Why This AI Quantum Computing Stock Is A Dip Buy Opportunity

Table of Contents

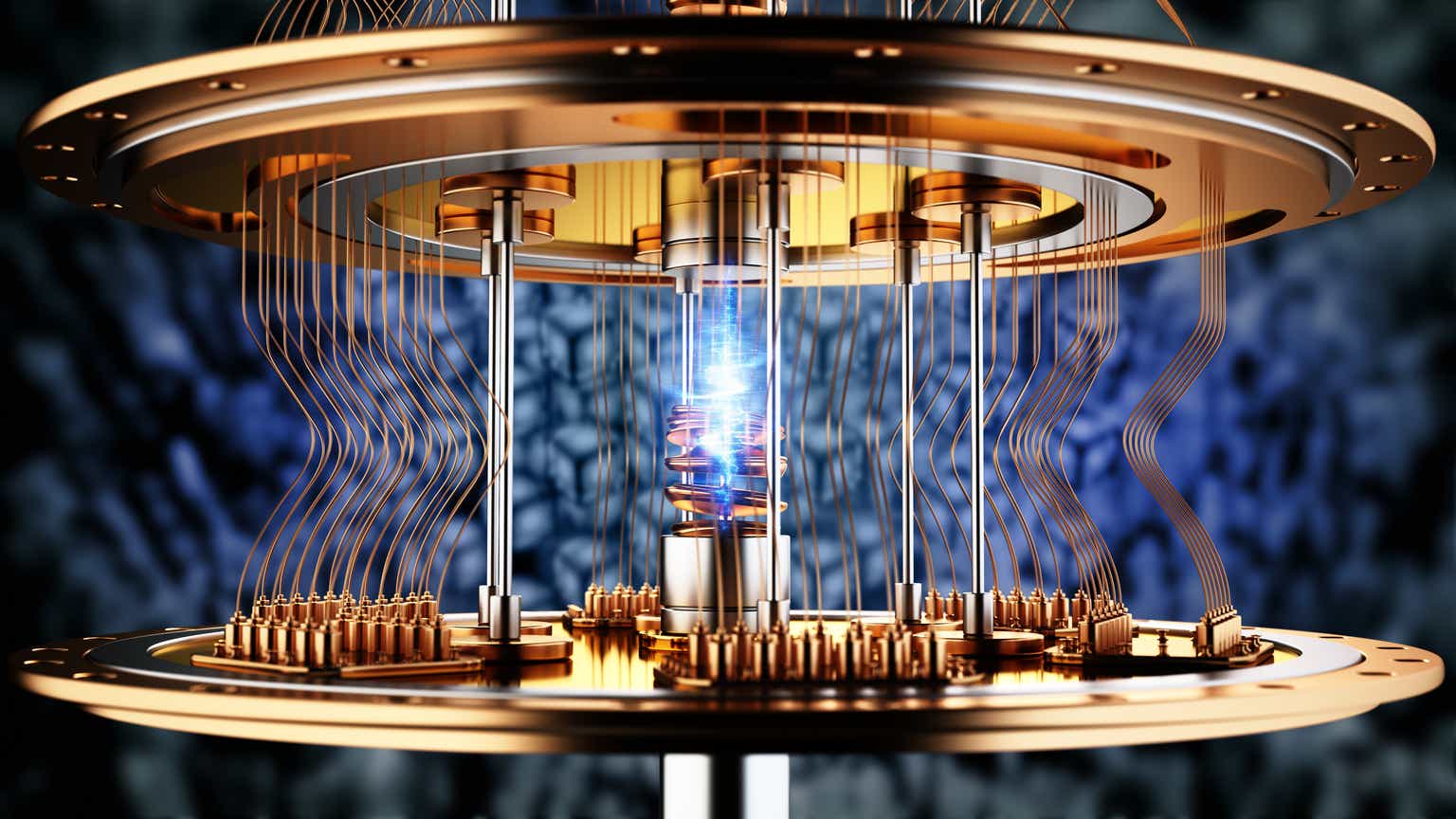

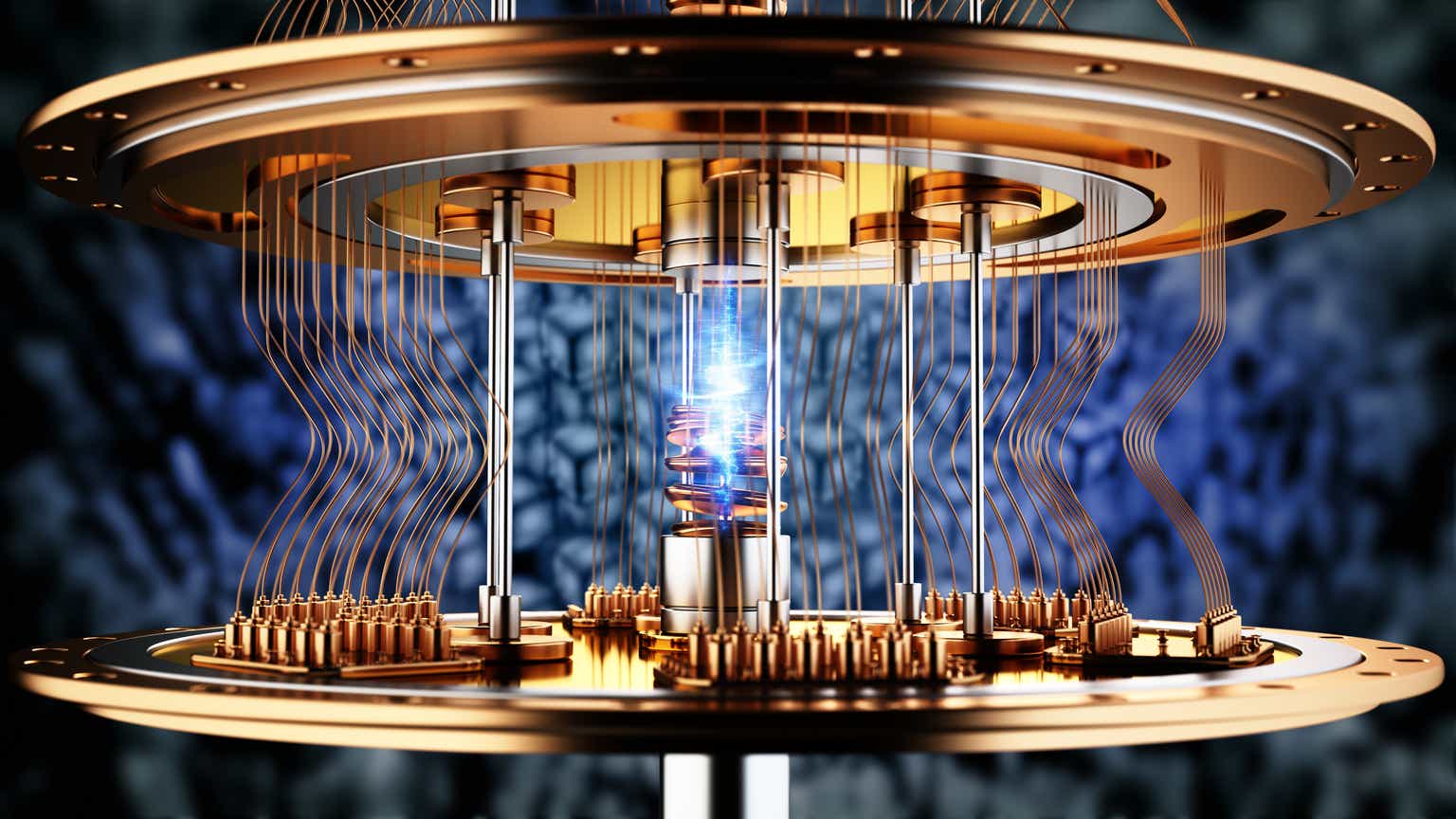

Understanding the Potential of AI Quantum Computing

The Transformative Power of Quantum Computing

Quantum computing holds the potential to revolutionize numerous industries by tackling problems far beyond the capabilities of classical computers. This "quantum supremacy," or the ability to solve problems impossible for classical computers, is based on exploiting quantum phenomena like superposition and entanglement. This unlocks unprecedented computational power with implications across diverse sectors.

- Drug Discovery: Quantum computers can simulate molecular interactions with far greater accuracy, accelerating the development of new drugs and therapies.

- Materials Science: Designing new materials with specific properties (e.g., superconductors, high-strength alloys) becomes significantly faster and more efficient.

- Financial Modeling: Quantum algorithms can optimize complex financial models, improving risk management and portfolio optimization.

These advancements are driven by the development of sophisticated quantum algorithms, harnessing the power of quantum advantage to achieve breakthroughs in speed and accuracy compared to classical approaches.

The Synergistic Power of AI and Quantum Computing

The combination of Artificial Intelligence and quantum computing creates a powerful synergy. AI significantly enhances quantum computing capabilities, and conversely, quantum computing unlocks new possibilities for AI.

- AI-optimized Quantum Algorithms: AI can be used to design and optimize quantum algorithms, improving their efficiency and performance.

- Error Correction in Quantum Computing: AI can help develop advanced error correction techniques, crucial for building more stable and reliable quantum computers.

- Quantum Machine Learning: Quantum computers can accelerate machine learning algorithms, leading to breakthroughs in areas like pattern recognition and data analysis.

This collaboration, resulting in hybrid quantum-classical algorithms, is a key driver of innovation and growth in this rapidly evolving field.

Analyzing the Specific AI Quantum Computing Stock: IonQ (IONQ)

Company Overview and Fundamentals

IonQ (IONQ) is a leading player in the quantum computing industry, specializing in trapped-ion quantum computers. Their business model focuses on providing cloud access to their quantum computers and developing quantum algorithms for various applications. Key financial metrics (while still early-stage) show strong growth potential, supported by significant investments and strategic partnerships.

- Recent Achievements: IonQ has demonstrated significant progress in qubit numbers and coherence times, key metrics for quantum computer performance.

- Partnerships: The company has established collaborations with major technology companies and research institutions.

- Patents: IonQ holds a strong patent portfolio protecting its innovative technology.

These factors demonstrate IonQ's commitment to pushing the boundaries of quantum computing technology.

Reasons for the Recent Dip

The recent dip in IonQ's stock price can be attributed to several factors:

- Market Correction: The broader market downturn has impacted many technology stocks, including those in the quantum computing sector.

- Sector-Specific Headwinds: Investor sentiment towards emerging technologies can be volatile, leading to periodic price fluctuations.

- Temporary Setbacks: While IonQ's progress has been remarkable, challenges in scaling up quantum computers are inherent to the technology.

These are temporary challenges, not indicative of fundamental flaws in IonQ's technology or business model.

Why the Dip Represents a Buying Opportunity

Despite the recent decline, IonQ's long-term growth potential remains exceptionally strong. The current stock valuation presents a unique opportunity for investors:

- Long-Term Growth Projections: Analysts predict significant growth in the quantum computing market over the next decade, positioning IonQ for substantial expansion.

- Potential Catalysts: Further advancements in qubit technology, strategic partnerships, and successful commercial applications could significantly boost the stock price.

- Comparison to Competitors: IonQ's technology and market positioning compare favorably to its competitors, making it a strong contender in the quantum computing race.

This confluence of factors suggests that the current price undervalues IonQ's long-term potential for significant returns. It represents an undervalued asset with potential for substantial upside.

Mitigating Risks and Due Diligence

Potential Risks Associated with Quantum Computing Investments

Investing in quantum computing, while potentially highly rewarding, carries inherent risks:

- Technological Hurdles: Scaling up quantum computers and achieving fault tolerance remain significant technological challenges.

- Regulatory Uncertainties: The regulatory landscape for quantum computing is still evolving, creating uncertainty.

- Competition: The quantum computing market is becoming increasingly competitive, with numerous players vying for market share.

A thorough understanding of these risks is crucial for informed investment decisions.

Conducting Thorough Due Diligence

Before investing in any AI quantum computing stock, including IonQ, it's essential to conduct thorough due diligence:

- Review Financial Reports: Analyze IonQ's financial statements, including revenue, expenses, and cash flow.

- Read Analyst Reviews: Consult reports from reputable financial analysts specializing in the technology sector.

- Stay Informed: Keep up-to-date on industry news and developments, understanding the competitive landscape.

This comprehensive approach minimizes investment risk and maximizes the chances of successful long-term returns.

Conclusion: Is This AI Quantum Computing Stock a Dip Buy Opportunity?

IonQ, with its advanced trapped-ion technology, strategic partnerships, and strong growth potential, presents a compelling dip buy opportunity in the exciting world of AI quantum computing. While risks exist in any emerging technology investment, the potential for significant long-term returns outweighs these concerns, especially given the current undervalued position.

With its promising technology and current undervalued position, this AI quantum computing stock could be a smart addition to your portfolio. Conduct thorough due diligence and consider adding this AI quantum computing stock to your investment strategy today. Remember to always consult with a financial advisor before making any investment decisions.

Featured Posts

-

The Gender Reveal Mummy Pig Welcomes A New Baby Pig

May 21, 2025

The Gender Reveal Mummy Pig Welcomes A New Baby Pig

May 21, 2025 -

Albrlman Aleraqy Ywafq Ela Tqaryr Dywan Almhasbt Bshan Almkhalfat 2022 2023

May 21, 2025

Albrlman Aleraqy Ywafq Ela Tqaryr Dywan Almhasbt Bshan Almkhalfat 2022 2023

May 21, 2025 -

Ginger Zee Of Gma Visits Wlos Ahead Of Asheville Rising Helene Special

May 21, 2025

Ginger Zee Of Gma Visits Wlos Ahead Of Asheville Rising Helene Special

May 21, 2025 -

New Indoor Bounce Park In Mesa Arizona Funbox Opens Its Doors

May 21, 2025

New Indoor Bounce Park In Mesa Arizona Funbox Opens Its Doors

May 21, 2025 -

Legal Battle Continues Ex Tory Councillors Wife And The Racial Hatred Tweet

May 21, 2025

Legal Battle Continues Ex Tory Councillors Wife And The Racial Hatred Tweet

May 21, 2025