Whistleblowers To Share $150 Million In Credit Suisse Settlement

Table of Contents

The Credit Suisse Settlement Details

The settlement resolves allegations of Credit Suisse's involvement in facilitating tax evasion, securities fraud, and other financial crimes. While specific details surrounding the exact nature of the misconduct remain partially confidential to protect the whistleblowers' identities, the DOJ's announcement confirms that the whistleblowers provided substantial evidence of systemic failures within Credit Suisse's compliance programs. The investigation, spanning several years, likely involved a thorough review of internal documents, client communications, and potentially wiretaps. While precise case numbers may not be publicly available due to the sensitive nature of the investigation, the settlement demonstrates the seriousness of the alleged misconduct.

- The size of the fine levied against Credit Suisse: The settlement includes a substantial financial penalty imposed on Credit Suisse, although the exact amount may not be fully disclosed to the public. This penalty acts as a significant deterrent against future misconduct.

- The specific allegations the whistleblowers exposed: The whistleblowers reportedly provided evidence related to the bank's facilitation of tax evasion schemes and potential securities fraud, among other allegations. This involved revealing internal knowledge of non-compliance with regulations and potential fraudulent activities.

- The DOJ’s statement regarding the settlement and the role of the whistleblowers: The DOJ praised the whistleblowers for their courage and crucial role in bringing Credit Suisse's misconduct to light, emphasizing the importance of whistleblowing in upholding the integrity of the financial system. The statement strongly suggests that the evidence provided by the whistleblowers was instrumental in securing the settlement.

- Mention any related civil lawsuits or investigations: It is likely that the Credit Suisse settlement is linked to, or stemmed from, prior civil lawsuits or regulatory investigations, although specifics are often kept confidential to maintain the integrity of ongoing or related investigations.

The Significance of the Whistleblower Reward

This $150 million reward is exceptionally significant. It represents one of the largest whistleblower payouts in history, dwarfing many previous awards in the financial sector. This substantial sum underscores the DOJ's commitment to incentivizing individuals to report financial crimes.

- The impact on future whistleblower cases: The enormous payout will likely encourage more individuals with knowledge of corporate misconduct to come forward. The increased potential reward significantly outweighs the risks associated with whistleblowing.

- Discussion on the effectiveness of the whistleblower program in uncovering financial crimes: The Credit Suisse settlement serves as a powerful testament to the effectiveness of whistleblower programs in uncovering complex financial crimes. The substantial reward proves that these programs are viable tools for uncovering corporate wrongdoing.

- Comparison to similar settlements and rewards: Compared to previous whistleblower rewards, particularly those concerning financial fraud, the $150 million payout stands out as exceptionally high, setting a new precedent and raising the stakes for corporate accountability.

- The role of the False Claims Act (FCA) or other relevant legislation in facilitating the settlement and reward: The False Claims Act likely played a key role in this settlement, providing the legal framework for whistleblowers to report fraud against the government and receive a portion of the recovered funds.

Implications for Corporate Governance and Compliance

The Credit Suisse settlement sends a strong message to financial institutions globally. It underscores the need for robust corporate governance and rigorous compliance programs.

- Increased scrutiny of financial institutions: Financial institutions will face heightened scrutiny from regulators and investors in the wake of this settlement. Increased audits and stricter compliance measures are likely to follow.

- The potential for increased investment in compliance programs to prevent similar issues: To mitigate future legal and financial risks, financial institutions will likely invest heavily in strengthening their compliance programs and internal controls.

- The impact on corporate culture and ethics: The settlement highlights the crucial role of fostering a strong ethical culture within financial organizations. Companies must prioritize transparency and accountability to avoid similar situations.

- Potential changes in regulatory oversight in response to the settlement: Regulatory bodies may introduce stricter regulations and enhance oversight of financial institutions to prevent similar instances of misconduct in the future.

Protecting Whistleblower Identities

Protecting the identities of whistleblowers is paramount. The DOJ and other agencies employ stringent measures to ensure their anonymity and safety, often working closely with legal counsel and utilizing confidential reporting channels. Laws like the False Claims Act include provisions to protect whistleblower identities and shield them from retaliation. This protection is vital to encouraging future whistleblowers to come forward without fear of reprisal.

Conclusion

The massive $150 million Credit Suisse settlement marks a pivotal moment for whistleblower protections and corporate accountability. This substantial reward, stemming from the exposure of significant financial fraud, underscores the vital role whistleblowers play in maintaining the integrity of the financial system. The Credit Suisse settlement and its significant whistleblower reward serve as a powerful incentive for individuals with knowledge of potential wrongdoing within financial institutions to come forward. If you have information about potential fraud, particularly concerning financial institutions like Credit Suisse, seek legal counsel to understand your rights and the process for reporting potential misconduct. Don't hesitate; the potential rewards for exposing financial fraud are substantial. Become a whistleblower and help uncover illegal activities.

Featured Posts

-

Despite A Possible The Monkey Flop 2025 Looks Good For Stephen King Adaptations

May 09, 2025

Despite A Possible The Monkey Flop 2025 Looks Good For Stephen King Adaptations

May 09, 2025 -

8 Cagr Projected For Wireless Mesh Networks Market Size

May 09, 2025

8 Cagr Projected For Wireless Mesh Networks Market Size

May 09, 2025 -

Arctic Comic Con 2025 A Photo Recap Featuring Characters Connections And The Ectomobile

May 09, 2025

Arctic Comic Con 2025 A Photo Recap Featuring Characters Connections And The Ectomobile

May 09, 2025 -

Fydyw Alshmrany Yuelq Ela Klam Jysws Bshan Antqalh Lflamnghw

May 09, 2025

Fydyw Alshmrany Yuelq Ela Klam Jysws Bshan Antqalh Lflamnghw

May 09, 2025 -

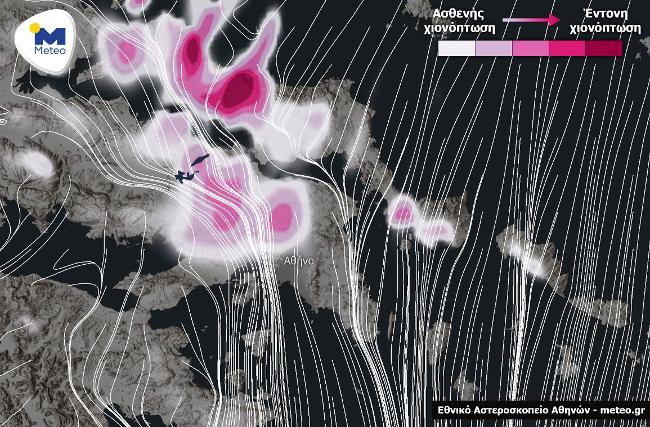

Imalaia I Krisimi Meiosi Ton Xionoptoseon

May 09, 2025

Imalaia I Krisimi Meiosi Ton Xionoptoseon

May 09, 2025