards of identifying strong, consumer staples companies and holding them for the long term. The significant returns generated from this seemingly simple investment underscore the power of identifying and capitalizing on exceptional brand power. Keywords: Coca-Cola, long-term investment, brand power, consumer staples, dividend income, compounding returns

American Express Acquisition

Buffett's investment in American Express following the 1960s Salad Oil scandal is a prime illustration of contrarian investing. While the market panicked, Buffett saw an opportunity. He purchased shares at a significantly discounted price, betting on the company's long-term resilience.

- Contrarian Approach:

- Capitalizing on Market Fear: Buffett recognized that the market's negative reaction was overblown and that American Express's fundamental value remained strong.

- Undervalued Assets: He identified an undervalued asset due to a temporary crisis, highlighting the importance of looking beyond short-term market noise.

- Substantial Returns: His contrarian approach yielded exceptional returns as American Express recovered and thrived.

This investment showcases the importance of conducting thorough due diligence, identifying undervalued assets, and capitalizing on market inefficiencies. Keywords: Contrarian investing, value investing, undervalued assets, crisis investing, bargain hunting, due diligence

Berkshire Hathaway's Intrinsic Value

Buffett's acquisition and development of Berkshire Hathaway itself is a testament to his investment philosophy. He initially invested in the struggling textile company, later transforming it into a diversified conglomerate.

- Transformation & Growth:

- From Textile to Conglomerate: Buffett shifted Berkshire Hathaway's focus from textiles to insurance and other profitable ventures.

- Understanding Intrinsic Value: He focused on acquiring companies with strong intrinsic value, often below their market price.

- Long-Term Growth: This strategic approach led to the exponential growth of Berkshire Hathaway, solidifying its position as one of the world's most successful companies.

This demonstrates the power of identifying and unlocking the intrinsic value of a company, even if its current operations are struggling. Keywords: Berkshire Hathaway, conglomerate, intrinsic value, long-term growth, company acquisition, diversification

Warren Buffett's Notable Investing Losses

Dexter Shoe Company

Not every investment by Buffett has been a success. His investment in Dexter Shoe Company serves as a valuable reminder that even the best investors make mistakes.

- Reasons for Failure:

- Management Failure: Buffett later acknowledged that he failed to adequately assess the management team's capabilities, leading to poor operational performance.

- Lack of Competitive Advantage: The company lacked a significant competitive advantage in the increasingly competitive shoe market.

- Learning from Mistakes: Buffett openly discussed this loss, emphasizing the importance of thorough due diligence and recognizing management shortcomings.

This highlights the crucial role of due diligence and the need to recognize and acknowledge management failures when making investment decisions. Keywords: Investment mistakes, management failure, due diligence, loss analysis, learning from mistakes

Energy Investments

Buffett’s forays into the energy sector have not always been as profitable as his other ventures. While he hasn't detailed specific failures extensively, his approach underscores the risks of sector-specific investments.

- Reasons for Less-Than-Successful Investments:

- Market Volatility: The energy sector is highly susceptible to fluctuations in commodity prices and government regulations.

- Sector-Specific Risks: Over-reliance on a single sector can amplify losses during market downturns.

- Importance of Diversification: This highlights the importance of diversification to mitigate risk and protect your portfolio.

This emphasizes the importance of diversifying investments across various sectors to mitigate risk and prevent large losses concentrated in one area. Keywords: Diversification, risk management, market volatility, sector-specific risk, portfolio management

Lessons from Losses

Buffett's losses, while significant, have served as crucial learning experiences. They illustrate that even the most successful investors experience setbacks.

- Key Takeaways:

- Losses are Inevitable: Accepting losses as part of investing is crucial for long-term success.

- Cutting Losses Quickly: Recognizing and exiting failing investments swiftly is essential to minimizing potential losses.

- Post-Mortem Analysis: Thoroughly analyzing failed investments to understand the causes and learn valuable lessons for future decisions is vital.

This emphasizes the importance of a robust risk management strategy, including cutting losses, learning from mistakes, and adapting your strategy accordingly. Keywords: Risk assessment, loss mitigation, portfolio optimization, investment discipline

Key Lessons from Warren Buffett's Investment Journey

The Importance of Long-Term Investing

Buffett's success is largely attributed to his long-term investment strategy.

- Long-Term Benefits:

- Compounding Returns: Allowing investments to grow over extended periods maximizes compounding effects.

- Patience and Discipline: Long-term investing requires patience and discipline to withstand market fluctuations.

- Ignoring Short-Term Noise: Focusing on the long-term vision allows you to ignore the distractions of short-term market volatility.

This underscores the importance of patience and discipline in long-term investing, focusing on the power of compounding. Keywords: Long-term investing, compounding, patience, discipline, market timing

Understanding Intrinsic Value

Buffett's approach centers around identifying companies with strong intrinsic value.

- Identifying Undervalued Companies:

- Fundamental Analysis: Conducting thorough fundamental analysis to assess a company's financial health and future potential is crucial.

- Discounted Cash Flow: Using tools like discounted cash flow analysis to estimate a company's intrinsic value can help identify undervaluation.

- Margin of Safety: Purchasing assets at a price significantly below their estimated intrinsic value provides a margin of safety.

This highlights the power of fundamental analysis and value investing to identify undervalued companies. Keywords: Intrinsic value, fundamental analysis, discounted cash flow, value investing, undervalued stocks

The Significance of a Strong Management Team

Buffett emphasizes the importance of investing in companies with ethical and competent leadership.

- Importance of Leadership:

- Management Integrity: Investing in companies with strong ethical leadership builds trust and ensures long-term sustainability.

- Long-Term Vision: Companies led by management with a clear long-term vision are more likely to succeed.

- Effective Leadership: Effective leadership fosters a positive company culture and operational efficiency.

This underscores the critical role of strong corporate governance and ethical leadership in the long-term success of a company. Keywords: Management quality, corporate governance, ethical investing, leadership, company culture

Conclusion

By examining Warren Buffett's greatest investing wins and losses, we can extract invaluable lessons applicable to all investors. His success stems not only from shrewd investment decisions but also from a long-term perspective, a deep understanding of intrinsic value, and the willingness to learn from both successes and failures. Remember, even legendary investors experience losses; the key is to minimize them and maximize the potential for long-term growth. To further enhance your investing knowledge and learn more about successful investment strategies, explore resources on value investing and Warren Buffett's investment philosophy. Mastering the art of Warren Buffett's investment strategies will ultimately lead you closer to your financial goals.

Featured Posts

-

Rianna Nespodivaniy Vikhid U Shirokikh Dzhinsakh Ta Dorogikh Prikrasakh

May 06, 2025

Rianna Nespodivaniy Vikhid U Shirokikh Dzhinsakh Ta Dorogikh Prikrasakh

May 06, 2025 -

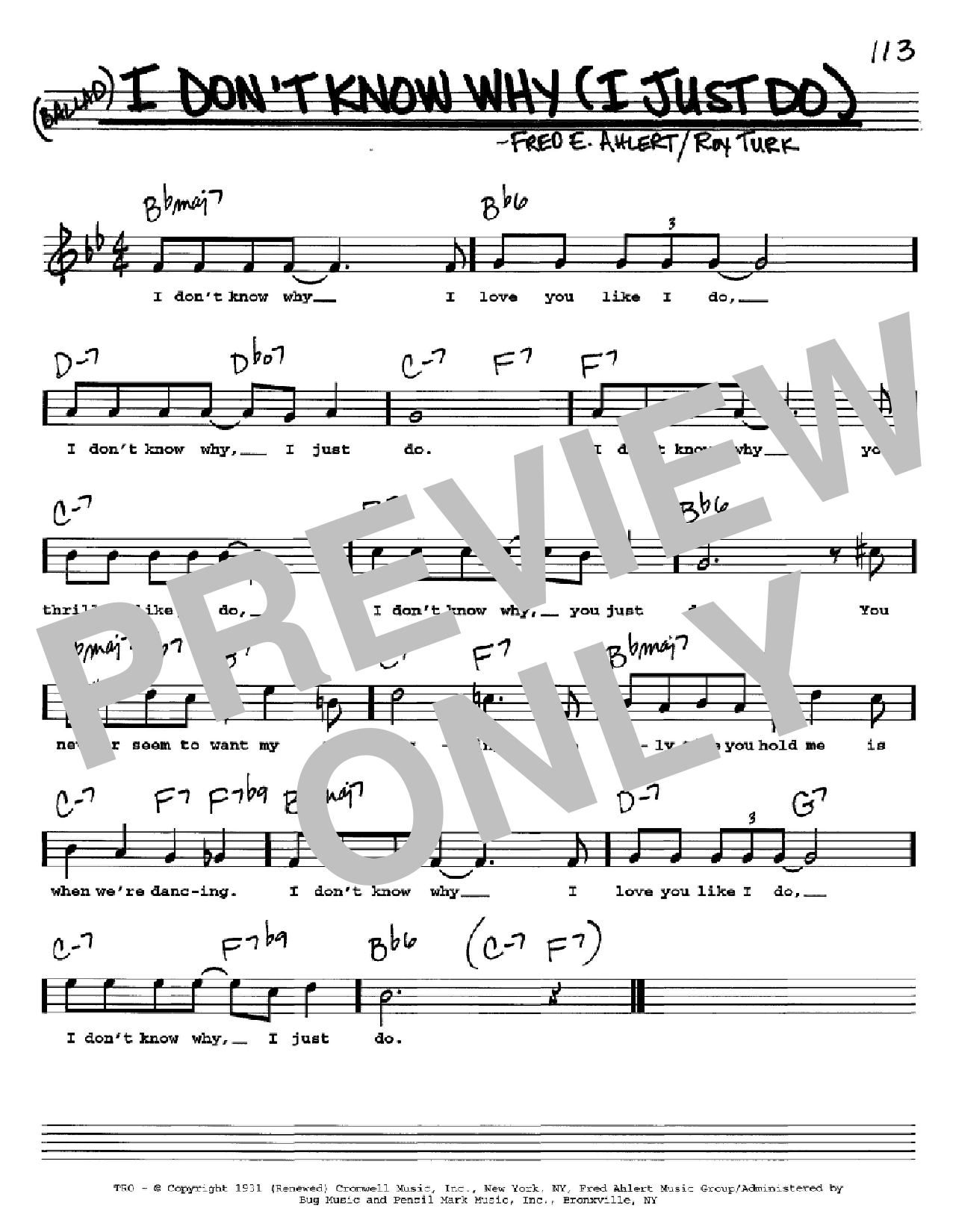

Ariana Grande And Jeff Goldblums I Dont Know Why Song Details And Release

May 06, 2025

Ariana Grande And Jeff Goldblums I Dont Know Why Song Details And Release

May 06, 2025 -

Halle Bailey Responds To Ddgs Dont Take My Son Diss Track

May 06, 2025

Halle Bailey Responds To Ddgs Dont Take My Son Diss Track

May 06, 2025 -

Priyanka Chopras Birthday Post For Sister Mannara Chopra A Bond Of Unbreakable Love

May 06, 2025

Priyanka Chopras Birthday Post For Sister Mannara Chopra A Bond Of Unbreakable Love

May 06, 2025 -

How To Watch March Madness Online Stream Every Game Without Cable

May 06, 2025

How To Watch March Madness Online Stream Every Game Without Cable

May 06, 2025