Why Investors Shouldn't Fear High Stock Market Valuations: A BofA Perspective

Table of Contents

The Importance of Context: Understanding Current Valuations

High stock market valuations, while seemingly alarming, require careful contextualization. Simply looking at a high price-to-earnings ratio (P/E ratio) without considering other factors can be misleading.

Comparing to Historical Data

High valuations aren't unprecedented. Throughout history, periods of elevated stock market valuations have been followed by periods of both growth and correction. It's crucial to compare current valuations to historical context, factoring in several key economic indicators:

- Interest Rates: Historically low interest rates can inflate valuations as the present value of future earnings increases. This makes higher price-to-earnings ratios seem more justifiable.

- Inflation: High inflation can erode the purchasing power of money, potentially driving up asset prices, including stocks, to compensate.

- Economic Growth: Strong economic growth can support higher stock prices as companies experience increased profitability.

BofA's research on historical market cycles shows that while high valuations can precede corrections, they don't always lead to immediate market crashes. For example, the dot-com bubble of the late 1990s and the preceding years saw extremely high valuations in certain sectors, followed by a significant correction, yet the market ultimately recovered and continued its long-term growth. Analyzing these historical parallels within the context of current economic indicators provides a more nuanced perspective on current valuations.

Considering the Impact of Low Interest Rates

Historically low interest rates significantly impact stock market valuations and investor behavior. When interest rates are low, the opportunity cost of investing in stocks decreases, making them a relatively more attractive investment compared to bonds or other fixed-income securities.

- Present Value of Future Earnings: Low interest rates increase the present value of future earnings, thereby justifying higher price-to-earnings ratios. Investors are willing to pay more for a company's stock when the discount rate (influenced by interest rates) is lower.

- Increased Investor Demand: Lower rates can stimulate borrowing and investment activity, further increasing demand for stocks.

- BofA's Analysis: BofA's analysts regularly publish reports examining the relationship between interest rates and stock valuations. Their analysis often highlights the impact of monetary policy on market dynamics and helps investors understand the current market environment. Understanding these dynamics is crucial for making informed investment decisions.

Long-Term Growth Potential Remains Strong

While broad market indices might show high valuations, focusing solely on these indices can be short-sighted. A more thorough approach involves analyzing individual company fundamentals and building a diversified portfolio.

Focusing on Underlying Company Fundamentals

Instead of reacting solely to broad market indicators, investors should assess the underlying fundamentals of individual companies. Focusing on strong, fundamentally sound companies can mitigate risks associated with high market valuations.

- Earnings Growth: Companies with consistent and robust earnings growth are less susceptible to market fluctuations.

- Strong Balance Sheets: Companies with low debt and strong cash flow are better equipped to weather economic downturns.

- Innovative Business Models: Companies with innovative products or services and a strong competitive advantage often demonstrate long-term growth potential, regardless of market-wide valuations.

- BofA's Company Analysis: BofA's equity research team provides detailed analysis on thousands of companies, assisting investors in identifying fundamentally strong companies with long-term growth potential.

The Power of Diversification

Diversification is a cornerstone of effective risk management, particularly in markets characterized by high valuations. A diversified portfolio reduces reliance on any single stock or sector.

- Sector Diversification: Investing across various sectors mitigates the impact of underperformance in any single area.

- Asset Class Diversification: Including asset classes beyond stocks, such as bonds or real estate, further diversifies the portfolio and reduces overall risk.

- BofA's Portfolio Strategies: BofA offers investment strategies and advice tailored to various risk tolerance levels, helping investors build diversified portfolios that suit their individual needs.

Navigating Volatility: Strategies for Success

High stock market valuations often translate to increased market volatility. Employing sound risk management techniques is crucial for success in such environments.

Risk Management Techniques

Effective risk management strategies are vital for navigating market uncertainty.

- Position Sizing: Carefully determining the appropriate amount to invest in each asset prevents overexposure to any single investment.

- Stop-Loss Orders: These orders automatically sell an asset when it reaches a predetermined price, limiting potential losses.

- Portfolio Rebalancing: Regularly rebalancing your portfolio back to your target asset allocation helps manage risk and capitalize on market opportunities.

- BofA's Risk Management Approach: BofA provides resources and guidance on implementing robust risk management strategies, helping investors tailor their approach to their individual circumstances.

The Role of Long-Term Investing

Maintaining a long-term investment horizon is critical in a high valuation market. Short-term market fluctuations don't always reflect long-term value.

- Ignoring Short-Term Noise: Avoid reacting emotionally to daily market movements. Focus on your long-term investment goals.

- Compounding Returns: A long-term approach allows for the compounding of returns, leading to significant wealth generation over time.

- BofA's Long-Term Strategies: BofA's investment advisors offer guidance on developing and sticking to a long-term investment plan that aligns with your risk tolerance and goals.

Conclusion

While high stock market valuations might initially cause concern, a thorough analysis reveals that they aren't inherently negative. By understanding the context of current valuations, focusing on the fundamentals of individual companies, and employing sound risk management strategies, investors can successfully navigate this market landscape. BofA's research and insights provide valuable tools for making informed investment decisions.

Call to Action: Don't let fear of high stock market valuations paralyze your investment strategy. Learn more about BofA's perspective on navigating this market and develop a robust investment plan that aligns with your risk tolerance and long-term goals. Take control of your investments today and understand how to leverage high stock market valuations effectively. Contact a BofA financial advisor to discuss your investment strategy and learn how to manage risk in this dynamic market.

Featured Posts

-

Car Dealers Renew Fight Against Ev Mandates

Apr 25, 2025

Car Dealers Renew Fight Against Ev Mandates

Apr 25, 2025 -

Manchester Eurovision A Comprehensive Guide For Visitors

Apr 25, 2025

Manchester Eurovision A Comprehensive Guide For Visitors

Apr 25, 2025 -

New Tariffs A Montreal Guitar Makers Struggle

Apr 25, 2025

New Tariffs A Montreal Guitar Makers Struggle

Apr 25, 2025 -

Navigating The Chinese Market Challenges Faced By Bmw Porsche And Other Automakers

Apr 25, 2025

Navigating The Chinese Market Challenges Faced By Bmw Porsche And Other Automakers

Apr 25, 2025 -

Eurovision Song Contest Manchester Dates Venue And Essential Info

Apr 25, 2025

Eurovision Song Contest Manchester Dates Venue And Essential Info

Apr 25, 2025

Latest Posts

-

Analyzing The Playing Time Of Paul Barnes And Champagnie For The San Antonio Spurs

Apr 30, 2025

Analyzing The Playing Time Of Paul Barnes And Champagnie For The San Antonio Spurs

Apr 30, 2025 -

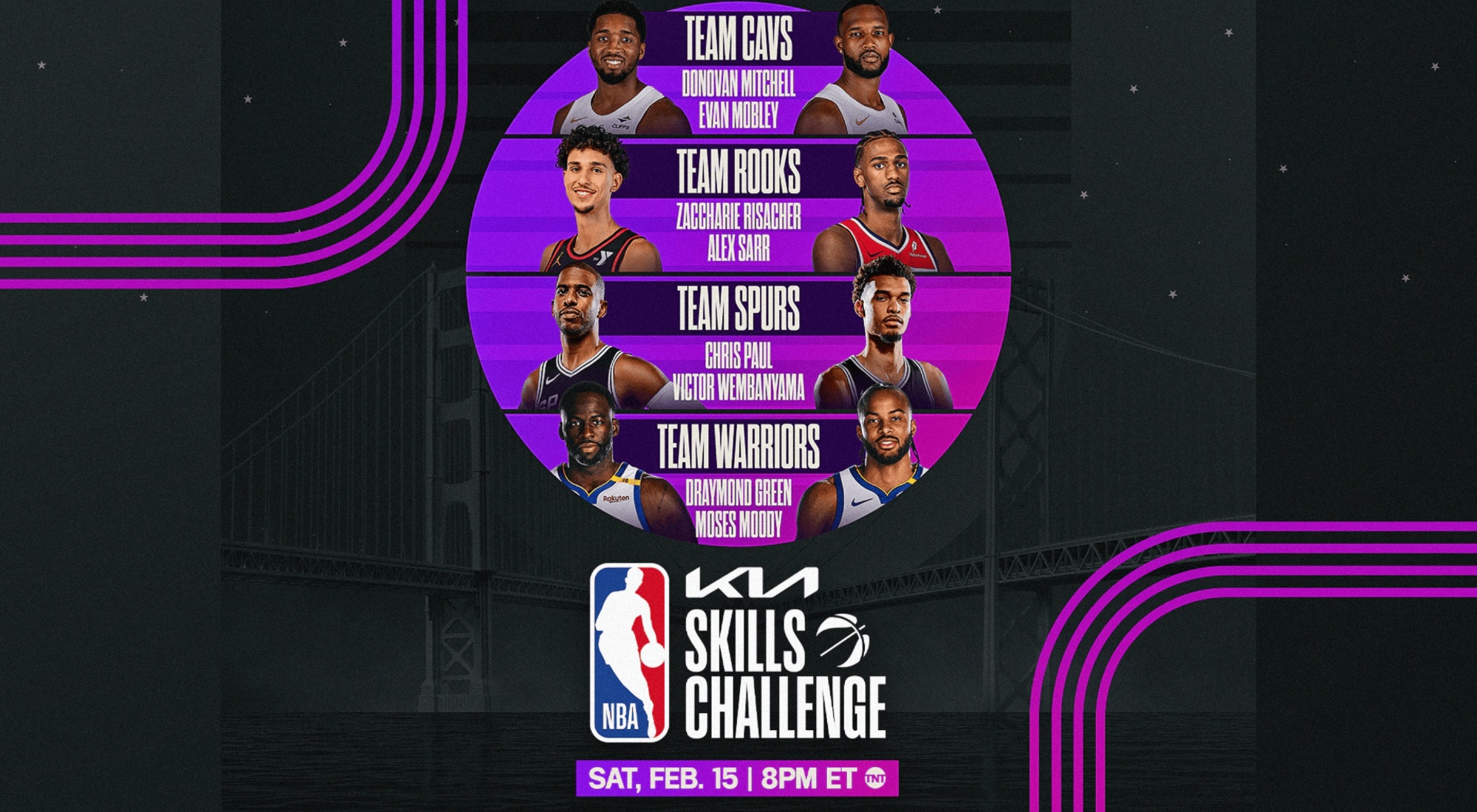

Nba Skills Challenge 2025 Understanding The Rules And Tiebreaker System

Apr 30, 2025

Nba Skills Challenge 2025 Understanding The Rules And Tiebreaker System

Apr 30, 2025 -

Chris Paul Harrison Barnes And Champagnies 2023 2024 Spurs Game Appearances

Apr 30, 2025

Chris Paul Harrison Barnes And Champagnies 2023 2024 Spurs Game Appearances

Apr 30, 2025 -

Analiza Sedlaceka Sanse Za Jokica I Jovica Na Evrobasketu

Apr 30, 2025

Analiza Sedlaceka Sanse Za Jokica I Jovica Na Evrobasketu

Apr 30, 2025 -

Nba Skills Challenge 2025 Players Teams And Competition Breakdown

Apr 30, 2025

Nba Skills Challenge 2025 Players Teams And Competition Breakdown

Apr 30, 2025