Which Cryptocurrency Will Weather The Trade War Storm?

Table of Contents

Decentralization as a Protective Factor

Decentralized cryptocurrencies offer a unique advantage in times of economic turmoil. Their inherent structure makes them less susceptible to the whims of geopolitical events and trade restrictions impacting traditional fiat currencies.

Reduced Vulnerability to Geopolitical Events

- Censorship Resistance: Decentralized networks are inherently resistant to censorship. Unlike traditional banking systems, which can be influenced or even controlled by governments, cryptocurrencies operate on a peer-to-peer basis, making them difficult to regulate or shut down, even during trade wars involving sanctions. This resistance to control is a major strength.

- Maintaining Value During Instability: The decentralized nature of many cryptocurrencies ensures that their value isn't solely tied to the fortunes of a single nation or economy. Even if a country's currency weakens due to trade disputes, a decentralized cryptocurrency can maintain relative stability due to its global network of users and miners.

- Examples of Decentralized Cryptocurrencies: Bitcoin (BTC) stands as a prime example of a highly decentralized cryptocurrency, making it a potential safe haven asset during geopolitical uncertainty. Other strong contenders include Litecoin (LTC) and Bitcoin Cash (BCH).

Portfolio Diversification Strategy

Including decentralized cryptocurrencies in a diversified investment portfolio can act as a hedge against traditional market downturns often triggered by trade wars.

- Reducing Overall Portfolio Risk: Cryptocurrencies frequently exhibit a low or even negative correlation with traditional assets. This means that when stock markets fall due to trade tensions, cryptocurrencies may not necessarily follow suit, offering a way to mitigate overall portfolio risk.

- Correlation During Trade Disputes: Historical data shows periods where cryptocurrency markets have moved independently of traditional markets during trade disputes. This lack of correlation provides diversification benefits for investors.

Adoption and Utility as Indicators of Resilience

The widespread adoption of a cryptocurrency and its real-world utility are strong indicators of its ability to withstand economic shocks.

Widespread Adoption Mitigates Risk

- Payment Systems and Decentralized Applications (dApps): Cryptocurrencies with established payment systems and a thriving ecosystem of decentralized applications (dApps) are less likely to suffer dramatic price drops during periods of uncertainty. Real-world utility increases demand and strengthens resilience.

- Examples of Widely Adopted Cryptocurrencies: Ethereum (ETH), with its robust smart contract platform and growing DeFi (Decentralized Finance) ecosystem, is a key example. Stablecoins, pegged to fiat currencies like the US dollar, also see increased demand during times of market volatility.

- Regulatory Clarity's Impact: Clear regulatory frameworks can encourage adoption, while uncertainty tends to have the opposite effect. Cryptocurrencies operating in jurisdictions with supportive regulations generally enjoy stronger adoption rates.

Technological Advancements and Scalability

Cryptocurrencies with advanced technology and high scalability offer a more robust and efficient system, attracting users and investors during uncertain times.

- Transaction Speeds and Fees: Improved transaction speeds and lower fees enhance user experience, increasing the attractiveness of a cryptocurrency. This is particularly important during times of high demand.

- Layer-2 Scaling Solutions: Technologies like Lightning Network (for Bitcoin) and Plasma (for Ethereum) alleviate scalability issues, allowing for faster and cheaper transactions, thereby bolstering the network's resilience.

- Innovative Technology Examples: Solana (SOL) and Cardano (ADA) are examples of cryptocurrencies employing innovative technology to improve scalability and transaction throughput, contributing to their overall resilience.

Specific Cryptocurrency Analysis

Bitcoin's Position in the Trade War

Bitcoin's decentralized nature, established network effect, and history of surviving previous economic downturns position it as a potential safe haven asset during trade wars. Its scarcity and limited supply also contribute to its perceived value during times of uncertainty.

Ethereum's Potential for Growth

Ethereum's growing DeFi ecosystem and the increasing adoption of its smart contract platform make it a strong contender. The ongoing development and upgrades to improve scalability increase its long-term potential, even amidst trade war anxieties.

Stablecoins as a Safe Haven

Stablecoins, designed to maintain a stable price relative to a fiat currency, provide a haven during market volatility. They offer a way for investors to preserve capital while navigating the fluctuations of other cryptocurrencies.

Conclusion

The ability of a cryptocurrency to withstand the impact of trade wars hinges on several key factors: decentralization, widespread adoption, real-world utility, and technological advancements. Our analysis suggests that cryptocurrencies like Bitcoin and Ethereum, with their strong decentralization and established ecosystems, are relatively well-positioned. Stablecoins offer a different type of resilience, providing stability during market downturns. However, it's crucial to remember that no cryptocurrency is entirely immune to market fluctuations. Further research into the specific attributes of different cryptocurrencies is crucial before making any investment choices. Continue your research on which cryptocurrency will best navigate the complexities of the global trade environment to make informed decisions that align with your risk tolerance and investment goals.

Featured Posts

-

Nyt Strands Today April 4 2025 Clues Hints And Pangram Solutions

May 09, 2025

Nyt Strands Today April 4 2025 Clues Hints And Pangram Solutions

May 09, 2025 -

Oilers Vs Kings Prediction Game 1 Nhl Playoffs Picks And Odds

May 09, 2025

Oilers Vs Kings Prediction Game 1 Nhl Playoffs Picks And Odds

May 09, 2025 -

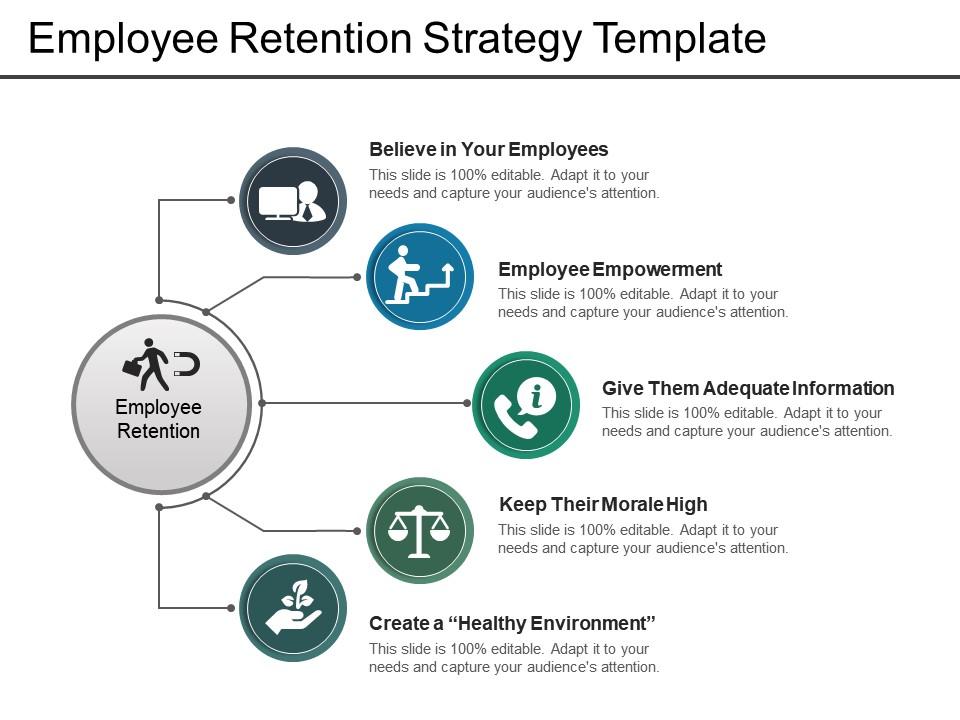

Investing In Middle Management A Strategy For Business Growth And Employee Retention

May 09, 2025

Investing In Middle Management A Strategy For Business Growth And Employee Retention

May 09, 2025 -

Gde Smotret Polufinaly I Final Ligi Chempionov 2024 2025 Prognozy I Statistika

May 09, 2025

Gde Smotret Polufinaly I Final Ligi Chempionov 2024 2025 Prognozy I Statistika

May 09, 2025 -

Ivan Barbashevs Ot Goal Wins Game 4 For Vegas Golden Knights

May 09, 2025

Ivan Barbashevs Ot Goal Wins Game 4 For Vegas Golden Knights

May 09, 2025

Latest Posts

-

Dakota Johnson Plinta Kraujingos Nuotraukos Visa Tiesa

May 10, 2025

Dakota Johnson Plinta Kraujingos Nuotraukos Visa Tiesa

May 10, 2025 -

Kraujingos Plintos Nuotraukos Dakota Johnson Ir Skandalas

May 10, 2025

Kraujingos Plintos Nuotraukos Dakota Johnson Ir Skandalas

May 10, 2025 -

Kas Nutiko Dakota Johnson Kraujingos Plintos Nuotraukos Ir Paaiskinimai

May 10, 2025

Kas Nutiko Dakota Johnson Kraujingos Plintos Nuotraukos Ir Paaiskinimai

May 10, 2025 -

Dakota Johnson Ir Kraujingos Plintos Nuotraukos Paaiskinimas

May 10, 2025

Dakota Johnson Ir Kraujingos Plintos Nuotraukos Paaiskinimas

May 10, 2025 -

Dakota Johnson And Family At Materialist La Screening

May 10, 2025

Dakota Johnson And Family At Materialist La Screening

May 10, 2025