Where Will Apple Stock (AAPL) Go Next? Key Price Level Projections

Table of Contents

Apple stock (AAPL) has consistently been a dominant force in the tech market and a favored investment for many. Its innovative products and strong brand loyalty have fueled impressive growth over the years. But the question on every investor's mind is: where is AAPL headed next? This article delves into key price level projections for Apple stock, examining crucial factors that could shape its future trajectory. We'll analyze current market conditions, identify key support and resistance levels, review expert opinions, and discuss inherent risks to provide a comprehensive outlook on AAPL's potential price movements.

Analyzing Current Market Conditions and AAPL's Performance

Understanding Apple's current performance is crucial for projecting its future. Recent earnings reports provide valuable insights into the company's financial health and its impact on investor sentiment. For example, a strong earnings beat could push the stock price higher, while disappointing results could lead to a decline. Analyzing these reports alongside significant news events – such as new product launches (like the latest iPhone or Apple Watch models), software updates, or supply chain disruptions – paints a clearer picture.

Macroeconomic factors also play a significant role. Interest rate hikes, inflation rates, and overall economic growth all impact consumer spending – a key driver of Apple's sales. A strong economy generally benefits AAPL, while economic downturns can lead to decreased consumer demand.

- Review of Q[Quarter] earnings – key takeaways and market reaction: [Insert analysis of the most recent Apple earnings report, including key performance indicators like revenue, earnings per share, and guidance. Mention the market's reaction to the report – did the stock price rise or fall? Why?]

- Impact of the latest iPhone/Mac/other product release on investor sentiment: [Discuss the latest product launch and its reception. Did it boost investor confidence? Analyze pre-orders, initial sales figures, and any related news coverage.]

- Assessment of global economic conditions and their effect on consumer spending (Apple's target market): [Analyze current economic conditions globally and their potential impact on consumer electronics spending. Consider factors such as inflation and recessionary fears.]

- Comparison of AAPL's performance against competitors (e.g., Microsoft, Google): [Compare Apple's performance to its main competitors in the tech sector. How does AAPL stack up in terms of market share, revenue growth, and innovation?]

Identifying Key Support and Resistance Levels for AAPL

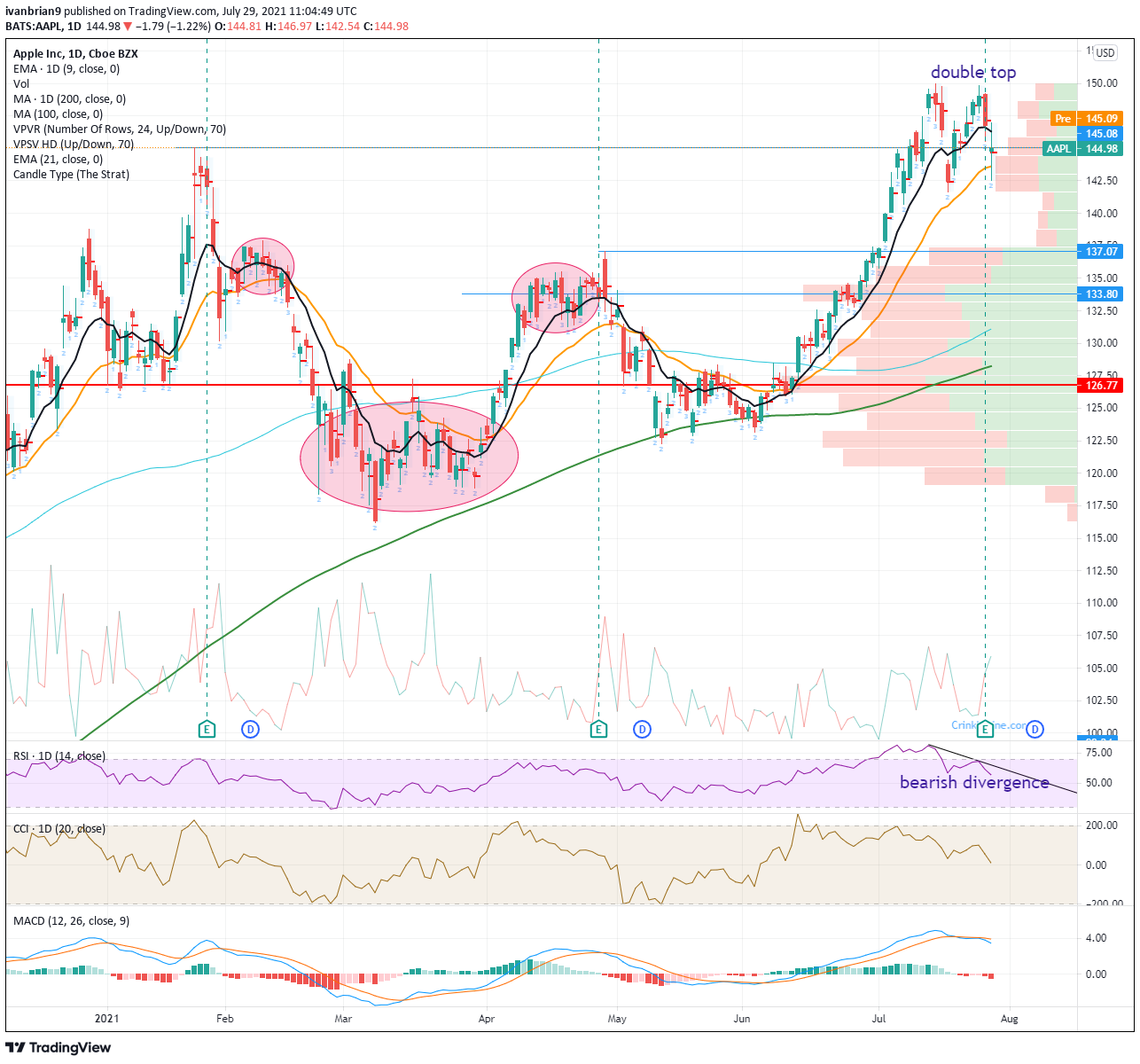

Technical analysis uses support and resistance levels to predict future price movements. Support levels represent price points where buying pressure is strong enough to prevent further declines, while resistance levels indicate price points where selling pressure is strong enough to prevent further advances. Identifying these levels for AAPL can help us project potential price ranges.

By analyzing historical price data, we can pinpoint significant support and resistance levels. These levels are often based on previous price highs and lows, and they can provide valuable insights into potential price reversals or breakouts.

- Historical price data analysis to identify significant support levels: [Use charts and graphs to visually represent historical support levels. For example, a significant support level might be a price point where the stock has bounced back multiple times in the past.]

- Identification of potential resistance levels based on previous price highs: [Similarly, visually represent resistance levels using charts and graphs. A major resistance level might be a previous all-time high that the stock has struggled to surpass.]

- Discussion of potential breakout scenarios from these levels: [Discuss what might happen if the price breaks above a resistance level or falls below a support level. What are the implications for the stock price?]

- Integration of moving averages (e.g., 50-day, 200-day) to support analysis: [Explain how moving averages can help confirm support and resistance levels. These are commonly used technical indicators that smooth out price fluctuations and provide a clearer picture of the trend.]

Expert Opinions and Price Target Predictions for Apple Stock

Many reputable financial analysts offer price target predictions for AAPL. These predictions represent their estimations of where the stock price might be at a specific point in the future. By analyzing these predictions, we can gain a better understanding of the overall market sentiment towards Apple stock. It's important to note that these are just predictions and not guarantees.

- Overview of price targets from leading financial institutions (e.g., Goldman Sachs, Morgan Stanley): [Summarize the price targets provided by leading financial institutions, including the timeframe for their predictions.]

- Summarize the bullish and bearish arguments presented by analysts: [Highlight the reasons analysts are bullish (expecting higher prices) or bearish (expecting lower prices) on AAPL. What are the key factors driving their opinions?]

- Discussion of the potential impact of upcoming events on price targets: [Discuss how upcoming events like product launches, earnings reports, or macroeconomic changes could affect analyst price targets.]

- Consideration of differing investment strategies (long-term vs. short-term): [Analysts' price targets often reflect different investment horizons. Short-term targets might focus on near-term price fluctuations, while long-term targets consider the company's overall growth potential.]

Risks and Uncertainties Associated with AAPL Price Projections

It's crucial to acknowledge that stock price predictions are inherently uncertain. Many unforeseen factors could impact Apple's stock price, making accurate projections difficult. Geopolitical events, increased competition, supply chain disruptions, and changes in consumer sentiment all pose potential risks. Diversification is crucial for managing these risks.

- Potential impact of geopolitical events on AAPL: [Discuss how global events, such as trade wars or political instability, could affect Apple's business and stock price.]

- Risks associated with increased competition in the tech sector: [Analyze the competitive landscape and the potential threat from competitors like Samsung, Google, and others.]

- Potential impact of supply chain disruptions: [Discuss the risks associated with disruptions to Apple's supply chain, which could impact production and sales.]

- Disclaimer: Stock market investment involves risk, and past performance does not guarantee future results.

Conclusion

This article has explored various factors influencing the potential future price movements of Apple stock (AAPL). From analyzing current market conditions and identifying key support and resistance levels to examining expert predictions and acknowledging inherent risks, we've attempted to provide a comprehensive overview. Remember that these are projections, not guarantees. The stock market is dynamic and unpredictable.

Call to Action: Stay informed about the latest developments impacting Apple stock (AAPL) and continue your research to make well-informed investment decisions. Monitor key price levels and expert opinions to better navigate the complexities of the stock market. Further research on AAPL and its competitive landscape is recommended before making any investment choices. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Farrows Plea Prosecute Trump For Deportations Of Venezuelan Gang Members

May 25, 2025

Farrows Plea Prosecute Trump For Deportations Of Venezuelan Gang Members

May 25, 2025 -

F1 Talli Ferrari Solmi Sopimuksen 13 Vuotiaan Kanssa Tutustu Nuoren Kuljettajan Uraan

May 25, 2025

F1 Talli Ferrari Solmi Sopimuksen 13 Vuotiaan Kanssa Tutustu Nuoren Kuljettajan Uraan

May 25, 2025 -

Finding Peace Amidst The Pandemic A Seattle Womans Connection To Nature

May 25, 2025

Finding Peace Amidst The Pandemic A Seattle Womans Connection To Nature

May 25, 2025 -

Escape To The Country Budget Friendly Dream Homes Under 1m

May 25, 2025

Escape To The Country Budget Friendly Dream Homes Under 1m

May 25, 2025 -

Glastonbury 2025 Headliner Announcement A Controversial Lineup

May 25, 2025

Glastonbury 2025 Headliner Announcement A Controversial Lineup

May 25, 2025

Latest Posts

-

Recent Developments Elon Musk And His Dogecoin Position

May 25, 2025

Recent Developments Elon Musk And His Dogecoin Position

May 25, 2025 -

The Elon Musk Dogecoin Effect A Reality Check

May 25, 2025

The Elon Musk Dogecoin Effect A Reality Check

May 25, 2025 -

Dogecoin Price And Elon Musks Influence A Current Analysis

May 25, 2025

Dogecoin Price And Elon Musks Influence A Current Analysis

May 25, 2025 -

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025

Is Elon Musk Abandoning Dogecoin A Deep Dive

May 25, 2025 -

The Truth About Elon Musk And His Dogecoin Investments

May 25, 2025

The Truth About Elon Musk And His Dogecoin Investments

May 25, 2025