Weihong Liu And The Acquisition Of 28 Hudson's Bay Leases

Table of Contents

The Significance of the Acquisition

The acquisition of 28 Hudson's Bay leases represents a massive undertaking in the Canadian retail real estate sector. This isn't just a collection of individual properties; it's a strategic acquisition of a significant portfolio of prime retail space, likely impacting the competitive landscape significantly. The sheer scale of the deal – 28 leases – underlines its importance. These leases are not randomly distributed; they are strategically located across key Canadian cities, placing Weihong Liu in a powerful position within the Canadian retail market.

-

Scale and Impact: The acquisition's size alone signifies a substantial shift in the ownership of key retail spaces in Canada. This will likely lead to changes in store offerings, brand representation and potentially trigger further real estate transactions.

-

Geographic Significance: The precise locations of these 28 leases are crucial, influencing the overall strategic value. Prime locations in major urban centers will undoubtedly command higher rental values and attract significant interest from potential tenants. The geographic distribution of these properties will shape the long-term strategic impact.

-

Potential for Redevelopment: This acquisition opens possibilities for future redevelopment projects and property enhancement, adding to the long-term value of the investment. Keywords: Strategic investment, retail portfolio, prime real estate, Canadian retail market.

Weihong Liu's Investment Strategy

Weihong Liu's investment strategy behind this acquisition demonstrates a keen understanding of the Canadian retail market and its potential for future growth. While specific details of their investment strategy may remain undisclosed, this large-scale acquisition showcases a long-term vision for property development and portfolio diversification.

-

Motivations: The acquisition likely reflects a belief in the long-term value of prime retail real estate, even amidst the challenges posed by e-commerce. A diversification strategy might be at play, spreading investment risk across multiple properties and locations.

-

Future Plans: Weihong Liu may pursue several strategies with these newly acquired leases. This could involve direct property management, lease renegotiations with existing tenants, or extensive redevelopment projects to adapt to changing market demands. Repurposing underutilized spaces for other commercial purposes could also be explored.

-

Previous Ventures: Analyzing Weihong Liu's previous successful real estate ventures can shed light on their overall investment philosophy and risk tolerance. Identifying previous successes and their strategies can provide insights into the likely approach with these Hudson's Bay leases. Keywords: Investment strategy, portfolio diversification, real estate development, property management.

Impact on Hudson's Bay Company

The sale of 28 leases represents a significant restructuring move for Hudson's Bay Company (HBC). The rationale behind this decision likely involves streamlining operations, reducing financial burdens, and potentially focusing on core business segments.

-

Restructuring and Financial Strategy: This large-scale lease sale may be part of a broader financial strategy to address potential debts or improve overall profitability. It might also be part of a larger restructuring initiative to refocus HBC on its core business strategy.

-

Financial Aspects: The financial details of the transaction—the sale price and associated terms—would provide critical insights into the overall value HBC placed on these properties and the financial benefits of the sale. This will be a key metric for evaluating the success of HBC's restructuring efforts.

-

Retail Transformation: The move likely reflects HBC's adaptation to the evolving retail landscape and a shift towards a more streamlined, potentially digitally-focused business model. This sale allows HBC to concentrate resources on its core operations. Keywords: Hudson's Bay Company, restructuring, financial strategy, retail transformation.

Future Outlook and Market Analysis

This acquisition has far-reaching implications for the Canadian real estate market. The changes in ownership of these significant retail properties will influence the competitive landscape, rental rates, and the overall direction of retail development in affected areas.

-

Market Trends: The deal reflects current trends in the Canadian real estate market, including the growing value of strategically located properties and the continuing adaptation to changing consumer behaviors and preferences.

-

Impact on Competitors: This acquisition may affect competitors by reducing the availability of prime retail space and potentially altering the competitive dynamics within the retail sector.

-

Expert Predictions: Seeking expert opinions on the potential long-term success of this acquisition and its effect on the wider Canadian retail market will provide valuable insights into the future. The long-term sustainability of the investment and its impact on the overall market will be observed keenly by industry experts. Keywords: Market trends, real estate investment, future of retail, competitive landscape.

Conclusion: The Weihong Liu and Hudson's Bay Lease Acquisition: A Turning Point?

Weihong Liu's acquisition of 28 Hudson's Bay leases represents a significant event in the Canadian real estate market. The scale of the deal, the strategic locations of the acquired properties, and the potential for future development all indicate a substantial impact on both Weihong Liu's portfolio and the Canadian retail landscape. The implications for Hudson's Bay Company, involving restructuring and a focus on core business strategies, further highlight the transformative nature of this deal. The long-term consequences of this acquisition remain to be seen, but its immediate impact is undeniable. To learn more about Weihong Liu's real estate investments and the future of Hudson's Bay properties, explore [link to relevant resource].

Featured Posts

-

Preduprezhdenie Mada Anomalnaya Zhara Pokholodanie I Silniy Shtorm V Izraile

May 30, 2025

Preduprezhdenie Mada Anomalnaya Zhara Pokholodanie I Silniy Shtorm V Izraile

May 30, 2025 -

Californias Marine Life Under Siege The Toxic Algae Bloom Crisis

May 30, 2025

Californias Marine Life Under Siege The Toxic Algae Bloom Crisis

May 30, 2025 -

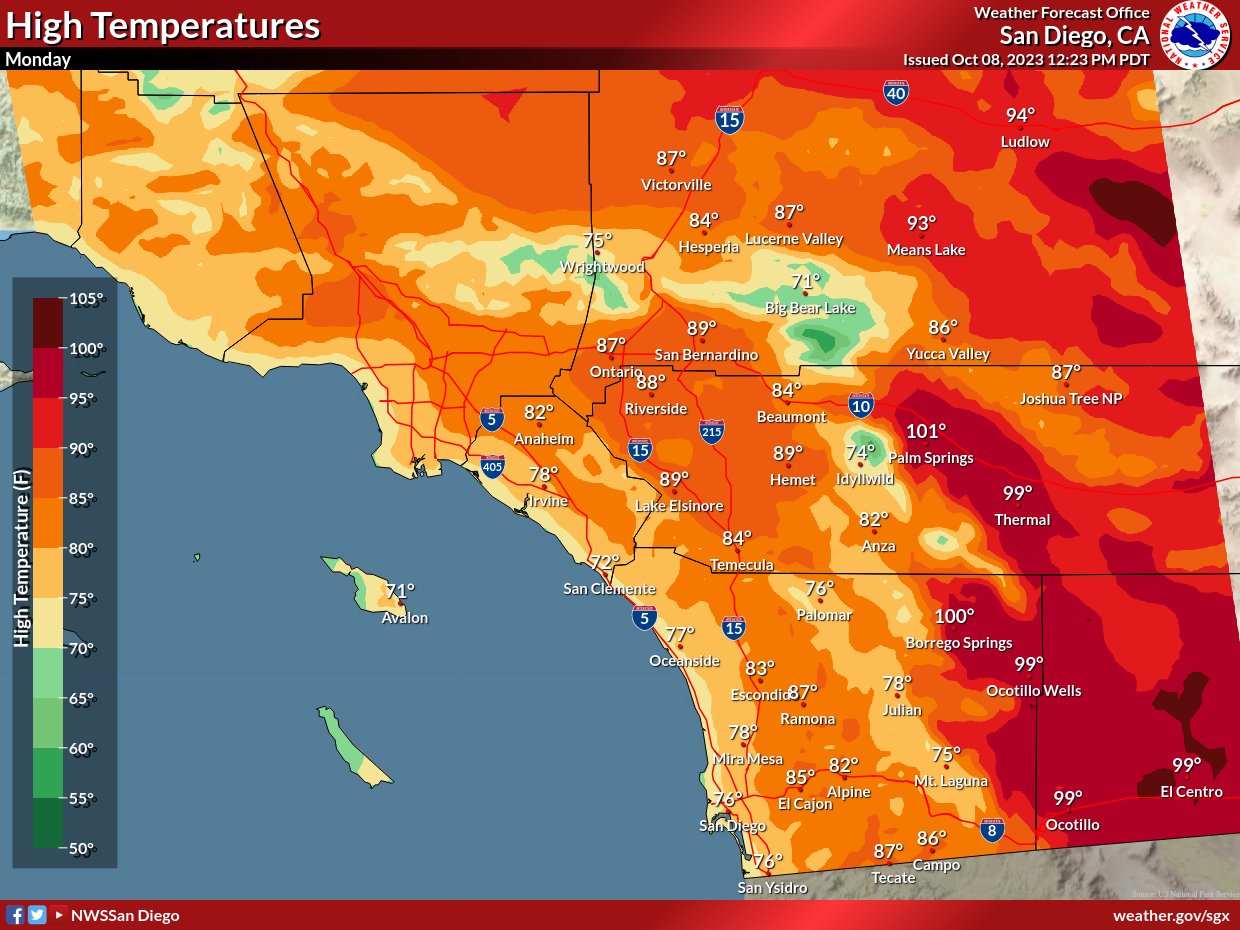

Enjoy Four Days Of Warm Sunny Weather In San Diego County

May 30, 2025

Enjoy Four Days Of Warm Sunny Weather In San Diego County

May 30, 2025 -

Cybercriminal Nets Millions Targeting Office365 Executive Accounts

May 30, 2025

Cybercriminal Nets Millions Targeting Office365 Executive Accounts

May 30, 2025 -

Sukses Rm Bts Nominasi Amas 2025 Dan Kolaborasi Terbaru Dengan Tablo

May 30, 2025

Sukses Rm Bts Nominasi Amas 2025 Dan Kolaborasi Terbaru Dengan Tablo

May 30, 2025