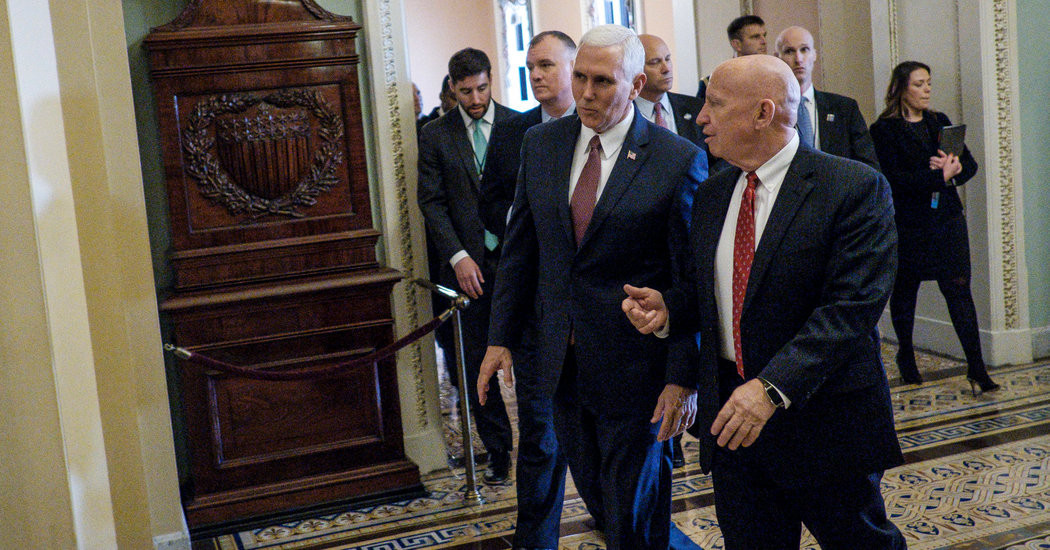

Will Republican Infighting Sink Trump's Tax Bill?

Table of Contents

The Key Points of Contention within the Republican Party

The Republican tax plan, even within the GOP, is not without its critics. Deep disagreements exist on several crucial aspects of the proposed legislation, threatening to derail the entire initiative. This intra-party conflict showcases the fault lines within the Republican coalition.

-

Differing Opinions on Corporate Tax Rates: A central point of contention revolves around the proposed corporate tax rate. While some Republicans advocate for a significant reduction to boost economic growth, others express concern about the potential impact on the national debt and argue for a more moderate decrease. This debate pits fiscal conservatives against those prioritizing economic stimulus.

-

Debate Surrounding Individual Tax Cuts and Their Impact on the Deficit: The individual tax cuts included in the Republican tax plan have also sparked intense debate. Concerns over the potential increase in the national deficit are fueling disagreements between those prioritizing tax relief for individuals and those emphasizing fiscal responsibility. Senators like [Insert Senator's Name], known for their fiscally conservative stance, have voiced strong reservations.

-

Disagreements on the Elimination or Modification of Specific Deductions: The proposed elimination or modification of certain deductions, such as the state and local tax (SALT) deduction, has further exacerbated internal divisions. This issue particularly impacts high-tax states, leading to strong opposition from Republican representatives from those regions. The conflict highlights the tension between national economic policy and the interests of specific states.

-

Internal Struggles Between Different Factions within the Republican Party: The Republican party is not a monolith. The clash between fiscal conservatives, who prioritize balanced budgets, and more moderate Republicans, who favor greater government spending in certain areas, significantly impacts the tax reform debate. This internal struggle plays out in the Senate and House, shaping the legislative process.

-

Specific Republican Senators or Representatives Known for Their Opposition or Skepticism: [Insert Names of Specific Republican Senators/Representatives and their stated concerns]. Their opposition represents a significant challenge to the bill's passage, demonstrating the depth of the internal divisions.

The Potential Consequences of Republican Divisions

The continued infighting within the Republican party carries potentially severe consequences for the tax bill and the broader political landscape.

-

Failure to Pass the Bill Entirely: The most significant risk is the complete failure to pass the Republican tax plan. This outcome would be a major setback for the Trump administration and the Republican party, undermining their legislative agenda.

-

Significant Amendments Weakening the Bill’s Impact: Even if the bill is passed, extensive amendments to address the concerns of dissenting Republicans could significantly weaken its intended impact. This would lead to a diluted version of the original plan, potentially failing to deliver on its economic promises.

-

Delays in the Legislative Process Leading to Uncertainty in the Market: Prolonged infighting and legislative gridlock could create uncertainty in the financial markets, potentially hindering economic growth. Investors may postpone investments until the future of the tax policy is clearer.

-

Damage to the Republican Party’s Image and Credibility: The public perception of the Republican party could suffer significantly if the infighting prevents the passage of a key legislative promise. This could have lasting political consequences.

-

Political Ramifications for the 2022 Mid-Term Elections: The failure to pass the tax bill could hurt Republican chances in the 2022 mid-term elections, as voters may punish the party for its inability to govern effectively.

External Factors Influencing the Outcome

Internal divisions within the Republican party are not the only factor influencing the fate of the tax bill. External factors also play a significant role.

-

Public Opinion and Polling Data on the Tax Bill: Public opinion polls reveal a mixed reaction to the proposed Republican tax plan, with some segments of the population expressing strong support while others harbor significant reservations. This public sentiment can influence lawmakers' decisions.

-

Lobbying Efforts by Interest Groups: Powerful interest groups are actively lobbying Congress to influence the final version of the bill. Groups like [mention specific interest groups] are actively involved in shaping the debate.

-

The Role of the Media in Shaping Public Perception: Media coverage significantly shapes public perception of the tax bill and the ongoing Republican infighting. This media narrative can impact public opinion and sway lawmakers' decisions.

-

Potential Influence of the Democratic Party: Although the Democrats lack the power to block the bill outright (assuming unified Republican support), their strategic actions and public statements can influence the negotiations and outcome.

Analyzing the Likelihood of Success (or Failure)

Predicting the outcome of the Republican tax bill is challenging due to the complex interplay of internal and external factors. A best-case scenario sees Republicans overcoming their internal differences and passing a modified version of the bill. A worst-case scenario involves the bill's complete failure, leading to significant political fallout. The most likely scenario involves a compromised bill with significant amendments that water down its original intent, possibly disappointing both proponents and opponents. Political analysis suggests that the probability of success hinges largely on the willingness of key Republican figures to compromise and find common ground. The tax reform outlook appears uncertain at present, demanding close monitoring of the ongoing legislative process.

Conclusion

The fate of Trump's tax bill hangs precariously in the balance. Key areas of disagreement within the Republican party, the potential for legislative gridlock, and external pressures all contribute to a highly uncertain outlook. The potential consequences – from a weakened bill to complete failure – are significant and will have wide-ranging implications. Will Republican infighting ultimately sink this ambitious piece of legislation? Stay informed about the ongoing developments surrounding this critical political issue and the future of Republican tax policy. Follow our blog for the latest updates on the Republican tax bill.

Featured Posts

-

Anthony Edwards 50 K Nba Fine For Inappropriate Fan Response

Apr 29, 2025

Anthony Edwards 50 K Nba Fine For Inappropriate Fan Response

Apr 29, 2025 -

Teens Rock Throwing One Convicted Of Murder

Apr 29, 2025

Teens Rock Throwing One Convicted Of Murder

Apr 29, 2025 -

Starbucks Union Rejects Companys Proposed Wage Increase

Apr 29, 2025

Starbucks Union Rejects Companys Proposed Wage Increase

Apr 29, 2025 -

The Unexpected Rise Of Macario Martinez From Street Sweeper To National Fame

Apr 29, 2025

The Unexpected Rise Of Macario Martinez From Street Sweeper To National Fame

Apr 29, 2025 -

A Geographic Analysis Of Emerging Business Hot Spots

Apr 29, 2025

A Geographic Analysis Of Emerging Business Hot Spots

Apr 29, 2025

Latest Posts

-

Nyt Strands Answers Monday March 31 2024 Game 393

Apr 29, 2025

Nyt Strands Answers Monday March 31 2024 Game 393

Apr 29, 2025 -

Complete Guide To Nyt Strands Hints And Answers March 3 2025

Apr 29, 2025

Complete Guide To Nyt Strands Hints And Answers March 3 2025

Apr 29, 2025 -

Nyt Strands Answers April 3 2025 Find The Spangram

Apr 29, 2025

Nyt Strands Answers April 3 2025 Find The Spangram

Apr 29, 2025 -

Nyt Strands Hints And Answers For The March 3 2025 Puzzle

Apr 29, 2025

Nyt Strands Hints And Answers For The March 3 2025 Puzzle

Apr 29, 2025 -

Solve Nyt Strands Game 393 March 31 Hints And Solutions

Apr 29, 2025

Solve Nyt Strands Game 393 March 31 Hints And Solutions

Apr 29, 2025