Will Tariffs Replace Income Taxes? Examining The Economic Realities

Table of Contents

The Theoretical Revenue Potential of Tariffs

Calculating Tariff Revenue

Tariff revenue generation is, in theory, straightforward: the import value of a good is multiplied by the applied tariff rate. For example, a $100 imported item with a 10% tariff generates $10 in revenue. However, the reality is far more complex.

- Import Volume Fluctuations: The revenue generated is directly tied to the volume of imports. Fluctuations in global demand, economic downturns, or shifts in consumer preferences can significantly impact import levels and thus tariff revenue.

- Tariff Rate Adjustments: Governments can adjust tariff rates to increase or decrease revenue. However, significant increases risk retaliation from other countries, leading to trade wars and reduced overall revenue.

- Elasticity of Demand: The elasticity of demand for imported goods plays a crucial role. If demand is inelastic (consumers continue buying even with price increases), tariff revenue increases. Conversely, elastic demand (consumers readily switch to substitutes) can lead to lower-than-expected revenue.

- Limitations: Relying solely on tariffs for government funding is inherently risky. Revenue is entirely dependent on the volume of imports, making it highly volatile and unpredictable compared to the relatively stable revenue stream from income taxes. The potential for retaliatory tariffs further complicates the picture, potentially reducing import volumes and undermining the entire revenue strategy.

Comparing Tariff Revenue to Income Tax Revenue

Historically, income tax revenue has consistently dwarfed tariff revenue in most developed economies. A comparison of historical data from various countries clearly illustrates this significant disparity.

- Scale of Revenue: Income taxes provide a far broader and more stable revenue base, encompassing a much larger segment of the economy than tariffs, which are limited to imported goods.

- Challenges of Tariff-Only Funding: Relying solely on tariffs for government funding would necessitate extraordinarily high tariff rates, risking significant economic disruption, trade wars, and consumer hardship. The inherent volatility of tariff revenue makes it an unreliable foundation for a stable government budget.

Economic Consequences of a Tariff-Based Tax System

Impact on Consumer Prices

Tariffs directly increase the cost of imported goods, leading to higher consumer prices. This inflation reduces consumer purchasing power, potentially impacting economic growth.

- Disproportionate Impact: Low-income households are disproportionately affected, as they spend a larger percentage of their income on essential goods, many of which are imported.

- Substitution Effects: Consumers may substitute imported goods with domestically produced alternatives, but this substitution is not always possible or equally efficient.

Effects on International Trade and Global Competitiveness

Tariffs can trigger trade wars and significantly damage international trade relationships.

- Retaliatory Tariffs: Other countries may retaliate by imposing their own tariffs on exports, harming domestic industries and reducing economic growth.

- Supply Chain Disruptions: Tariffs disrupt global supply chains, increasing production costs for businesses and potentially impacting job security.

Distortion of Market Mechanisms

Tariffs interfere with the free market, leading to inefficiencies.

- Protection of Inefficient Industries: Tariffs protect inefficient domestic industries from foreign competition, preventing necessary restructuring and innovation.

- Reduced Economic Efficiency: The overall welfare of society is reduced due to lost consumer surplus and inefficient resource allocation.

Practical Challenges of Implementing a Tariff-Based Tax System

Administrative Complexity

Administering a tariff-based tax system is far more complex than managing income taxes.

- Setting Appropriate Rates: Determining appropriate tariff rates requires extensive economic analysis and involves significant political considerations.

- Enforcement and Compliance: Enforcing compliance and preventing smuggling requires a large bureaucracy and sophisticated monitoring systems, leading to increased administrative costs.

Political and Social Implications

A shift to a tariff-based tax system would likely face strong political opposition and could trigger social unrest.

- Impact on Industries and Regions: Certain industries and regions would be disproportionately impacted by increased import costs and potential job losses.

- Potential for Social Unrest: The combination of increased prices and potential job losses could lead to significant social and political instability.

Conclusion

Replacing income taxes with tariffs is impractical. The revenue generated by tariffs is insufficient to fund government operations, and its volatility makes it an unreliable revenue source. Furthermore, a tariff-based tax system would inflict significant economic damage, distorting market mechanisms, harming international trade relations, and disproportionately impacting low-income households. While tariffs serve a role within a broader tax system, they cannot replace the much larger and more stable revenue generated by income taxes. Further research and realistic policy discussions should focus on balanced and sustainable tax reform strategies. A comprehensive understanding of both tariffs and income taxes is crucial for informed economic policy.

Featured Posts

-

Investigation Launched Following Deaths Of Mexican Human Rights Activist And Partner

Apr 30, 2025

Investigation Launched Following Deaths Of Mexican Human Rights Activist And Partner

Apr 30, 2025 -

I Kideia Toy Papa Fragkiskoy Poioi Itan Ekei O Tramp Kai I Oykraniki Antiprosopeia

Apr 30, 2025

I Kideia Toy Papa Fragkiskoy Poioi Itan Ekei O Tramp Kai I Oykraniki Antiprosopeia

Apr 30, 2025 -

Tarykh Srf Meashat Abryl 2025 Melwmat Hamt L 13 Mlywn Mstfyd

Apr 30, 2025

Tarykh Srf Meashat Abryl 2025 Melwmat Hamt L 13 Mlywn Mstfyd

Apr 30, 2025 -

Cavaliers Edge Blazers In Overtime Thriller Hunter Leads With 32

Apr 30, 2025

Cavaliers Edge Blazers In Overtime Thriller Hunter Leads With 32

Apr 30, 2025 -

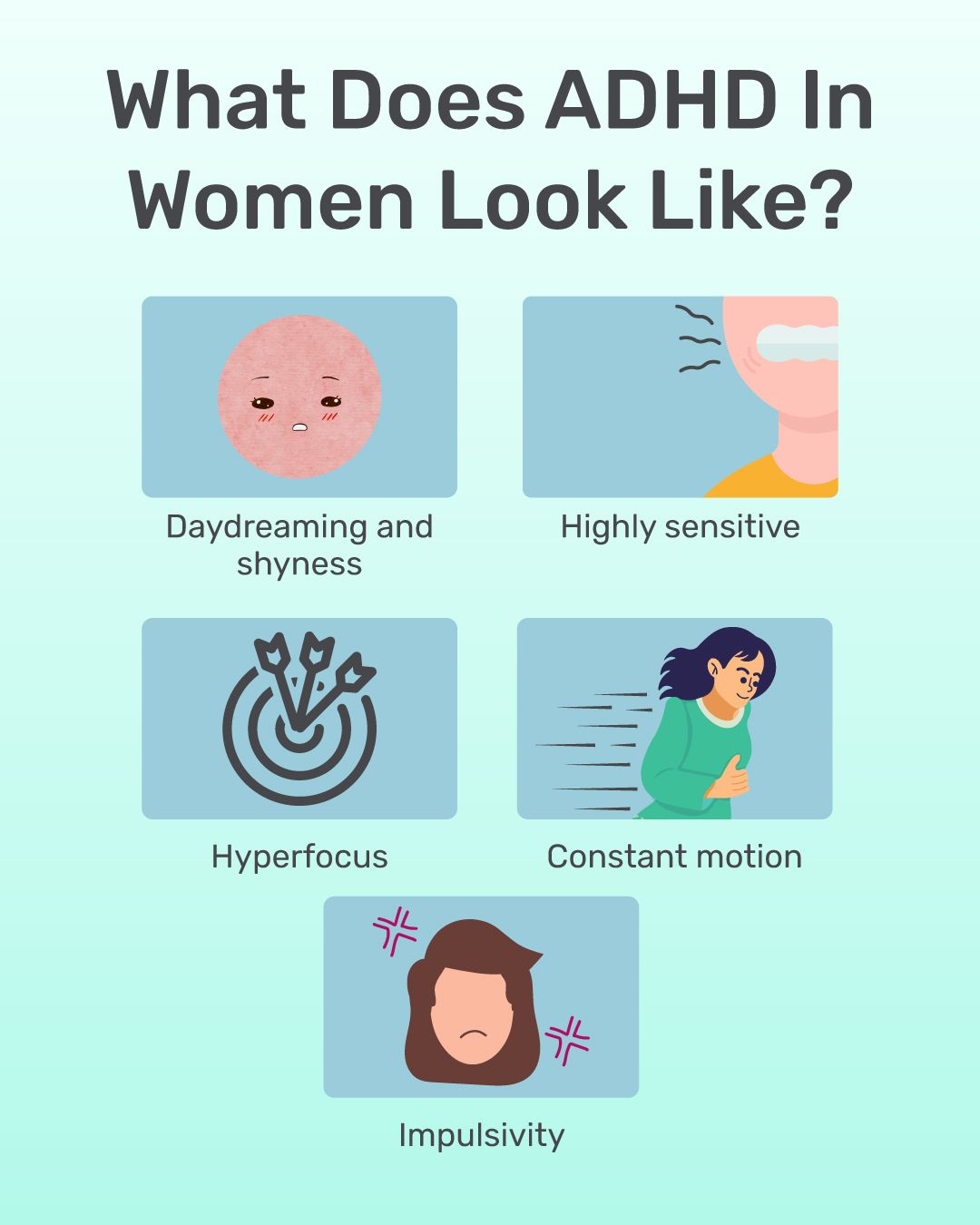

More Young People Diagnosed With Adhd At Aiims Opd Exploring Potential Triggers

Apr 30, 2025

More Young People Diagnosed With Adhd At Aiims Opd Exploring Potential Triggers

Apr 30, 2025

Latest Posts

-

Ithrottir I Bonus Deildinni Meistaradeildar Og Nba Leikadagskra

Apr 30, 2025

Ithrottir I Bonus Deildinni Meistaradeildar Og Nba Leikadagskra

Apr 30, 2025 -

M Buzelis Ir Jo Tylejimas Vilniaus Savu Vardu Turnyro Ivykiai

Apr 30, 2025

M Buzelis Ir Jo Tylejimas Vilniaus Savu Vardu Turnyro Ivykiai

Apr 30, 2025 -

Bonus Deildin Dagskra Yfir Meistaradeildina Og Nba Leiki

Apr 30, 2025

Bonus Deildin Dagskra Yfir Meistaradeildina Og Nba Leiki

Apr 30, 2025 -

Savo Vardo Turnyre Vilniuje Matas Buzelis Isliko Tylus Analize

Apr 30, 2025

Savo Vardo Turnyre Vilniuje Matas Buzelis Isliko Tylus Analize

Apr 30, 2025 -

Meistaradeildin And Nba I Bonus Deildinni Dagskra Og Upplysingar

Apr 30, 2025

Meistaradeildin And Nba I Bonus Deildinni Dagskra Og Upplysingar

Apr 30, 2025