Why The Venture Capital Secondary Market Is Booming

Table of Contents

Increased Liquidity Demands from LPs

Limited Partners (LPs), the institutional investors (like pension funds and endowments) who invest in venture capital funds, are increasingly seeking quicker access to capital than traditional exit strategies—like IPOs or acquisitions—allow. This demand for liquidity is fueling the secondary market's growth.

- Shorter Investment Horizons for LPs: Many LPs now operate with shorter investment horizons, requiring more frequent rebalancing of their portfolios. The secondary market offers a mechanism to achieve this.

- Need to Rebalance Portfolios: Unexpected market shifts or changes in strategic priorities can necessitate portfolio rebalancing. Selling existing venture capital investments in the secondary market provides the necessary flexibility.

- Unexpected Capital Requirements: Unforeseen circumstances might require LPs to access capital quickly. The secondary market offers a faster alternative to waiting for a traditional exit event.

- Strategic Reallocation of Funds to Other Opportunities: LPs might identify more attractive investment opportunities and require liquidating existing assets to capitalize on them. The secondary market facilitates this strategic reallocation.

These liquidity pressures are driving LPs to actively participate in the venture capital secondary market, creating a robust demand for existing venture capital investments.

Sophisticated Investors Seeking Diversification & Returns

The venture capital secondary market isn't just for LPs; it's attracting a wave of sophisticated investors, including institutional investors and high-net-worth individuals, who are leveraging this market to achieve diversification and potentially higher returns.

- Access to High-Growth Companies: The secondary market provides access to established, high-growth companies that might not be accessible through primary investments. This allows for immediate exposure to promising ventures.

- Diversification Across a Wider Range of Assets: Venture capital investments traditionally represent a significant long-term commitment. The secondary market allows for greater diversification across various asset classes, reducing overall portfolio risk.

- Potential for Higher Returns Compared to Traditional Asset Classes: While riskier than some assets, venture capital investments, particularly those acquired through the secondary market at potentially discounted prices, offer the potential for significantly higher returns.

- Reduced Risk Through Diversification: By diversifying across multiple venture-backed companies via secondary purchases, investors can mitigate the risk inherent in any single investment.

This influx of sophisticated capital further fuels the secondary market's growth, driving up transaction volumes and competition.

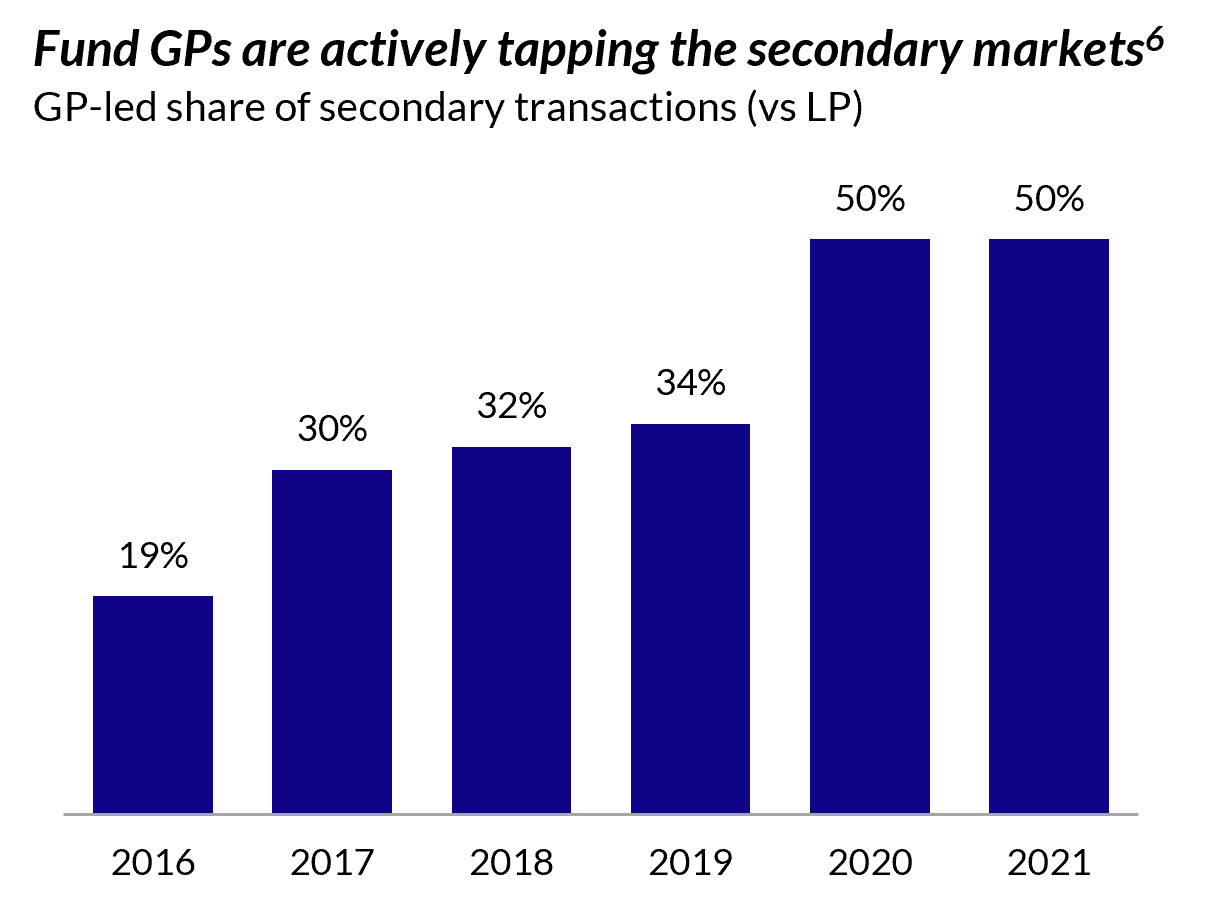

Maturation of the Venture Capital Ecosystem

The burgeoning venture capital secondary market is also a result of the maturation of the overall venture capital ecosystem. Improved infrastructure and increased market transparency have made the secondary market significantly more accessible and efficient.

- Improved Valuation Methodologies: More sophisticated valuation techniques have emerged, reducing uncertainty and increasing confidence in secondary market transactions.

- Rise of Specialized Secondary Market Platforms and Brokerages: The development of dedicated platforms and brokerages simplifies the process of buying and selling venture capital investments.

- Increased Regulatory Clarity: Greater regulatory clarity has reduced uncertainty and increased participation by institutional investors.

- Greater Data Availability and Transparency: Increased data availability and transparency allows for more informed investment decisions, fostering confidence in the market.

The Role of Technology in the Secondary Market Boom

Technology is playing a crucial role in driving the efficiency and accessibility of the venture capital secondary market.

- Fintech: Fintech solutions are streamlining processes, improving data analysis, and facilitating faster transactions.

- Data Analytics: Advanced data analytics are enhancing valuation accuracy and risk assessment, making the market more attractive to investors.

- Online Platforms: Online platforms are creating more efficient and transparent marketplaces for buying and selling venture capital stakes.

- Automation: Automation is streamlining various aspects of the transaction process, from due diligence to settlement.

Capitalizing on the Booming Venture Capital Secondary Market

The venture capital secondary market's boom is driven by a potent combination of increased liquidity needs among LPs, the diversification strategies of sophisticated investors, and the maturation of the ecosystem itself, propelled by technological advancements. This market presents significant opportunities for both buyers and sellers. Buyers gain access to a diverse range of high-growth companies and potentially higher returns, while sellers achieve desired liquidity. The venture capital secondary market presents a significant opportunity for investors seeking enhanced liquidity, diversification, and access to high-growth companies. Learn more about navigating this booming market and finding the right opportunities for your portfolio.

Featured Posts

-

Tremor On Netflix Release Date Plot And Cast Updates

Apr 29, 2025

Tremor On Netflix Release Date Plot And Cast Updates

Apr 29, 2025 -

The Hidden Cost Of Temu Examining The Effect Of Trump Tariffs On Us Consumers

Apr 29, 2025

The Hidden Cost Of Temu Examining The Effect Of Trump Tariffs On Us Consumers

Apr 29, 2025 -

Covid 19 Pandemic Lab Owner Convicted Of Falsified Test Results

Apr 29, 2025

Covid 19 Pandemic Lab Owner Convicted Of Falsified Test Results

Apr 29, 2025 -

Tylor Megills Success With The Mets Pitching Strategies And Results

Apr 29, 2025

Tylor Megills Success With The Mets Pitching Strategies And Results

Apr 29, 2025 -

Senate Majority Leader Schumer I M Staying Put Future Of Senate Leadership

Apr 29, 2025

Senate Majority Leader Schumer I M Staying Put Future Of Senate Leadership

Apr 29, 2025

Latest Posts

-

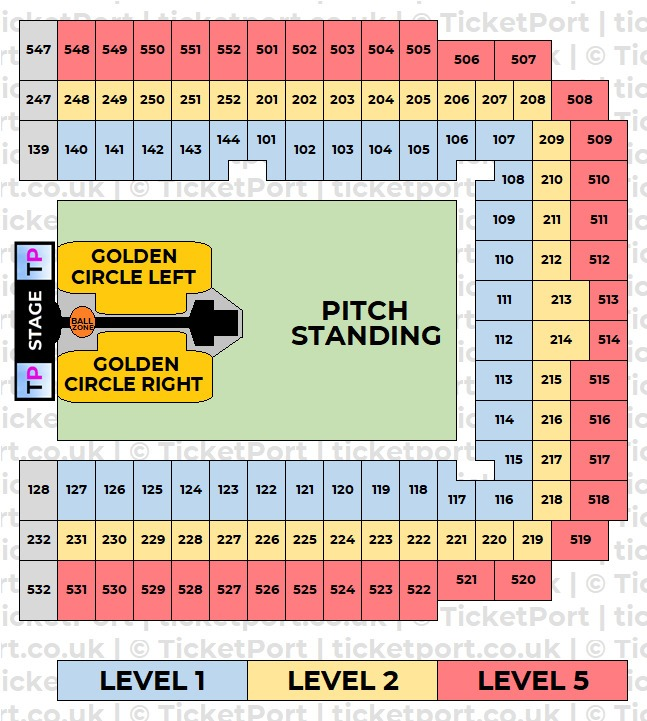

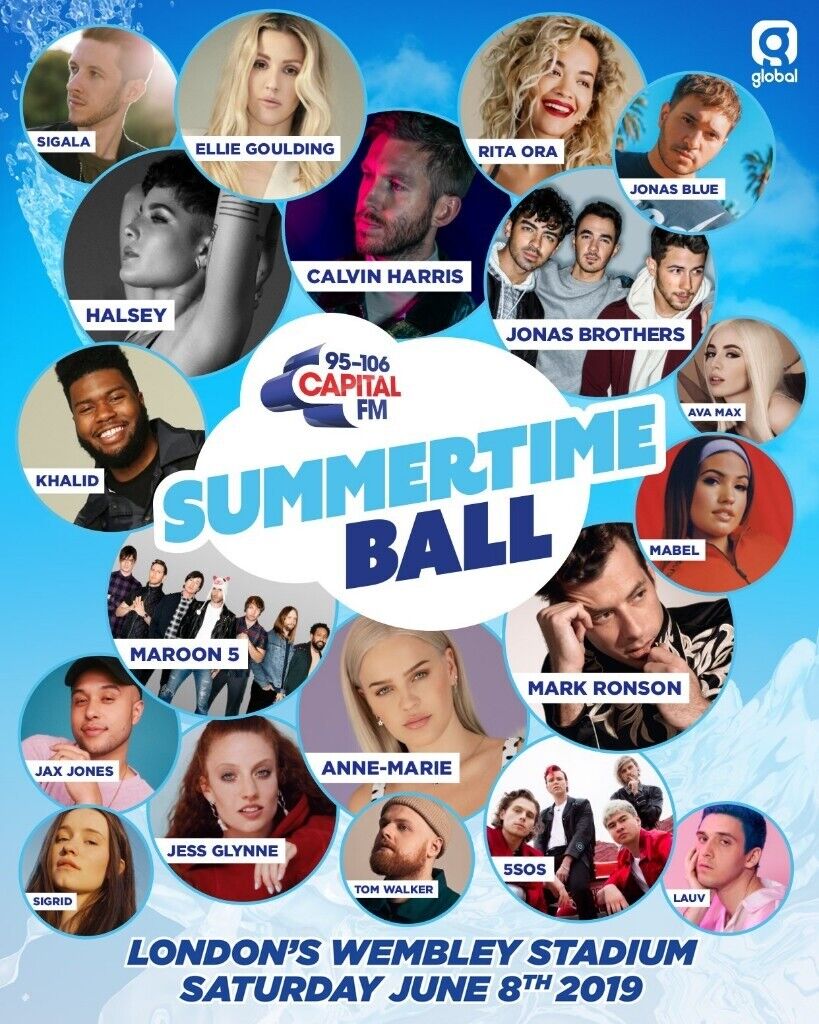

Capital Summertime Ball 2025 Where And How To Buy Tickets

Apr 29, 2025

Capital Summertime Ball 2025 Where And How To Buy Tickets

Apr 29, 2025 -

Secure Your Capital Summertime Ball 2025 Tickets A Step By Step Guide

Apr 29, 2025

Secure Your Capital Summertime Ball 2025 Tickets A Step By Step Guide

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets Your Step By Step Guide To Purchase

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Your Step By Step Guide To Purchase

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets Your Guide To Buying

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Your Guide To Buying

Apr 29, 2025 -

Securing Your Capital Summertime Ball 2025 Tickets Tips And Strategies

Apr 29, 2025

Securing Your Capital Summertime Ball 2025 Tickets Tips And Strategies

Apr 29, 2025