Will Palantir Be A Trillion-Dollar Company By 2030? An In-Depth Analysis

Table of Contents

The question burning in the minds of many investors is: Will Palantir be a trillion-dollar company by 2030? Currently boasting a significantly lower market capitalization, such a leap would represent an extraordinary growth trajectory for the data analytics giant. This in-depth analysis will explore the feasibility of this ambitious goal, examining Palantir's current market position, future growth prospects, and the various factors that could contribute to—or hinder—its journey to a trillion-dollar valuation. We will delve into Palantir stock performance, its valuation, its future in the rapidly evolving data analytics market, and the potential challenges it faces.

H2: Palantir's Current Market Position and Growth Strategy:

H3: Analyzing Palantir's Revenue Streams and Growth Rate:

Palantir's revenue streams are primarily derived from two segments: government contracts and commercial clients. The government sector, historically a significant contributor, provides a stable revenue base but often involves lengthy procurement cycles. The commercial sector, while potentially offering faster growth, requires robust sales efforts and competitive pricing strategies. Analyzing Palantir's financial reports reveals a fluctuating year-over-year growth rate in recent years. Sustaining a high revenue growth rate is crucial for achieving a trillion-dollar valuation. We need to carefully track their revenue growth, analyzing the contribution of each segment and the overall trend to predict future performance. This requires a detailed look at their government contracts, commercial partnerships, and the success of their platform expansion.

H3: Competitive Landscape and Market Share:

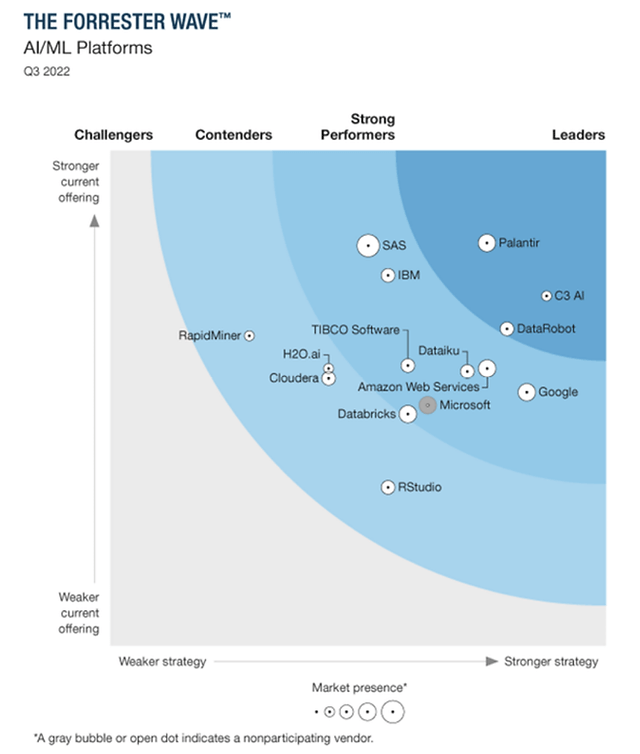

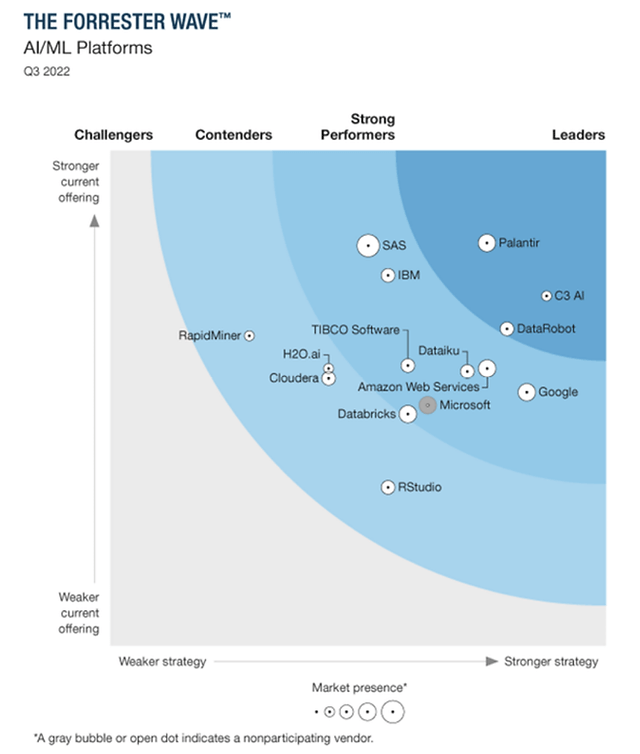

Palantir operates in a fiercely competitive landscape, facing formidable rivals like AWS, Google Cloud, and Microsoft Azure. These tech giants possess vast resources and established market presence, presenting significant challenges to Palantir's ambitions. Maintaining or increasing market share necessitates continuous technological innovation, strategic partnerships, and effective marketing strategies. Key to success will be Palantir's ability to differentiate itself through superior data analytics capabilities, focusing on specific niche markets, and building strong customer relationships. Success in the data analytics and artificial intelligence markets requires agility and adaptability.

- Palantir's key technological advantages: Proprietary algorithms and data integration capabilities.

- Strategic partnerships: Collaborations with technology providers and industry leaders can enhance market reach.

- Potential for expansion into new markets: Exploring untapped sectors like healthcare and finance.

H2: Factors Contributing to (or Hindering) a Trillion-Dollar Valuation:

H3: Technological Innovation and Future Product Development:

Palantir's future hinges on its ability to continuously innovate and develop cutting-edge products. Investment in research and development (R&D) focusing on artificial intelligence (AI), machine learning, and advanced data mining techniques will be paramount. Successful product innovation will drive customer adoption, expansion into new markets, and ultimately, increased revenue. The company's ability to leverage AI to improve the efficiency and effectiveness of its platform will be key to future growth. We must assess the rate of innovation and the potential market impact of new Palantir products.

H3: Market Demand and Global Adoption of Data Analytics:

The global demand for data analytics solutions is rapidly increasing, presenting a significant opportunity for Palantir. Businesses across various sectors are increasingly recognizing the importance of data-driven decision-making, fueling the growth of the data analytics market. Palantir's ability to capitalize on this trend, penetrate new markets, and demonstrate the value of its platform will determine its success. Tracking global market size and Palantir's market penetration rate will give us a clearer picture of its growth trajectory.

H3: Economic and Geopolitical Factors:

Global economic conditions, geopolitical instability, and regulatory changes pose considerable risks to Palantir's growth potential. Recessions can significantly impact spending on data analytics solutions, potentially affecting both government and commercial contracts. Geopolitical risks, including trade wars and international conflicts, could disrupt supply chains and impact market demand. Changes in regulations, particularly in data privacy and security, could present compliance challenges and increase operational costs. An accurate assessment of these risks is crucial in evaluating Palantir's valuation.

- Potential impact of recessionary pressures: Reduced demand for data analytics solutions.

- Role of government regulations: Compliance costs and potential restrictions on data usage.

- Influence of technological disruptions: Emergence of competing technologies and platforms.

H2: Financial Projections and Valuation Analysis:

H3: Analyzing Palantir's Financial Statements:

A thorough review of Palantir's financial statements—including revenue, profit margins, and cash flow—is essential for assessing the sustainability and growth potential of the business. Key metrics like return on investment (ROI) and operating profit margins must be analyzed to understand the company's profitability and efficiency. Consistency in generating positive cash flow is vital for sustaining growth and justifying a high valuation.

H3: Discounted Cash Flow (DCF) Analysis:

A DCF model provides a valuable tool for estimating Palantir's future cash flows and arriving at a potential valuation by 2030. However, the accuracy of the DCF heavily depends on the assumptions used, particularly regarding future revenue growth rates and discount rates. Multiple scenarios must be considered to understand the range of possible valuations. Transparency in the assumptions made is crucial for understanding the reliability of the DCF model’s projection.

H3: Comparable Company Analysis (CCA):

Comparing Palantir's valuation multiples (such as Price-to-Earnings ratio and Price-to-Sales ratio) with those of similar companies provides valuable insights into its relative valuation. Identifying comparable companies in the data analytics and AI sectors allows us to assess whether Palantir is overvalued or undervalued relative to its peers. However, perfect comparables are rare, so caution is needed when using CCA for valuation purposes.

- Financial projections: Presented in a clear and concise tabular format.

- Limitations of valuation models: Acknowledging the inherent uncertainties and assumptions in any valuation exercise.

- Potential scenarios: Highlighting different outcomes based on varying assumptions regarding growth rates and market conditions.

Conclusion:

Will Palantir be a trillion-dollar company by 2030? Based on our analysis, reaching such a valuation by 2030 presents significant challenges, but is not entirely improbable. Success depends heavily on continuous technological innovation, sustained revenue growth across both government and commercial sectors, and the ability to navigate a competitive landscape and various macroeconomic headwinds. Palantir's success hinges on its ability to execute its growth strategy, effectively manage risks, and capitalize on the burgeoning demand for data analytics solutions. Key takeaways include the importance of sustained technological innovation, the role of government and commercial revenue streams, and the influence of external factors.

What are your thoughts on Palantir's potential to become a trillion-dollar company? Share your predictions and insights in the comments below! For further research on Palantir's stock and future prospects, explore reputable financial news sources and investment analysis platforms.

Featured Posts

-

The Implications Of Trumps Nomination Of Casey Means For Surgeon General

May 10, 2025

The Implications Of Trumps Nomination Of Casey Means For Surgeon General

May 10, 2025 -

Divine Mercy Extended Religious Life And Gods Compassion In 1889

May 10, 2025

Divine Mercy Extended Religious Life And Gods Compassion In 1889

May 10, 2025 -

10 Essential Film Noir Movies To Watch

May 10, 2025

10 Essential Film Noir Movies To Watch

May 10, 2025 -

The Nnpc And Dangote Collaboration And Competition In The Fuel Sector

May 10, 2025

The Nnpc And Dangote Collaboration And Competition In The Fuel Sector

May 10, 2025 -

Les Miserables Cast May Boycott Trumps Kennedy Center Appearance

May 10, 2025

Les Miserables Cast May Boycott Trumps Kennedy Center Appearance

May 10, 2025

Latest Posts

-

Finding Value And History A Look At Celebrity Antiques Road Trip

May 10, 2025

Finding Value And History A Look At Celebrity Antiques Road Trip

May 10, 2025 -

Nottingham Attack Survivor Speaks Out Heartbreaking Plea After Triple Killing

May 10, 2025

Nottingham Attack Survivor Speaks Out Heartbreaking Plea After Triple Killing

May 10, 2025 -

Investigation Launched After Illegal Access Of Stabbing Victims Records By Nhs Staff In Nottingham

May 10, 2025

Investigation Launched After Illegal Access Of Stabbing Victims Records By Nhs Staff In Nottingham

May 10, 2025 -

Understanding Wynne And Joanna All At Sea

May 10, 2025

Understanding Wynne And Joanna All At Sea

May 10, 2025 -

Nottingham Stabbing Police Probe Into Unauthorized Access Of Patient Records By Nhs Staff

May 10, 2025

Nottingham Stabbing Police Probe Into Unauthorized Access Of Patient Records By Nhs Staff

May 10, 2025