Will Ripple's XRP Price Hit $3.40? A Deep Dive Into Market Dynamics

Table of Contents

Ripple's Legal Battle and its Impact on XRP Price

The ongoing SEC lawsuit against Ripple significantly impacts XRP's price and overall market sentiment. Keywords related to this section include: Ripple lawsuit SEC, XRP SEC lawsuit, Ripple legal outcome, XRP price lawsuit impact, Ripple vs SEC. The outcome of this legal battle remains uncertain, creating significant volatility in the XRP price.

-

Potential Outcomes and their Impact: A favorable ruling could boost investor confidence, potentially driving XRP's price upward. Conversely, an unfavorable ruling could lead to delisting from major exchanges and a substantial price drop. The uncertainty itself dampens investor enthusiasm and trading volume.

-

Regulatory Uncertainty: The SEC lawsuit highlights the regulatory uncertainty surrounding cryptocurrencies, particularly in the US. This uncertainty affects not only XRP but the entire cryptocurrency market. Clearer regulatory frameworks could positively impact XRP's price by reducing risk and encouraging institutional investment.

-

Delisting Risks and Consequences: The threat of delisting from major exchanges is a significant concern for XRP investors. Delisting would severely limit liquidity and accessibility, potentially causing a drastic price decline. This is a critical factor to consider in any XRP price prediction.

-

Long-Term Effects on Adoption: The legal battle's long-term effect on XRP's adoption remains to be seen. A positive outcome could lead to increased adoption by financial institutions, while a negative outcome might hinder its growth. This will play a crucial role in future XRP price analysis.

The Overall Cryptocurrency Market and its Influence on XRP

XRP's price is heavily influenced by the overall cryptocurrency market. Keywords relevant to this section are: Cryptocurrency market cap, Bitcoin price, altcoin market, market sentiment, crypto regulation, bull market, bear market. Analyzing the correlation between Bitcoin's price and XRP's price is crucial for understanding XRP's price movements.

-

Bitcoin's Influence: As the dominant cryptocurrency, Bitcoin's price often dictates the direction of the altcoin market, including XRP. A bullish Bitcoin market generally translates into positive momentum for XRP, while a bear market often leads to price declines.

-

Market Sentiment and Altcoin Performance: The overall cryptocurrency market sentiment—bullish or bearish—directly impacts altcoins like XRP. Positive sentiment fuels demand, while negative sentiment leads to sell-offs.

-

Macroeconomic Factors: Macroeconomic factors, such as inflation, interest rates, and global economic conditions, influence the cryptocurrency market and XRP's price. Periods of economic uncertainty often lead to decreased investment in riskier assets like cryptocurrencies.

-

Regulatory Changes: Global regulatory changes impacting cryptocurrencies can significantly affect XRP's price. Positive regulatory developments can boost investor confidence and increase demand, while negative developments can have the opposite effect.

XRP's Technological Advancements and Adoption Rate

XRP's technological capabilities and adoption rate are crucial factors in determining its long-term price. Relevant keywords here include: XRP technology, XRP Ledger, XRP use cases, XRP adoption, scalability, transaction speed, energy efficiency.

-

XRP Ledger Advantages: The XRP Ledger boasts features like speed, scalability, and low transaction fees, making it an attractive option for cross-border payments and other applications.

-

Cross-Border Payment Use Cases: XRP's primary use case is facilitating fast and cost-effective cross-border payments. Wider adoption by financial institutions in this area could significantly boost its price.

-

Technological Comparisons: XRP’s speed, scalability, and energy efficiency compare favorably to some other cryptocurrencies, making it a potentially more attractive and sustainable option.

-

Partnerships and Upgrades: Strategic partnerships and technological upgrades can increase XRP's adoption and enhance its value proposition, potentially driving price appreciation.

Predicting XRP's Future Price: A Realistic Approach

Predicting XRP's future price with certainty is impossible. However, by combining fundamental analysis (examining factors like adoption rate and regulatory landscape) with technical analysis (studying price charts and trading patterns), we can create realistic price scenarios. Keywords for this section include: XRP price prediction 2024, XRP price prediction 2025, long-term XRP price, XRP investment strategy, technical analysis, fundamental analysis.

-

Limitations of Prediction Models: All price prediction models have limitations. Unforeseen events and market shifts can render even the most sophisticated models inaccurate.

-

Fundamental vs. Technical Analysis: A comprehensive XRP price forecast needs both fundamental and technical analysis. Fundamental analysis assesses the underlying value proposition, while technical analysis identifies potential price trends based on historical data.

-

Realistic Price Scenarios: Based on the factors discussed, reaching $3.40 is possible but depends on favorable legal outcomes, a robust cryptocurrency market, and continued technological advancements and adoption. More conservative predictions might suggest lower, but still significant, price targets.

-

Investment Risk Disclaimer: Investing in cryptocurrencies like XRP is inherently risky. Price volatility is significant, and losses are possible.

Conclusion

This deep dive into the factors influencing XRP's price suggests that while reaching $3.40 is possible, it depends heavily on the outcome of the Ripple lawsuit, the overall health of the cryptocurrency market, and XRP's continued technological advancements and adoption. The inherent volatility of the cryptocurrency market must be considered. Do your own thorough research before investing in XRP. Understanding the complexities surrounding Ripple's XRP price is crucial for informed decision-making. Continue to follow developments in the Ripple lawsuit and the broader cryptocurrency market to make well-informed decisions about your XRP investments.

Featured Posts

-

Xrp Ripple Investment A Realistic Look At Long Term Potential

May 07, 2025

Xrp Ripple Investment A Realistic Look At Long Term Potential

May 07, 2025 -

How To Watch The Dallas Wings Vs Las Vegas Aces Wnba Preseason Game Online

May 07, 2025

How To Watch The Dallas Wings Vs Las Vegas Aces Wnba Preseason Game Online

May 07, 2025 -

First Look Adidas Anthony Edwards 2 Basketball Shoes

May 07, 2025

First Look Adidas Anthony Edwards 2 Basketball Shoes

May 07, 2025 -

Watch Warriors Vs Hornets Game Time Tv Channel And Streaming Details March 3rd

May 07, 2025

Watch Warriors Vs Hornets Game Time Tv Channel And Streaming Details March 3rd

May 07, 2025 -

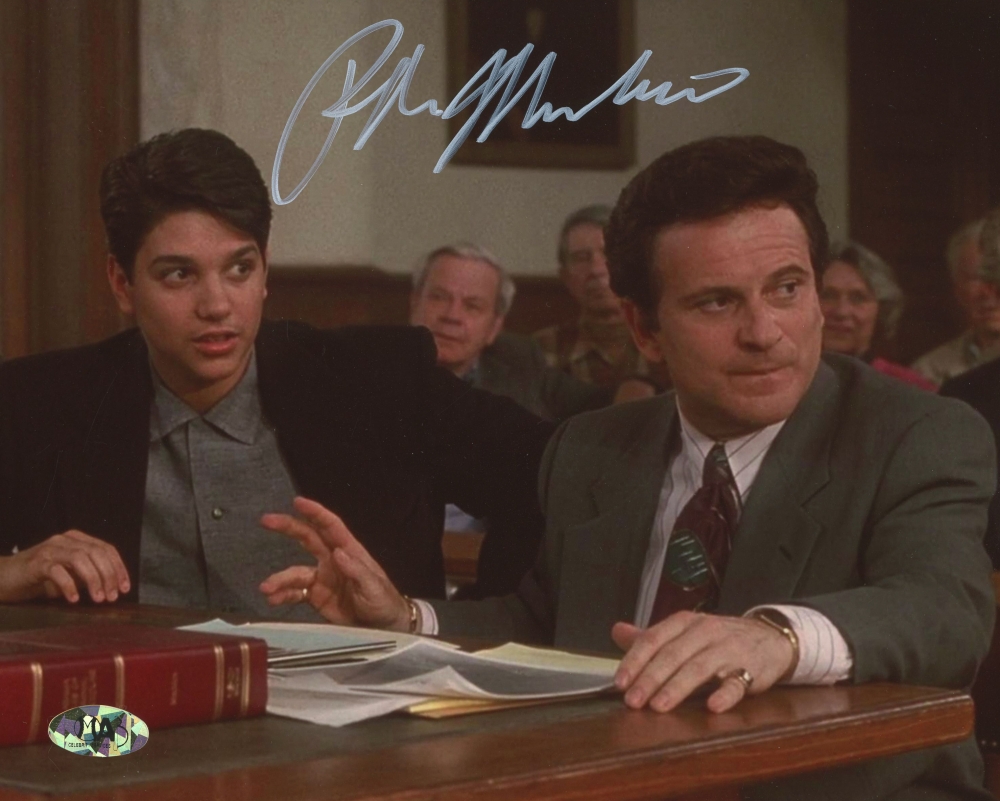

Ralph Macchio Offers Update On Potential My Cousin Vinny Reboot With Joe Pesci

May 07, 2025

Ralph Macchio Offers Update On Potential My Cousin Vinny Reboot With Joe Pesci

May 07, 2025

Latest Posts

-

Tuerkiye De Kripto Para Piyasasi Ve Bakan Simsek In Goeruesleri

May 08, 2025

Tuerkiye De Kripto Para Piyasasi Ve Bakan Simsek In Goeruesleri

May 08, 2025 -

Ekonomi Bakani Ndan Kripto Para Birimlerine Iliskin Yeni Uyari

May 08, 2025

Ekonomi Bakani Ndan Kripto Para Birimlerine Iliskin Yeni Uyari

May 08, 2025 -

Kripto Varlik Yatirimcilarina Bakan Simsek Ten Oenemli Uyari

May 08, 2025

Kripto Varlik Yatirimcilarina Bakan Simsek Ten Oenemli Uyari

May 08, 2025 -

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Son Dakika Gelismeleri

May 08, 2025

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Son Dakika Gelismeleri

May 08, 2025 -

Bakan Simsek Ten Kripto Para Piyasasina Uyari Riskler Ve Oeneriler

May 08, 2025

Bakan Simsek Ten Kripto Para Piyasasina Uyari Riskler Ve Oeneriler

May 08, 2025