Why 10-Year Mortgages Aren't Popular In Canada

Table of Contents

While common in other countries, 10-year mortgages remain a niche product in the Canadian housing market. In fact, the vast majority of Canadian homeowners opt for shorter-term mortgages, typically five-year terms. A 10-year mortgage in Canada is a mortgage contract with a fixed interest rate and repayment schedule spanning ten years. Unlike shorter-term options like 5-year or 25-year mortgages, it locks in your interest rate for a significantly longer period. Despite the potential benefits of long-term stability, several factors contribute to the low popularity of 10-year mortgages in Canada.

<h2>Higher Initial Interest Rates and Potential for Rate Increases</h2>

One of the primary reasons for the limited adoption of 10-year mortgages is the higher initial interest rate. Lenders typically charge a premium for the extended commitment, reflecting the increased risk associated with long-term lending. This higher initial rate translates to significantly larger monthly payments compared to shorter-term mortgages.

Furthermore, the risk of interest rate increases over the 10-year period is substantial. While a fixed-rate mortgage protects against short-term fluctuations, unforeseen economic events could lead to significant changes over such a long timeframe. This uncertainty about future interest rate fluctuations makes long-term affordability difficult to predict.

- Increased monthly payments compared to shorter-term mortgages can strain household budgets.

- Uncertainty about future interest rate fluctuations introduces a significant element of risk.

- Difficulty in predicting long-term affordability makes financial planning challenging.

<h2>Limited Flexibility and Prepayment Penalties</h2>

Unlike shorter-term mortgages, 10-year mortgages offer limited flexibility. Life circumstances change, and homeowners may need to sell their property or refinance before the 10-year term concludes. Breaking a 10-year mortgage early comes with significant prepayment penalties. These penalties can be substantial, often including interest rate differentials and administrative fees. The type of penalty often depends on the specific mortgage contract and lender.

- Challenges in selling the property or refinancing before the term ends can create significant financial hurdles.

- High cost of breaking the mortgage early due to substantial penalties makes early termination a financially unattractive option.

- Restrictions on additional principal payments limit the ability to accelerate mortgage payoff and save on interest.

<h2>Canadian Homeowner Preferences and Market Dynamics</h2>

Canadian homeowners generally exhibit a preference for shorter-term mortgages. This cultural preference reflects a desire for flexibility and the ability to renegotiate interest rates every few years, taking advantage of potential market changes. The Canadian mortgage market structure further reinforces this trend. The abundance of attractive 5-year mortgage options with competitive interest rates makes shorter-term mortgages a more appealing choice for most borrowers. Lenders' product offerings and marketing strategies also heavily emphasize these shorter-term options.

- Preference for shorter-term financial commitments reflects a risk-averse approach to mortgage financing.

- Abundance of 5-year mortgage options with competitive rates makes them the dominant choice in the market.

- Influence of lenders' product offerings and marketing strategies further reinforces the prevalence of shorter-term mortgages.

<h3>The Psychological Factor: Risk Aversion and Uncertainty</h3>

Committing to a 10-year mortgage involves a significant psychological hurdle for many Canadian homeowners. The long-term commitment introduces considerable uncertainty about future financial circumstances. This uncertainty, coupled with risk aversion, plays a significant role in homeowner decisions. Many prefer the certainty and predictability of shorter-term mortgages, even if it means potentially missing out on potentially lower long-term interest rates.

- Preference for certainty and predictability in financial planning drives the choice for shorter-term mortgages.

- Fear of unforeseen circumstances affecting long-term affordability influences mortgage term selection.

- Emotional aversion to long-term financial commitments plays a significant role in decision-making.

<h2>Conclusion: Understanding the Canadian Mortgage Landscape and Choosing the Right Term</h2>

In summary, the unpopularity of 10-year mortgages in Canada stems from a combination of factors: higher initial interest rates and the risk of rate increases, limited flexibility and substantial prepayment penalties, prevailing homeowner preferences for shorter-term options, and the psychological impact of long-term financial commitment. Before committing to a mortgage, carefully consider your individual circumstances. A 10-year mortgage might not be the norm, but it could be the right fit for some. Speak with a mortgage broker today to explore all your options, including whether a 10-year mortgage might be the right fit for you.

Featured Posts

-

Louisiana Derby 2025 Your Guide To Odds Contenders And Kentucky Derby Picks

May 04, 2025

Louisiana Derby 2025 Your Guide To Odds Contenders And Kentucky Derby Picks

May 04, 2025 -

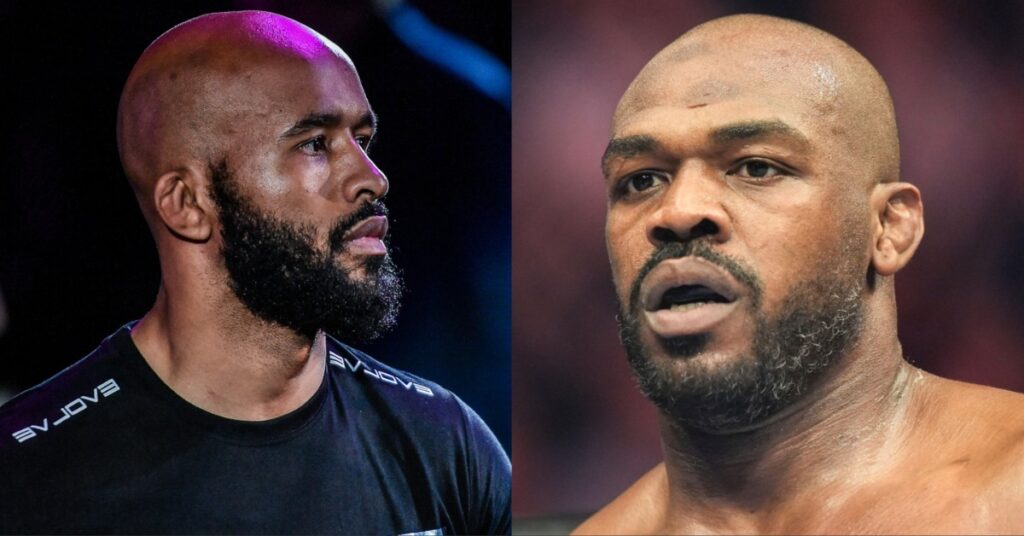

Your Guide To Ufc Des Moines Fight Predictions And Betting Tips

May 04, 2025

Your Guide To Ufc Des Moines Fight Predictions And Betting Tips

May 04, 2025 -

Hate Crime Attack Man Receives 53 Year Prison Sentence

May 04, 2025

Hate Crime Attack Man Receives 53 Year Prison Sentence

May 04, 2025 -

Even Marvel Knows Its Movies And Shows Need Improvement

May 04, 2025

Even Marvel Knows Its Movies And Shows Need Improvement

May 04, 2025 -

Charles Barkley Predicts Oilers And Leafs Playoff Success

May 04, 2025

Charles Barkley Predicts Oilers And Leafs Playoff Success

May 04, 2025