Will Trump's Accusations Boost The South Korean Won Against The US Dollar (KRW/USD)?

Table of Contents

Trump's Accusations and Their Geopolitical Impact on KRW/USD

The nature of Trump's accusations, while varying in specifics over time, often centers around trade imbalances, security commitments, and allegations of unfair practices. These statements can significantly impact US-South Korea relations, creating uncertainty that ripples through financial markets. The potential consequences for the KRW/USD exchange rate are multifaceted:

- Increased political uncertainty impacting investor confidence: Negative rhetoric from the US can erode investor confidence in South Korea's economic stability, leading to capital flight and a weakening of the Won.

- Potential for trade disputes and retaliatory measures: Trump's accusations could escalate into full-blown trade wars, harming South Korea's export-driven economy and putting downward pressure on the KRW. Increased tariffs and trade restrictions directly affect the KRW/USD exchange rate.

- Impact on foreign investment in South Korea: Uncertainty stemming from political tensions discourages foreign direct investment (FDI), further weakening the Won against the dollar. A decrease in FDI can have a significant long-term impact on the KRW/USD.

- Shifting market sentiment towards risk aversion: Global investors often flee to safer assets (like the US dollar) during times of geopolitical instability, leading to a sell-off in riskier currencies like the South Korean Won. This risk-off sentiment directly affects KRW/USD trading.

Analyzing the Economic Fundamentals of the South Korean Won

South Korea boasts a strong technological sector and a highly skilled workforce. However, its export-oriented economy makes it vulnerable to global trade tensions. Analyzing the following key economic indicators is crucial for understanding the KRW's potential response to Trump's accusations:

- Export-oriented economy and its susceptibility to global trade tensions: A significant portion of South Korea's GDP is dependent on exports, making it highly vulnerable to trade disputes. Any negative impact on exports directly weakens the KRW.

- Strength of South Korea's technological sector: The robust tech sector provides a degree of resilience, mitigating some of the negative impacts of political uncertainty. Technological innovation can support the Won's value.

- Current account balance and its implications for the KRW: A strong current account surplus generally supports the currency, while a deficit can put downward pressure on it. Monitoring South Korea's current account is vital for predicting KRW/USD movements.

- Inflation rates and interest rate policies of the Bank of Korea: The Bank of Korea's monetary policy plays a critical role. Higher interest rates can attract foreign investment, strengthening the Won, while low rates may weaken it.

Historical Precedents: How Previous Political Events Affected KRW/USD

Examining past instances where political events influenced the KRW/USD exchange rate provides valuable insights:

- Examples of past crises and their impact on the currency pair: Past economic crises, such as the Asian financial crisis, and political events, such as periods of heightened North Korean tensions, offer valuable case studies.

- Analysis of market reactions to similar political events: Studying past market reactions to similar situations helps predict potential outcomes in response to Trump's accusations. This historical analysis helps refine predictions of future KRW/USD trends.

- Identifying patterns and trends in past currency movements: By identifying patterns, we can better understand how the market typically reacts to political developments and economic shocks. Analyzing these patterns is critical for informed decision-making.

Market Sentiment and Speculation: Predicting the KRW/USD Trajectory

Market sentiment and speculation are significant drivers of currency fluctuations. Analyzing these factors is crucial for predicting the KRW/USD trajectory:

- Analyzing current market forecasts and predictions for the KRW/USD: Professional economic forecasts provide a valuable perspective, albeit with inherent uncertainties. These predictions offer insights into market expectations.

- Assessing the impact of news and media coverage on exchange rates: Media narratives and news reports significantly impact market sentiment, often driving short-term volatility in the KRW/USD. News coverage can dramatically affect short-term fluctuations.

- Considering the potential for short-term volatility versus long-term trends: While Trump's accusations may cause short-term volatility, the long-term trend will likely be determined by more fundamental economic factors. Differentiating between short-term volatility and long-term trends is essential.

Safe-Haven Status of the Won: A Counterargument

Interestingly, despite the negative rhetoric, the Won might appreciate due to its perceived safe-haven status within the region. Amidst broader global uncertainty, investors might seek refuge in the South Korean economy, leading to increased demand for the Won. This represents a counterargument to a simple expectation of depreciation based solely on Trump's accusations.

Conclusion

Trump's accusations against South Korea could create short-term volatility in the KRW/USD exchange rate. However, the long-term trajectory depends on a complex interplay of geopolitical factors and South Korea's economic fundamentals. While increased political uncertainty and potential trade disputes could weaken the Won, the country's economic strengths and potential safe-haven status could offer countervailing forces. It's crucial to consider various economic factors beyond political rhetoric when analyzing the KRW/USD. Stay informed about the latest developments in US-South Korea relations and continue monitoring the KRW/USD exchange rate for any significant changes. Understanding the impact of Trump's accusations on the KRW/USD is crucial for making informed decisions in the foreign exchange market. Keep up-to-date on the latest analysis concerning the KRW/USD exchange rate.

Featured Posts

-

Broadcoms V Mware Acquisition At And T Exposes A Potential 1 050 Cost Increase

Apr 25, 2025

Broadcoms V Mware Acquisition At And T Exposes A Potential 1 050 Cost Increase

Apr 25, 2025 -

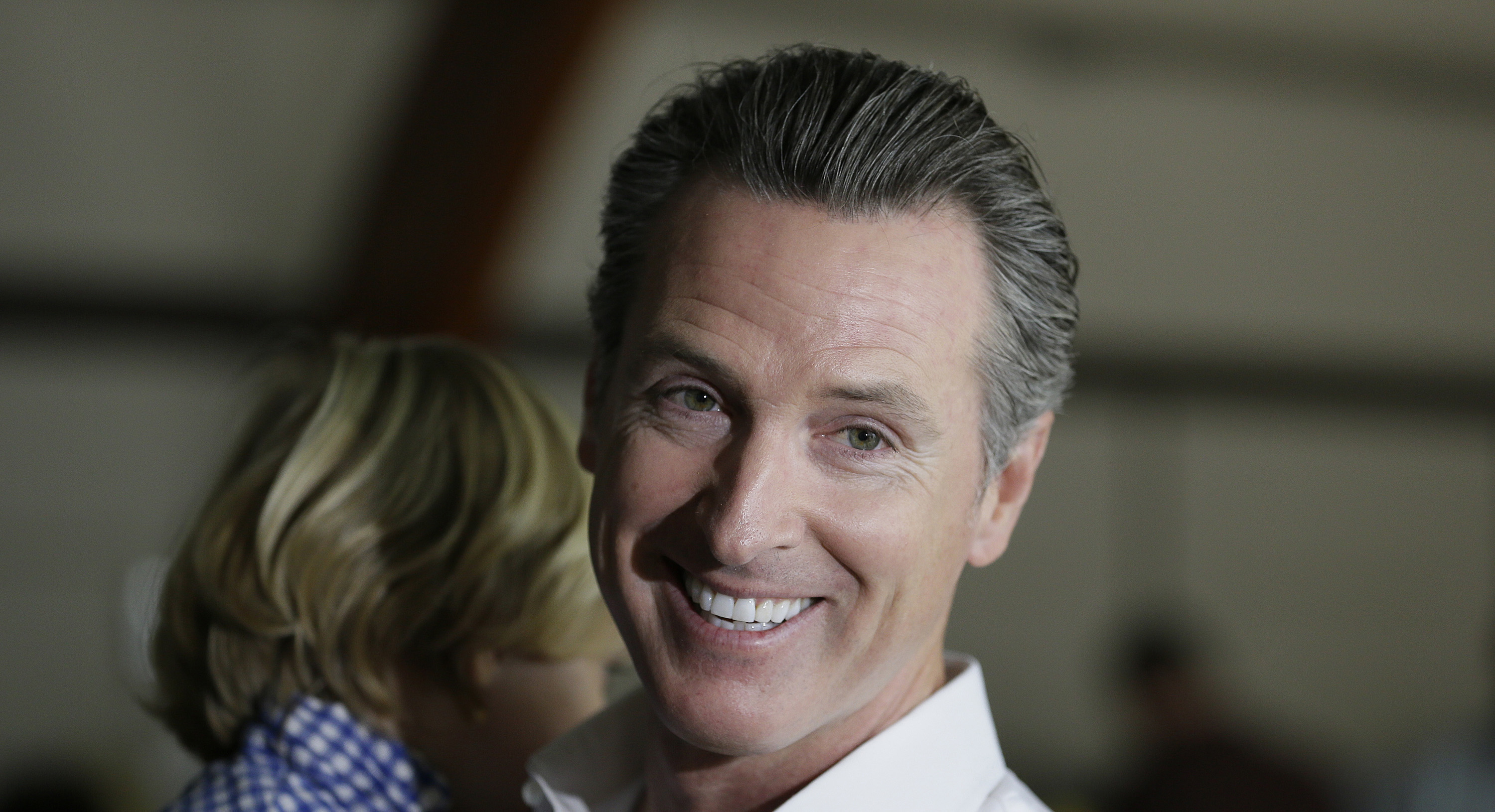

Gavin Newsoms Toxic Democrats Remark A Political Backlash

Apr 25, 2025

Gavin Newsoms Toxic Democrats Remark A Political Backlash

Apr 25, 2025 -

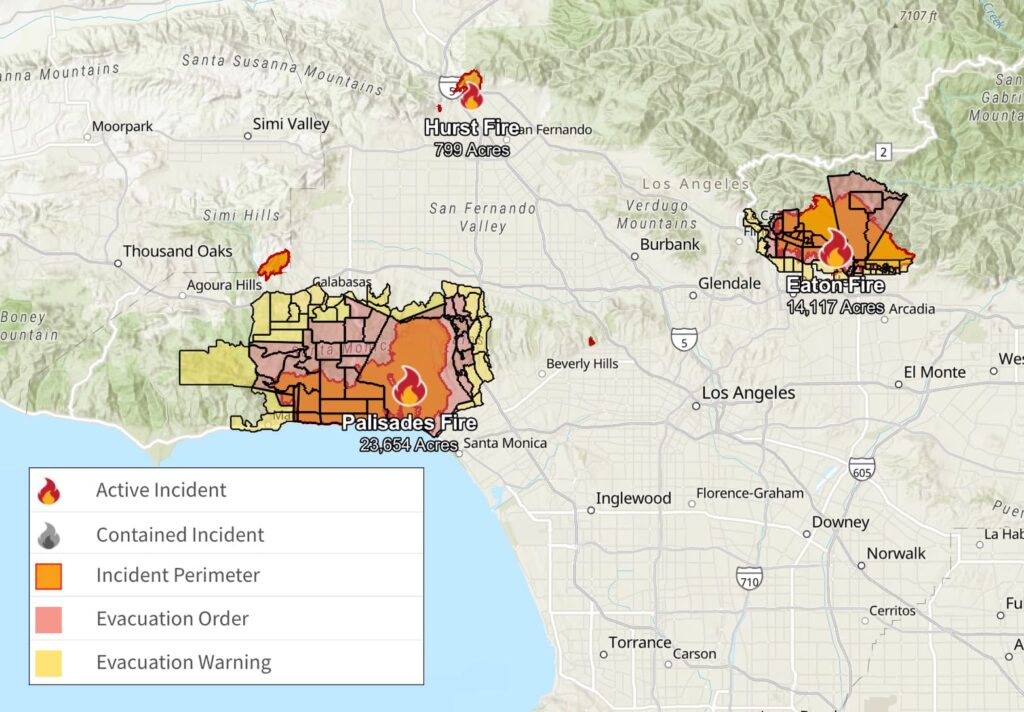

Los Angeles Wildfires The Rise Of Disaster Betting

Apr 25, 2025

Los Angeles Wildfires The Rise Of Disaster Betting

Apr 25, 2025 -

Olivia Rodrigos Consistent Fashion Choice At The 2025 Grammys

Apr 25, 2025

Olivia Rodrigos Consistent Fashion Choice At The 2025 Grammys

Apr 25, 2025 -

Unilever Reports Better Than Expected Sales Analysis Of Pricing Strategies And Demand

Apr 25, 2025

Unilever Reports Better Than Expected Sales Analysis Of Pricing Strategies And Demand

Apr 25, 2025

Latest Posts

-

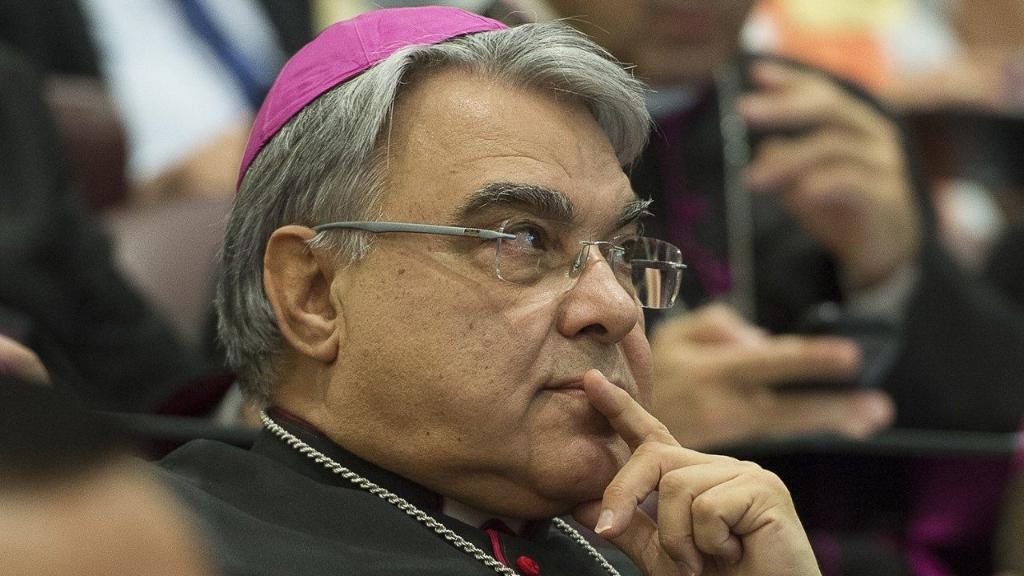

Caso Becciu Ultime Notizie Sui Fondi 8xmille

Apr 30, 2025

Caso Becciu Ultime Notizie Sui Fondi 8xmille

Apr 30, 2025 -

Sentenza Becciu 40 000 Euro Di Risarcimento Agli Accusatori

Apr 30, 2025

Sentenza Becciu 40 000 Euro Di Risarcimento Agli Accusatori

Apr 30, 2025 -

Processo Becciu Aggiornamenti Sui Fondi 8xmille

Apr 30, 2025

Processo Becciu Aggiornamenti Sui Fondi 8xmille

Apr 30, 2025 -

8xmille Rinvio Del Processo Per Il Fratello Di Becciu

Apr 30, 2025

8xmille Rinvio Del Processo Per Il Fratello Di Becciu

Apr 30, 2025 -

Becciu Dovra Risarcire 40 000 Euro La Sentenza Del Tribunale

Apr 30, 2025

Becciu Dovra Risarcire 40 000 Euro La Sentenza Del Tribunale

Apr 30, 2025