Why Kentucky Storm Damage Assessments Are Delayed

Table of Contents

Overwhelming Volume of Claims

Following a significant storm, insurance companies across Kentucky are inundated with a massive influx of claims. This sheer volume significantly overwhelms their resources, leading to substantial processing delays in Kentucky storm damage assessments. The increased demand puts a strain on every aspect of the claims process.

- Increased call volume to insurance companies: Phone lines are often jammed with policyholders attempting to report damage, creating further delays.

- Backlog in claim processing and assignment to adjusters: Claims pile up, resulting in extended wait times before an adjuster is assigned to your case.

- Limited availability of adjusters to handle all claims promptly: Insurance companies may struggle to find enough qualified adjusters to handle the increased workload, especially in the immediate aftermath of a widespread disaster.

- Shortage of skilled professionals in the region post-disaster: The demand for skilled professionals, like contractors and engineers, needed to assess and repair damage, can also contribute to delays.

Damage Assessment Challenges in Kentucky's Diverse Terrain

Kentucky's varied geography presents significant logistical challenges for damage assessors. The state's diverse terrain, including mountainous regions and widespread rural areas, makes accessing damaged properties time-consuming and difficult, especially immediately after a storm. This impacts the speed and efficiency of Kentucky storm damage assessments.

- Impassable roads and infrastructure damage hindering access: Flooding, downed trees, and power outages can make reaching affected areas nearly impossible.

- Remote locations requiring specialized equipment and longer travel times: Assessors may need four-wheel-drive vehicles or even helicopters to reach remote properties, significantly increasing travel time.

- Safety concerns for assessors navigating hazardous conditions: Assessors face risks from downed power lines, unstable structures, and other hazards, which can delay or postpone assessments.

- Increased travel time impacting assessment speed and efficiency: The extra time spent traveling to and from remote locations directly reduces the number of assessments that can be completed each day.

Severe Weather Impacts on Assessment Teams

Subsequent storms or inclement weather can further impede assessment efforts, creating a ripple effect of delays in Kentucky storm damage assessments. Teams may be forced to halt work due to safety concerns, causing further backlogs.

- Post-storm weather events delaying access to damaged areas: A second storm can make previously accessible areas impassable, extending the wait for assessments.

- Safety protocols requiring assessment teams to postpone work: Prioritizing the safety of assessment teams is paramount, leading to unavoidable delays when weather conditions are unsafe.

- Damage to assessor vehicles and equipment impacting operations: Storm damage can affect the vehicles and equipment needed to conduct assessments, hindering the process.

The Complexity of Insurance Claims

Kentucky storm damage assessments aren't simply about identifying damage; they require meticulous documentation, verification, and evaluation of policy coverage. This detailed process, inherent in all Kentucky storm damage assessments, is inherently time-consuming.

- Detailed photographic and video evidence required for each claim: Comprehensive documentation is crucial for supporting the claim, adding to the assessment time.

- Verification of policy details and coverage limits: Insurance companies must carefully review each policy to determine coverage limits and any exclusions that might apply.

- Assessment of pre-existing damage and its contribution to current damage: Distinguishing between pre-existing damage and storm-related damage is a critical and often complex part of the assessment process.

- Negotiation of settlement amounts with policyholders: Reaching an agreement on the final settlement amount can take time and often involves back-and-forth communication between the insurer and the policyholder.

Fraudulent Claims & Investigations

Following significant storms, there's an increased risk of fraudulent claims. Insurance companies must conduct thorough investigations to protect against false reporting and inflated damage claims, which inevitably impacts the speed of legitimate Kentucky storm damage assessments.

- Increased scrutiny of claims to identify potentially fraudulent activity: This extra level of scrutiny adds to the overall processing time for all claims.

- Investigations can take time, causing delays in legitimate claim processing: Investigating suspected fraudulent claims requires time and resources, impacting the processing of legitimate claims.

- Verification of damage claims through multiple channels: Insurance companies often utilize multiple methods to verify the reported damage, slowing down the process.

- Potential impact on the processing times for non-fraudulent claims: The resources dedicated to investigating fraudulent claims can pull resources away from processing legitimate claims, leading to further delays.

Conclusion

Delays in Kentucky storm damage assessments are often a result of a confluence of factors, ranging from the sheer volume of claims to the logistical challenges of assessing damage across Kentucky's diverse terrain. Understanding these contributing factors helps homeowners and businesses manage their expectations and prepare for a potentially lengthy process. While delays are frustrating, proactive communication with your insurance provider, meticulous documentation of the damage, and patience are key to navigating this difficult time. Remember to thoroughly document your Kentucky storm damage for a smoother claims process. Take the necessary steps to prepare yourself and your property for future storms to minimize the impact of potential future Kentucky storm damage assessments.

Featured Posts

-

Remember Mondays Eurovision Song A Powerful Statement Against Online Hate

May 01, 2025

Remember Mondays Eurovision Song A Powerful Statement Against Online Hate

May 01, 2025 -

Veteran Dallas Star Passes Away Aged 100

May 01, 2025

Veteran Dallas Star Passes Away Aged 100

May 01, 2025 -

Automotive Tariffs Trumps Proposed Mitigation Strategy

May 01, 2025

Automotive Tariffs Trumps Proposed Mitigation Strategy

May 01, 2025 -

Papa Francesco Aggiornamenti Sulla Situazione Del Cardinale Becciu

May 01, 2025

Papa Francesco Aggiornamenti Sulla Situazione Del Cardinale Becciu

May 01, 2025 -

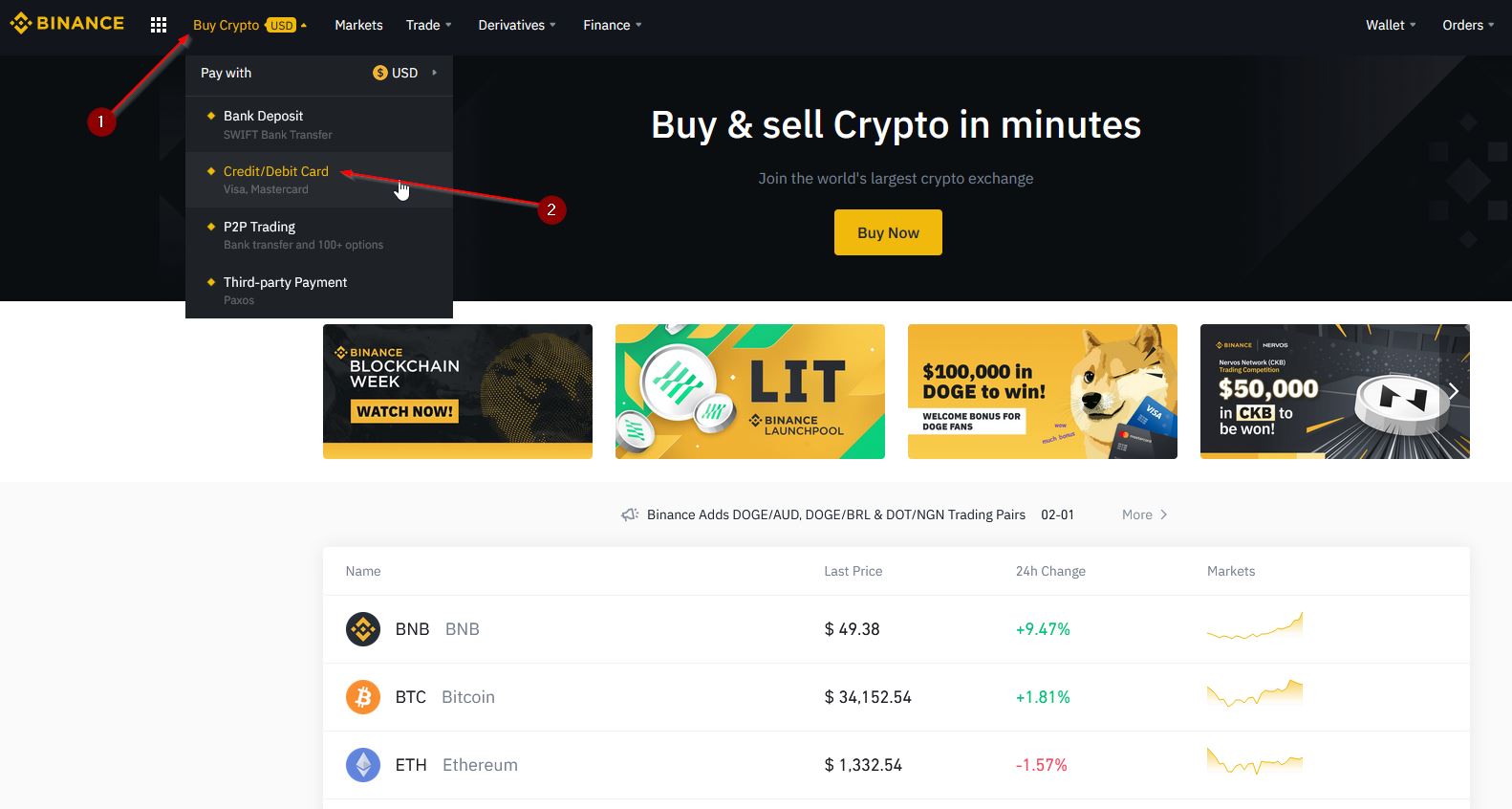

Is It Wise To Buy Xrp Ripple Now

May 01, 2025

Is It Wise To Buy Xrp Ripple Now

May 01, 2025

Latest Posts

-

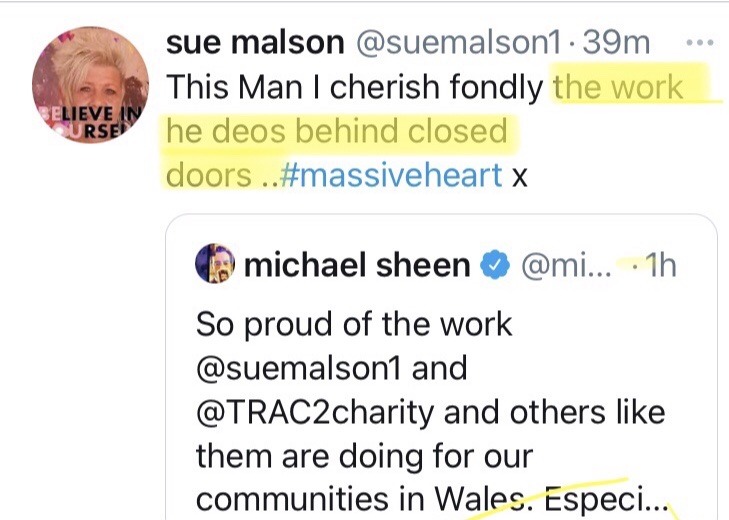

Sheens Documentary Addressing The Backlash Over The 1 Million Gift

May 02, 2025

Sheens Documentary Addressing The Backlash Over The 1 Million Gift

May 02, 2025 -

Michael Sheens 1 Million Giveaway A Charitable Act Explained

May 02, 2025

Michael Sheens 1 Million Giveaway A Charitable Act Explained

May 02, 2025 -

Michael Sheens 1 Million Giveaway A Documentary Under Scrutiny

May 02, 2025

Michael Sheens 1 Million Giveaway A Documentary Under Scrutiny

May 02, 2025 -

1 Million Debt Forgiven Michael Sheens Act Of Kindness

May 02, 2025

1 Million Debt Forgiven Michael Sheens Act Of Kindness

May 02, 2025 -

The Truth About Michael Sheens Million Pound Donation

May 02, 2025

The Truth About Michael Sheens Million Pound Donation

May 02, 2025