Will Canadian Tire's Acquisition Of Hudson's Bay Succeed? A Cautious Analysis

Table of Contents

Canadian Tire's acquisition of Hudson's Bay Company (HBC) is a seismic event in the Canadian retail landscape. This massive merger, announced in 2023, promises significant potential but also presents considerable challenges. Will this bold strategic move result in a powerhouse retailer or a costly misstep? This analysis will delve into the key factors determining the success or failure of Canadian Tire's ambitious undertaking. We'll explore the potential synergies, the competitive pressures, and the financial implications of this landmark acquisition.

Synergies and Overlap: Can Canadian Tire and Hudson's Bay Integrate Effectively?

The success of this merger hinges on the ability of Canadian Tire to effectively integrate two very different retail brands. Significant synergies are promised, but substantial obstacles must be overcome.

Product Overlap and Brand Differentiation

A key challenge lies in the overlap of certain product categories. Both retailers offer home goods, apparel, and some sporting goods. This presents a risk of cannibalization – where one brand's sales negatively impact the other's.

- Examples of overlapping product categories: Home décor, bedding, kitchenware, basic apparel.

- Strategies to avoid cannibalization: Clear brand differentiation through targeted marketing and distinct product offerings. Positioning Hudson's Bay as a more upscale, aspirational brand, while maintaining Canadian Tire's focus on value and practicality. Potential for rebranding or repositioning certain HBC brands to minimize direct competition.

- Potential for rebranding or repositioning of HBC brands: Restructuring the HBC brand portfolio to focus on specific niches or price points, thus minimizing direct competition with Canadian Tire’s existing offerings.

Supply Chain Integration and Efficiency

Consolidating supply chains offers significant potential for cost savings and improved efficiency. However, merging two disparate systems presents considerable logistical hurdles.

- Potential areas of synergy in distribution and warehousing: Combined warehousing and distribution networks can lead to economies of scale, reduced transportation costs, and more efficient inventory management.

- Challenges in merging disparate systems: Integrating different IT systems, inventory management software, and logistics platforms will require significant investment and expertise. Potential for disruptions during the integration process.

- Potential for economies of scale: Increased purchasing power through combined volume, leading to lower costs for both retailers.

Market Competition and Consumer Behaviour

Canadian Tire faces a highly competitive retail environment. The combined entity must navigate the challenges of established giants and evolving consumer preferences.

Competition from Other Retailers

Walmart, Amazon, and other major retailers exert significant pressure on the Canadian market. The merged entity must develop a strong competitive strategy to gain and maintain market share.

- Key competitors and their market share: Analyzing the market share of major competitors like Walmart, Amazon, Loblaws, and others is crucial to understand the competitive landscape.

- Strategies to differentiate against competitors: Leveraging the combined strengths of both brands – Canadian Tire’s focus on value and automotive services, and Hudson’s Bay’s appeal to a more upscale customer. Investing in omnichannel capabilities to compete effectively with online retailers.

- Analysis of market saturation: Understanding the level of saturation in specific market segments is critical for strategic planning and identifying growth opportunities.

Changing Consumer Preferences

Evolving consumer behaviour, particularly the growth of e-commerce, demands adaptability and innovation.

- Growth of e-commerce: The rise of online shopping requires a robust and user-friendly e-commerce platform for both brands.

- Shifting shopping habits: Understanding changing consumer preferences, including sustainable practices and ethical sourcing, is vital for long-term success.

- The importance of omnichannel strategies: A seamless integration of online and offline shopping experiences is crucial to attract and retain customers.

Financial Viability and Investment Risk

The acquisition's financial implications are paramount. Canadian Tire must carefully manage debt levels and ensure a reasonable return on investment.

Debt Levels and Financial Burden

Acquiring Hudson's Bay's debt significantly impacts Canadian Tire's financial health. Careful management is crucial to avoid jeopardizing its financial stability.

- Analysis of Canadian Tire’s current financial strength: Assessing Canadian Tire’s existing debt levels, cash flow, and profitability is vital to determine its capacity to absorb HBC’s debt.

- Assessment of acquisition financing: Understanding the terms and conditions of the financing used to fund the acquisition.

- Potential impact on credit rating: The increased debt burden could affect Canadian Tire's credit rating, potentially increasing borrowing costs in the future.

Return on Investment and Long-Term Growth

The long-term success of this merger rests on generating a substantial return on investment and achieving sustainable growth.

- Projected synergies and cost savings: Accurate projections of cost savings and increased revenue from synergies are crucial for determining the ROI.

- Potential for increased market share: The combined entity has the potential to gain market share by leveraging the strengths of both brands and expanding its customer base.

- Evaluation of risk factors: Careful assessment of potential risks, including integration challenges, competitive pressures, and economic downturns, is essential for informed decision-making.

Conclusion

The Canadian Tire-Hudson's Bay acquisition presents a complex picture with both significant opportunities and considerable risks. While the potential for synergies in supply chain management and expanded market reach is substantial, integrating two distinct retail brands, navigating intense competition, and managing a significant debt burden will require careful execution and strategic adaptation. The success of this merger remains uncertain and warrants continued observation. Will Canadian Tire successfully navigate these challenges and create a retail powerhouse? Only time will tell. Continue following the story and engage in discussions about the future of Canadian Tire's acquisition of Hudson's Bay. Further research into Canadian retail market trends and corporate merger analyses will provide additional insights into this unfolding narrative.

Featured Posts

-

Photos Cassie Venturas Stunning Red Carpet Look While Pregnant At Mob Land Premiere

May 18, 2025

Photos Cassie Venturas Stunning Red Carpet Look While Pregnant At Mob Land Premiere

May 18, 2025 -

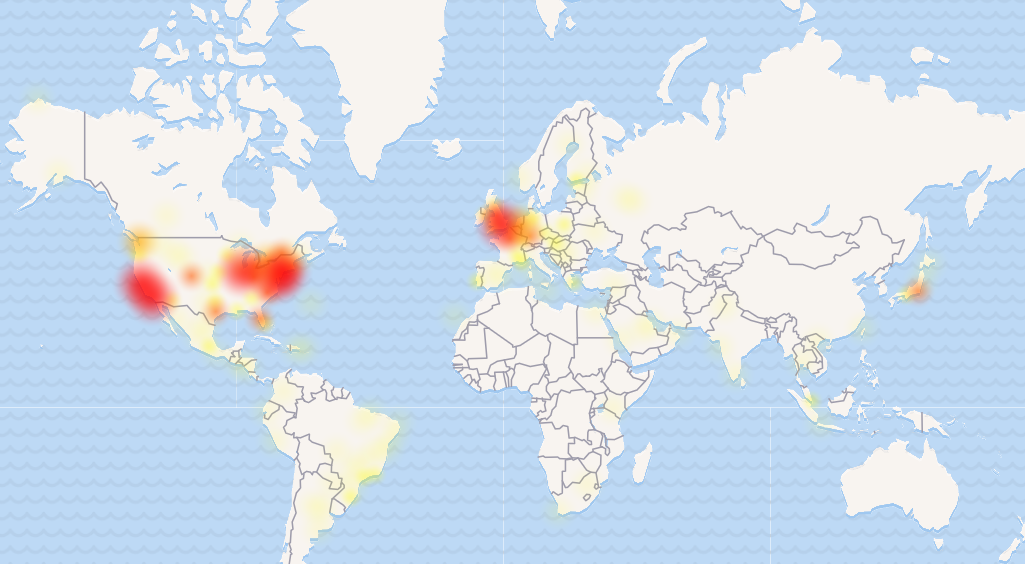

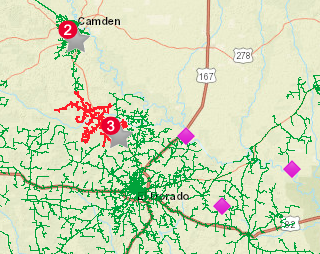

Reddit Experiencing Major Outage Users Affected Worldwide

May 18, 2025

Reddit Experiencing Major Outage Users Affected Worldwide

May 18, 2025 -

Classmate Shares Account Of Amanda Bynes Past At School

May 18, 2025

Classmate Shares Account Of Amanda Bynes Past At School

May 18, 2025 -

Reddit Issues Widespread Outage Reported Globally

May 18, 2025

Reddit Issues Widespread Outage Reported Globally

May 18, 2025 -

Metropolis Japan Unveiling The Urban Landscape

May 18, 2025

Metropolis Japan Unveiling The Urban Landscape

May 18, 2025

Latest Posts

-

Nfl Analyst Predicts Patriots Trajectory Following 2025 Draft

May 18, 2025

Nfl Analyst Predicts Patriots Trajectory Following 2025 Draft

May 18, 2025 -

Patriots Future Nfl Analyst Weighs In After 2025 Draft

May 18, 2025

Patriots Future Nfl Analyst Weighs In After 2025 Draft

May 18, 2025 -

You Toon Caption Contest Winner Announced Booing Bears Takes The Prize

May 18, 2025

You Toon Caption Contest Winner Announced Booing Bears Takes The Prize

May 18, 2025 -

The Swim With Mike Program A Lifeline For The Trojan Community

May 18, 2025

The Swim With Mike Program A Lifeline For The Trojan Community

May 18, 2025 -

Brave Suffolk Teen Rescues Child From Drowning

May 18, 2025

Brave Suffolk Teen Rescues Child From Drowning

May 18, 2025