Why Did D-Wave Quantum (QBTS) Stock Price Fall On Monday?

Table of Contents

Market-Wide Downturn and its Impact on QBTS

Monday's market performance played a significant role in the D-Wave Quantum (QBTS) stock price fall. A broader market downturn, often characterized by increased market volatility and risk aversion, can negatively affect even seemingly unrelated stocks. This is because investors often sell off assets across the board during periods of uncertainty.

- Market Indices Performance: Major indices like the S&P 500 and Nasdaq experienced significant declines on Monday, indicating a general negative sentiment in the market. The specific percentage drops in these indices should be included here for context (refer to actual market data).

- Tech Sector Impact: Negative economic news, particularly concerning interest rate hikes or inflation figures, can severely impact the technology sector, which includes QBTS. This is because tech companies are often valued based on future growth, and rising interest rates increase the discount rate applied to future earnings.

- Correlation Analysis: A correlation analysis between QBTS's price movement and the broader market indices would provide further evidence of the market-wide downturn's influence.

Lack of Significant Positive News or Catalysts for QBTS

The absence of positive news or catalysts concerning D-Wave's technology, contracts, or partnerships likely contributed to the D-Wave Quantum (QBTS) stock price fall. In a relatively new and rapidly evolving sector like quantum computing, positive developments are crucial for maintaining investor confidence and driving stock prices upward.

- Recent D-Wave Announcements: A review of recent press releases and announcements from D-Wave is necessary to assess whether any significant positive developments were lacking. Did they announce any new partnerships, contract wins, or technological breakthroughs? The lack of such news can easily lead to a sell-off.

- Impact of Investor Wait-and-See: Without significant positive news, investors may adopt a "wait-and-see" attitude, leading to decreased buying pressure and potentially triggering a price decline. The inherent uncertainty surrounding the quantum computing sector amplifies this effect.

- Technology Advancements: The lack of visible advancements in D-Wave's quantum computing technology relative to competitors could also lead to diminished investor confidence.

Profit-Taking and Investor Sentiment

Profit-taking by investors who had previously seen gains in QBTS may have exacerbated Monday's decline. Combined with shifts in investor sentiment, even unrelated negative news can significantly impact stock prices.

- Trading Volume Analysis: Analyzing QBTS's trading volume on Monday can provide insights into the extent of profit-taking. High trading volume alongside a price drop suggests a significant number of investors selling their shares.

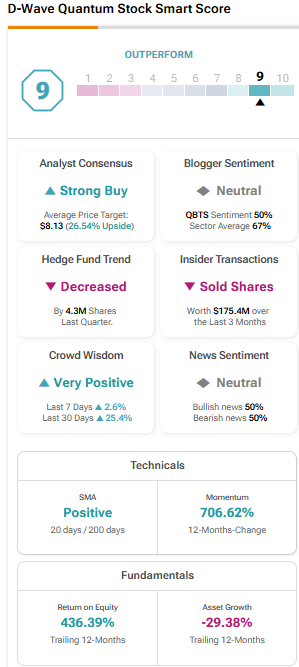

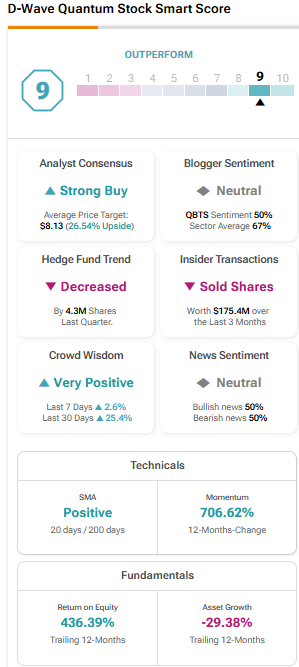

- Analyst Ratings and Recommendations: Any changes in analyst ratings or recommendations for QBTS could impact investor sentiment and contribute to the price decline. Negative revisions or downgrades would likely fuel selling.

- Social Media Sentiment: Examining social media sentiment surrounding D-Wave and the broader quantum computing sector can provide clues about investor psychology and overall market perception.

Speculative Trading and Volatility in the Quantum Computing Sector

The quantum computing sector is inherently volatile, characterized by speculative trading and exaggerated price movements. This is partly due to its nascent stage and the uncertainty surrounding its future growth.

- Comparison with other Quantum Computing Companies: Comparing QBTS's volatility to other publicly traded quantum computing companies helps to determine if the price drop was unique to QBTS or indicative of a broader sector trend.

- High-Risk Investment Profile: Investing in QBTS, and other quantum computing stocks, involves a high degree of risk. Speculative investments are often highly susceptible to significant price swings.

- Influence of Speculative Traders: Short-term price fluctuations are often driven by speculative traders who react quickly to market sentiment and news, leading to amplified volatility.

Conclusion: Understanding the Factors Behind the D-Wave Quantum (QBTS) Stock Price Fall and What to Expect

The D-Wave Quantum (QBTS) stock price drop on Monday was likely a confluence of factors: a general market downturn, the absence of positive company news, profit-taking by some investors, and the inherent volatility of the quantum computing sector. Understanding these factors is vital for informed investment decisions in this exciting but risky space.

The future price movements of QBTS remain uncertain. While the long-term prospects of quantum computing are promising, investors should maintain a cautious outlook and carefully consider the risks involved. For a deeper understanding, conduct thorough research on D-Wave Quantum (QBTS) and stay informed about factors influencing its stock performance. This includes performing your own D-Wave Quantum (QBTS) stock analysis and carefully considering all aspects of investing in D-Wave Quantum (QBTS).

Featured Posts

-

Cote D Ivoire Bruno Kone Et Le Lancement Des Plans D Urbanisme De Detail Un Projet Pour Le Developpement Urbain

May 20, 2025

Cote D Ivoire Bruno Kone Et Le Lancement Des Plans D Urbanisme De Detail Un Projet Pour Le Developpement Urbain

May 20, 2025 -

Madrid Open Sabalenka Triumphs Over Mertens

May 20, 2025

Madrid Open Sabalenka Triumphs Over Mertens

May 20, 2025 -

Big Bear Ai Bbai Stock Crash Of 2025 Causes And Analysis

May 20, 2025

Big Bear Ai Bbai Stock Crash Of 2025 Causes And Analysis

May 20, 2025 -

James Cronin Highfields New Head Coach

May 20, 2025

James Cronin Highfields New Head Coach

May 20, 2025 -

The Gretzky Loyalty Debate Examining The Fallout From Trumps Tariffs And Statehood Proposals

May 20, 2025

The Gretzky Loyalty Debate Examining The Fallout From Trumps Tariffs And Statehood Proposals

May 20, 2025

Latest Posts

-

Domaca Kancelaria Vs Firemna Kancelaria Ktora Je Pre Vas Lepsia

May 21, 2025

Domaca Kancelaria Vs Firemna Kancelaria Ktora Je Pre Vas Lepsia

May 21, 2025 -

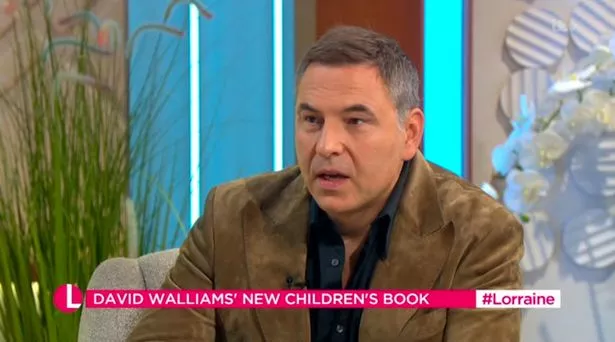

David Walliams Cancelled Comment Leaves Lorraine Kelly Uncomfortable

May 21, 2025

David Walliams Cancelled Comment Leaves Lorraine Kelly Uncomfortable

May 21, 2025 -

The Cliff Richard Musical Roadblocks For Lucas And Walliams Collaboration

May 21, 2025

The Cliff Richard Musical Roadblocks For Lucas And Walliams Collaboration

May 21, 2025 -

Matt Lucas And David Walliams Cliff Richard Musical The Unexpected Obstacle

May 21, 2025

Matt Lucas And David Walliams Cliff Richard Musical The Unexpected Obstacle

May 21, 2025 -

Matt Lucas And David Walliams Cliff Richard Musical One Big Snag

May 21, 2025

Matt Lucas And David Walliams Cliff Richard Musical One Big Snag

May 21, 2025