What Is A Real Safe Bet In Today's Market?

Table of Contents

Diversification: Spreading Your Risk Across Asset Classes

The cornerstone of any successful long-term investment strategy is diversification. This crucial principle emphasizes the importance of not putting all your eggs in one basket. A diversified portfolio spreads your investments across various asset classes, reducing your overall risk exposure. A truly safe bet isn't about avoiding risk entirely, but about managing it effectively.

The Importance of a Diversified Portfolio:

- Different Asset Classes: A well-diversified portfolio typically includes a mix of stocks (equities), bonds (fixed-income), real estate, commodities (like gold or oil), and potentially alternative investments. Each asset class reacts differently to market conditions, offering a natural hedge against losses in any single area. A secure investment strategy understands and utilizes this principle.

- Mitigating Market Volatility: Diversification is your shield against market downturns. When one asset class underperforms, others may offset those losses, preventing significant portfolio erosion. This is the essence of a low-risk investment approach.

- Tailored Portfolios: The ideal level of diversification depends on your risk tolerance and investment goals. A younger investor with a longer time horizon might tolerate a higher proportion of stocks, while someone closer to retirement might prefer a more conservative portfolio with a greater allocation to bonds. A safe bet is always personalized.

The keywords associated with this approach include "diversified portfolio," "risk mitigation," "asset allocation," and "portfolio diversification strategy." Building a truly diversified portfolio is key to finding a safe bet in the current market.

Government Bonds: A Traditional Safe Haven

Government bonds, particularly those issued by stable, developed economies, have historically served as a safe haven for investors. These bonds represent a loan to the government, offering a relatively predictable stream of income. While not completely risk-free, they are generally considered a low-risk investment option.

Understanding Government Bond Yields and Risks:

- Inverse Relationship: Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices generally fall, and vice versa. Understanding this dynamic is crucial for making informed investment decisions. A secure investment strategy incorporates this.

- Creditworthiness: The creditworthiness of the government issuing the bond significantly impacts its risk profile. Bonds issued by countries with strong economies and stable political systems are generally considered safer than those from emerging markets.

- Inflation Risk: Inflation can erode the purchasing power of your bond's fixed income. While government bonds provide a safe bet in terms of principal repayment, inflation can affect their real return. This is a risk to consider.

Keywords associated with this section include "government bonds," "low-risk bonds," "fixed-income investments," "bond yields," and "treasury bonds." Government bonds can form a significant part of a safe bet investment strategy.

Index Funds: Passive Investing for Long-Term Growth

Index funds offer a simple and effective way to achieve diversification and long-term growth. These funds track a specific market index (like the S&P 500), passively mirroring its performance. They are a relatively low-risk approach to investing in the stock market.

The Benefits of Passive Investing:

- Lower Expense Ratios: Index funds typically have lower expense ratios than actively managed funds, meaning more of your investment stays invested, leading to higher returns over time. This makes it a cost-effective option for a safe bet.

- Long-Term Performance: Historically, index funds have demonstrated strong long-term performance, keeping pace with overall market growth. This makes them a reliable component of a low-risk strategy.

- Diversification Inherent: By tracking a broad market index, index funds inherently provide diversification across multiple companies and sectors. This in-built diversification is a significant advantage for any long-term investment strategy.

Keywords associated with this section include "index funds," "passive investing," "low-cost investing," "long-term investment strategy," and "market index." Investing in index funds can be a truly safe bet for long-term growth.

Real Estate: A Tangible Asset with Potential for Long-Term Growth

Real estate represents a tangible asset class that can play a valuable role in a diversified portfolio. While riskier than government bonds or index funds, it offers potential for both rental income and capital appreciation.

The Strengths and Weaknesses of Real Estate Investment:

- Rental Income & Appreciation: Real estate can generate passive income through rental properties and benefit from long-term appreciation in property values. This aspect can make real estate a good component for a safe bet strategy.

- High Initial Investment & Expenses: Real estate investments often require significant upfront capital and ongoing expenses (maintenance, taxes, insurance). This makes it essential to carefully assess your financial capacity.

- Market Research Crucial: Location and market research are vital before investing in real estate. Understanding local market trends and demand is essential to mitigate risks.

Keywords associated with this section include "real estate investment," "rental income," "property investment," "tangible assets," and "real estate market." Real estate can certainly be part of a diversified, safe bet portfolio.

Conclusion

Building a secure investment portfolio requires a multifaceted approach. There's no single foolproof "safe bet" in today's market, but by diversifying your investments across asset classes like government bonds, index funds, and real estate (while carefully considering your risk tolerance), you can significantly reduce your overall risk. Understanding the characteristics of each asset class and implementing a well-defined investment strategy are essential to achieving long-term financial security. Start planning your low-risk investment strategy today! Remember, a truly safe bet is one that aligns with your financial goals and risk tolerance.

Featured Posts

-

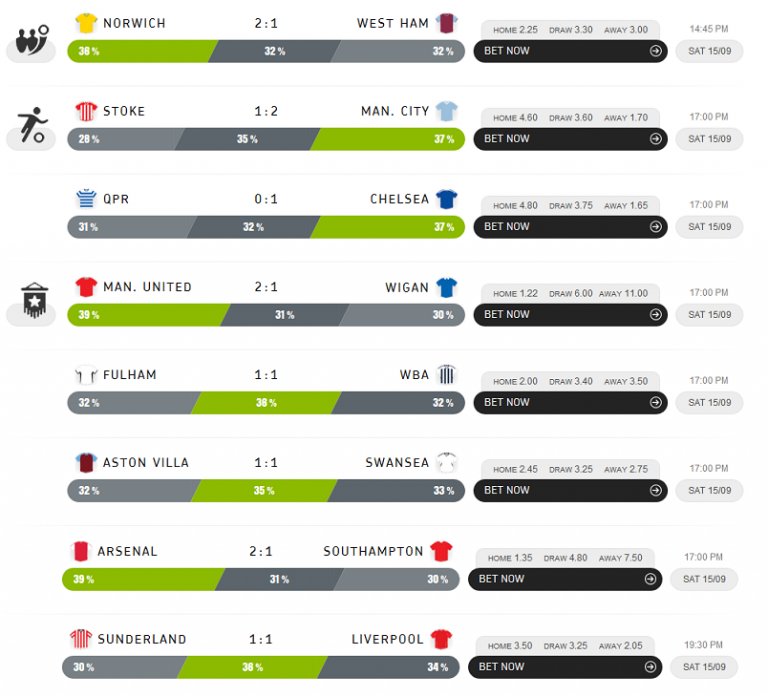

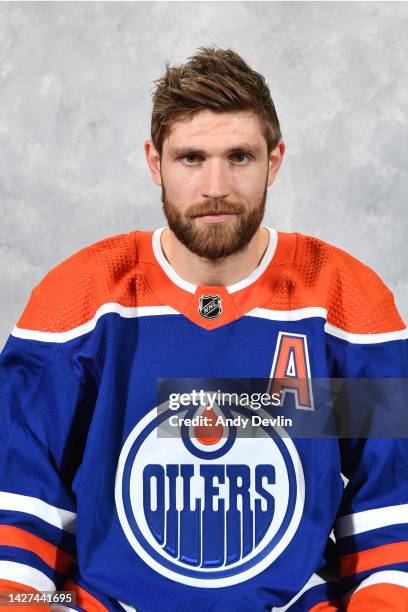

Tonights Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Odds

May 09, 2025

Tonights Nhl Playoffs Oilers Vs Kings Game 1 Prediction And Betting Odds

May 09, 2025 -

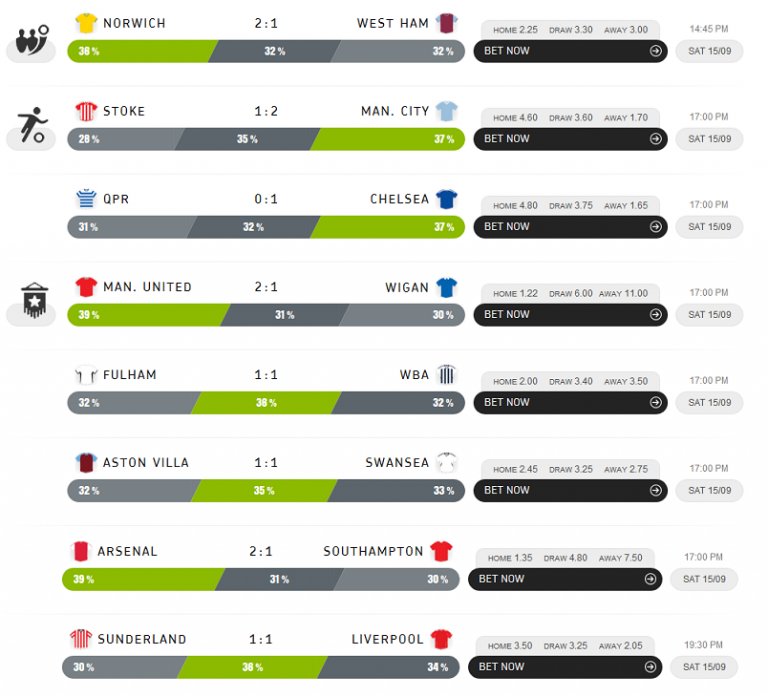

Analysis Trump Tariffs Cost Top 10 Billionaires 174 Billion

May 09, 2025

Analysis Trump Tariffs Cost Top 10 Billionaires 174 Billion

May 09, 2025 -

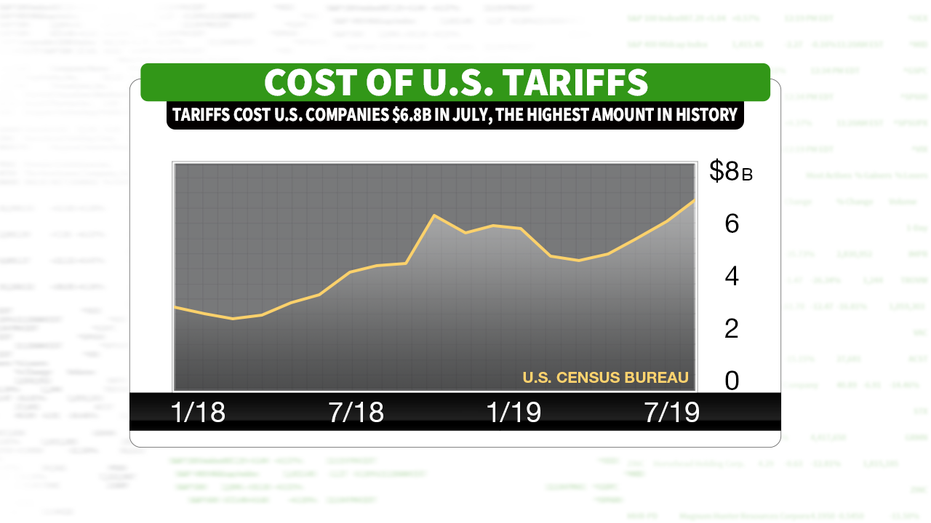

Edmonton Oilers Draisaitls Lower Body Injury Timeline Playoffs In Sight

May 09, 2025

Edmonton Oilers Draisaitls Lower Body Injury Timeline Playoffs In Sight

May 09, 2025 -

Meiomena Xionia Sta Imalaia Apeili Gia Tin Perioxi

May 09, 2025

Meiomena Xionia Sta Imalaia Apeili Gia Tin Perioxi

May 09, 2025 -

The Snl Harry Styles Impression Did He Hate It

May 09, 2025

The Snl Harry Styles Impression Did He Hate It

May 09, 2025