Wealth Transfer And Succession Planning: A Guide For The Super Rich

Table of Contents

Minimizing Estate Taxes & Tax-Efficient Wealth Transfer Strategies

Effective wealth transfer and succession planning requires a deep understanding of tax implications. Minimizing your estate tax burden is paramount to preserving your wealth for future generations.

Understanding Estate Tax Laws

Estate tax laws are intricate and vary significantly across jurisdictions. Understanding these laws is the foundation of any successful wealth transfer strategy.

- Gift tax annual exclusion: This allows you to gift a certain amount of money each year without incurring gift tax.

- Marital deduction: Allows for the transfer of unlimited assets between spouses without incurring estate tax.

- Charitable giving strategies: Donating assets to qualified charities can significantly reduce your taxable estate.

- Generation-skipping transfer tax: This tax applies to transfers of assets to beneficiaries who are two or more generations younger than the grantor.

Understanding the differences in estate tax laws across jurisdictions is critical, especially if you hold international assets. A qualified estate planning attorney can help navigate these complexities and ensure compliance.

Advanced Tax Planning Techniques

Beyond basic estate planning, several advanced techniques can significantly reduce your tax liability.

- Irrevocable Life Insurance Trusts (ILITs): These trusts own and control life insurance policies, keeping the death benefit out of your taxable estate.

- Dynasty Trusts: These trusts can continue in perpetuity, passing wealth down through generations while minimizing estate taxes.

- Grantor Retained Annuity Trusts (GRATs): These trusts allow you to transfer assets while minimizing gift tax by leveraging the growth of the assets within the trust.

- Family Limited Partnerships (FLPs): These partnerships can help transfer ownership of assets to heirs while reducing estate taxes through valuation discounts.

- Charitable Remainder Trusts (CRTs): These trusts provide income to the grantor for life, then distribute the remaining assets to charity, offering tax benefits.

These sophisticated strategies require careful planning and expert advice. A knowledgeable financial advisor specializing in high-net-worth individuals can help you determine which techniques are most suitable for your specific circumstances.

Asset Protection & Preservation for Future Generations

Protecting your assets from unforeseen circumstances is as crucial as minimizing taxes. A comprehensive plan is vital for long-term wealth preservation.

Creating a Robust Estate Plan

A comprehensive estate plan is the cornerstone of wealth transfer and succession planning. This includes:

- Wills: These legal documents dictate how your assets will be distributed after your death.

- Trusts: Trusts provide greater control and flexibility in managing and distributing assets, offering significant asset protection benefits. Living trusts manage assets during your lifetime, while testamentary trusts take effect upon your death.

- Durable Powers of Attorney: These documents appoint individuals to manage your financial and healthcare affairs if you become incapacitated.

- Appointing Executors and Trustees: Carefully selecting responsible and trustworthy individuals to manage your estate is crucial.

The legal ramifications of each document are significant, so professional guidance is essential.

Protecting Assets from Creditors and Litigation

Protecting your wealth from potential lawsuits or creditors is vital. Strategies include:

- Domestic Asset Protection Trusts (DAPTs): These trusts protect assets from creditors in certain jurisdictions.

- Offshore Asset Protection Trusts: These trusts offer asset protection in jurisdictions with more favorable laws. However, they are subject to more complex regulatory requirements.

- Liability Insurance: Adequate liability insurance provides a financial safety net against potential lawsuits.

The legal and ethical implications of asset protection strategies must be carefully considered, and professional advice is crucial to ensure compliance with all applicable laws.

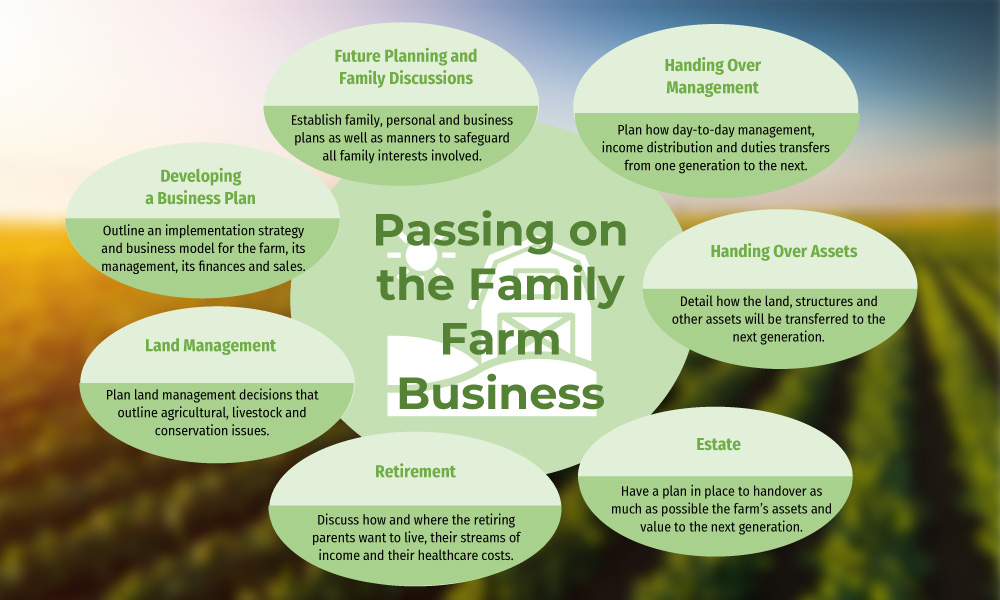

Family Governance & Communication for Seamless Succession

Effective communication and family governance are vital for a smooth transition of wealth and the prevention of future disputes.

Establishing Family Councils & Protocols

Open communication and a well-defined governance structure are critical. This involves:

- Family Meetings: Regular meetings provide a platform for discussion, education, and conflict resolution.

- Family Constitutions: A formal document outlining family values, governance structures, and wealth distribution guidelines can help prevent future disputes.

- Mediation Services: Engaging a mediator can help resolve conflicts and facilitate constructive dialogue within the family.

Family councils can significantly improve communication and prevent family conflict, ensuring a harmonious transfer of wealth.

Educating Heirs about Wealth Management

Preparing heirs for the responsibility of managing significant wealth is crucial. This includes:

- Financial Education Programs: Providing structured education on financial management, investing, and philanthropy.

- Mentorship Opportunities: Connecting heirs with experienced financial advisors and mentors.

- Family Office Services: Employing a family office can provide comprehensive wealth management services tailored to the family's needs.

Failing to educate heirs can lead to poor financial decisions and family conflict. Proactive education is essential for responsible wealth management.

Conclusion

Effective wealth transfer and succession planning is a multifaceted process requiring careful planning and professional guidance. By employing sophisticated tax planning strategies, implementing robust asset protection measures, and fostering open family communication, you can safeguard your legacy and ensure a smooth transition of assets to future generations. Don't delay – contact a qualified estate planning attorney and financial advisor today to begin crafting your personalized wealth transfer and succession plan. Proactive planning regarding your wealth transfer and succession planning is crucial to securing your family's future.

Featured Posts

-

Jailed Councillors Wifes Defence Migrant Hotel Rant Did Not Encourage Violence

May 22, 2025

Jailed Councillors Wifes Defence Migrant Hotel Rant Did Not Encourage Violence

May 22, 2025 -

Vybz Kartel Dominates Brooklyn Sold Out Shows A Testament To His Popularity

May 22, 2025

Vybz Kartel Dominates Brooklyn Sold Out Shows A Testament To His Popularity

May 22, 2025 -

Philadelphia Fuel Costs Average Increase Of 6 Cents Continued Rise Expected

May 22, 2025

Philadelphia Fuel Costs Average Increase Of 6 Cents Continued Rise Expected

May 22, 2025 -

Pm Strengthens Embassy Security Following Blood Libel Threats

May 22, 2025

Pm Strengthens Embassy Security Following Blood Libel Threats

May 22, 2025 -

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten Uw Gids

May 22, 2025

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten Uw Gids

May 22, 2025