Why Analysts Are Concerned About The Sustainability Of Strong Corporate Earnings

Table of Contents

The Inflationary Squeeze and its Impact on Corporate Profitability

The current inflationary environment is arguably the biggest threat to the sustainability of strong corporate earnings. Rising prices across the board are squeezing profit margins and forcing companies to make difficult choices.

Rising Input Costs

Increasing raw material prices, energy costs, and transportation expenses are significantly eating into corporate profits. This is particularly acute in industries heavily reliant on these inputs.

- Manufacturing: The cost of steel, plastics, and other raw materials has skyrocketed, impacting manufacturers' ability to maintain profit margins.

- Energy: Soaring energy prices are impacting both production costs and consumer demand, leading to reduced profitability in energy-intensive industries.

- Data: The US inflation rate hit a 40-year high in early 2023, with significant increases in energy and food prices. This translates directly to higher input costs for businesses.

Companies are attempting to offset these increased costs by raising prices for consumers, but this strategy isn't always successful. Consumers may reduce spending in response, leading to further challenges.

Wage Inflation and Labor Shortages

Wage inflation, driven by a tight labor market and increased demand for workers, is another significant pressure on corporate profitability. Many sectors are facing labor shortages, forcing them to offer higher wages to attract and retain talent.

- Statistics: Wage growth has outpaced inflation in several sectors, increasing labor costs for businesses.

- Talent Acquisition: Competition for skilled workers is fierce, requiring companies to offer competitive salaries and benefits packages, impacting earnings.

- Productivity: While higher wages can boost productivity in some cases, the impact on overall profitability remains a key concern for analysts.

The interplay between rising wages and productivity is a critical factor in determining the sustainability of earnings.

Consumer Spending Slowdown

A potential slowdown in consumer spending represents a significant threat to corporate revenue. As inflation erodes purchasing power and economic uncertainty grows, consumers may reduce their spending, particularly on discretionary items.

- Shifting Behavior: Consumers are increasingly prioritizing essential goods over non-essential purchases.

- Decreased Demand: Reduced consumer demand translates directly into lower sales and reduced revenue for businesses.

- Sectoral Impact: Sectors reliant on discretionary spending (e.g., retail, hospitality, entertainment) are particularly vulnerable to a consumer spending slowdown, while sectors focused on essential goods (e.g., groceries, utilities) may be more resilient.

Supply Chain Disruptions and Their Lingering Effects

Persistent supply chain disruptions continue to hamper corporate performance and add uncertainty to future earnings forecasts.

Ongoing Bottlenecks and Delays

Global supply chains remain strained, plagued by port congestion, transportation issues, and raw material shortages. These bottlenecks lead to production delays, increased costs, and reduced availability of goods.

- Automotive Industry: The automotive industry has been particularly hard-hit by semiconductor chip shortages, leading to production cuts and impacting earnings.

- Technology Sector: The tech sector faces challenges in sourcing components and managing logistics, impacting product launches and revenue streams.

- Statistics: Lead times for many goods have increased significantly, impacting inventory levels and increasing costs.

Geopolitical factors add further complexity and uncertainty to these already strained supply chains.

Geopolitical Instability and its Role

Geopolitical instability, including trade wars and international conflicts, creates significant uncertainty and further disrupts supply chains. These events can lead to unexpected disruptions, making it difficult for companies to forecast and plan effectively.

- Trade Wars: Trade disputes can lead to tariffs and other trade restrictions, increasing costs and disrupting supply routes.

- International Conflicts: Geopolitical conflicts can disrupt transportation routes, impact access to raw materials, and create uncertainty about future supplies.

- Forecasting Challenges: The unpredictable nature of geopolitical events makes it extremely difficult for businesses to accurately forecast future supply chain performance and their impact on earnings.

The Looming Threat of a Recession

The risk of a recession looms large, posing a significant threat to the sustainability of strong corporate earnings. Several key economic indicators suggest a potential slowdown.

Economic Slowdown Indicators

Several key indicators point towards a potential recession:

- GDP Growth: Slowing GDP growth signals a weakening economy, reducing overall consumer and business spending.

- Inflation Rates: Persistently high inflation erodes purchasing power and can lead to a contraction in economic activity.

- Interest Rates: Rising interest rates increase borrowing costs for businesses and consumers, potentially dampening economic growth.

- Unemployment Figures: Rising unemployment can further reduce consumer spending and overall economic activity.

- Forecasts: Leading economic institutions are increasingly expressing concerns about the risk of a recession.

Impact on Consumer and Business Confidence

A recessionary environment would negatively affect both consumer and business confidence, leading to reduced spending and investment.

- Reduced Consumer Spending: Economic uncertainty and potential job losses can lead to a significant decrease in consumer spending.

- Decreased Business Investment: Businesses may postpone or cancel capital expenditures in anticipation of a downturn.

- Job Security: Concerns about job security can lead to reduced consumer confidence and spending.

Conclusion

The sustainability of strong corporate earnings faces significant headwinds. Persistent inflation is squeezing profit margins, supply chain disruptions are adding costs and complexity, and the looming threat of a recession adds a further layer of uncertainty. These factors collectively pose a serious challenge to the long-term profitability of many companies. To make informed investment decisions, it’s crucial to stay abreast of economic developments and carefully analyze the financial health of companies, considering the impacts of inflation, supply chain resilience, and the broader economic outlook. Understanding the factors that influence earnings sustainability is paramount when evaluating strong corporate earnings. Further research into earnings sustainability and analyst concerns will prove beneficial for making sound financial judgments.

Featured Posts

-

Izrail Mada Prognoziruet Ekstremalnye Pogodnye Usloviya Zhara Kholod I Shtorm

May 30, 2025

Izrail Mada Prognoziruet Ekstremalnye Pogodnye Usloviya Zhara Kholod I Shtorm

May 30, 2025 -

Ditte Okman Udstiller Kare Quist En Analyse Af Han Taler Udenom

May 30, 2025

Ditte Okman Udstiller Kare Quist En Analyse Af Han Taler Udenom

May 30, 2025 -

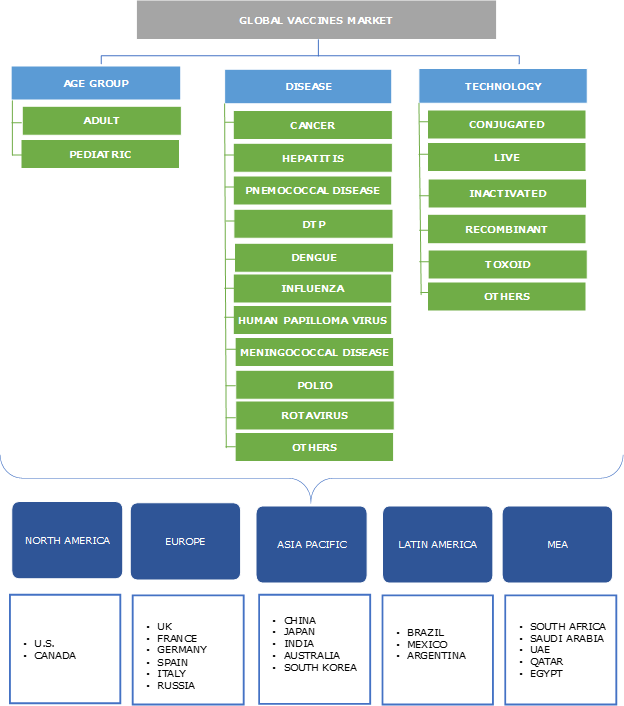

Understanding The Dynamics Of The Booming Vaccine Packaging Market

May 30, 2025

Understanding The Dynamics Of The Booming Vaccine Packaging Market

May 30, 2025 -

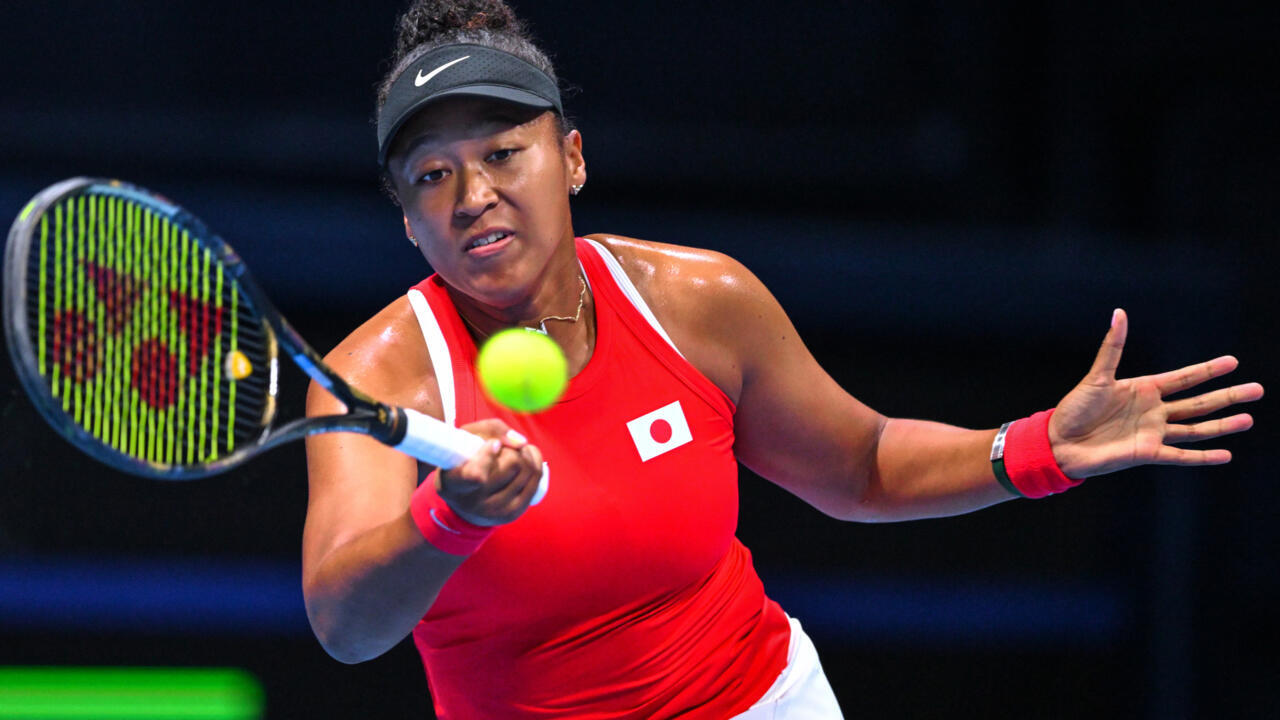

Mstqbl Awstabynkw Alwaed Ela Almlaeb Altrabyt

May 30, 2025

Mstqbl Awstabynkw Alwaed Ela Almlaeb Altrabyt

May 30, 2025 -

Programma Tileoptikon Metadoseon Kyriakis 11 5

May 30, 2025

Programma Tileoptikon Metadoseon Kyriakis 11 5

May 30, 2025