Why Current Stock Market Valuations Shouldn't Deter Investors: BofA Analysis

Table of Contents

BofA's Key Arguments Against Market Overvaluation

BofA's analysis counters the narrative of an overvalued market by highlighting several crucial factors. Their perspective suggests that current stock market valuations, while high compared to historical averages, are justified by underlying economic strength and future growth potential.

Strong Corporate Earnings Growth

BofA highlights the continued strength of corporate earnings as a major counterpoint to high valuations. Many sectors are experiencing robust growth, defying predictions of a significant slowdown.

- Technology: The technology sector continues to drive significant earnings growth, fueled by innovation in areas like artificial intelligence, cloud computing, and cybersecurity. Companies in this sector consistently exceed expectations, supporting higher valuations.

- Healthcare: The healthcare industry, driven by aging populations and advancements in medical technology, shows strong and consistent earnings growth, bolstering overall market performance.

- Financials: While interest rate sensitivity is a factor, the financial sector is benefiting from increased lending activity in certain segments, leading to positive earnings contributions.

The relationship between earnings growth and Price-to-Earnings (P/E) ratios is crucial. While P/E ratios may seem high, they are often justified by the robust earnings growth projected for many companies, suggesting future value appreciation. This means that while the current price may seem high relative to current earnings, the expectation is for earnings to grow, making the current price more reasonable over the long term.

Low Interest Rates and Monetary Policy

The impact of low interest rates and accommodative monetary policy remains a significant factor supporting stock market valuations. These policies influence both corporate behavior and investor sentiment.

- Cost of Capital: Low interest rates reduce the cost of capital for companies, allowing them to invest more, expand operations, and ultimately boost earnings. This increased investment fuels growth and helps justify higher valuations.

- Monetary Stimulus: The potential for further monetary stimulus, particularly if economic growth slows, could provide additional support for stock prices, counteracting any downward pressure from valuation concerns.

- Inflation's Impact: Low inflation (or even deflation in some areas) allows central banks to maintain low interest rates for longer periods. This sustained low-interest-rate environment enhances the attractiveness of equities compared to fixed-income investments.

Long-Term Growth Potential

BofA emphasizes the long-term growth prospects of the global economy as a key justification for current stock market valuations. The belief is that the current valuations are reflective of expectations of sustained, long-term growth.

- GDP Growth Projections: Many economists project continued, albeit moderate, GDP growth in major economies, suggesting sustained corporate earnings growth and therefore justifying higher valuations.

- Emerging Technologies: Emerging technologies like artificial intelligence, biotechnology, and renewable energy hold immense potential to drive future economic expansion and corporate profitability. Investments in these areas are fueling expectations of future growth.

- Global Economic Growth: While geopolitical risks exist, the continued expansion of emerging markets adds another layer of potential for long-term growth, supporting the outlook for higher stock valuations.

Addressing Investor Concerns about High Valuations

While the arguments presented are compelling, it's essential to address investor concerns regarding high valuations.

Understanding Valuation Metrics

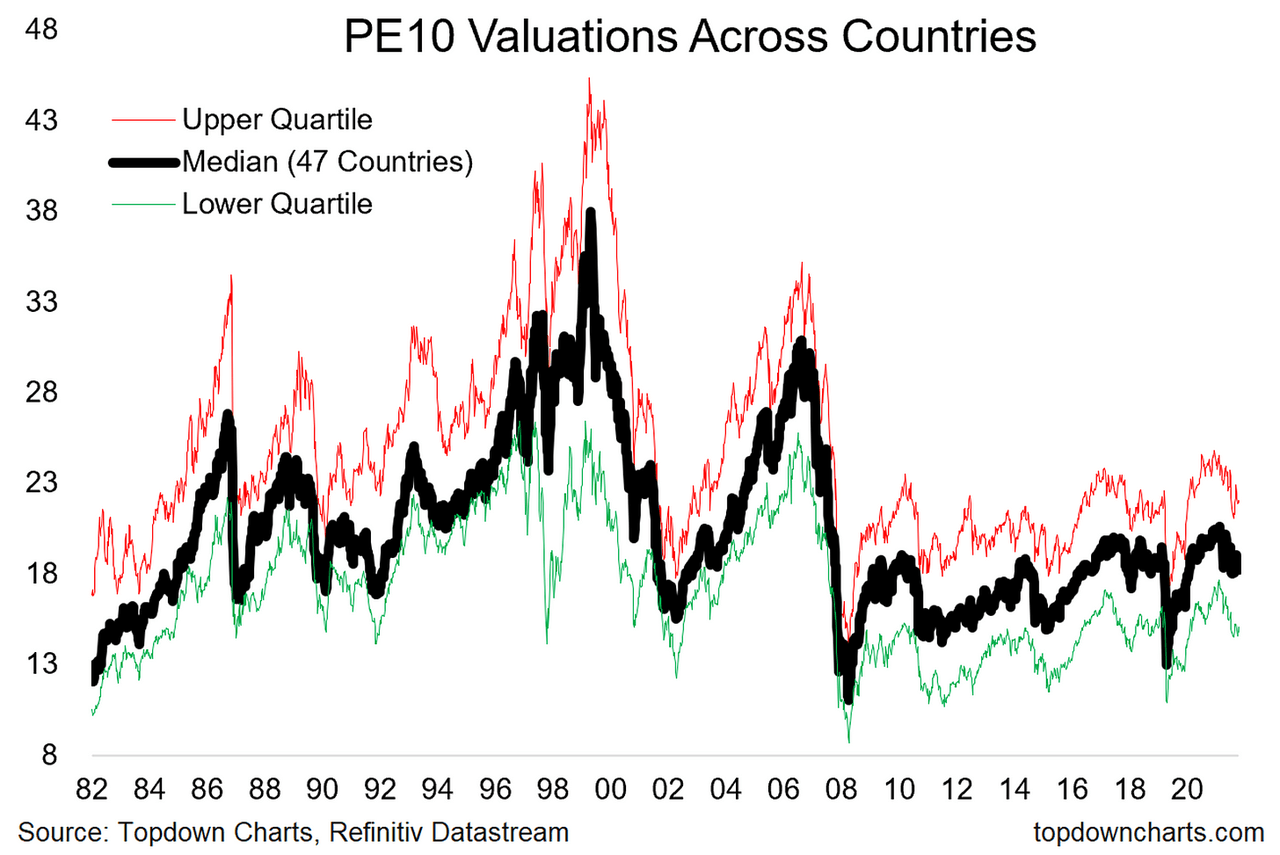

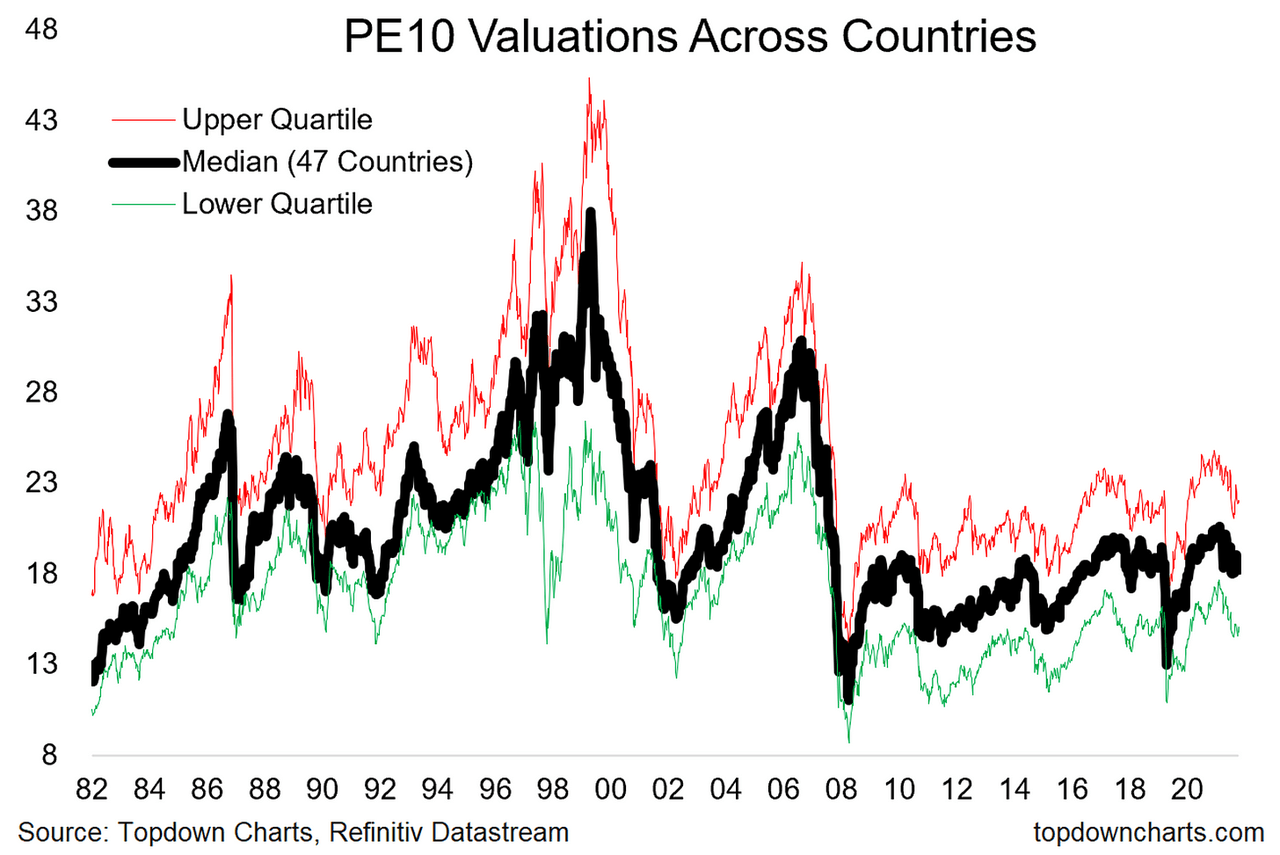

Several valuation metrics, such as the Price-to-Earnings (P/E) ratio and the Cyclically Adjusted Price-to-Earnings (Shiller PE) ratio, are often cited as indicators of market overvaluation. However, these metrics have limitations.

- Misleading Metrics: Using these metrics in isolation, without considering factors like earnings growth, interest rates, and future growth potential, can be misleading. A high P/E ratio might simply reflect high growth expectations, not necessarily overvaluation.

- Absolute vs. Relative Valuation: It's crucial to consider both absolute and relative valuations. A high P/E ratio compared to historical averages doesn't automatically signify overvaluation if similar companies in the same sector trade at even higher multiples.

- Earnings Growth Context: Valuation metrics should always be interpreted in the context of earnings growth. A high P/E ratio paired with strong and accelerating earnings growth is significantly different from the same ratio paired with stagnant or declining earnings.

The Importance of Long-Term Investment Strategies

To mitigate the risks associated with short-term market volatility, a long-term investment strategy is crucial.

- Diversification: Diversifying across different asset classes (stocks, bonds, real estate) and sectors reduces overall portfolio risk. This helps mitigate the impact of any single sector or market downturn.

- Time Horizon's Impact: The longer your investment time horizon, the less impact short-term market fluctuations have on your overall returns. Long-term investors can ride out market corrections and benefit from long-term growth.

- Historical Market Performance: Historically, the stock market has provided positive returns over the long term, despite periods of volatility. A long-term perspective is key to capturing these long-term gains.

Managing Risk in a High-Valuation Environment

Even in a potentially strong market, managing risk is essential.

- Dollar-Cost Averaging: Investing a fixed amount regularly, regardless of market price, mitigates the risk of investing a lump sum at a market peak.

- Diversification Strategies: Diversification across geographies, sectors, and asset classes remains a cornerstone of risk management in any market environment.

- Professional Financial Advice: Seeking professional advice from a financial advisor can help you tailor your investment strategy to your individual risk tolerance and financial goals. They can help navigate the complexities of the current market.

- Stop-Loss Orders: For investors less comfortable with volatility, stop-loss orders can limit potential losses by automatically selling assets if they fall below a predetermined price.

Conclusion

While current stock market valuations may appear high, BofA's analysis suggests that robust earnings growth, low interest rates, and strong long-term growth prospects outweigh concerns about market overvaluation. Investors should adopt a long-term perspective, focusing on diversification and risk management strategies. Don't let perceived high stock market valuations deter you from considering strategic investment opportunities. By understanding the underlying economic factors and employing sound investment practices, investors can navigate the current market conditions and potentially benefit from future growth.

Call to Action: Learn more about navigating the current market and building a robust investment strategy by exploring further resources on long-term investing and BofA's market analysis. Don't let current stock market valuations prevent you from achieving your financial goals – start planning your investment strategy today!

Featured Posts

-

Conclave Crisis Will A Convicted Cardinal Participate In Choosing The Next Pope

Apr 25, 2025

Conclave Crisis Will A Convicted Cardinal Participate In Choosing The Next Pope

Apr 25, 2025 -

Nfl Draft Projections Will The Saints Draft Kamaras Heir Apparent

Apr 25, 2025

Nfl Draft Projections Will The Saints Draft Kamaras Heir Apparent

Apr 25, 2025 -

Bayerns Comeback Win Over Stuttgart Extends Bundesliga Lead

Apr 25, 2025

Bayerns Comeback Win Over Stuttgart Extends Bundesliga Lead

Apr 25, 2025 -

Public Viewing Of Pope Francis Body St Peters Basilica

Apr 25, 2025

Public Viewing Of Pope Francis Body St Peters Basilica

Apr 25, 2025 -

Ridley Scotts Apple Tv Show 5 Reasons The Reviews Are Positive

Apr 25, 2025

Ridley Scotts Apple Tv Show 5 Reasons The Reviews Are Positive

Apr 25, 2025

Latest Posts

-

Arc Raiders Second Public Test What To Expect This Month

May 01, 2025

Arc Raiders Second Public Test What To Expect This Month

May 01, 2025 -

Actor Michael Sheens 100 000 Donation 900 Peoples Debt Cleared

May 01, 2025

Actor Michael Sheens 100 000 Donation 900 Peoples Debt Cleared

May 01, 2025 -

Arc Raiders Public Test 2 New Gameplay Details And Release Date

May 01, 2025

Arc Raiders Public Test 2 New Gameplay Details And Release Date

May 01, 2025 -

Michael Sheen Pays Off 1 Million Debt For 900 People

May 01, 2025

Michael Sheen Pays Off 1 Million Debt For 900 People

May 01, 2025 -

Post Six Nations Review Frances Success And Lions Squad Formation

May 01, 2025

Post Six Nations Review Frances Success And Lions Squad Formation

May 01, 2025