Where To Invest: A Comprehensive Map Of The Country's Hottest Business Areas

Table of Contents

Tech Hubs: Silicon Valleys Across the Nation

The technology sector continues to be a powerhouse for investment, creating numerous opportunities for substantial returns. Identifying the top tech hubs within the country is key to maximizing your investment potential.

Top Cities for Tech Investment:

-

Detailed analysis of major tech cities: Our analysis considers several key factors including population growth, the size and skill level of the available talent pool, the amount of venture capital funding attracted, and the overall economic health of the region. We've identified specific metrics to help you compare cities directly.

-

Examples:

- City A (focus on AI and Fintech): City A boasts a rapidly growing population, attracting top talent in artificial intelligence and financial technology. Recent data shows a 15% year-over-year job growth in the AI sector and an average salary for AI professionals exceeding $150,000. Venture capital investment in Fintech startups in City A reached a record high last year.

- City B (focus on software development and gaming): City B is a well-established tech hub known for its strong software development and gaming industries. With a large and experienced talent pool, it consistently attracts significant investment, showcasing a stable, mature market.

- City C (emerging tech hub with potential for high growth): City C represents an exciting emerging market with significant potential for high growth. While the current infrastructure is still developing, the city's proactive approach to attracting tech companies and its lower cost of living compared to established hubs makes it an attractive option for investors seeking higher risk, higher reward opportunities.

Investing in Tech Startups:

Investing in tech startups can be highly rewarding but also carries significant risk. Here are some strategies to consider:

- Identifying promising tech startups: Look for companies with innovative solutions, a strong management team, and a clear path to profitability. Thorough due diligence is essential, including reviewing financial statements, market analysis, and competitive landscape.

- Risk mitigation strategies: Diversify your portfolio across multiple startups to mitigate risk. Only invest what you can afford to lose and consider seeking advice from experienced investment professionals.

- Understanding current trends: Stay informed about the latest trends in technology, such as artificial intelligence (AI), virtual reality/augmented reality (VR/AR), blockchain technology, and the metaverse. Understanding these trends will help you identify promising investment opportunities.

Real Estate: Prime Locations for Property Investment

Real estate remains a cornerstone of sound investment strategies, offering both stability and potential for significant appreciation. However, smart investment requires identifying high-growth markets.

High-Growth Residential Markets:

- Analysis of cities with strong population growth and rising property values: We've analyzed cities experiencing significant population increases driven by factors like job growth and improved quality of life. These cities generally demonstrate strong upward pressure on property values.

- Factors influencing property values: Several factors impact property values, including the strength of the local job market, the quality of infrastructure (transportation, schools, healthcare), and the availability of amenities (parks, restaurants, cultural attractions).

- Different property investment strategies: Investors have various options, including flipping properties for short-term gains, or holding properties for long-term rental income.

Commercial Real Estate Opportunities:

- High demand for commercial spaces: Cities with thriving economies typically have high demand for commercial spaces, including retail, office, and industrial properties. This demand can translate into strong rental income and property value appreciation.

- Identifying undervalued properties: Thorough market research is crucial to identifying properties priced below their market value, offering potential for significant returns.

- Understanding lease agreements and tenant relationships: Managing commercial real estate requires a solid understanding of lease agreements, tenant management, and property maintenance.

Renewable Energy: A Growing Sector for Green Investments

The renewable energy sector is experiencing explosive growth, driven by increasing environmental awareness and government support.

Government Incentives and Support:

- Overview of government policies and incentives: Many governments offer substantial financial incentives to encourage investment in renewable energy projects.

- Examples of tax credits, grants, and subsidies: These incentives can significantly reduce the initial investment cost and boost the overall return on investment. These may include tax credits, grants, accelerated depreciation, and feed-in tariffs.

Investment Opportunities in Renewable Energy:

- Types of renewable energy investments: Investment opportunities range from large-scale solar and wind farms to smaller-scale projects, including residential solar installations.

- Potential risks and rewards: While renewable energy investments offer significant potential rewards, understanding the inherent risks, such as weather dependency and regulatory changes, is crucial.

- Due diligence required: Thorough due diligence is critical, including evaluating the project's technical feasibility, financial viability, and environmental impact.

Emerging Markets: Uncovering Hidden Gems for High Returns

Emerging markets often present opportunities for high returns, but they also carry increased risk.

Identifying Undervalued Sectors:

- Focus on lesser-known areas with high growth potential: Explore sectors with strong future growth prospects, but which may not yet be fully recognized by mainstream investors.

- Examples of emerging sectors: Consider sectors like sustainable agriculture, medical tourism, and technology focused on emerging markets.

- Strategies for identifying promising investment opportunities: Look for markets with supportive government policies, strong demographics, and a growing middle class.

Mitigating Risks in Emerging Markets:

- Risk assessment and due diligence process: A rigorous risk assessment is crucial, considering political, economic, and social factors. Conduct comprehensive due diligence before investing.

- Strategies for managing potential political and economic risks: Diversification across multiple investments and geographies can help to mitigate risks associated with political instability or economic downturns.

Conclusion

This guide has mapped out some of the country's hottest business areas, highlighting key sectors offering lucrative investment opportunities. From booming tech hubs and prime real estate locations to the expanding renewable energy sector and promising emerging markets, careful consideration of diverse options can lead to significant returns. Remember to conduct thorough due diligence and research before making any investment decisions. Start exploring your options today – find the perfect place to invest and build your financial future. Remember to research thoroughly and understand the risks associated with each investment before making any decisions. Find your ideal where to invest today!

Featured Posts

-

Key England Players Injured Ahead Of Zimbabwe Test Series

May 23, 2025

Key England Players Injured Ahead Of Zimbabwe Test Series

May 23, 2025 -

Emergency Evacuation Of Livestock In Swiss Alpine Village Due To Landslide Danger

May 23, 2025

Emergency Evacuation Of Livestock In Swiss Alpine Village Due To Landslide Danger

May 23, 2025 -

Juventus Managerial Search Ten Hag Emerges As Potential Candidate

May 23, 2025

Juventus Managerial Search Ten Hag Emerges As Potential Candidate

May 23, 2025 -

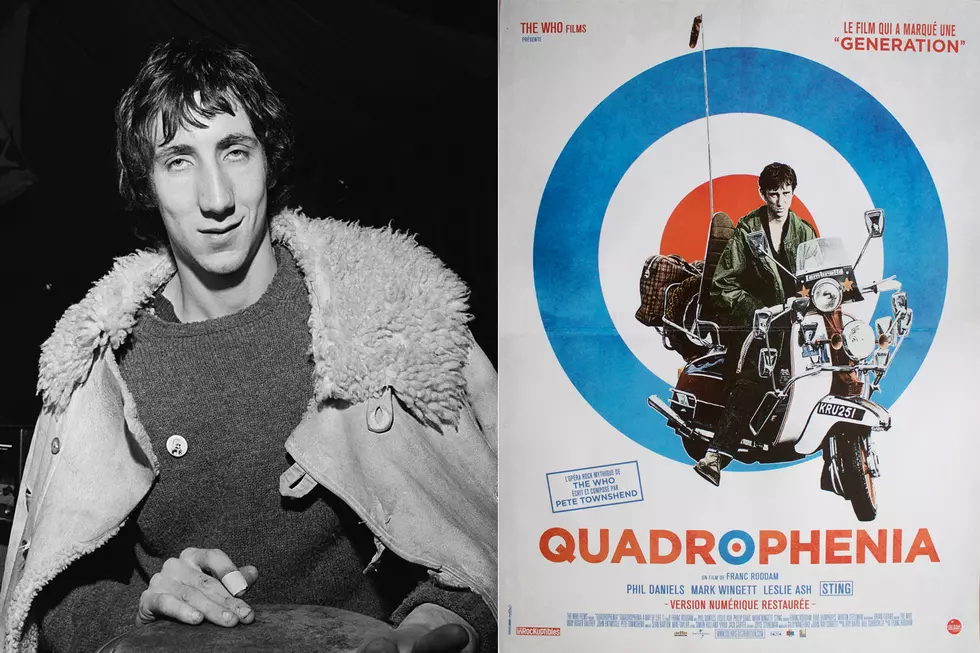

Ranking Pete Townshends Solo Albums From Worst To Best

May 23, 2025

Ranking Pete Townshends Solo Albums From Worst To Best

May 23, 2025 -

Goroskopy I Predskazaniya Chto Ozhidat V Buduschem

May 23, 2025

Goroskopy I Predskazaniya Chto Ozhidat V Buduschem

May 23, 2025

Latest Posts

-

Memorial Day Gas Prices A Decade Low Forecast

May 23, 2025

Memorial Day Gas Prices A Decade Low Forecast

May 23, 2025 -

Arrows Neal Mc Donough Damien Darhk And A Possible Dc Project

May 23, 2025

Arrows Neal Mc Donough Damien Darhk And A Possible Dc Project

May 23, 2025 -

Neal Mc Donough And Pro Bull Riding A Look At The Last Rodeo

May 23, 2025

Neal Mc Donough And Pro Bull Riding A Look At The Last Rodeo

May 23, 2025 -

Neal Mc Donough Would Damien Darhk Beat Superman Exclusive Interview

May 23, 2025

Neal Mc Donough Would Damien Darhk Beat Superman Exclusive Interview

May 23, 2025 -

The Last Rodeo Neal Mc Donough Faces The Danger Of Pro Bull Riding

May 23, 2025

The Last Rodeo Neal Mc Donough Faces The Danger Of Pro Bull Riding

May 23, 2025