Will Canadian Tire's Acquisition Of Hudson's Bay Succeed? A Cautious Outlook

Table of Contents

Overlapping Customer Bases and Brand Synergies

The success of this merger hinges significantly on the synergy between Canadian Tire and Hudson's Bay's customer bases. While seemingly disparate at first glance – one focusing on automotive, home improvement, and sporting goods, the other on apparel and home furnishings – there is considerable overlap in their demographics. Both cater to a broad range of middle-class consumers.

Canadian Tire could leverage Hudson's Bay's stronger presence in urban centers, expanding its reach beyond its traditional suburban footprint. Cross-promotion opportunities abound; imagine Canadian Tire's auto parts advertised within Hudson's Bay's catalogues, or Hudson's Bay home décor featured in Canadian Tire stores. However, challenges remain.

- Potential for increased market share: Combining customer databases could significantly boost market share.

- Integration challenges: Merging disparate brand identities and loyalty programs poses a significant hurdle. Maintaining customer loyalty across both brands requires careful navigation.

- Opportunities for bundled offerings: Cross-promotions and bundled offers could attract new customers and increase average transaction values. Think discounts on home improvement supplies with the purchase of new patio furniture.

- Risks of alienating existing customer bases: A poorly executed integration could alienate existing customers loyal to either brand.

Integration Challenges and Operational Efficiency

Merging two large retail organizations is inherently complex. Canadian Tire's acquisition of Hudson's Bay presents significant integration challenges across various operational areas. Seamless integration is crucial for success. Failure to achieve this could lead to significant financial losses and reputational damage.

- IT integration costs and delays: Harmonizing IT systems, including inventory management, point-of-sale systems, and customer relationship management (CRM) will be costly and time-consuming.

- Streamlining operations and reducing redundancies: Identifying and eliminating redundancies in staffing, warehousing, and supply chain will be essential for maximizing efficiency. This could lead to job losses, impacting employee morale.

- Impact of potential job losses: Potential layoffs are a major risk, affecting not only employees but also potentially harming customer perception and brand image.

- Operational disruptions: The integration process itself will likely cause operational disruptions, potentially impacting sales and customer satisfaction.

Competitive Landscape and Market Dynamics

The Canadian retail market is fiercely competitive. Established players like Walmart and Amazon pose significant challenges. Canadian Tire's acquisition of Hudson's Bay alters the competitive landscape, but its impact remains uncertain.

- Major competitors and market share: Walmart and Amazon dominate online and brick-and-mortar retail, holding substantial market share. This acquisition needs to create a compelling value proposition to compete effectively.

- Potential for price wars: The combined entity might engage in price wars to gain market share, potentially squeezing profit margins.

- Impact of e-commerce: A robust e-commerce strategy is vital to compete with Amazon. Integrating online and offline sales channels seamlessly will be crucial.

- Differentiation from competitors: The combined entity needs to differentiate its offering through superior customer service, exclusive products, or a compelling brand narrative.

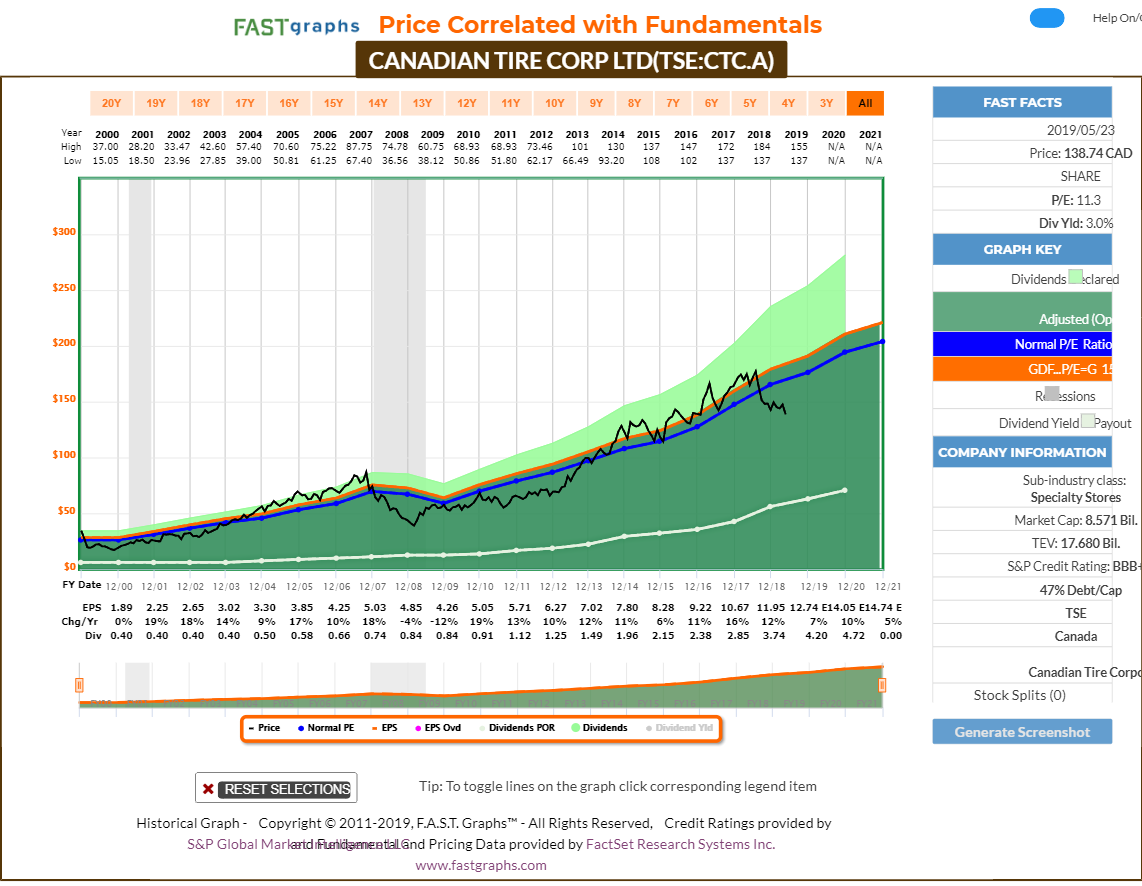

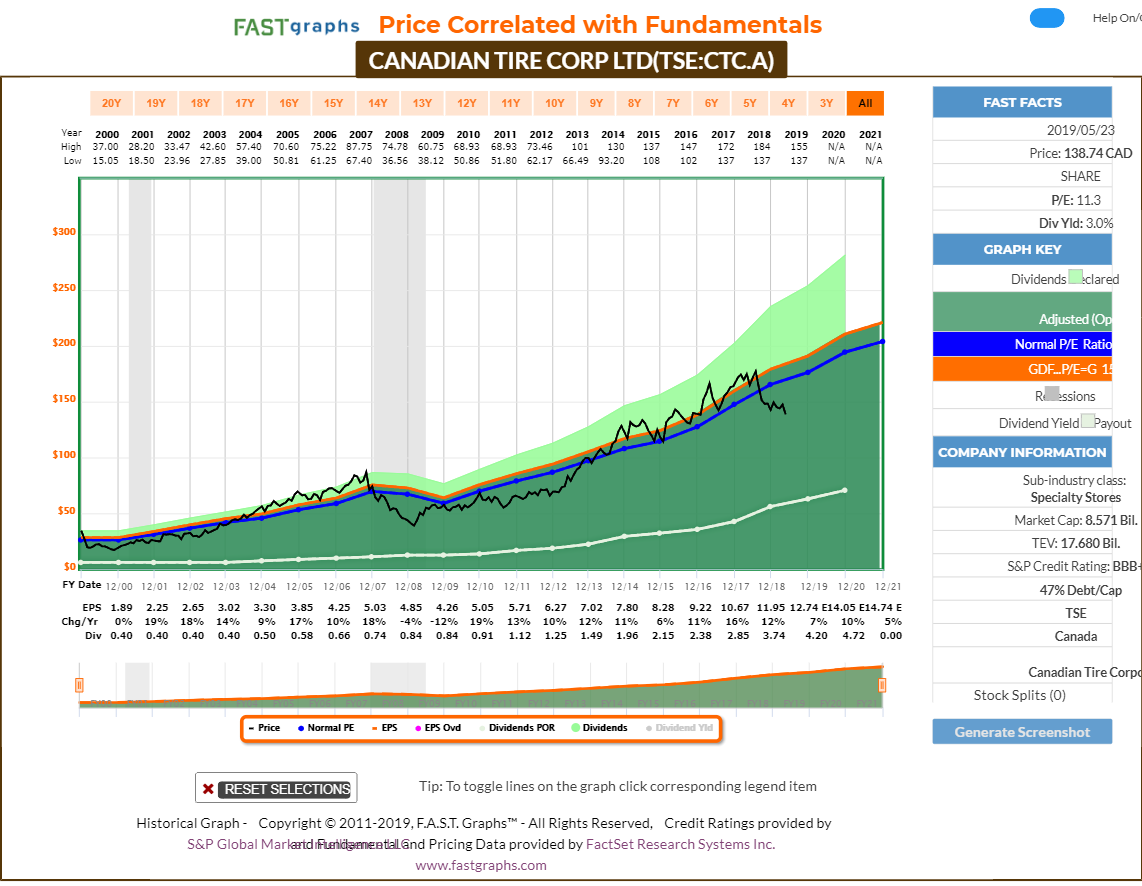

Financial Implications and Return on Investment

The financial implications of this acquisition are substantial. The purchase price, financing methods, and projected ROI all play critical roles in determining the long-term success. Unforeseen costs and delays could significantly impact profitability.

- Acquisition cost and debt levels: The acquisition's cost will significantly impact Canadian Tire's debt levels, potentially affecting its financial flexibility.

- Projected financial performance: Accurate forecasting of the combined entity's financial performance is crucial, factoring in synergies and integration costs.

- Sensitivity analysis of key assumptions: Conducting a sensitivity analysis to understand the impact of various assumptions on ROI is vital for informed decision-making.

- Potential for unforeseen costs and delays: Unforeseen challenges during the integration process could lead to cost overruns and delays, negatively impacting profitability.

Conclusion: Will Canadian Tire's Acquisition of Hudson's Bay Ultimately Succeed?

Canadian Tire's acquisition of Hudson's Bay presents a complex scenario with significant potential benefits and considerable risks. While the potential synergies in customer reach and cross-promotion are appealing, the integration challenges and competitive landscape pose significant hurdles. The financial implications, including the acquisition cost and potential for unforeseen expenses, demand cautious optimism. Ultimately, the success of this merger hinges on the execution of a flawless integration strategy and a compelling value proposition that resonates with consumers in an increasingly competitive market.

What are your thoughts on Canadian Tire's Acquisition of Hudson's Bay? Do you believe this merger will succeed, or are you more cautious? Share your predictions and insights in the comments below!

Featured Posts

-

The Gretzky Loyalty Debate Examining The Fallout From Trumps Tariffs And Statehood Proposals

May 20, 2025

The Gretzky Loyalty Debate Examining The Fallout From Trumps Tariffs And Statehood Proposals

May 20, 2025 -

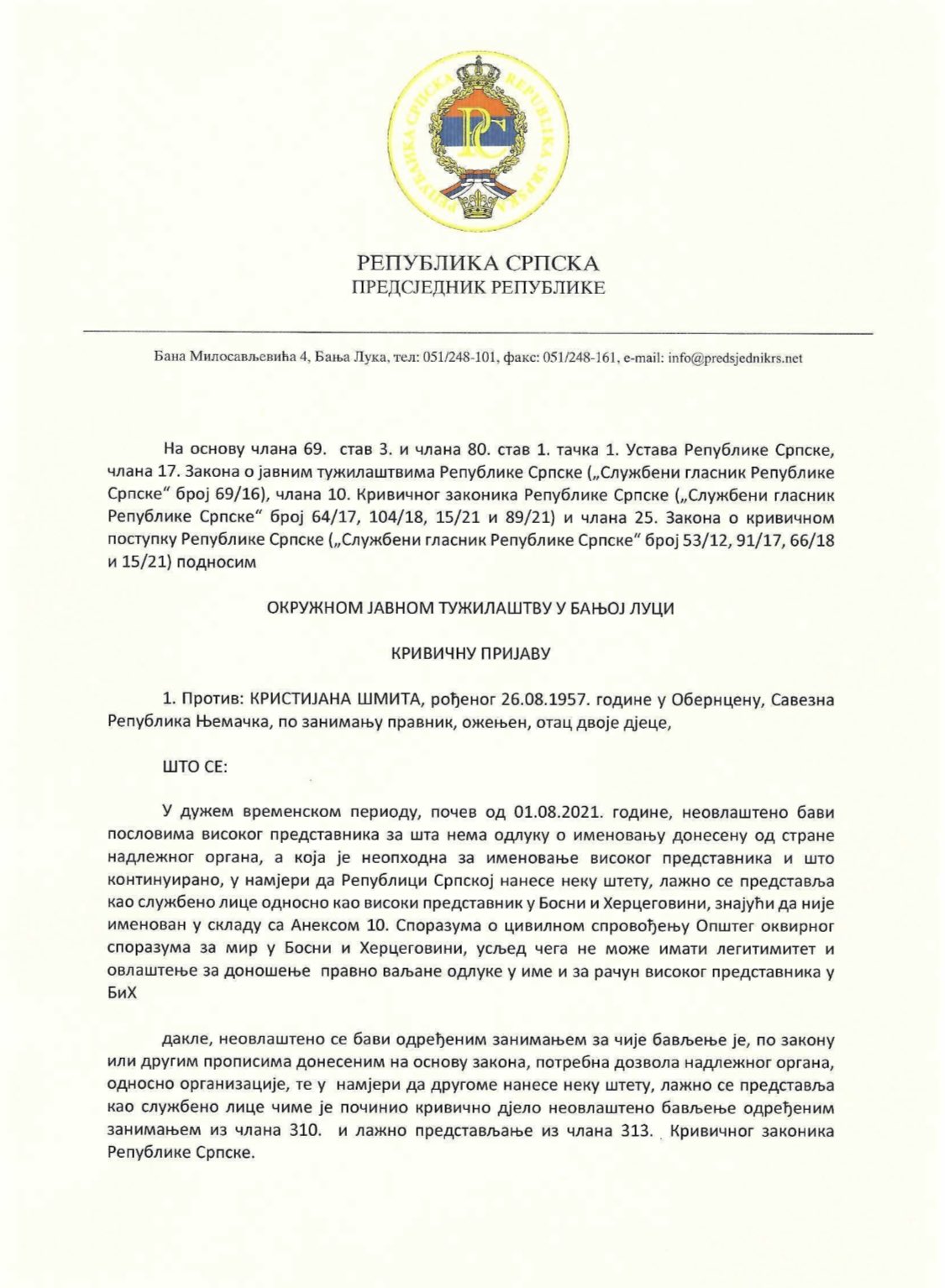

Napad Na Detsu U Bi Kh Tadi Optuzhu E Shmita Za Trogodishnji Sukob

May 20, 2025

Napad Na Detsu U Bi Kh Tadi Optuzhu E Shmita Za Trogodishnji Sukob

May 20, 2025 -

Ftc Challenges Court Ruling On Microsofts Activision Buyout

May 20, 2025

Ftc Challenges Court Ruling On Microsofts Activision Buyout

May 20, 2025 -

New Hmrc Rules Eliminate Tax Returns For Many

May 20, 2025

New Hmrc Rules Eliminate Tax Returns For Many

May 20, 2025 -

Postman Pro Tips Hidden Features You Never Knew Existed

May 20, 2025

Postman Pro Tips Hidden Features You Never Knew Existed

May 20, 2025

Latest Posts

-

Benjamin Kaellman Kehitys Ja Potentiaali Huuhkajissa

May 20, 2025

Benjamin Kaellman Kehitys Ja Potentiaali Huuhkajissa

May 20, 2025 -

Benjamin Kaellman Potentiaalia Huuhkajien Hyoekkaeykseen

May 20, 2025

Benjamin Kaellman Potentiaalia Huuhkajien Hyoekkaeykseen

May 20, 2025 -

Huuhkajat Saavat Uutta Voimaa Kaellmanista

May 20, 2025

Huuhkajat Saavat Uutta Voimaa Kaellmanista

May 20, 2025 -

Rtl Groups Streaming Business Progress Towards Profitability

May 20, 2025

Rtl Groups Streaming Business Progress Towards Profitability

May 20, 2025 -

Kaellmanin Nousu Kenttien Ja Katsomojen Ulkopuolella

May 20, 2025

Kaellmanin Nousu Kenttien Ja Katsomojen Ulkopuolella

May 20, 2025