Will Trump's Next Speech Send Bitcoin Soaring Above $100,000? A Price Prediction Analysis

Table of Contents

H2: Trump's Historical Influence on Cryptocurrency Markets

H3: Past Statements and Market Reactions: Donald Trump's pronouncements on economic policy and financial matters often ripple through global markets, and the cryptocurrency space is no exception. Analyzing past instances where Trump's statements directly or indirectly influenced Bitcoin's price reveals a complex relationship.

- Example 1 (Hypothetical): On [Date], Trump tweeted negatively about Bitcoin regulation, leading to a [Percentage]% drop in Bitcoin's price within [Timeframe]. This demonstrates the immediate impact of his words on market sentiment. (Insert chart/graph illustrating this price fluctuation here)

- Example 2 (Hypothetical): Conversely, on [Date], positive statements regarding economic growth, potentially boosting investor confidence, correlated with a [Percentage]% rise in Bitcoin's price. (Insert chart/graph illustrating this price fluctuation here)

These examples illustrate the power of "Trump crypto" related news in influencing "Bitcoin price history" and highlight the importance of "market sentiment analysis" in predicting future price movements.

H3: Potential for Positive or Negative Sentiment: Trump's upcoming speech could evoke either positive or negative market reactions depending on its content and the prevailing economic climate.

- Positive Sentiment: A speech focusing on pro-growth policies, deregulation, or positive comments about blockchain technology could potentially boost investor confidence, leading to increased demand for Bitcoin and pushing its price upward. This scenario thrives on "positive market sentiment."

- Negative Sentiment: Conversely, a speech emphasizing stricter regulations, negative commentary on cryptocurrencies, or hinting at economic instability could trigger a sell-off, leading to a price decline. This scenario relies on "negative market sentiment" and reflects concerns about "Trump's economic policies" impacting Bitcoin's "volatility."

H2: Factors Beyond Trump's Speech Affecting Bitcoin's Price

H3: Macroeconomic Conditions: The broader economic landscape plays a significant role in Bitcoin's price regardless of Trump's pronouncements.

- Inflation: High inflation rates often drive investors towards alternative assets like Bitcoin, potentially increasing its value. "Bitcoin and inflation" are intrinsically linked.

- Interest Rates: Interest rate hikes by central banks can impact investor appetite for riskier assets like cryptocurrencies, potentially leading to a price correction. The relationship between "interest rate hikes" and Bitcoin's price is often inverse.

- Recessionary Fears: Concerns about a potential recession can also influence Bitcoin's price, as investors may seek refuge in safer havens. Understanding the interplay between "recession and Bitcoin" is crucial for accurate price prediction.

H3: Adoption and Technological Developments: Several factors independent of Trump's influence significantly affect Bitcoin's price trajectory.

- Bitcoin ETF Approval: The approval of a Bitcoin exchange-traded fund (ETF) could potentially lead to increased institutional investment and broader adoption, pushing the price higher. "Bitcoin ETF" approval is a significant catalyst for price increases.

- Institutional Adoption: Growing institutional adoption of Bitcoin by large corporations and financial institutions adds legitimacy and further fuels price appreciation.

- Regulatory Clarity: Clear and favorable regulations in major markets can significantly boost investor confidence and lead to increased adoption, impacting the "Bitcoin adoption" rate positively. Advances in "blockchain technology" can also influence investor sentiment.

H2: Predicting Bitcoin's Price: A Realistic Assessment

H3: Probability of Reaching $100,000: Based on the factors discussed above, achieving a "$100,000 Bitcoin" price in the short term seems unlikely. While Trump's speech could introduce significant short-term volatility, longer-term price movements are determined by fundamental factors like adoption rates, macroeconomic conditions, and regulatory changes. A "$100,000 Bitcoin prediction" necessitates a confluence of positive developments across these areas. The "Bitcoin price forecast" therefore needs a holistic perspective.

H3: Potential Price Ranges and Scenarios: Let's outline potential scenarios:

- Scenario 1 (Bullish): Positive speech + favorable macroeconomic conditions + ETF approval = Potential price range: $50,000 - $70,000

- Scenario 2 (Neutral): Neutral speech + mixed macroeconomic conditions + no significant regulatory changes = Potential price range: $30,000 - $40,000

- Scenario 3 (Bearish): Negative speech + negative macroeconomic conditions + stricter regulations = Potential price range: $20,000 - $30,000

(Include charts/graphs illustrating these price ranges and scenarios here) These "Bitcoin price range" projections highlight the "market prediction" complexity.

3. Conclusion: Will Trump's Words Move Bitcoin to $100,000? The Verdict

While Trump's next speech could indeed cause significant short-term fluctuations in Bitcoin's price, reaching $100,000 solely due to his words is unlikely. The "Bitcoin price prediction" remains a multifaceted puzzle, influenced by numerous interacting variables beyond a single speech. The inherent "cryptocurrency market volatility" necessitates caution.

Therefore, while Trump's influence is undeniable, it's crucial to remember that Bitcoin's price trajectory is dictated by a complex interplay of factors. We must avoid simplistic cause-and-effect interpretations.

To make informed investment decisions, learn more about Bitcoin price predictions, stay informed about Trump's impact on cryptocurrency, and analyze the Bitcoin market before investing. Don't rely solely on short-term speculative events; understand the fundamentals that drive long-term price movements. Thoroughly researching the "Bitcoin price prediction" landscape is vital before investing.

Featured Posts

-

Bitcoin Price Prediction 1 500 Growth In Five Years

May 08, 2025

Bitcoin Price Prediction 1 500 Growth In Five Years

May 08, 2025 -

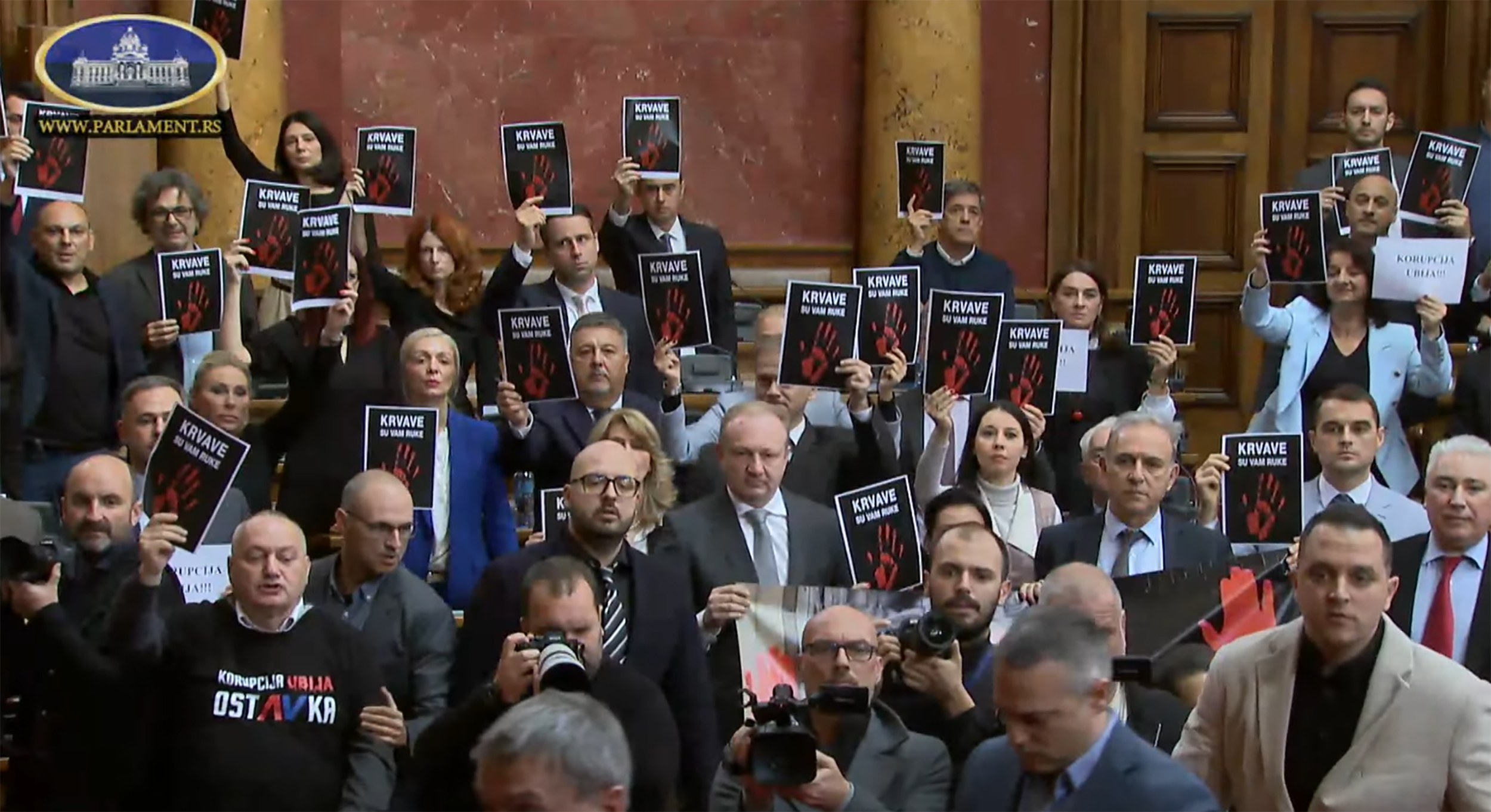

Izjava Pavla Grbovica Prihvatljivi Svi Predlozi Za Prelaznu Vladu

May 08, 2025

Izjava Pavla Grbovica Prihvatljivi Svi Predlozi Za Prelaznu Vladu

May 08, 2025 -

Los Angeles Wildfires The Disturbing Reality Of Disaster Gambling

May 08, 2025

Los Angeles Wildfires The Disturbing Reality Of Disaster Gambling

May 08, 2025 -

Millions Stolen Through Executive Office365 Account Compromises Fbi Investigation

May 08, 2025

Millions Stolen Through Executive Office365 Account Compromises Fbi Investigation

May 08, 2025 -

Arsenal I Ps Zh Rezultaty Vsekh Evrokubkovykh Vstrech

May 08, 2025

Arsenal I Ps Zh Rezultaty Vsekh Evrokubkovykh Vstrech

May 08, 2025

Latest Posts

-

Saturday Night Live A Pivotal Point In Counting Crows History

May 08, 2025

Saturday Night Live A Pivotal Point In Counting Crows History

May 08, 2025 -

Performance Geometrique Superieure Des Corneilles Par Rapport Aux Babouins Une Analyse Comportementale

May 08, 2025

Performance Geometrique Superieure Des Corneilles Par Rapport Aux Babouins Une Analyse Comportementale

May 08, 2025 -

Did Saturday Night Live Make Counting Crows Famous A Look Back

May 08, 2025

Did Saturday Night Live Make Counting Crows Famous A Look Back

May 08, 2025 -

Capacites Geometriques Inattendues Chez Les Corneilles Depassement Des Performances Des Babouins

May 08, 2025

Capacites Geometriques Inattendues Chez Les Corneilles Depassement Des Performances Des Babouins

May 08, 2025 -

The Night Counting Crows Changed Their Snl Performance And Its Legacy

May 08, 2025

The Night Counting Crows Changed Their Snl Performance And Its Legacy

May 08, 2025