Will Australian Assets Surge After The Election? Expert Analysis

Table of Contents

Potential Impacts on the Australian Property Market

The Australian property market is highly sensitive to government policy changes. The upcoming election promises significant shifts that could dramatically alter the landscape for property investors and homebuyers alike.

Government Policies and Housing Affordability

Government policies play a crucial role in shaping housing affordability and investment opportunities. Changes to tax policies, such as capital gains tax concessions or negative gearing rules, directly influence the attractiveness of property investment. Proposed changes to housing construction and supply, including initiatives to increase the number of affordable homes, also have significant implications. First-home buyer schemes, designed to assist entry into the market, can greatly influence demand.

- Potential Policy Impacts:

- Labor Party: May introduce stricter regulations on negative gearing, potentially reducing investor demand. They might also focus on increasing social housing supply.

- Liberal/National Coalition: May focus on deregulation and incentives for developers, aiming to increase supply and potentially driving up prices in certain sectors.

- Other Parties: Policies from smaller parties could introduce additional variables influencing the market, requiring closer examination.

Interest Rate Sensitivity and Mortgage Market

The Reserve Bank of Australia's (RBA) interest rate decisions are intrinsically linked to the election outcome. A change in government might lead to different economic priorities, impacting the RBA's approach to monetary policy. Interest rate hikes cool down a booming market, impacting borrowing capacity and potentially causing a decrease in property values. Conversely, interest rate cuts can stimulate demand.

- Potential Scenarios:

- Higher Interest Rates: Could lead to reduced borrowing capacity, slowing down market activity and potentially causing a correction in property prices.

- Lower Interest Rates: Could stimulate increased borrowing and higher demand, potentially driving up property prices, particularly in competitive markets.

- Status Quo: Maintaining current interest rates could lead to a relatively stable market, although other economic factors could still influence property values.

The Stock Market's Response to the Election Outcome

The Australian stock market's reaction to the election result will depend on a number of factors, including the perceived economic competence of the winning party, their proposed policies, and the overall global economic climate. Different sectors will experience varying levels of impact.

Sector-Specific Performance

Certain sectors will be more susceptible to policy changes than others. The resource sector (mining, energy) is heavily influenced by government regulations and resource prices. The financial sector's performance is often tied to interest rate movements and economic confidence. The technology and innovation sectors are sensitive to government support for R&D and technological advancement.

- Potential Sectoral Shifts:

- Resources: Increased focus on renewables could negatively impact fossil fuel companies, while support for mining could bolster related stocks.

- Financials: Interest rate decisions and economic stability greatly affect banks and financial institutions.

- Technology: Government investment in technology and innovation can create significant growth opportunities.

Investor Sentiment and Market Volatility

Investor sentiment is a critical factor. A decisive election result perceived as positive for the economy could boost confidence, while an unexpected or uncertain outcome might lead to short-term volatility. Understanding how to manage risk in a volatile market is crucial.

- Managing Market Volatility:

- Diversification: Spreading investments across different asset classes and sectors reduces risk.

- Long-Term Perspective: Maintaining a long-term investment strategy can help weather short-term market fluctuations.

- Professional Advice: Consulting a financial advisor can provide personalized guidance based on individual risk tolerance and investment goals.

Economic Indicators and Forecasting the Post-Election Economy

Analyzing key economic indicators is vital to forecasting the post-election economic climate. GDP growth projections, employment rates, and inflation are all interconnected and influential factors.

GDP Growth Projections

Various economic models provide differing projections for Australian GDP growth following the election. These forecasts incorporate various factors, such as projected inflation, employment levels, consumer spending, and global economic conditions.

- Key Factors Influencing GDP Growth:

- Inflation: High inflation can dampen consumer spending and hinder economic growth.

- Employment: Strong employment growth fuels economic activity and boosts consumer confidence.

- Government Spending: Government investment and policy decisions play a significant role.

Employment and Inflation Outlook

Government policies directly impact employment rates and inflation. For example, increased government spending might boost employment but could also lead to higher inflation if not managed effectively. The RBA’s response to inflation will influence interest rates, creating a ripple effect on the economy.

- Potential Economic Scenarios:

- Strong Growth, Moderate Inflation: A scenario of sustained economic growth with manageable inflation.

- Slow Growth, High Inflation: A scenario of slower economic expansion accompanied by persistent inflationary pressures.

- Recessionary Environment: A less likely but possible scenario involving negative economic growth and potential job losses.

Conclusion

This analysis has explored the multifaceted impact of the Australian election on various asset classes. The Australian property market and stock market are poised to respond to the new government's policies and the subsequent economic climate. The potential for a post-election surge in Australian assets is dependent on a myriad of factors, including the specific policies implemented, the RBA's response, and global economic trends. The overall performance of Australian assets post-election will depend heavily on the economic climate.

Understanding the potential consequences of the upcoming Australian election on your investments is crucial. Stay informed and prepare for a potentially dynamic market by conducting thorough due diligence and seeking professional financial advice regarding your Australian assets. Begin planning your post-election investment strategy today!

Featured Posts

-

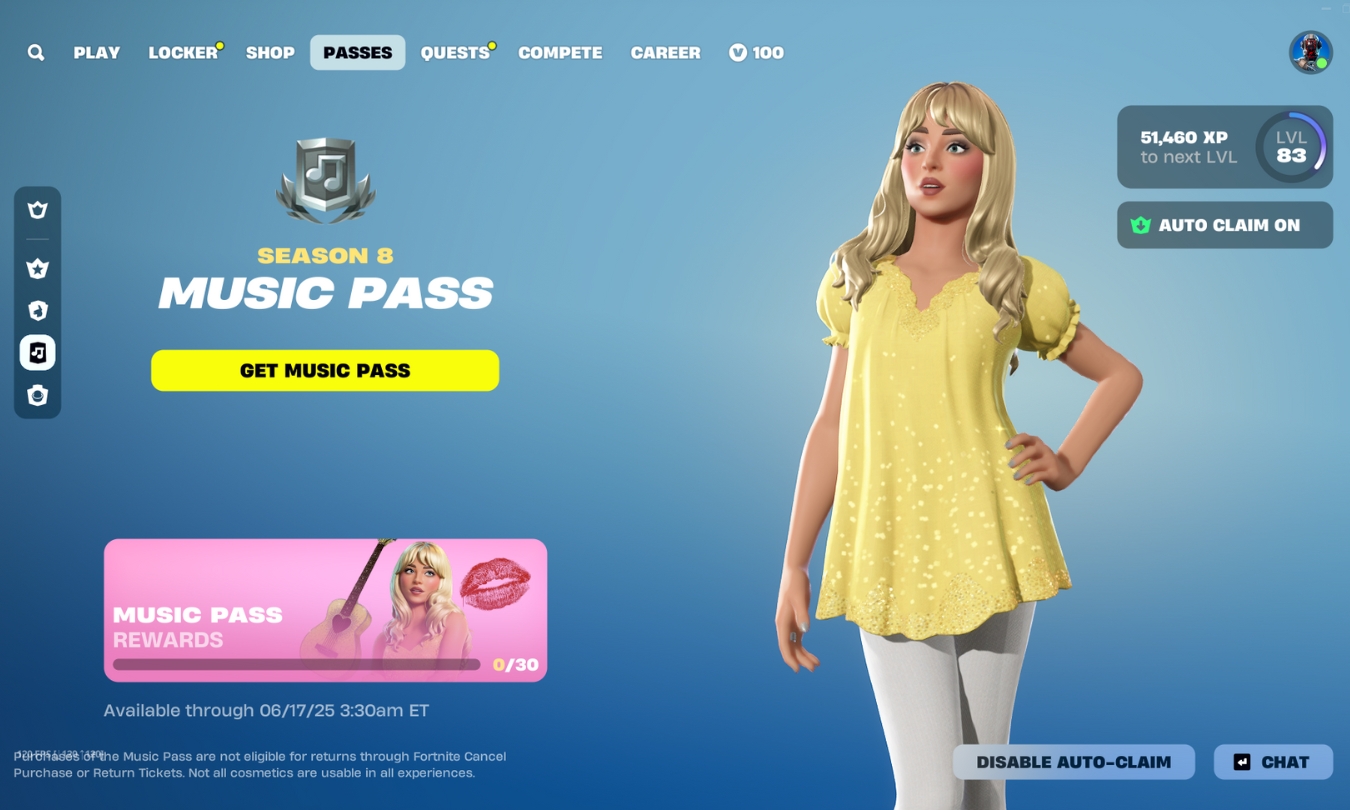

Obtaining Sabrina Carpenter Fortnite Skins A Step By Step Guide

May 06, 2025

Obtaining Sabrina Carpenter Fortnite Skins A Step By Step Guide

May 06, 2025 -

Daughters Cryptic Remarks About Ashton Kutcher Spark Controversy

May 06, 2025

Daughters Cryptic Remarks About Ashton Kutcher Spark Controversy

May 06, 2025 -

Gypsy Rose Blanchards Weight Loss A Postpartum Success Story

May 06, 2025

Gypsy Rose Blanchards Weight Loss A Postpartum Success Story

May 06, 2025 -

Robert Pattinson More Than Just An Actor A Diaper Changing Expert

May 06, 2025

Robert Pattinson More Than Just An Actor A Diaper Changing Expert

May 06, 2025 -

Tracee Ellis Ross On Dating And Loneliness A Candid Conversation With Michelle Obama

May 06, 2025

Tracee Ellis Ross On Dating And Loneliness A Candid Conversation With Michelle Obama

May 06, 2025