Whale Alert: 20 Million XRP Bought – Implications For Ripple Investors

Table of Contents

Understanding the Significance of the Whale Alert

First, let's define what a "whale" is in the cryptocurrency market. A crypto whale is an individual or entity holding a significant amount of a particular cryptocurrency, possessing enough capital to influence its price through large-scale buying or selling. This 20 million XRP purchase represents a substantial move in the market. To put it into perspective, consider the overall XRP market capitalization. A purchase of this size can create noticeable price fluctuations, impacting other investors.

The potential impact of such a large purchase on price manipulation is a key concern. While this whale may not be intentionally manipulating the market, their actions can certainly contribute to short-term price volatility.

- Definition of a crypto whale: An entity holding a significant amount of cryptocurrency, capable of influencing market prices.

- Market cap context of 20 million XRP: While the percentage of the total XRP supply this represents is relatively small, the sheer volume is still significant enough to influence short-term price action.

- Potential for short-term price increases: The immediate effect of a large buy order is often a surge in price, as demand temporarily outstrips supply.

- Risk of temporary price inflation: This price increase might be artificial and unsustainable, potentially leading to a correction later.

Potential Reasons Behind the Massive XRP Purchase

Why would a whale invest such a significant sum into XRP? Several factors could be at play:

- Belief in XRP's long-term potential: The whale may believe in Ripple's technology and the future adoption of XRP as a global payment solution.

- Speculation on positive Ripple news: Positive developments in the Ripple-SEC lawsuit, increased institutional adoption, or technological advancements could drive this large investment.

- Strategic investment moves: The purchase could be part of a larger strategic investment plan, aiming to capitalize on future growth.

- Arbitrage opportunities: The whale might be exploiting price discrepancies between different cryptocurrency exchanges.

Here are some additional considerations:

- Ripple's ongoing legal battle: The outcome of the Ripple-SEC lawsuit significantly impacts XRP's price and investor sentiment. A positive outcome could trigger a massive price rally.

- Adoption of XRP by financial institutions: Increasing adoption by banks and payment processors boosts XRP's credibility and value.

- Technological advancements in XRP Ledger: Improvements in speed, scalability, and functionality attract more users and developers to the XRP ecosystem.

- Overall market sentiment towards XRP: Positive market sentiment generally translates into higher demand and price appreciation.

Implications for Ripple Investors – Short-Term and Long-Term

This 20 million XRP purchase has clear short-term implications for XRP price and trading volume. We can expect increased volatility and potentially a price surge in the immediate aftermath. However, the long-term implications are more complex and depend on several intertwined factors.

- Short-term price volatility: Expect increased price swings following such a large transaction.

- Potential for profit-taking after price surge: After an initial price increase, some investors may take profits, leading to a potential price correction.

- Long-term growth potential of XRP: The long-term success of XRP depends on factors like market adoption, regulatory clarity, and technological advancements.

- Risks associated with regulatory uncertainty: The ongoing legal battles surrounding Ripple and XRP introduce significant uncertainty.

Analyzing the Ripple-SEC Lawsuit's Influence

The Ripple-SEC lawsuit casts a long shadow over the XRP market. The outcome of this case will profoundly influence investor sentiment and whale activity.

- Potential positive outcomes and their impact: A favorable ruling could send XRP's price soaring, attracting more investors.

- Potential negative outcomes and their impact: An unfavorable ruling could severely damage investor confidence and lead to a significant price drop.

- Uncertainty surrounding the lawsuit's effect on investor confidence: This uncertainty creates volatility and makes it difficult to predict long-term price movements.

Conclusion

The recent whale alert signaling a 20 million XRP purchase is a significant event in the XRP market. While it may lead to short-term price fluctuations, the long-term implications depend heavily on various factors, including the outcome of the Ripple-SEC lawsuit and overall market trends. This large purchase signifies considerable confidence in XRP by some market players.

Call to Action: Stay informed about the latest developments in the XRP market and continue researching before making any investment decisions. Keep an eye out for future Whale Alert updates regarding XRP to make informed decisions about your XRP investments. Remember to always conduct thorough due diligence before investing in any cryptocurrency.

Featured Posts

-

Deset Pobedi Po Red Za Vesprem Triumf Nad Ps Zh

May 08, 2025

Deset Pobedi Po Red Za Vesprem Triumf Nad Ps Zh

May 08, 2025 -

Affordable Power The 12 Inch Microsoft Surface Pro

May 08, 2025

Affordable Power The 12 Inch Microsoft Surface Pro

May 08, 2025 -

Xrp And The Grayscale Etf Analyzing The Potential For Record Highs

May 08, 2025

Xrp And The Grayscale Etf Analyzing The Potential For Record Highs

May 08, 2025 -

Pik Seged Shokantna Pobeda Nad Pariz Za Chetvrtfinale Lige Shampiona

May 08, 2025

Pik Seged Shokantna Pobeda Nad Pariz Za Chetvrtfinale Lige Shampiona

May 08, 2025 -

Who Are The Rogue Exiles In Path Of Exile 2

May 08, 2025

Who Are The Rogue Exiles In Path Of Exile 2

May 08, 2025

Latest Posts

-

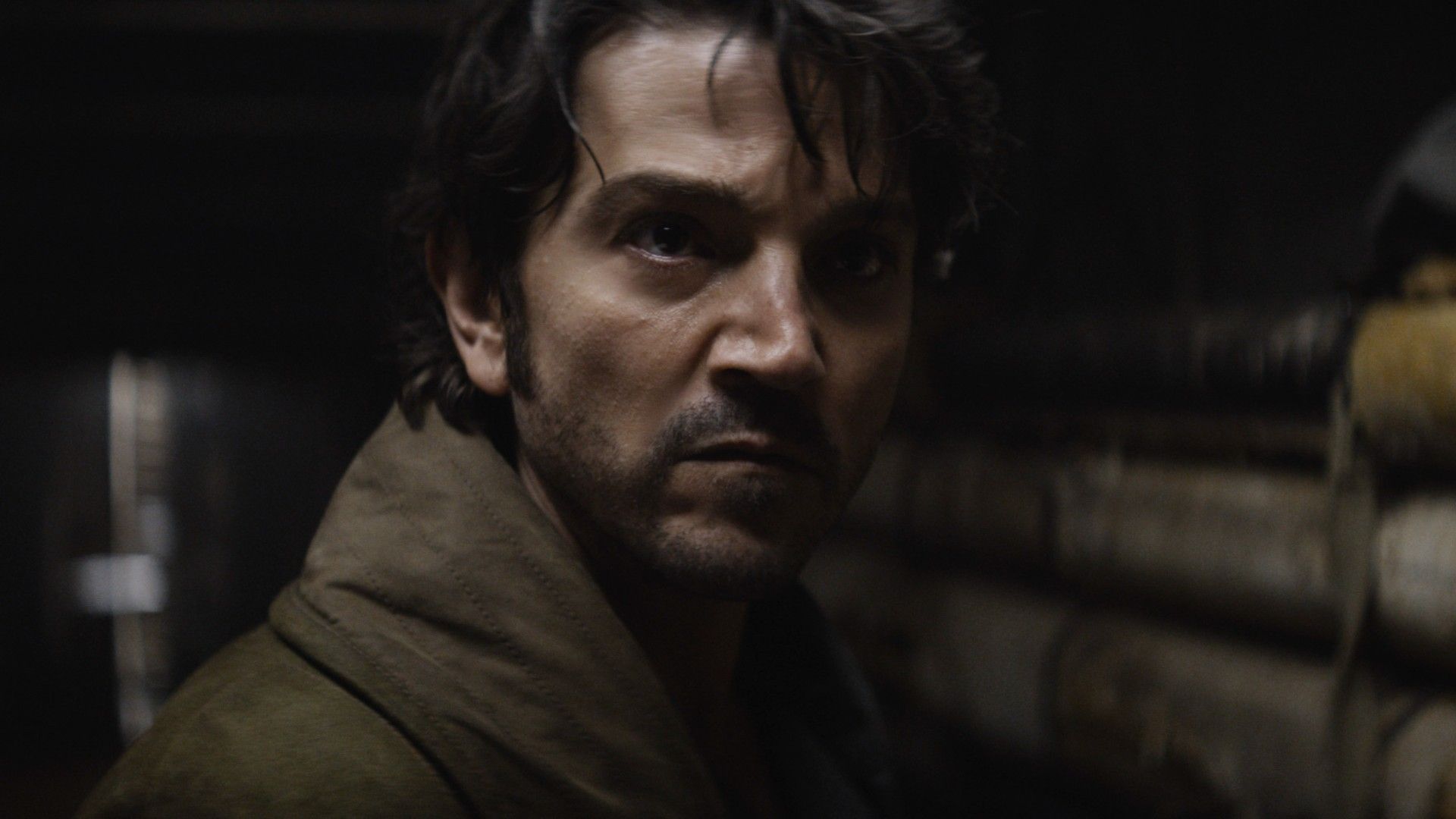

Andor Season 2 Trailer Release Date Speculation And Confirmed Details

May 08, 2025

Andor Season 2 Trailer Release Date Speculation And Confirmed Details

May 08, 2025 -

Todays Weather Partly Cloudy With A Chance Of Insert Relevant Condition

May 08, 2025

Todays Weather Partly Cloudy With A Chance Of Insert Relevant Condition

May 08, 2025 -

Everything We Know About Andor Season 2 Release Date Trailer And More

May 08, 2025

Everything We Know About Andor Season 2 Release Date Trailer And More

May 08, 2025 -

Pwlys Mqablh Gjranwalh Myn Fayrng Ka Waqeh 5 Hlaktyn Dyrynh Dshmny

May 08, 2025

Pwlys Mqablh Gjranwalh Myn Fayrng Ka Waqeh 5 Hlaktyn Dyrynh Dshmny

May 08, 2025 -

Expect Partly Cloudy Conditions Weather Outlook And Planning

May 08, 2025

Expect Partly Cloudy Conditions Weather Outlook And Planning

May 08, 2025