Where To Invest: A Geographic Analysis Of New Business Hotspots

Table of Contents

North American Investment Hotspots

The US Sun Belt

States like Texas, Florida, and Arizona are experiencing explosive growth, driven by a confluence of factors. Lower taxes and a pro-business environment are attracting companies and talent, while population growth fuels demand. Affordable housing (relative to other parts of the US) in certain areas further enhances its appeal.

Cities like Austin (renowned for its thriving tech scene), Tampa (booming in logistics and healthcare), and Phoenix (a major hub for technology and manufacturing) are prime examples. Austin’s job growth rate consistently outpaces national averages, while Tampa's port facilitates significant economic activity. Phoenix's expanding tech sector is attracting significant investment.

- Key Industries Thriving in the Sun Belt:

- Technology (software, hardware, AI)

- Healthcare (biotech, pharmaceuticals, medical devices)

- Logistics and distribution

- Renewable energy

Data shows that Texas's GDP growth consistently exceeds the national average, illustrating the strong economic performance of the region.

Canadian Tech Hubs

Canada boasts thriving tech hubs, particularly in Toronto, Vancouver, and Montreal. These cities benefit from strong tech talent pools cultivated by leading universities, substantial government support for innovation (through grants and tax incentives), and easier access to funding compared to some other regions.

Toronto is a global leader in artificial intelligence (AI), while Vancouver excels in video game development and fintech. Montreal is becoming a significant player in AI research and development.

-

Advantages of Canadian Tech Hubs:

- Access to skilled talent

- Government support for innovation

- Strong venture capital ecosystem

-

Disadvantages:

- Higher cost of living in major cities

- Seasonal weather variations in some areas

European Investment Opportunities

Western European Innovation Centers

Germany, the UK, and France remain attractive investment destinations due to their strong economies, skilled workforce, and well-established infrastructure. These countries offer stable political and regulatory environments, making them attractive to long-term investors.

Berlin’s vibrant startup scene, London’s dominance in finance and technology, and Paris's growing presence in renewable energy and fashion exemplify the diverse opportunities in Western Europe.

- Key Industries in Western Europe:

- Renewable energy

- Pharmaceuticals and biotechnology

- Finance and insurance

- Automotive

Emerging Markets in Eastern Europe

Poland and the Czech Republic represent compelling emerging market opportunities within Europe. Lower labor costs compared to Western Europe, coupled with growing economies and access to the EU single market, make them attractive for businesses seeking cost-effective operations and expansion into a large consumer market.

Warsaw, Poland's capital, is a major hub for business and finance, while Prague, the Czech Republic's capital, is known for its strong tech sector and manufacturing base.

-

Opportunities in Eastern Europe:

- Lower labor costs

- Growing consumer markets

- Access to EU markets

-

Challenges in Eastern Europe:

- Potential language barriers

- Navigating regulatory differences

Asia-Pacific Region: Growth and Emerging Markets

Southeast Asia's Rise

Southeast Asian nations like Singapore, Vietnam, and Indonesia are experiencing rapid economic growth, driven by large and burgeoning populations, increasing consumer spending, and government initiatives to attract foreign investment.

Singapore, a global financial center, offers a highly developed infrastructure and stable political environment. Vietnam's manufacturing sector is booming, while Indonesia's vast market presents huge potential.

-

Potential in Southeast Asia:

- Large and growing consumer markets

- Relatively low labor costs

- Government support for foreign investment

-

Risks in Southeast Asia:

- Political stability concerns in some areas

- Infrastructure development challenges in certain regions

Innovation Hubs in East Asia

China (especially specific regions like Shenzhen), South Korea, and Japan remain significant players in the global economy. Technological advancements, strong manufacturing bases, and large domestic markets make them attractive for various industries.

Shenzhen's technological prowess, Seoul's dominance in electronics, and Japan’s advanced manufacturing capabilities illustrate the diverse strengths of East Asia.

-

Strengths of East Asian Markets:

- Technological innovation

- Strong manufacturing capabilities

- Large domestic markets

-

Challenges in East Asia:

- Geopolitical risks

- Navigating complex regulatory environments

Key Factors to Consider When Choosing an Investment Location

Selecting the right location necessitates a comprehensive evaluation of several key factors. Macroeconomic factors such as GDP growth, inflation, and interest rates significantly impact investment returns. The size and potential of the target market are also crucial, along with a thorough understanding of the regulatory environment and ease of doing business. Infrastructure and logistical considerations, including transportation networks and access to resources, are also essential. Finally, understanding the local culture and business practices is critical for successful operations.

- Checklist for Investors:

- Macroeconomic stability

- Market size and potential

- Regulatory environment

- Infrastructure and logistics

- Cultural considerations

- Access to talent

Conclusion

This analysis has highlighted several key investment hotspots across North America, Europe, and the Asia-Pacific region, demonstrating the diverse global opportunities available. Successful geographic investment hinges on a nuanced understanding of macroeconomic conditions, market size, regulatory frameworks, infrastructure, and cultural contexts. Remember to conduct thorough due diligence and consider consulting with financial advisors to tailor your strategy to your specific investment goals. Start your geographic investment analysis today! Learn more about profitable locations for your next investment and unlock the potential of strategic global positioning.

Featured Posts

-

Polish Woman And Acquaintance Deny Targeting Mc Cann Family Home

May 09, 2025

Polish Woman And Acquaintance Deny Targeting Mc Cann Family Home

May 09, 2025 -

The Life And Times Of Samuel Dickson A Canadian Industrialist

May 09, 2025

The Life And Times Of Samuel Dickson A Canadian Industrialist

May 09, 2025 -

R5

May 09, 2025

R5

May 09, 2025 -

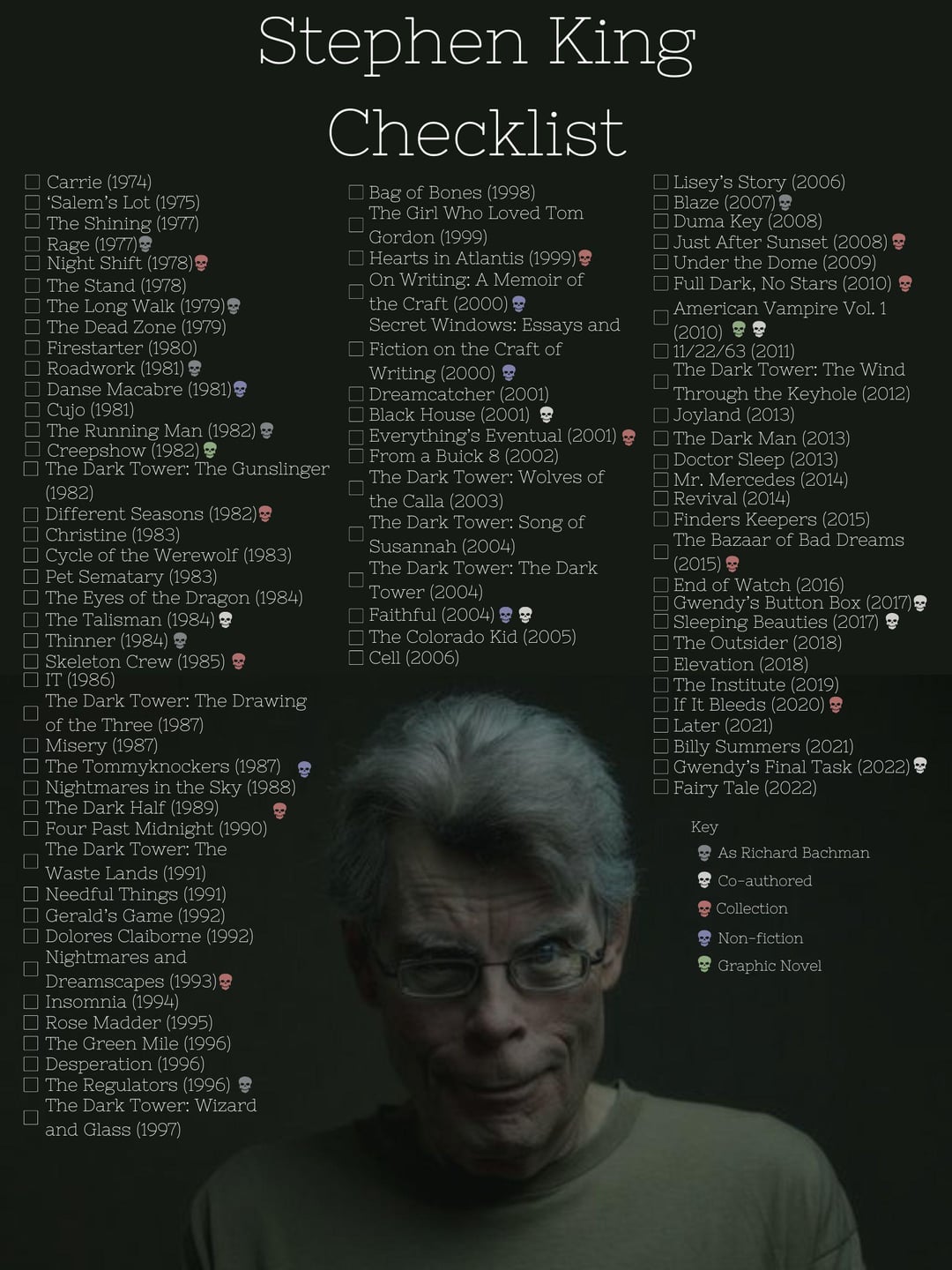

Short Sweet And Scary A Stephen King Series Perfect For A Quick Binge

May 09, 2025

Short Sweet And Scary A Stephen King Series Perfect For A Quick Binge

May 09, 2025 -

Sensex And Nifty Rally Understanding The 1 400 And 23 800 Point Surge

May 09, 2025

Sensex And Nifty Rally Understanding The 1 400 And 23 800 Point Surge

May 09, 2025