What Makes A Crypto Exchange Compliant In India? A Simple Guide For 2025

Table of Contents

Understanding the Indian Regulatory Framework for Cryptocurrencies

The legal status of cryptocurrencies in India remains somewhat ambiguous. While not explicitly banned, there's no specific legislation officially recognizing them as legal tender. Several government bodies play a role, most notably the Reserve Bank of India (RBI) and the potential for future legislation from the parliament. This lack of clarity creates significant challenges for crypto exchanges seeking to operate within the law.

- Current ambiguity surrounding cryptocurrency classification: Cryptocurrencies are currently neither explicitly legalized nor banned, leading to uncertainty for businesses.

- RBI's stance on cryptocurrencies and potential future regulations: The RBI has expressed concerns about the risks associated with cryptocurrencies, particularly regarding money laundering and consumer protection. They may issue further guidelines or regulations in the future.

- The role of self-regulatory organizations (SROs) in the Indian crypto space: The absence of a comprehensive legal framework has led to calls for the establishment of SROs to oversee the industry and establish best practices. This is an evolving area.

- Key challenges and uncertainties for crypto exchanges in India: Exchanges face difficulties in obtaining banking services, navigating tax regulations, and complying with evolving regulatory expectations. Predicting future regulations is difficult.

KYC/AML Compliance for Indian Crypto Exchanges

Know Your Customer (KYC) and Anti-Money Lauundering (AML) compliance are crucial for any crypto exchange operating in India. Strict adherence to these guidelines is essential to prevent the use of cryptocurrencies for illicit activities, such as money laundering and terrorist financing. Failure to comply can lead to severe penalties.

- Strict adherence to KYC/AML guidelines to prevent illegal activities: Exchanges must implement robust systems to verify the identities of their users and monitor their transactions for suspicious activity.

- Implementation of robust KYC/AML procedures, including identity verification and transaction monitoring: This involves verifying user identities using official documentation, monitoring transaction patterns for red flags, and reporting suspicious activity to the relevant authorities.

- The penalties for non-compliance with KYC/AML regulations in India: Non-compliance can result in hefty fines, legal action, and even the closure of the exchange.

- Integration with relevant Indian KYC/AML databases: Exchanges should integrate with relevant databases to verify user identities and flag potentially risky transactions.

- Regular audits and compliance reviews to ensure ongoing adherence: Regular internal and external audits are crucial to ensure that KYC/AML procedures remain effective and compliant.

Data Security and Privacy Regulations for Crypto Exchanges in India

Protecting user data is paramount for any crypto exchange operating in India. Compliance with data protection laws and regulations, such as the upcoming Personal Data Protection Bill, is non-negotiable. Data breaches can lead to significant financial and reputational damage.

- Compliance with data protection laws and regulations in India (e.g., Personal Data Protection Bill): Exchanges must ensure that they collect, process, and store user data in accordance with relevant laws.

- Implementing robust security measures to protect user data from breaches and cyberattacks: This includes employing strong encryption, multi-factor authentication, and regular security audits.

- Transparency in data handling practices and user consent mechanisms: Users must be informed about how their data is collected, used, and protected. Clear consent mechanisms are necessary.

- Regular security audits and penetration testing: Regular assessments help identify vulnerabilities and strengthen security protocols.

- Data encryption and secure storage practices: Sensitive data must be encrypted both in transit and at rest.

Tax Compliance for Crypto Transactions in India

The taxation of cryptocurrency transactions in India is evolving. Currently, profits from cryptocurrency trading are taxed as income under the Income Tax Act, and GST may also apply. Crypto exchanges must ensure accurate reporting and record-keeping to comply.

- Taxation of crypto gains as income under the Income Tax Act: Profits from cryptocurrency trading are considered income and are subject to income tax.

- GST implications for cryptocurrency transactions: Depending on the nature of the transaction, GST may apply.

- Accurate reporting and record-keeping requirements for crypto exchanges: Exchanges must maintain accurate records of all transactions and provide this information to tax authorities when requested.

- Cooperation with tax authorities and compliance with tax reporting regulations: Exchanges must cooperate fully with tax authorities and comply with all reporting requirements.

- Understanding the implications of withholding taxes on crypto transactions: Depending on future regulations, withholding taxes on crypto transactions may be introduced.

Choosing a Compliant Jurisdiction for your Crypto Exchange in India

The location of your exchange's operations significantly impacts its compliance. Operating from a jurisdiction with clear and supportive cryptocurrency regulations offers advantages, while operating from a jurisdiction with unclear or restrictive regulations exposes the exchange to significant risks.

- Understanding state-specific regulations regarding cryptocurrencies: Regulations may vary across different states in India.

- The benefits of operating in a jurisdiction with clear and supportive crypto regulations: This reduces legal uncertainty and facilitates smoother operations.

- The risks associated with operating in jurisdictions with unclear or restrictive regulations: This can lead to legal challenges, operational disruptions, and reputational damage.

- The legal implications for exchanges operating from outside India but serving Indian users: Exchanges serving Indian users may still need to comply with Indian regulations, even if based elsewhere.

Conclusion

Successfully operating a crypto exchange in India requires a comprehensive understanding of Crypto Exchange Compliance India. This involves navigating the complex regulatory framework, adhering to KYC/AML and data protection regulations, ensuring tax compliance, and choosing a suitable jurisdiction. By prioritizing these key aspects, crypto exchanges can build trust, protect users, and operate legally within the evolving Indian crypto landscape. To learn more about maintaining robust Crypto Exchange Compliance in India, consult legal and financial professionals specializing in this area. Don't compromise on Crypto Exchange Compliance in India – it's crucial for your long-term success.

Featured Posts

-

Former Nfl Qb Steals Fly Ball From Max Muncy In Japan

May 15, 2025

Former Nfl Qb Steals Fly Ball From Max Muncy In Japan

May 15, 2025 -

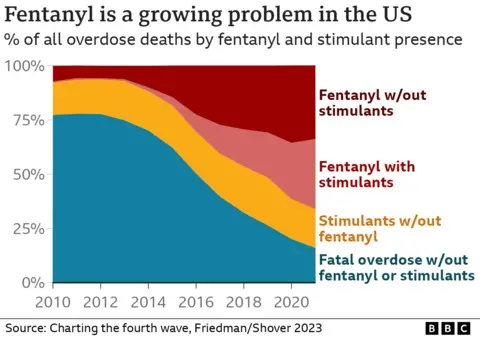

The Fentanyl Problem Chinas Role And Potential Reckoning Says Ex Us Official

May 15, 2025

The Fentanyl Problem Chinas Role And Potential Reckoning Says Ex Us Official

May 15, 2025 -

Biden Rejects Accusations Examining The Evidence

May 15, 2025

Biden Rejects Accusations Examining The Evidence

May 15, 2025 -

Lindungi Warga Pesisir Perdebatan Seputar Pembangunan Giant Sea Wall

May 15, 2025

Lindungi Warga Pesisir Perdebatan Seputar Pembangunan Giant Sea Wall

May 15, 2025 -

Padres Historic Mlb Winning Streak Unseen Since 1889

May 15, 2025

Padres Historic Mlb Winning Streak Unseen Since 1889

May 15, 2025