Weihong Liu: The Billionaire Behind The Hudson's Bay Lease Purchases

Table of Contents

Weihong Liu: A Profile of the Billionaire Investor

Weihong Liu's Business Empire

Weihong Liu's business acumen extends across various sectors, although details about his private holdings remain somewhat opaque. His overall net worth, while not publicly disclosed with precision, places him firmly among the ranks of billionaires. Beyond his recent foray into Hudson's Bay leases, his investment portfolio is rumored to include significant stakes in diverse industries. Keywords: Weihong Liu net worth, investment strategy, business ventures, portfolio.

- Key Sectors: While specifics are limited, reports suggest involvement in sectors like technology, manufacturing, and potentially even private equity.

- Significant Holdings: Identifying specific companies within his portfolio remains challenging due to the private nature of many of his investments.

Liu's Investment Philosophy and Approach

Understanding Weihong Liu's investment philosophy is key to deciphering his strategy regarding the Hudson's Bay lease purchases. While his precise approach remains largely undisclosed, his actions suggest a preference for strategically significant, long-term investments with high growth potential. Keywords: investment philosophy, long-term investment, real estate strategy, risk assessment.

- Key Characteristics: His acquisitions suggest a keen eye for undervalued assets and a willingness to engage in large-scale transactions. He appears to be a long-term player, focused on building value rather than short-term gains.

- Risk Tolerance: While unknown, the scale of his acquisitions suggests a high risk tolerance, possibly coupled with a sophisticated risk assessment strategy.

The Hudson's Bay Lease Acquisitions: A Detailed Look

Scale and Significance of the Purchases

The number and value of Hudson's Bay leases acquired by Weihong Liu are substantial, representing a significant investment in the Canadian retail landscape. While precise figures remain confidential, reports suggest the acquisition encompasses numerous properties across multiple locations, encompassing prime retail spaces in major Canadian cities. Keywords: Hudson's Bay lease, property acquisition, real estate portfolio, investment value.

- Key Properties: While a comprehensive list remains unavailable publicly, several key locations across major Canadian urban centers are reported to be included in the portfolio.

- Geographical Distribution: The strategic distribution of acquired leases suggests a deliberate approach to maximize long-term potential and diversification within his investment.

Potential Implications of Liu's Investments

The implications of Weihong Liu's investments in Hudson's Bay leases are far-reaching. For Hudson's Bay Company, it could signal a restructuring or a shift in their long-term strategy. For the Canadian real estate market, it represents a significant injection of capital and could potentially influence future development and valuations in affected areas. Keywords: market impact, real estate development, future implications, economic effect.

- Positive Impacts: Increased investment could lead to revitalization of properties and surrounding areas, creating jobs and boosting local economies.

- Negative Impacts: Concerns may arise regarding potential increased rents for smaller businesses and the changing landscape of traditional retail spaces.

The Future of Weihong Liu and his Investments in Hudson's Bay

Predictions and Speculations

Predicting the future trajectory of Weihong Liu's Hudson's Bay investments requires careful consideration of various factors. Continued expansion within the Hudson's Bay portfolio is a possibility, alongside potential development projects and even acquisitions of other retail properties. Keywords: future plans, investment outlook, expansion strategy, market prediction.

- Possible Scenarios: Liu might consolidate his holdings, focusing on property management and development; or he could look to further expand his portfolio through additional acquisitions.

- Market Influences: Future market conditions, particularly within the retail sector, will significantly influence the success of Liu's investments.

Conclusion: Understanding Weihong Liu's Influence on Hudson's Bay Lease Purchases

Weihong Liu's significant acquisition of Hudson's Bay leases represents a pivotal moment in the Canadian real estate landscape. His investment strategy, though largely shrouded in secrecy, showcases a keen understanding of long-term value and potential. The implications for both the Hudson's Bay Company and the market are significant, setting the stage for future developments and influencing the direction of real estate investments in Canada. Keywords: Weihong Liu, Hudson's Bay, lease purchases, billionaire investor, real estate market.

Learn more about the intriguing world of Weihong Liu's investments and their impact on the Hudson's Bay lease market by following [link to related article/website]. Stay informed on the latest developments in billionaire real estate acquisitions.

Featured Posts

-

Queensland Music Awards Night Marred By Antisemitism Accusations

May 29, 2025

Queensland Music Awards Night Marred By Antisemitism Accusations

May 29, 2025 -

New French Law Phone Confiscation For Drug Related Offenses

May 29, 2025

New French Law Phone Confiscation For Drug Related Offenses

May 29, 2025 -

Hl Ansf Alqwmu Dhkra Astqlal Wtnna Wtqyym Msyrtna

May 29, 2025

Hl Ansf Alqwmu Dhkra Astqlal Wtnna Wtqyym Msyrtna

May 29, 2025 -

Community Mourns Environmental Advocate Lost To Floods In Nky

May 29, 2025

Community Mourns Environmental Advocate Lost To Floods In Nky

May 29, 2025 -

Nieuw Statendam A Successful Start To Invergordons Cruise Season

May 29, 2025

Nieuw Statendam A Successful Start To Invergordons Cruise Season

May 29, 2025

Latest Posts

-

Munichs Bmw Open 2025 Zverev Battles Griekspoor In Quarter Finals

May 31, 2025

Munichs Bmw Open 2025 Zverev Battles Griekspoor In Quarter Finals

May 31, 2025 -

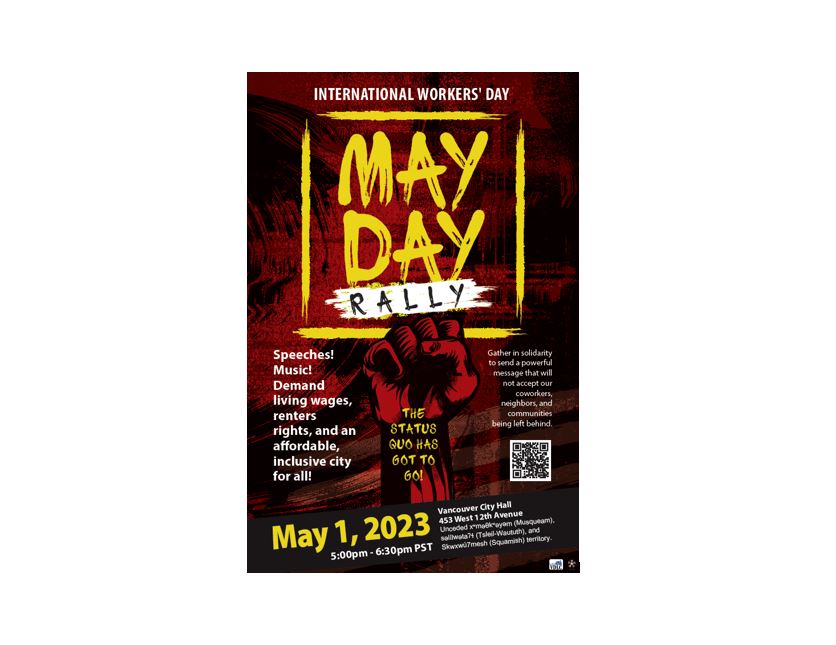

May Day Rally In Kingston Images Show Strength And Solidarity Daily Freeman

May 31, 2025

May Day Rally In Kingston Images Show Strength And Solidarity Daily Freeman

May 31, 2025 -

Bmw Open 2025 Zverev Griekspoor Quarter Final Showdown In Munich

May 31, 2025

Bmw Open 2025 Zverev Griekspoor Quarter Final Showdown In Munich

May 31, 2025 -

Indian Wells Surprise Zverevs First Match Exit And His Honest Assessment

May 31, 2025

Indian Wells Surprise Zverevs First Match Exit And His Honest Assessment

May 31, 2025 -

Trump Administration Loses Key Advisor Elon Musks Resignation Explained

May 31, 2025

Trump Administration Loses Key Advisor Elon Musks Resignation Explained

May 31, 2025