Weak Q1 Figures Send Kering Shares Down 6%

Table of Contents

Declining Sales in Key Brands

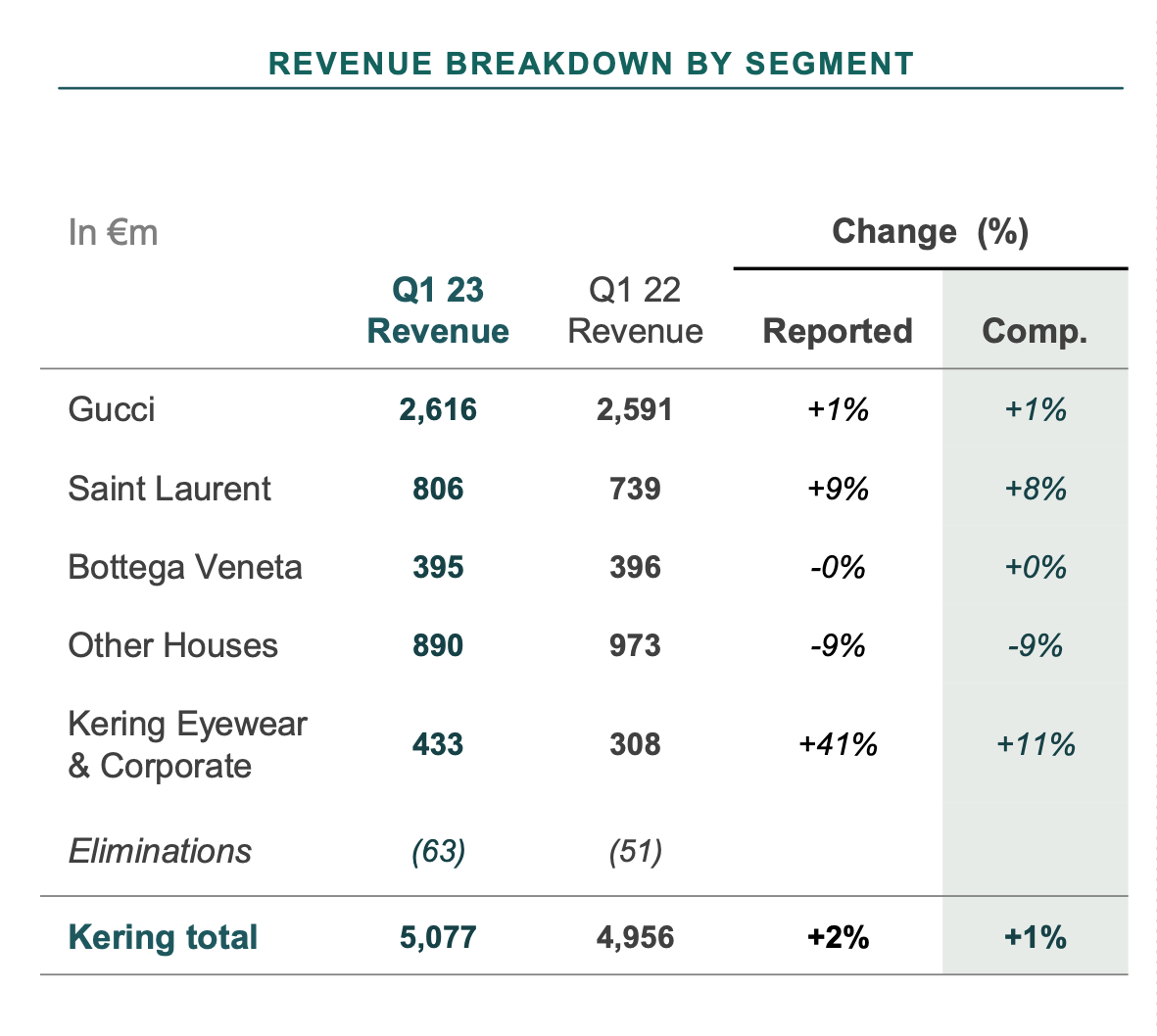

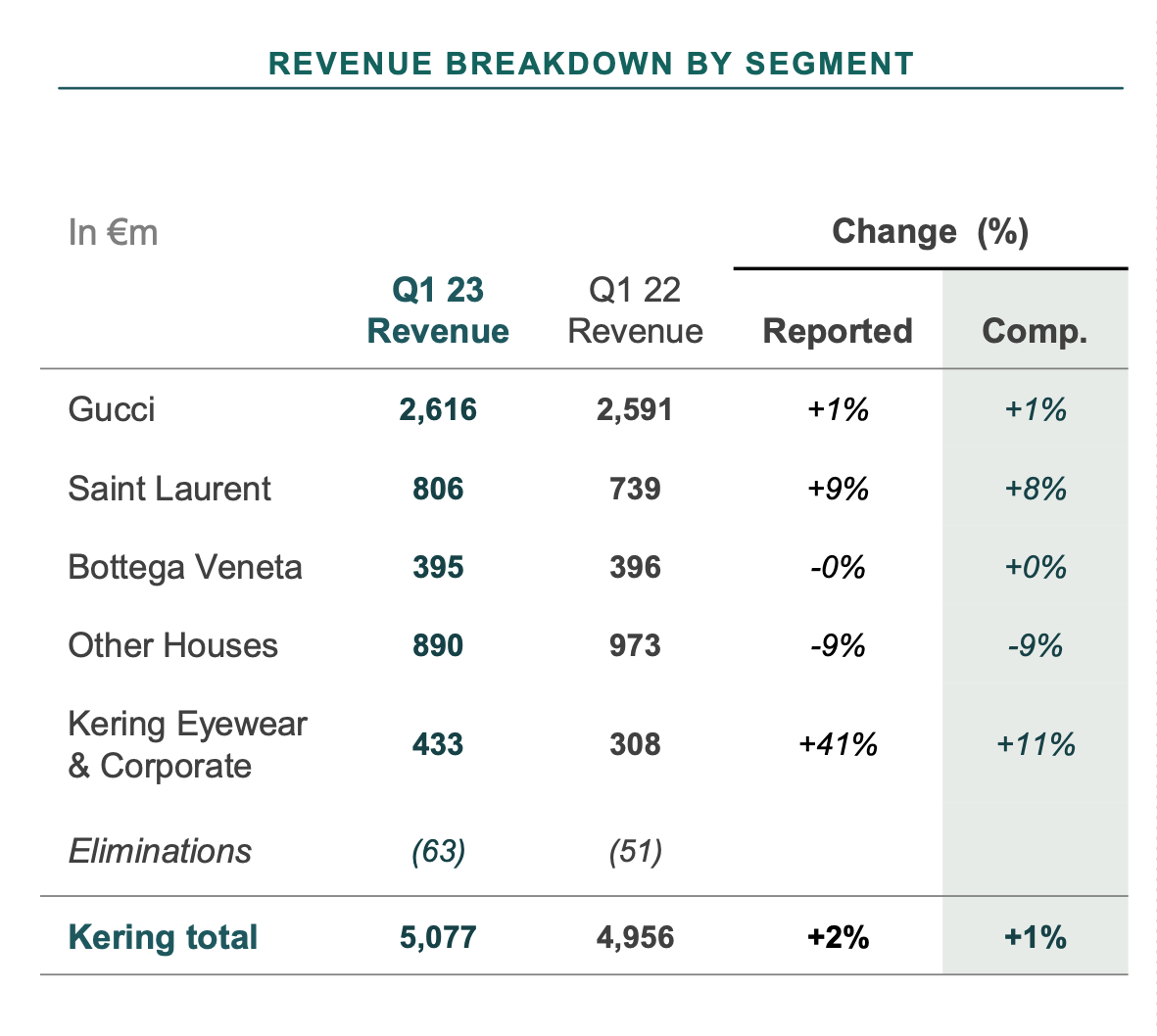

Kering's Q1 2024 results revealed a concerning trend: declining sales across several of its key brands. This underperformance significantly impacted the company's overall financial performance and contributed to the subsequent stock market reaction.

-

Gucci: Experienced a notable sales decrease of X% (replace X with the actual percentage if available), marking a significant slowdown compared to previous quarters. This decline can be attributed to several factors, including changing consumer preferences, increased competition from other luxury brands, and potentially, inventory challenges. The decreased demand for Gucci’s flagship products, particularly [mention specific product categories if available], impacted sales significantly. Keywords: Gucci sales, Gucci revenue decline, Gucci performance Q1 2024.

-

Yves Saint Laurent (YSL): While performing relatively better than Gucci, YSL still saw a sales dip of Y% (replace Y with the actual percentage if available). This suggests that even high-performing brands within the Kering portfolio are susceptible to the current economic headwinds impacting the luxury goods market. The brand’s strategy to target a younger demographic may require adjustments given the current market conditions. Keywords: Yves Saint Laurent revenue, YSL sales decline, YSL Q1 performance.

-

Bottega Veneta: Experienced a more pronounced sales drop of Z% (replace Z with the actual percentage if available), highlighting the challenges faced by the brand in regaining momentum. The brand's efforts to reposition itself within the luxury market seem to be facing some headwinds. Keywords: Bottega Veneta performance, Bottega Veneta sales slump, Bottega Veneta Q1 results.

The overall decline across these major brands underscores the challenges Kering faces in navigating a complex and evolving luxury goods landscape. The reasons for this decline are multi-faceted, encompassing shifting consumer behavior, macroeconomic uncertainties, and increased competition in the luxury sector.

Impact of Geopolitical Factors and Economic Uncertainty

The disappointing Q1 results cannot be viewed in isolation from the broader macroeconomic environment. Several geopolitical factors and economic uncertainties have significantly impacted consumer spending on luxury goods.

-

Global Inflation and Recession Fears: Rising inflation and persistent fears of a global recession have dampened consumer confidence, particularly among high-net-worth individuals who are a primary driver of the luxury market. This cautious spending has translated into decreased demand for luxury items. Keywords: inflation impact luxury goods, global economic uncertainty, recession fears luxury market.

-

Geopolitical Instability: The ongoing war in Ukraine and other geopolitical tensions have created further uncertainty, impacting global supply chains and consumer sentiment. This instability negatively affected both production and demand for luxury goods, further contributing to Kering's Q1 performance. Keywords: geopolitical risks luxury market, Ukraine war impact luxury, global supply chain disruptions.

-

China's Economic Slowdown: The slowdown in the Chinese economy, a crucial market for luxury goods, also played a significant role. Reduced consumer spending in China has directly impacted the sales of many luxury brands, including those under the Kering umbrella. Keywords: China luxury market slowdown, Chinese consumer spending, impact of China economy on luxury.

Kering's Response and Future Outlook

In response to the disappointing Q1 results, Kering has [mention Kering’s official statement or press release summary]. The company is likely to implement several strategies to address the challenges and improve its performance in the coming quarters.

-

Marketing and Brand Repositioning: Expect to see renewed marketing efforts focused on engaging consumers and strengthening brand image. This may include targeted campaigns to appeal to specific demographics and innovative product launches. Keywords: Kering strategy, Kering marketing, brand repositioning, luxury marketing strategy.

-

Cost-Cutting Measures: Kering may introduce cost-cutting measures to enhance efficiency and improve profitability. This could involve streamlining operations, reducing expenses, and optimizing inventory management. Keywords: Kering cost-cutting, operational efficiency, Kering profitability.

-

Analyst Predictions: Analysts' forecasts for Kering’s future performance are [mention analysts’ predictions and their rationale]. The outlook remains somewhat uncertain, given the ongoing global economic challenges. Keywords: analyst predictions Kering, Kering stock forecast, Kering future outlook.

Analysis of Investor Reaction and Stock Market Response

The immediate market reaction to Kering's Q1 results was swift and negative. The 6% drop in the Kering share price reflects investor concerns regarding the company's performance and the broader luxury market outlook.

-

Share Price Volatility: The Kering share price experienced considerable volatility following the release of the Q1 results. This underscores the sensitivity of the luxury sector to economic fluctuations and geopolitical events. Keywords: Kering stock price, share price volatility, Kering market capitalization.

-

Investor Sentiment: Investor sentiment towards Kering has soured following the weaker-than-expected Q1 performance. This decline in confidence is likely to persist until there are clear signs of a turnaround. Keywords: investor sentiment Kering, Kering investor confidence.

-

Trading Volume: Trading volume for Kering shares likely increased significantly following the announcement of the Q1 results, reflecting heightened investor activity and interest in the company's performance. Keywords: Kering trading volume, stock market reaction Kering.

Navigating the Challenges Facing Kering's Share Price

Kering's disappointing Q1 2024 results, characterized by declining sales across key brands and exacerbated by macroeconomic headwinds, led to a significant 6% drop in its share price. The company's future performance hinges on its ability to adapt to changing consumer preferences, navigate geopolitical uncertainties, and effectively implement strategies to boost sales and regain investor confidence. While the short-term outlook remains uncertain, Kering's long-term prospects remain tied to the enduring appeal of its luxury brands. To stay informed about Kering’s financial performance and investment implications, it is crucial to monitor Kering's future announcements, particularly the upcoming Q2 results and any subsequent updates on its strategic initiatives. Consider the implications of Kering's performance within the context of your own investment strategy related to luxury goods and the broader market. Keep an eye on the Kering share price outlook and the overall performance of the luxury goods sector.

Featured Posts

-

From Distant Shores To Dc A Love Story Cut Short

May 25, 2025

From Distant Shores To Dc A Love Story Cut Short

May 25, 2025 -

Pomnite Li Konchita Vurst Transformatsiyata Na Pobeditelkata Ot Evroviziya

May 25, 2025

Pomnite Li Konchita Vurst Transformatsiyata Na Pobeditelkata Ot Evroviziya

May 25, 2025 -

Esc 2025 Conchita Wurst And Jj Live At Eurovision Village

May 25, 2025

Esc 2025 Conchita Wurst And Jj Live At Eurovision Village

May 25, 2025 -

Netherlands Hosts Major Bangladesh Investment Event 1 500 Attendees

May 25, 2025

Netherlands Hosts Major Bangladesh Investment Event 1 500 Attendees

May 25, 2025 -

Memorial Day Poster Contest Hawaii Keiki Celebrate With Lei Making Art

May 25, 2025

Memorial Day Poster Contest Hawaii Keiki Celebrate With Lei Making Art

May 25, 2025

Latest Posts

-

Building Contamination From Ohio Train Derailment A Continuing Health Concern

May 25, 2025

Building Contamination From Ohio Train Derailment A Continuing Health Concern

May 25, 2025 -

Recent Developments Elon Musk And His Dogecoin Position

May 25, 2025

Recent Developments Elon Musk And His Dogecoin Position

May 25, 2025 -

The Elon Musk Dogecoin Effect A Reality Check

May 25, 2025

The Elon Musk Dogecoin Effect A Reality Check

May 25, 2025 -

Dogecoin Price And Elon Musks Influence A Current Analysis

May 25, 2025

Dogecoin Price And Elon Musks Influence A Current Analysis

May 25, 2025 -

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025