Why The Federal Reserve Is Different: Interest Rate Policy Explained

Table of Contents

The Federal Reserve is the central bank of the United States, responsible for maintaining the stability of the financial system and promoting maximum employment and stable prices. Unlike commercial banks, the Fed doesn't operate to make a profit; its primary function is to implement monetary policy to achieve its economic goals. A key aspect of this policy is setting interest rates. However, the Fed's approach differs significantly from many other central banks globally.

The Dual Mandate of the Federal Reserve

Unlike many central banks worldwide that primarily focus on inflation control (a single mandate), the Federal Reserve operates under a dual mandate: maintaining price stability and achieving maximum employment. This difference significantly impacts its interest rate policy.

- Price Stability: The Fed measures price stability using metrics like the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index. These indices track the average change in prices paid by urban consumers for a basket of goods and services. A low and stable inflation rate is the primary goal.

- Maximum Employment: This involves striving for a low unemployment rate and high labor force participation. The Fed considers various labor market indicators, such as the unemployment rate, job creation numbers, and wage growth, to gauge progress towards maximum employment.

- Balancing Act: Balancing these two goals presents a significant challenge. For instance, aggressively lowering interest rates to boost employment might fuel inflation, and vice versa. The Fed must carefully weigh the potential trade-offs in its monetary policy decisions.

Independence of the Federal Reserve

The Federal Reserve enjoys a significant degree of operational independence from the government. This independence is a critical factor differentiating its interest rate policy from central banks in many other countries.

- Structural Independence: The Fed's structure, with its independent Board of Governors and decentralized Reserve Banks, contributes significantly to its autonomy. The governors are appointed for staggered 14-year terms, insulating them from short-term political pressures.

- Checks and Balances: While independent, the Fed is still subject to oversight and accountability. Congress holds the power to audit the Fed and influence its activities, including the appointment of the Chair.

- Arguments for and Against: The debate over central bank independence is ongoing. Advocates emphasize the need to shield monetary policy from political interference, while critics raise concerns about accountability and potential for unchecked power.

The Federal Open Market Committee (FOMC) and its Decision-Making Process

The Federal Open Market Committee (FOMC) is the key body responsible for setting Federal Reserve interest rate policy. Its decisions directly influence short-term interest rates and broader monetary conditions.

- FOMC Composition: The FOMC comprises the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four other Reserve Bank presidents on a rotating basis.

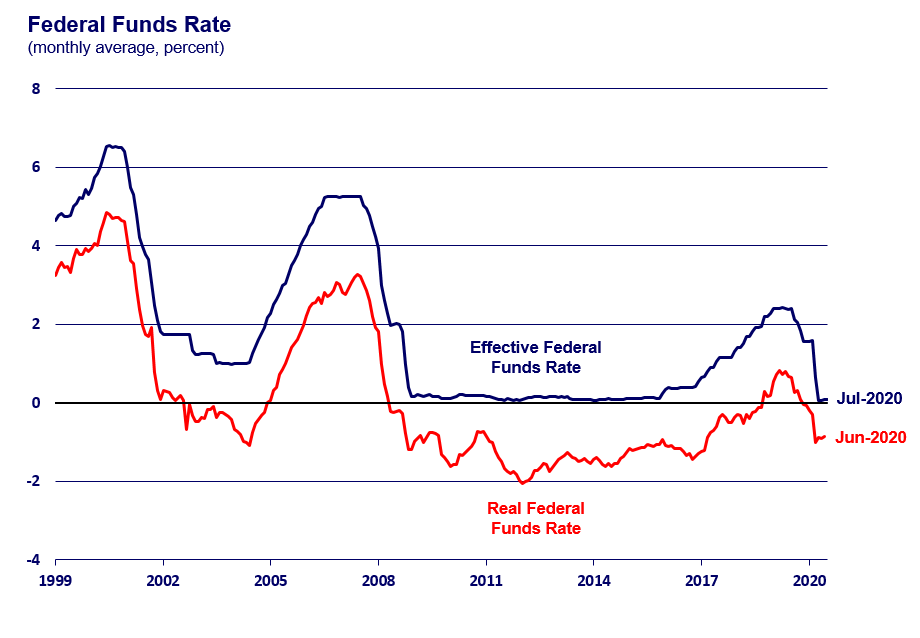

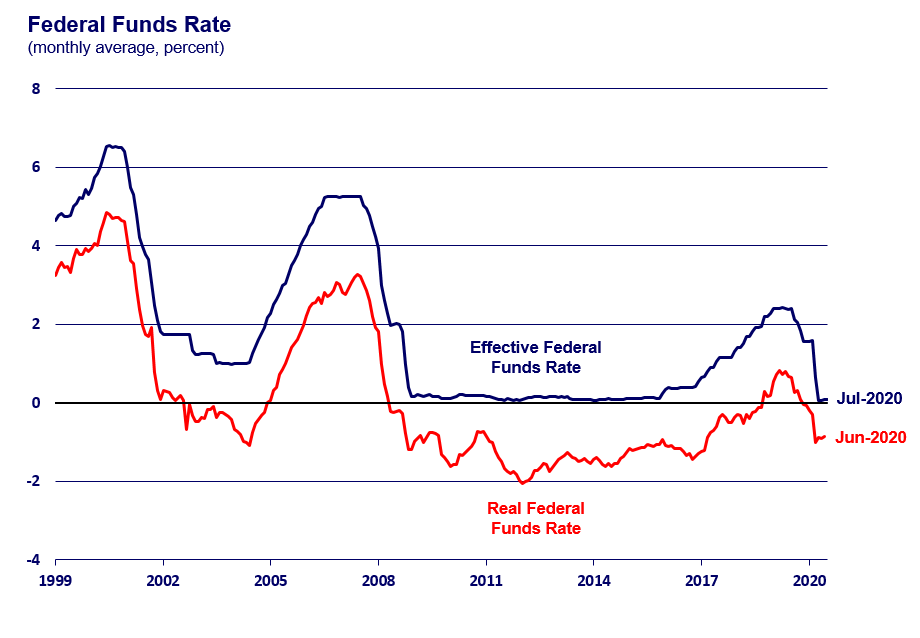

- Policy Tools: The FOMC employs several tools to implement its monetary policy, including adjusting the federal funds rate (the target rate banks charge each other for overnight loans), conducting open market operations (buying or selling government securities), and employing quantitative easing (large-scale asset purchases).

- Transparency and Communication: The FOMC emphasizes transparency in its decision-making process. It releases statements after each meeting, providing insights into its assessment of economic conditions and its policy intentions. This communication is crucial for market stability and expectations management.

Impact of Federal Reserve Interest Rate Policy on the US Economy

Changes in Federal Reserve interest rate policy have profound effects on the US economy, rippling through various sectors.

- Borrowing Costs: Interest rate hikes increase borrowing costs for businesses and consumers, potentially slowing down economic activity, while rate cuts stimulate borrowing and investment.

- Inflation and Unemployment: The Fed aims to strike a balance between controlling inflation and maximizing employment. Higher interest rates combat inflation but can increase unemployment; lower rates boost employment but can increase inflation.

- Stock Market and Exchange Rates: Interest rate changes influence investor sentiment and capital flows, affecting stock market performance and exchange rates.

Comparing the Federal Reserve to Other Central Banks

The Federal Reserve's approach to monetary policy stands out when compared to other central banks globally.

- European Central Bank (ECB): The ECB, like the Fed, has a mandate for price stability but is less explicitly focused on employment. Its structure and communication strategies also differ from the Fed’s.

- Bank of Japan (BOJ): The BOJ has employed extensive quantitative easing programs, significantly impacting its balance sheet and influencing the yield curve in ways different from the Fed's past interventions.

- Communication Differences: Central banks vary considerably in their transparency and communication strategies. The Fed's approach is generally considered more transparent than that of some other central banks.

Conclusion: Understanding the Nuances of Federal Reserve Interest Rate Policy

The Federal Reserve interest rate policy is unique due to its dual mandate, significant independence, and the intricate decision-making process of the FOMC. Understanding these nuances is crucial for grasping the complexities of the US economy and its global impact. The Fed's actions significantly influence borrowing costs, inflation, employment levels, and financial market dynamics. Stay informed about Federal Reserve interest rate policy to better understand its influence on the economy and make informed financial decisions. Learn more about the intricacies of Federal Reserve monetary policy and deepen your knowledge of the Federal Reserve's impact on interest rates.

Featured Posts

-

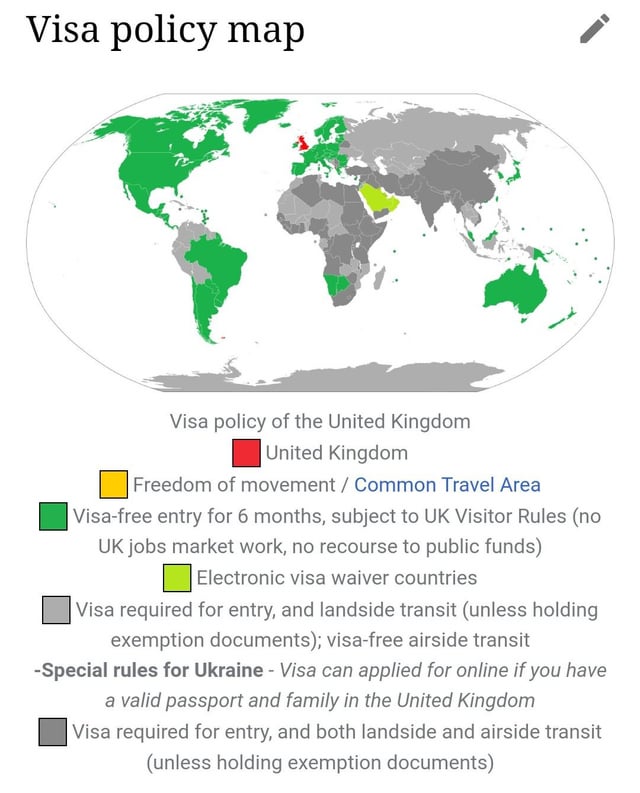

Uk Visa Policy Update Impact And Implications For Applicants

May 10, 2025

Uk Visa Policy Update Impact And Implications For Applicants

May 10, 2025 -

Palantir Stock Price Rally Prompts Analyst Forecast Revisions

May 10, 2025

Palantir Stock Price Rally Prompts Analyst Forecast Revisions

May 10, 2025 -

Korol Charlz Iii Posvyatil Stivena Fraya V Rytsari Podrobnosti Tseremonii

May 10, 2025

Korol Charlz Iii Posvyatil Stivena Fraya V Rytsari Podrobnosti Tseremonii

May 10, 2025 -

Report Uk Plans To Restrict Visa Applications For Certain Nationalities

May 10, 2025

Report Uk Plans To Restrict Visa Applications For Certain Nationalities

May 10, 2025 -

Who Plays David In High Potential Episode 13 The Kidnapper Casting Explained

May 10, 2025

Who Plays David In High Potential Episode 13 The Kidnapper Casting Explained

May 10, 2025